Choosing the Best Personal Finance Software Solutions in 2026

Personal finance is an instance of financial literacy that includes the analysis and management of multiple activities related to earning, saving, spending, and investing funds within the framework of both individual needs and groups of people.

At the same time, complex analysis of all components related to budgeting and cash flow management within the scope of personal finance is a complex process optimised and simplified by specialised personal finance software.

This article intends to explain the advantages accounting and personal finance software have and which is the best on the market today.

Key Takeaways

- Personal finance software is an ecosystem of solutions aimed at automation, optimisation, and control of personal finance activity.

- The main functions of personal finance software are budgeting, income and expense control, analysis, planning, and collection of statistical and financial data.

Benefits of Using Personal Money Management Software

Utilising the best personal finance software can provide numerous advantages that greatly improve your ability to manage financial affairs professionally. These tools are designed to streamline various aspects of financial oversight, making it easier for users to track their income, expenses, and savings goals.

These are the key advantages the usage of personal finance software programs can give:

Centralised Financial Administration

Leading personal finance software features a unified dashboard that consolidates all your financial accounts — such as bank accounts, credit cards, investments, and loans — into a single, cohesive platform. This integration facilitates a more streamlined approach to accounting for your finances.

Software for personal finance also provides consolidated data, enabling users to access and oversee all financial information from one central location. This simplification improves visibility and enhances control over financial affairs, making it simpler to supervise and manage your long-term financial health.

Enhanced Budgeting

Personal finance software allows you to create tailored budgets aligning with your financial preferences and spending patterns. This customisation will enable users to modify their budgets, ensuring they remain relevant to changing financial circumstances.

Additionally, this software provides real-time spending and income tracking, enabling users to manage their financial affairs. By monitoring these elements continuously, individuals can adhere to their budgets more effectively and make timely adjustments when required.

Automated Expense Tracking

Complimentary personal finance software offers automatic categorisation, which organises your transactions effortlessly, simplifying the process of monitoring and evaluating your expenditures.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

It also generates comprehensive reports that present in-depth analyses and visual representations of your spending patterns, aiding in identifying potential savings opportunities.

Personal finance software is a digital alternative to control and manage your budget that has replaced personal financial advisors.

8 Best Personal Finance Software Solutions in 2026

Personal finance is relevant to every person, and the criticality of competent accounting and personal money planning determines the degree of financial literacy and safety of making future decisions related to money transactions.

Today, on the market, there is a great variety of practical accounting and personal finance software that provides a complete package of tools and solutions to optimise the process of personal finance regulation.

1. Quicken

Quicken is an all-encompassing personal finance tool designed to assist users in managing their financial lives effectively. It provides a range of functionalities, including budgeting, bill management, investment oversight, and retirement strategy development, making it a versatile tool for various financial needs.

The platform boasts several key features, such as expense tracking, the ability to create custom categories, investment tracking, and plans for debt reduction.

Besides that, it offers a mobile application allowing users to access their financial information conveniently while moving. Quicken is particularly suited for individuals seeking a comprehensive solution for their financial supervisory requirements.

2. Mint

Mint is a complimentary and intuitive application that stands out for its robust budgeting and expense management capabilities. The app seamlessly connects with your bank accounts, credit cards, and investment portfolios, allowing for effortless financial oversight.

Notable functionalities include budgeting tools, reminders for bill payments, monitoring of credit scores, and tracking of investments. This platform suits novices and individuals seeking a straightforward, no-cost financial governance solution.

3. YNAB (You Need A Budget)

YNAB, which stands for You Need A Budget, is a software solution that facilitates effective budgeting by promoting active financial governance through its distinctive zero-based budgeting methodology. This approach assures that every dollar is allocated to a specific purpose, helping users to maintain a clear overview of their financial situation.

The platform offers several key features, including goal-setting capabilities, tools for debt repayment, and the ability to sync data in real time across multiple devices.

YNAB is particularly well-suited for individuals committed to taking an active role in their budgeting process and determined to gain control over their financial health.

4. Tiller Money

Tiller Money is a financial accounting tool that leverages Google Sheets and Excel to offer personalised budgeting and tracking templates. This software seamlessly integrates with your financial transactions, ensuring that your spreadsheets are updated daily.

The platform boasts several key features, including customisable templates, real-time updates, and extensive support for various financial accounts. It is particularly well-suited for individuals who favour spreadsheet-based solutions and seek a high degree of customisation in their financial planning.

5. GoodBudget

GoodBudget is an intuitive budgeting service that employs an envelope system to assist users in distributing their funds across different spending categories. This straightforward approach makes it easier for individuals to manage their money effectively.

The app offers essential features such as expense tracking, debt consolidation, and the ability to sync data across various devices. It is particularly well-suited for couples and families who favour envelope budgeting and seek a user-friendly solution for monitoring their expenditures.

6. Moneydance

Moneydance is a desktop application designed for professional finance oversight, prioritising user privacy and data security. This software provides a robust platform for individuals looking to take charge of their financial operations while ensuring that their sensitive information remains protected.

Its notable features are detailed financial reporting, investment tracking, and bill payment capabilities. It is particularly suited for users who favour a desktop environment and place a high value on maintaining privacy in their financial dealings.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

7. EveryDollar

EveryDollar is a budgeting solution that utilises the zero-based budgeting approach to help users manage their finances effectively. This tool is designed to simplify the budgeting process, making it accessible for individuals looking to gain better control over their spending habits.

Among its key functionalities, EveryDollar offers an intuitive drag-and-drop interface for easy budget creation and modification. Additionally, it provides expense tracking capabilities and, in its premium version, allows for seamless integration with users’ bank accounts, enhancing the overall budgeting experience.

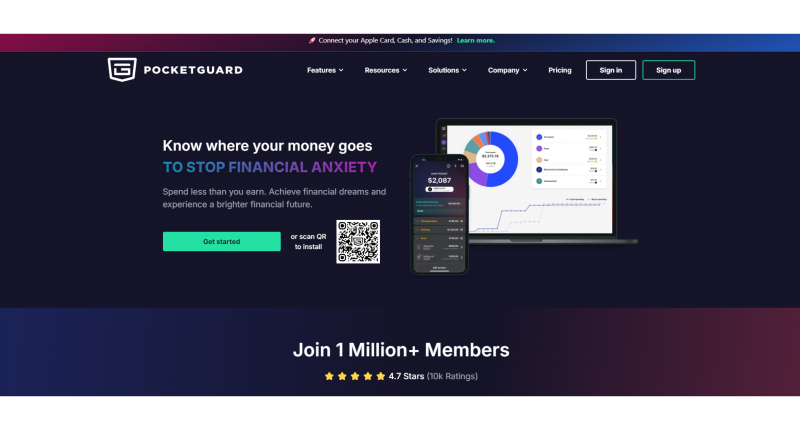

8. PocketGuard

PocketGuard is a financial forecasting application designed to assist users in monitoring their expenditures and gaining insight into their available disposable income. Providing a clear overview of financial standing empowers individuals to make deliberate spending decisions.

Among its notable features is the “In My Pocket” function, which displays the amount of money available for spending. Additionally, PocketGuard offers automatic tracking of expenses, along with budgeting tools and reminders for upcoming bills, ensuring users stay on top of their financial commitments.

Conclusion

In 2026, the best personal finance software solutions offer diverse features to cater to various financial accounting needs. Many options offer free trials, allowing you to explore their functionalities and find the best fit for your financial journey. Investing time in a suitable personal finance tool can contribute to budgeting, savings, and all-around financial health.

When selecting personal finance software, consider your specific needs, such as budgeting, investment tracking, ease of use, cost, and support and ensure it concurs with your financial expectations and integrates well with your daily routine.

FAQ

What is personal finance software?

Personal finance software helps individuals manage their finances by tracking their spending, creating budgets, negotiating investments, and planning for financial goals.

Why should I use personal finance software?

Using personal finance software can simplify managing your money by automating tasks such as tracking expenses, categorising spending, and providing insights into your financial habits.

How do I choose the right personal finance software?

Consider your financial goals, the features you require (like budgeting, investment tracking, or debt management), ease of use, customer support, and cost.

Are these personal finance tools secure?

Most reputable personal finance software solutions employ high-level security measures, including encryption and multi-factor authentication, to protect your financial data.

Is personal finance software suitable for all financial situations?

Personal finance software can be helpful for most people, whether you’re managing day-to-day spending, saving for a big purchase, paying off the debt, or investing for the future.