Best REIT Companies You Need to Invest in – Investor Guide

Most traders talk about tech stocks, blue-chip companies, and financial stocks as the best-growing equities. However, real estate is the dark horse of the stock market, expanding the investor’s portfolio to include rentals, commercial and residential spaces, and various property-based income-generating models.

REIT companies facilitate buying and selling properties without actual owning, offering a unique proposition that differs significantly from traditional stocks, bonds and Forex pairs. Let’s explain how REIT works and the largest REIT companies today.

Key Takeaways

- Real estate investment companies allow investors to buy shares in properties and lands without physically owning them.

- REITs make real estate investments more affordable for a larger market category.

- Property investment is growing in healthcare sectors due to the ageing population and increasing rental prices.

- Household residential properties are expected to recover after the recent interest rate cuts.

The Working of REIT Companies

Real estate investment trusts (REITs) are corporations that own, finance, and manage properties to produce income. They actively buy and lease real estate in various sectors, including residential houses, multi-unit family houses, commercial spaces, social buildings, and more.

REIT companies offer their shares on the secondary exchange markets like NYSE, NASDAQ and LSE. Market participants buy REIT shares to own a piece of real estate without directly holding and managing the property.

This setting facilitates the access of new traders and low-capital investments into the estate business, especially since this market requires significant capital to buy or develop buildings and lands.

REITs became legal by a presidential decree in 1960 in the United States, which allowed corporations to gather funds from investors and invest the pool in real estate with high gaining potential.

As such, REIT firms operate as mutual funds in the way they pool money from investors towards selected baskets. However, the pool is operated in the estate market. In exchange, investors receive money from property value appreciation and dividends on owned stocks.

Latest REIT Trends

The real estate business has been growing steadily, and after the stagnation of the global market in 2020-2021, the industry is booming.

2025 is a promising year for REIT investments after the recovering inflation rates in the US and EU and the improving economic conditions in global markets. The recent Fed rate cut is expected to contribute largely to investing in REITs.

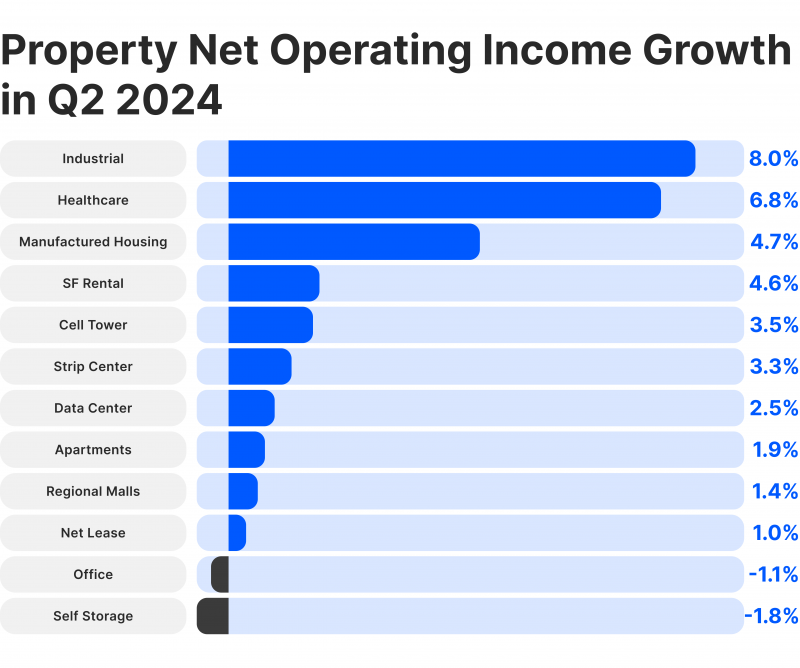

The year has witnessed an increasing interest in commercial property, especially self-storage spaces and industrial buildings. The boost in manufacturing and uptick in inflation after the pandemic benefited these trends massively.

Therefore, the industrial, healthcare, and technology sectors in REIT have a high potential for the remainder of this year.

Pros and Cons of Investing in REIT Companies

The concept of REIT makes investing in real estate highly easy and accessible, lowering the entry barriers and allowing more investors to speculate and trade property stocks. Let’s evaluate the benefits and challenges of REIT investments.

Advantages

- REITs offer a valuable diversification from traditional trading in classic stocks, bonds, currency pairs and commodities. Real estate has a distinct growth trajectory than conventional assets.

- REIT firms allow new investors and those with limited budgets to invest in properties without having significant initial capital. This approach minimises the damage from unexpected risks.

- REITs provide passive income generation opportunities, including real estate valuation and dividend growth, as all REIT firms are legally required to pay 90% of their returns as dividends.

- The emergence of more REITs increased the property market liquidity, making it more dynamic, less volatile and rich in opportunities.

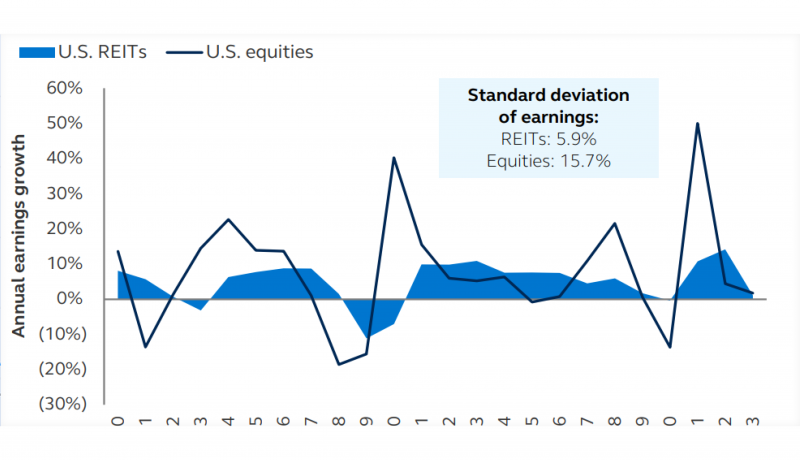

- REIT stocks have low short-term volatility, focusing on long-term profitability and significant property valuation over 10 and 15 years.

Disadvantages

- The trusts’ money managers control REIT pools, giving investors little to no control over their funds, making the decision-making process entirely reliant on the REIT company.

- The REIT dividend is a taxable income, which can diminish the realised returns per share. Some jurisdictions have lower tax rates for long-term compared to short-term dividends.

- REIT prices and valuation depend on market conditions, especially interest rate, inflation and economic growth. If demand for the property decreases, REIT returns will eventually drop.

- Real estate stocks are less volatile than ordinary shares, which limits short-term gains or speculations that can generate significant gaining opportunities.

- Some REITs charge premium fees for handling and investing your money, and some of these costs can offset your gains.

Public vs Private REIT Companies

The vast majority of the largest REIT companies are publicly listed in regional and global markets that span thousands of investors. However, some private property companies offer lucrative opportunities in real estate. Let’s distinguish between private and public REITs.

Public REITs

The most common type of property investment trust is a public one. These companies release their shares on the New York Stock Exchange, London Stock Exchange and NASDAQ and are subject to strict regulatory guidelines similar to other listed equities.

Real estate investment firms list their shares in public markets to grow their share value and attract income investors of all types, increasing the demand and surging the stock price.

Private REITs

These firms are not listed on public stock exchanges. Therefore, they are only subject to limited SEC laws, giving issuers and investors more freedom.

Private REIT shares are offered to institutional investors with low compliance requirements and higher dividend yields.

Public Non-Listed

These hybrid REITs are not publicly traded on secondary markets like the first category. Instead, they are available on crowdfunding platforms and online real estate investment trusts, where investors find opportunities and features.

These markets are usually less liquid than public REITs due to less cash flow and are subject to complete SEC regulations.

REITs became regulated in 1960 when US President Eisenhower signed The Cigar Excise Tax Extension, which allowed large-scale, income-generating real estate investments.

Top 10 REIT Companies to Invest in

After understanding the nature, trends and benefits of REIT companies, let’s discuss the best REIT you can find today. Some firms specialise in one sector, such as commercial, technology, or residential, while others offer a fair mixture of high-yielding shares.

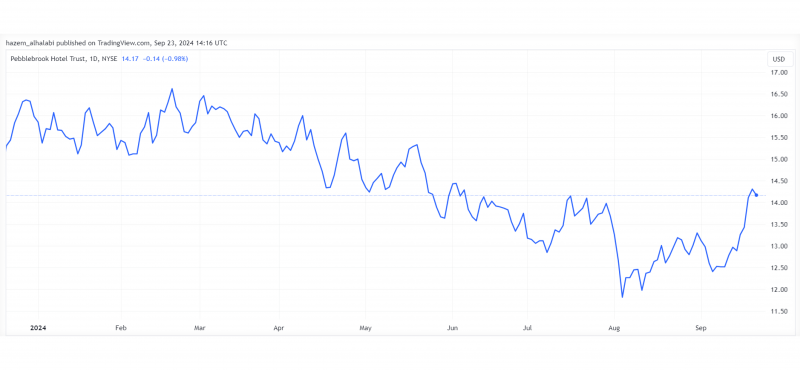

1. Pebblebrook Hotel (PEB)

Industry: Hotels and Hospitality.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Annual dividend yield: 0.28%

Peeblebrook is a US real estate trust founded in 2009 that specialises in hotels and leisure facilities. This portfolio includes over 45 high-end and luxury hotels in the United States.

The NYSE-listed stock is a highly affordable REIT priced around the $15 range, growing significantly over the last month. In 2024, the PEB share price declined due to increasing inflation. However, the recent recovery saw the stock jumping from $11 to $13 in one month and then over $14 by the last week of September.

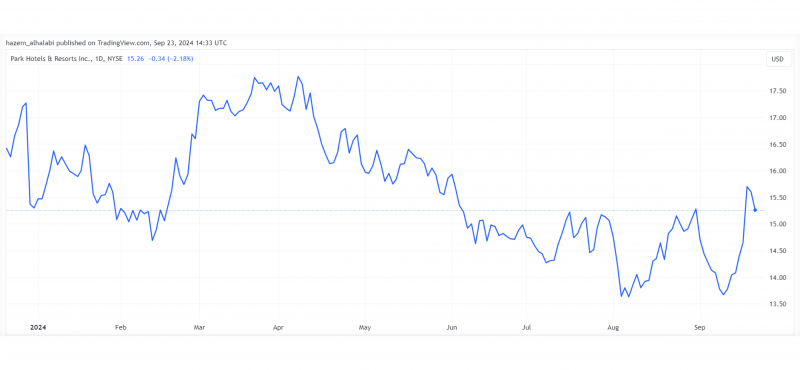

2. Park Hotels & Resorts (PK)

Industry: Hotels and Hospitality.

Annual dividend yield: 6.55%

Park Hotels & Resorts was founded in 2017 in the US, with a broad portfolio that owns multiple leisure properties, hotels, and motels. The company later dropped its low-value properties and focused on high-end and luxury resorts and brands like Marriott, Hilton, and Hyatt.

It is one of the top REIT companies with an attractive yield per year, coupled with reasonable stock performance and long-term stability.

The company’s stock is traded on the NYSE exchange, which had a significant valuation in Q1-2024, surging from $15 to over $17. The market price fell slightly following the US economic meltdown, but late signs of recovery started building up in September as the stock price went from $13 to $15.50 in one week.

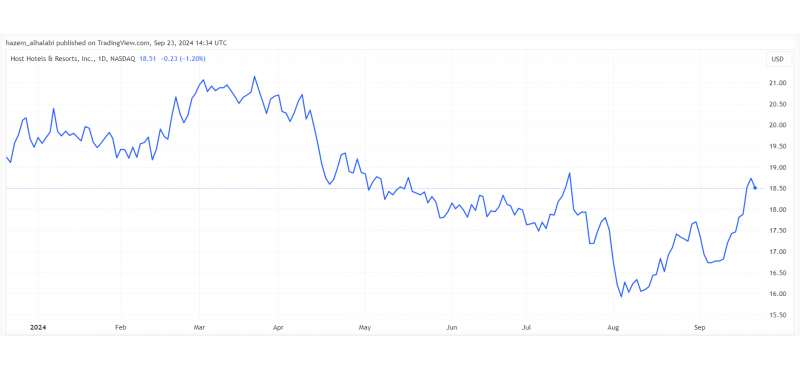

3. Host Hotels & Resorts (HST)

Industry: Hotels and Hospitality.

Annual dividend yield: 4.29%

The third leisure property investor is Host Hotels & Resorts, one of the largest US REITs in NASDAQ that specialises in luxury hotels and resorts. Its portfolio includes popular brands such as Ritz-Carlton, Four Seasons and Hilton, besides other over 80 hotels.

The stock price offers a reasonable performance, which swung on both sides this year. Starting from $19 to $21 in the first quarter, before following the US market decline to $16. However, the stock experienced a substantial upward trend that started in August, picking up the price to $18.80 by the end of September, offering shareholders a fair growth rate.

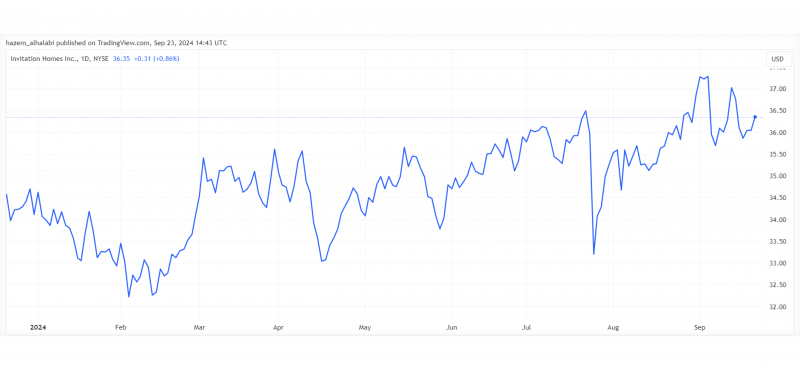

4. Invitation Homes (INVH)

Industry: Residential – Rental Properties.

Annual dividend yield: 3.07%

Invitation Homes Incorporation was founded in 2012 as a single-family property management company. Its portfolio includes over 85,000 houses that INVH finances and leases in 16 US cities.

With a fair dividend yield of around 3%, INVH stocks are suitable for investors who prefer some volatility in their REIT investments. The market price has been fluctuating on both sides every month between the $33.50 and $36.50 range.

However, a recent breakthrough saw the stock price reaching $37 for the first time since September 2022, offering sustainable revenue growth with reasonable, quarterly paid dividends.

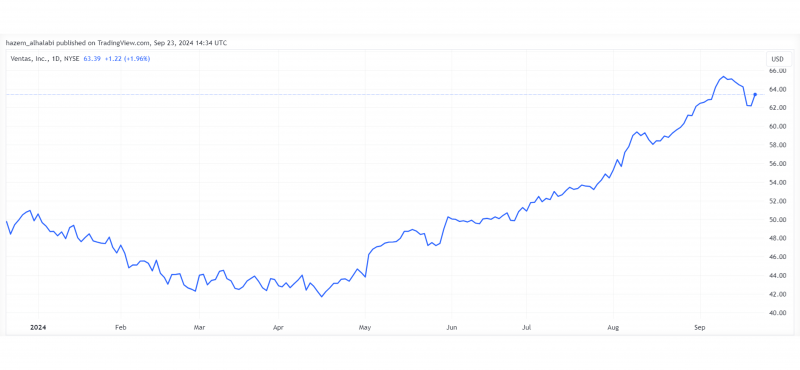

5. Ventas Inc. (VTR)

Industry: Healthcare.

Annual dividend yield: 2.80%

Ventas Inc. is a REIT firm that specialises in building retirement homes, healthcare facilities, and lodging for senior citizens. The company owns over 1350 properties in the US, UK and Canada.

Healthcare REIT investments have grown phenomenally recently due to the ageing population and increasing rental prices. Both factors increase the demand for retirement houses and drive prices higher.

VTR in NYSE is performing significantly this year, with a massive growth every month. The stock recorded a 28% growth YTD, starting the year at $50 and scraping the surface of $65 by the end of September.

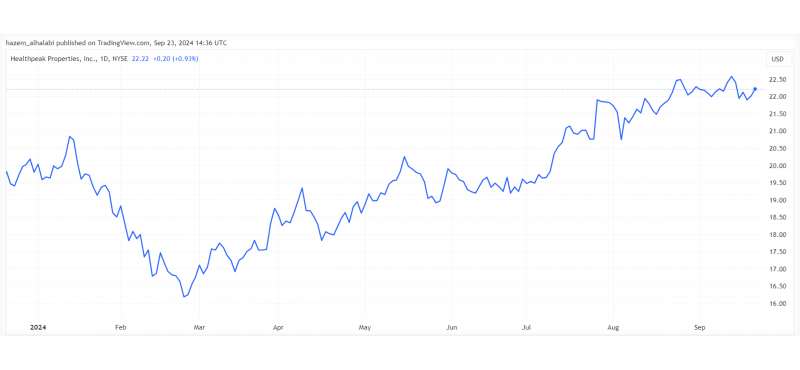

6. Healthpeak Properties (DOC)

Industry: Healthcare.

Annual dividend yield: 5.32%

Healthpeak Properties is one of the oldest US REIT firms. It was created in 1985 and focuses on the healthcare sector, including retirement houses, life science facilities and medical labs.

The company operates and invests in over 480 healthcare real estate properties in the US, with a combined value of $20 billion. The company offers a reasonably high quarterly dividend rate of 5.32%.

After slightly dropping from $20 to $16 in the first quarter, the stock started an upward trend, focusing on low volatility and long-term profitability. DOC stocks trade at $22.50 by the end of September, keeping its momentum above the $20 threshold since July.

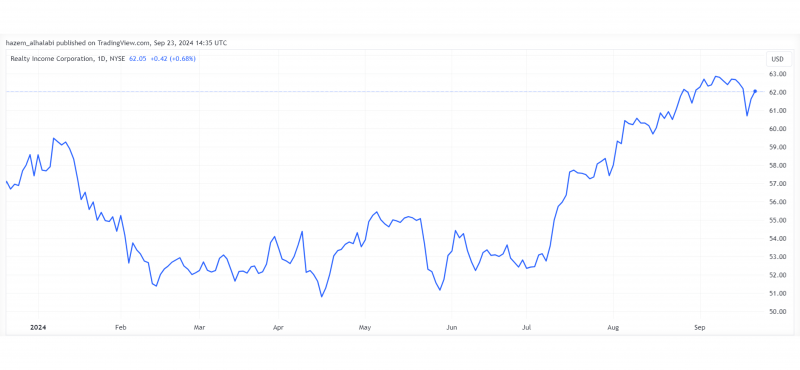

7. Realty Income Corp. (O)

Industry: Single-Tenant Commercial Real Estate.

Annual dividend yield: 5.07%

Realty Income Corporation was founded in 1969 as a real estate investment trust with a broad portfolio of retail and industrial properties in the US and Europe.

The company manages and finances over 15,000 properties, such as convenience stores, groceries, home improvement, drug stores, retail, restaurants, automotive service and more. O stocks in NYSE have been performing fairly stable this year, with a breakthrough starting in Q3.

The 5% dividend payable monthly provides a stable income for investors as the stock price keeps growing well above $60 from $52 in July.

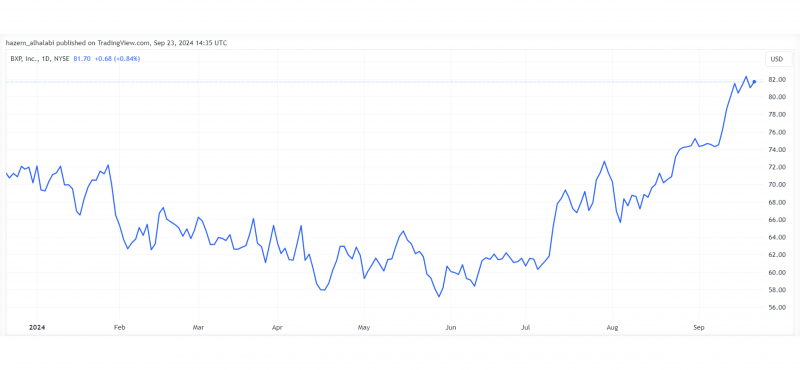

8. BXP Inc. (BXP)

Industry: Commercial – Workspaces.

Annual dividend yield: 4.77%

BXP is a premier workspace development and management company that builds and provides high-tech offices and spaces for leading corporations in the US. Established in 1970, the company offers 181 properties in six major business hubs: Washington DC, Seattle, Los Angeles, Boston, New York, and San Francisco.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

The increasing rental prices and demand have contributed to driving the stock price to new levels for the first time in two years. After slightly dropping from $72 to around $60 throughout the first two quarters this year, the stock recovered in July to $72 and reached $82 in September.

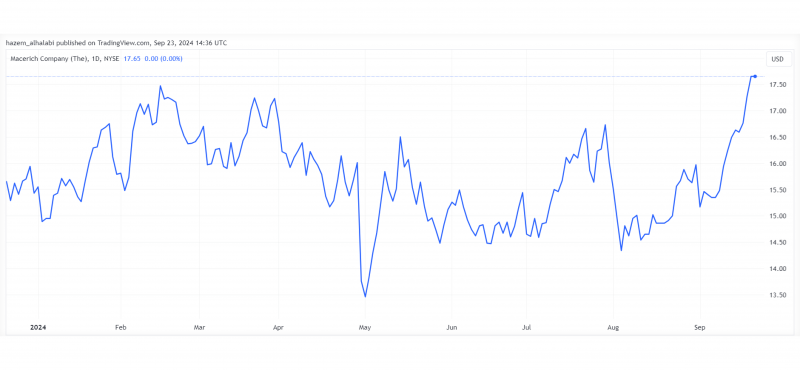

9. Macerich (MAC)

Industry: Commercial – Shopping Centres.

Annual dividend yield: 3.87%

Macerich is a REIT corporation that invests in shopping centres and malls in the US. The company owns and operates over 45 properties on both coasts of the nation, such as the Broadway Plaza in California and Queens Center in New York.

After a disappointing stock performance in 2023, trading under $13 for most of the time, NYSE: MAC improved significantly last year. The stock started the year at $15.50 and kept sustainable growth with minimum volatility.

However, a significant surge in September picked up the market value from $15 to over $17 in three weeks, offering lucrative returns with a reasonable dividend yield paid quarterly.

10. Crown Castle Inc. (CCI)

Industry: Commercial – Telecommunication Towers.

Annual dividend yield: 5.36%

Crown Castle Incorporation was established in 1994 in Texas, with a niche focus on building and operating wired/wireless telecommunication towers. The company owns over 40,000 cellular towers, over 110,000 small cellular nodes, and 90,000 route miles of fibre cables.

The company offers one of the highest REIT dividend rates, payable quarterly. CCI stocks in NYSE benefit highly from mobile service and network innovations in 4G and 5G, increasing the demand for telecommunication towers and surging the market price.

After the stock price dropped from $116 to $95 in the first half of 2024, it recovered significantly in the second half, growing to $115 in August and reaching $120 in September for the first time this year.

Conclusion

REIT companies offer facilitated access to real estate without having to pay significant capital to own land or property. You can buy shares in real estate investment trusts and grow your capital from rental income, dividend yields and value appreciation.

Property investment trusts invest and manage different real estate types, from healthcare to residential, commercial and industrial. This allows you to expand your portfolio and multiply your income streams.

FAQ

What is the best REIT stock?

Commercial REIT companies have been growing sustainably this year, especially in healthcare and industrial spaces. The ageing population and the increasing manufacturing needs for storage inflect higher stock growth in REITs.

Is investing in REITs a good idea?

Yes. However, they offer long-term profitability rather than short-term volatility and gains. Real estate investments grow slowly, offering a stream of interest income and multi-year longevity.

What are REIT investment trends?

After the Fed interest rate cut, residential properties are expected to pick up the trend. Households can acquire better loans, and REITs will potentially increase their investments in residential mortgages and leases.

What makes REITs better than stocks?

During a recession, short-term stocks become highly volatile, with mostly a downward slope. On the other hand, property investments focus on 10-15-20 years of profitability, making them less prone to short-term fluctuations.