Explaining Float Rotation – How it Helps You Identify Hidden Market Patterns?

Articles

Trading has become one of the most viable and lucrative career paths in recent years. Previously, trading was only available to highly educated professionals with substantial trading funds to spare. Now, digital technologies allow numerous individuals to participate in global trading and earn significant returns for their efforts. However, the increased accessibility doesn’t mean that the trading landscape is any more accessible compared to the past. On the contrary, trading has become much more challenging and complex due to increased global competition.

This article will discuss one of the most essential topics in the trading field – the float rotation and its benefit to potential investors.

Key Takeaways

- Floating stocks represent the total number of shares that can be freely traded on the stock market.

- Float rotation calculates the ratio of total floating stock turnovers during trading hours.

- Float rotation is an excellent mechanism for understanding the shifts in market-wide strategies related to particular company stocks.

Starting With Basics – What is Float In Stocks?

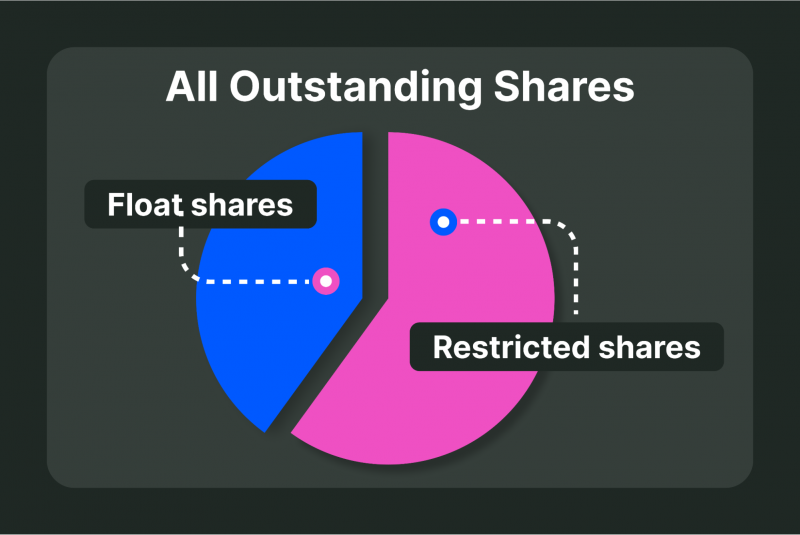

To understand the float rotation concept, let’s first explore the definition of floating stocks. Let’s answer a simple question – are all issued stocks available for active trading on the market? In theory, all issued stocks should be available for traders, right? But in practice, a proportion of stocks is almost always unavailable due to being held by insider employees, top management or financial institutions. Some stocks are outright restricted from being traded due to various regulatory reasons.

Float Shares vs. Outstanding Shares

Thus, the total supply of stocks, called the outstanding shares, and the amount of tradable stocks are two different figures, and the floating stocks represent the latter. Numerous variables affect the stock floats, including stock buybacks, executive takeovers or restructuring of the company’s business models. Therefore, it is important to monitor companies and their decisions to understand the potential percentage of float stocks.

How Does Float Affect Price?

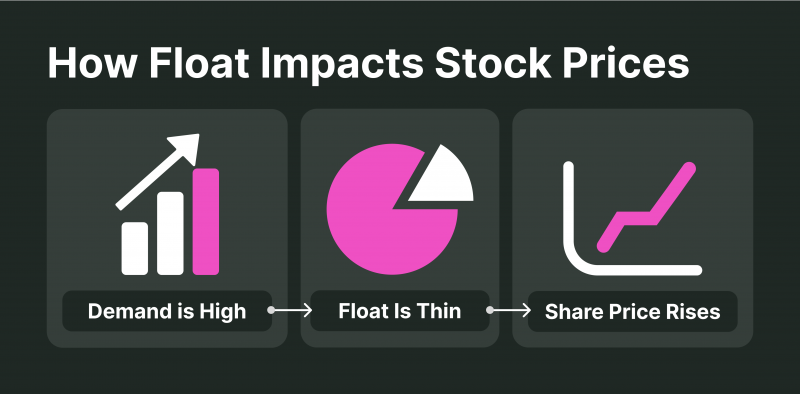

But what is the purpose of floating stocks? After all, the restricted shares do not take away anything from the tradable ones. They also don’t affect the share price directly. However, stock restriction is still an essential part of stock price movements on the market. Floating stocks affect the liquidity of the stock markets tremendously. Simply put, the floating proportion dictates the availability of particular company stocks.

For example, if Google’s floating stocks are at 70% of the total issued number and the market demands 80%, then the restricted shares will cause illiquidity. Google’s share prices will increase due to the market demand, making it much harder for traders to purchase Google shares. On the contrary, if the supplied floating stocks exceed the demand on the market, then the shares will be easy to buy at reasonably quoted market prices.

However, the floating stock percentages tend to change dramatically in some instances, making certain company shares liquid or illiquid in a matter of hours. High and low-float stocks require dramatically different strategies, and traders should approach them accordingly. For example, low-float stocks are highly volatile.

Holding them for a certain period might benefit traders if the demand spike is expected shortly, as they could sell the low-float stocks with substantial premiums. Conversely, holding high-float stocks is often pointless, as they are not scarce resources on the market. However, that could change if the market shows bullish tendencies in a particular period of time. Thus, monitoring the floating amounts for desired stocks is rewarding and crucial, as purchasing them might become exceedingly difficult in the next trading window.

How To Calculate Float Rotation?

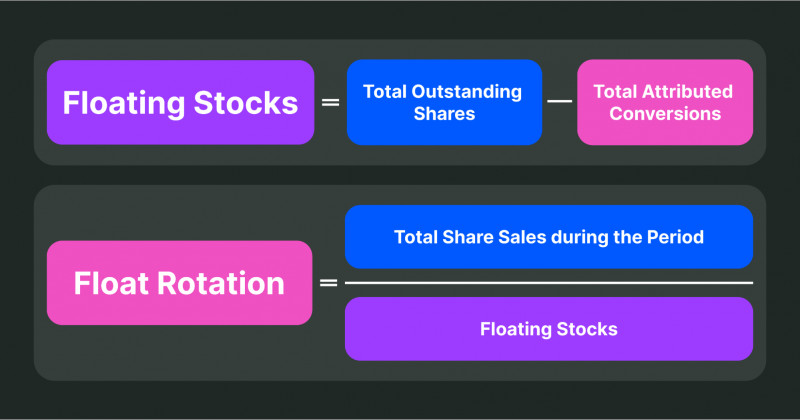

As described above, the float rotation formula is relatively trivial to calculate. Float rotation has two crucial variables – floating stocks and their traded amount during a specified period. To identify floating stocks, one must deduct restricted shares from all outstanding shares for a particular company. Next, the float rotation formula divides the total share sales by the floating stock amount. The derived ratio showcases the total number of times the float shares have exchanged hands during the day-trading period. Examining a float chart to visualise the trading volume in a simple and understandable manner is also advisable.

While calculating the float rotation is simple, deriving proper insights and assumptions is challenging and highly subjective.

Why Is Float Rotation Essential In Trading?

The float rotation utilises the float amount of particular company shares to identify the total number of turnovers within a specified period, usually a single trading day. Imagine a company with 10,000 outstanding shares but only 5,000 floating shares to visualise this concept. The 5,000 float stocks were traded 20,000 times during trading hours. In this case, float rotation amounts to 4, as the market only included 5,000 shares of company X, but all shares were traded four times as much during the day.

Thus, float rotation is a formula for calculating the stock turnover ratio. It is another vital concept in the trading realm, showcasing how many times the total supply of shares has swapped ownership. Calculating and analysing this ratio is important, as it can shed light on the stock price movements. Every time the total supply of float stocks exchanges owners, the trading interests are reset completely.

The new owners have new aspirations. If the previous goal were to increase the price to $100, new stockholders would have a mission to increase that amount further. Conversely, new owners might be bearish and decide to hold the stocks, which will cause a different ripple effect throughout the stock market. Thus, traders that wish to short this particular stock must consider that the shares are owned by completely different parties, which can drastically affect the success of the short position.

To further emphasise this point, let’s imagine a scenario where company X’s shares have a float rate of less than one. This means that the 5,000 shares mentioned above were not even fully traded during the open hours. Thus, the general strategy about the stockholders remains the same for the next trading interval. If the float rotation exceeded the ratio of one, the overall market strategy would likely change. Thus, traders must investigate the potential strategic changes of new holders to anticipate future price movements correctly.

Final Thoughts

Float rotation is often a key concept in uncovering the patterns and causes of price movements in the stock market. With this formula, traders can understand market activity better and derive more data-informed trading strategies instead of shooting in the dark. Calculating and examining float rotations on any desired shares is crucial, as they could signal considerable changes in the overall market strategy surrounding particular company shares.