Bitcoin Fork: When Is It Going To Be?

Today, Bitcoin is the most expensive crypto project on the market. As a benchmark of information technology, it acts as a reference point for the entire crypto industry, setting its direction of movement. During its existence, Bitcoin has gone through several forks, which, to a certain extent, change the rules of blockchain and allow the creation of a new, independent crypto network. The last fork of the said coin happened in 2017, but when can we expect the next one?

This article will shed light on a Bitcoin fork and its advantages. In addition, you will learn about the top 4 currently functioning Bitcoin forks and whether we should expect a new fork of the coin blockchain in the near future.

Key Takeaways

- A Bitcoin fork is a branching of the main blockchain and the creation of a separate and independent blockchain with new characteristics.

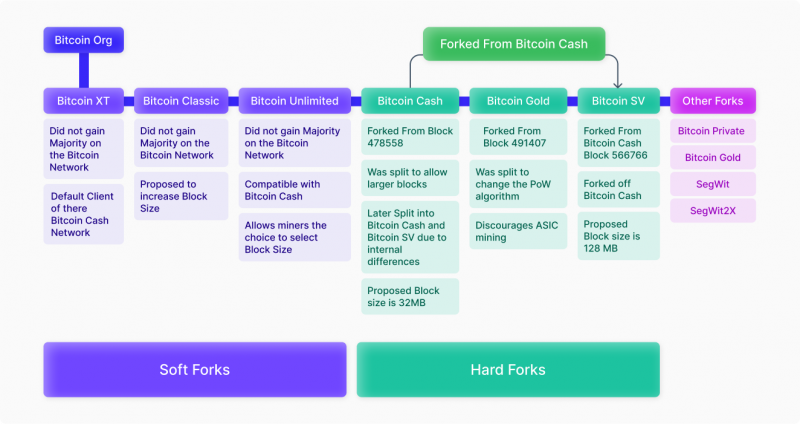

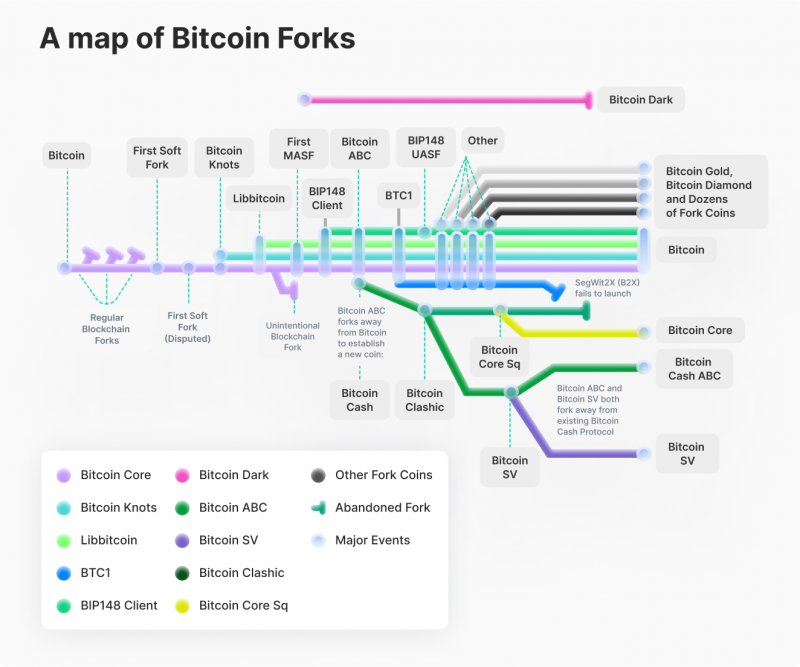

- Soft forks are aimed at changing a part of the main blockchain by applying new rules of operation. Hard forks often involve creating a new chain from scratch with new rules of operation.

- The most famous fork of Bitcoin is considered to be Bitcoin Cash, which occurred in August 2017.

What is Bitcoin Fork?

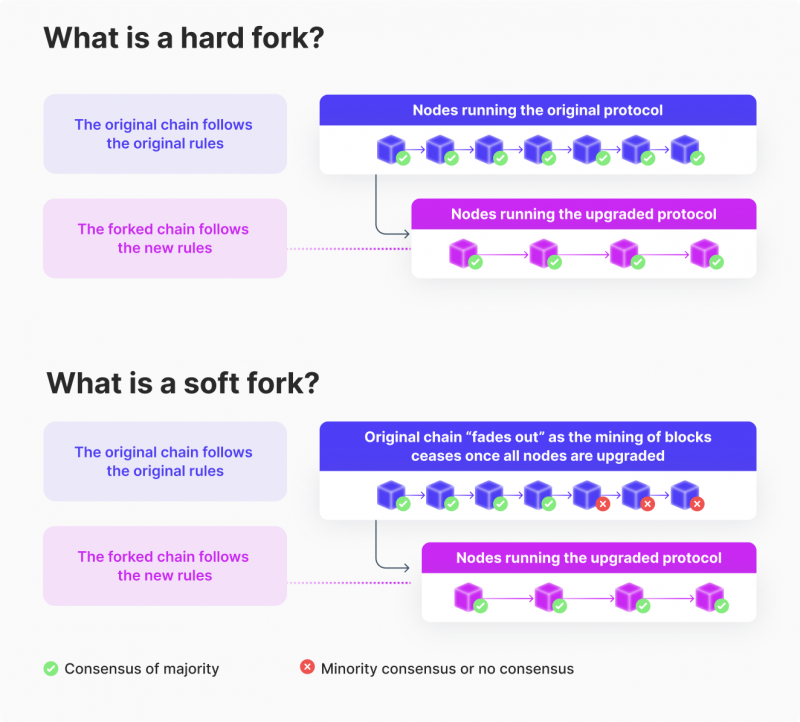

Fork (or branching) refers to the process by which the consensus in the community of a particular crypto project has split into two or more blockchains because of a relatively radical change in the underlying protocol. Such a process can take place on the blockchain of any cryptocurrency, including Bitcoin. Whenever a Bitcoin blockchain source code update is proposed in order for these changes to take effect, two sequential processes known as a soft or hard fork are conducted.

A soft fork is usually considered a “soft” source code modification. The blockchain rules are modified in a soft fork without requiring software to execute the new rules. If some nodes (nodes) in the network do not accept the new rules, those nodes can still communicate with the nodes that use the new rules. For better understanding, we can draw an analogy with foreign languages. If, before the fork, all nodes “talked” in American English, and the new rules require switching to the British version, the nodes that continue to use the American version will still be able to understand the British version. At the same time, nodes that use British English will find it easy to understand the American version. Thus, a soft fork is a reversible code change that does not break the consensus on the protocol itself.

In the hard fork process, the new rules contradict the old rules to such an extent that the nodes that have not accepted them do not obtain information from the nodes that have received them. The old nodes speak English, and the new nodes speak Chinese, to follow the same analogy with languages. A hard fork involves changing the consensus mechanism itself, in which case the entire network is split into two parts that can never communicate again. This is because blocks recognized as valid in one part will not be considered valid in the other. Also, a hard fork may refer to a change in the rules of operation associated with the need to change the protocol. In other words, sometimes, one has to resort to one type of fork to make Bitcoin currency better and safer.

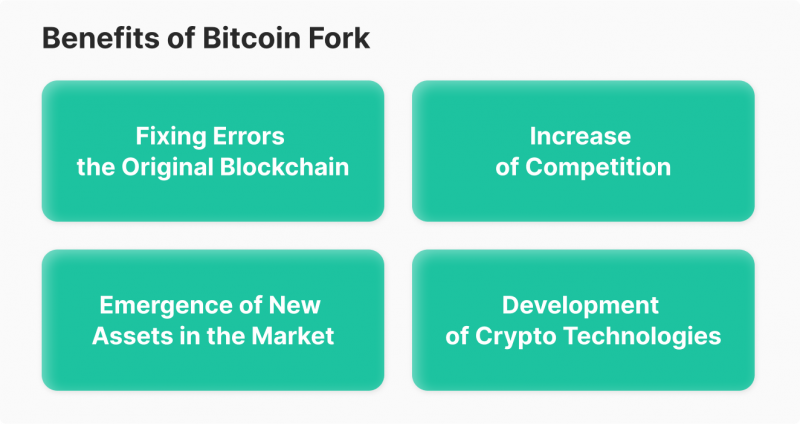

Benefits of Bitcoin Fork

In essence, each Bitcoin fork is a copy of Bitcoin, but due to the completely altered structure of the ledger, they are separate projects that have some similarities with the original Bitcoin blockchain. Bitcoin has experienced several major forks in its history that have benefited it. So, soft forks as well as hard forks provide several benefits that include the following:

Fixing Errors in the Original Blockchain

As a rule, applying the fork within the Bitcoin blockchain allowed obtaining an utterly new crypto-asset with unique features of the network structure, which subsequently helped detect and correct (if possible) flaws and errors associated with the operation of the original blockchain of the coin. This step was always an attempt to improve and modernize all the registry elements to fully scale the network and introduce new technologies, thanks to which one can radically change the blockchain concept. Nowadays, after many forks of the network, Bitcoin, despite the most outstanding value on the market, still suffers from relatively slow transactions and a low scalability threshold, unlike many other crypto assets.

Emergence of New Assets in the Market

As mentioned above, the fork process involves blockchain branching when it becomes possible to create an entirely new crypto asset with a unique set of characteristics, having its own peculiar ecosystem. Bitcoin forks resulted in such well-known coins as Bitcoin Cash, Litecoin, Bitcoin SV, Bitcoin Gold, Bitcoin Diamond, and Bitcoin Platinum. Each of these coins still exists on the market and has advantages and disadvantages. Still, all of these solutions have contributed significantly to rethinking the whole concept of the original Bitcoin blockchain development.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Development of Crypto Technologies

Each new Bitcoin fork has created fertile ground for the development of the blockchain itself and crypto technology as a whole. Being the most popular crypto project on the market, Bitcoin has always been the center of attraction for new and promising ideas related to using its publicly available blockchain code in a variety of directions, which led to the creation and distribution of such exciting and promising crypto technologies as GameFi, NFTs, DeFi, Multichains, Metaverse, and others, which in turn became the basis for the development of other technologies.

Increase of Competition

It may not seem obvious to many, but the fact that Bitcoin’s blockchain is branching out is generating healthy competition not only within its own network, but also among many other companies seeking to either create their own digital currency or adopt all the positive aspects of forks. Such competition is accelerating progress in the development of both systems and solutions aimed at improving the cryptocurrency distribution register and transforming the entire crypto industry as a whole.

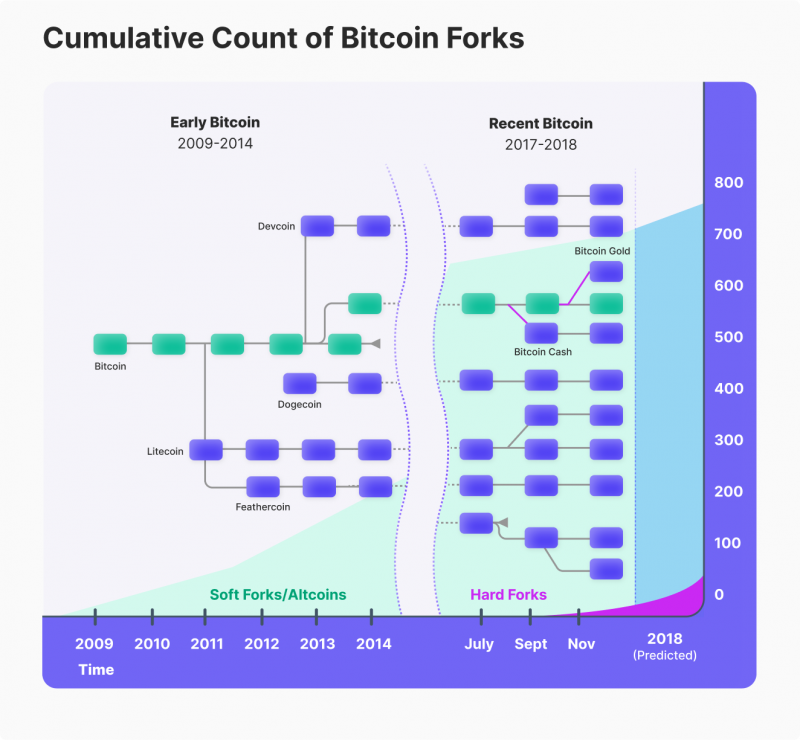

Throughout its history, Bitcoin has experienced a total of 105 forks.

The Future of Bitcoin Blockchain: When to Expect the Next Fork?

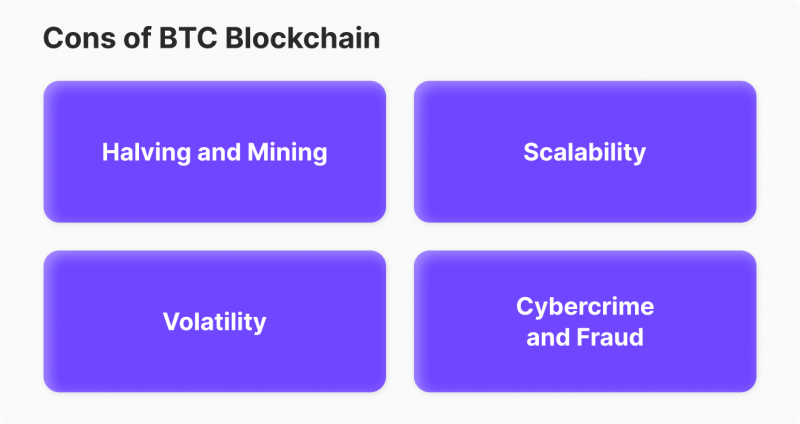

Today the Bitcoin community sees Bitcoin as a “digital gold,” which will continue to generate income for investors for a long time, even if it is split into two cryptocurrencies. Bitcoin’s strengths should remain its security, independence from government and financial institutions, irreversibility, and, most importantly, scalability. Nevertheless, today Bitcoin has tough criticism because its system has serious disadvantages, the solution of which is either too expensive at this stage or technologically not yet possible, even with modern computing power and information technology. From this, it follows that many factors talk about the urgent need to create a new fork of Bitcoin, which will help find new ways to solve the existing problems in the blockchain of the coin, among which we can highlight the following.

Halving and Mining

One of the first and most significant problems that is a stumbling block for Bitcoin blockchain development and, consequently, requires a fork is halving – multiple decreases in the remuneration miners receive for each block mined in the network. This event takes place every 4 years and reduces miners’ profit by precisely 2 times, which leads to unpleasant consequences in the form of increasing the cost of transactions within the network as well as the rapid growth of Bitcoin’s value, which in turn creates other unpleasant consequences.

Volatility

Bitcoin volatility is dictated by market sentiment, which is often based on the news background, the nature of which determines the state of both the coin itself and the entire crypto market as a consequence. The difficulty of BTC volatility is a severe hindrance for network scaling, but on the one hand, it indicates the need to make a fork to explore ways to reduce the impact of various factors on the coin’s price.

Scalability

A blockchain network is a decentralized ledger in which each network element stores all the information it contains. This ensures that the loss of one node does not affect overall functionality, and constant validation prevents inconsistent changes to the stored information. However, the more computers there are, the more time is spent on these checks and transferring data to each. The speed and bandwidth go down, which is a scaling difficulty – the more nodes in the network, the worse its throughput and the slower the overall operation.

Cybercrime and Fraud

The popularity of Bitcoin has given rise to a network security concern, expressed in systematic attempts by fraudulent organizations and cybercriminals to break into the blockchain network. This issue has become one of the most acute, requiring not only a blockchain fork, but also the creation of reliable protection protocols that will resist any type of penetration and attack.

Despite the serious shortcomings existing in the BTC blockchain and the existing need for change, there is currently no comprehensive and reliable information regarding the next fork of the Bitcoin network, but it can be argued with some probability that it will happen either before the halving coin scheduled for 2024 or after it, when the fee for miners for each mined block in the network will again be halved.

Bitcoin Blockchain Evolution: Top 5 Active Forks Today

Bitcoin is the oldest coin on the market, having been around since 2008, and therefore has a number of different forks, each with the goal of creating a new blockchain and bringing in new ideas and developments, while retaining some code of the original Bitcoin blockchain.

Active Era

The active phase of forks (both soft and hard) began back in 2017, when a hard fork resulted in a separate standalone blockchain called Bitcoin Cash. However, this is not the only example, and below are the most serious forks of the network that are still working today.

Bitcoin XT

This is the first hard fork of the Bitcoin network, which took place in August 2015. Based on the original Bitcoin Core code, the hard fork was supposed to increase the block size to 8 MB, thereby increasing the network’s throughput to 24 transactions per second. However, the cryptocurrency did not receive the necessary support from miners. The transition to Bitcoin XT required 75% of all Bitcoin miners to join the new network, but only 12% supported the hard fork. Consequently, in 2016, one of the leading developers, Mike Hearn sold his cryptocurrencies and left the project. After that, only 20 nodes remained from the original number of more than 4,000 units, which made this network incapable of functioning.

Bitcoin Unlimited

This hard fork was launched in May 2016 to change the block size, where miners were invited to choose the size of the future network block themselves. According to miners, the increase in block size would not only eliminate the queue, but also increase their profitability by increasing the total commission in the block. However, critics of this hard fork, primarily developers, noted that this strategy has a high probability that large centralized pools of miners will start to manipulate the development of the network.

Consequently, miners with limited hardware capabilities would not be able to participate in the development of the network and would eventually be squeezed out entirely. Thus, the network will become centralized within several pools. Experts also found various bugs in Bitcoin Unlimited’s software, which caused 70% of the network’s nodes to crash in April and May of the same year, thus undermining the crypto community’s trust in this fork.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Bitcoin Classic

This fork was made in early 2016 to solve the Bitcoin network scaling problems, which the Bitcoin XT hard fork failed to solve. The project was supposed to increase the block size first to 2 MB and, after another two years, to 4 MB. But even this hard fork did not get proper support from the crypto community: in the beginning, more than 2,000 nodes participated in the project, but by 2017 their number dropped to 100. Subsequently, it became known that the project was closing, and the developers called to support the new-found fork of Bitcoin Cash.

Bitcoin Cash

Bitcoin Cash fork is the most successful and major Bitcoin fork to date. The Bitcoin Cash protocol appeared on August 1, 2017, on block 478.558 due to a forced hard fork. This fork increased the block size from 1 MB to 8 MB, which in turn increased the bandwidth of the network and reduced the price of transaction fees. After the hard fork, Bitcoin holders had an equal amount of Bitcoin cache cryptocurrencies in their wallets. The new network included a mechanism to protect against parallel transactions in the two blockchains.

Bitcoin Gold

Bitcoin Gold fork appeared on October 24 due to a hard fork on a block of 491,407, made by the Hong Kong-based mining firm Lightning ASIC. The project aims to become a more attractive currency for non-professional miners than the original Bitcoin. In this regard, Bitcoin Gold can be mined by more network members. The initiators of the hard fork use the new Equihash algorithm instead of the old one, which provides the Proof-of-Work protocol. This algorithm is more sensitive to the amount of RAM and is used in mining the cryptocurrency Zcash.

Conclusion

Bitcoin hard forks have become a powerful tool for developing the coin’s concept and improving its network. Each of the forks that happened to the registry of the most important cryptocurrency on the market contributed to the possibility of rethinking its potential and prospects of technological potential, revealing which would create the ideal blockchain that would be equally decentralized, secure and well scaled.