Fed Meeting September Results in Interest Rates Cut, What Does it Mean for Businesses?

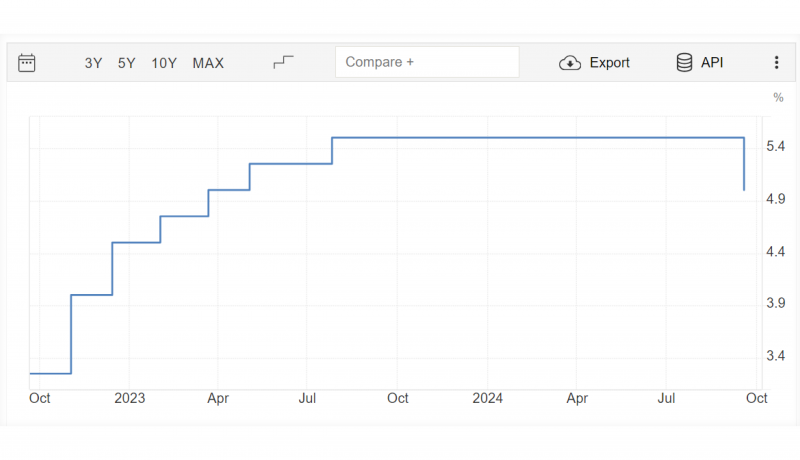

The Federal Reserve decision has finally come through, meeting the expectations of most economists and investors. The historical decision entails lowering interest rates by 0.50% for the first time in years.

This decision affects financial institutions, businesses and end-users who must prepare for new saving plans and investment decisions. The decision was made to boost economic growth after the improvement of macroeconomic rates. Let’s discuss more details on the Fed meeting in September and the implications of this announcement.

Fed Meeting September Outcomes

In its 6th scheduled meeting, the Federal Open Market Committee decided on September 8th to lower its benchmark interest rate by half a percentage point, 50 basis points, or 0.50%.

The Fed cut interest rates in response to the easing economic indicators like unemployment and inflation. This decrease is expected to stimulate spending, motivate users to take loans, and increase their investments, ultimately boosting the economy.

Reducing these rates is historical because the last time the Fed made such a decision was back in 2020 as an emergency plan during the pandemic. Before that, the previous half-a-point reduction was during the 2008 financial crisis.

The market was split before the Fed meeting in September. After the disappointment in July’s meeting to change the Fed rate, economists expected a decision to come through in Q3. Market analysts were two-sided about the decrease amount, and the unpleasant hiring rates suggested that a 0.25% decrease was more likely than a 0.50%.

Now, the doors are open for speculations on the next Fed meeting taking place in November.

How Does The Fed Lowering Interest Rates Affect You?

The new Fed rate affects other areas of the economy, including consumer loans, auto loans, mortgages, saving accounts, and other forms of investments.

Essentially, this reduction means that the central bank will charge lower credit returns. This way, credits become more affordable, and institutions and users get better conditions on their loans and spend more.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

As a result, if you are opening a savings account with your bank, you will get less interest, making these investments a little bit less exciting. On the flip side, housing and automobile loans become more affordable.

When the Fed cuts interest rates, investors are more likely to seek high-yielding securities and assets, taking on more high-risk/high-reward opportunities.

Interest Rates Types

The new Federal borrowing rate will affect other sectors. Let’s review the top interest rates in the US and how they are affected by this decision.

Fed funding rate: the rate banks charge each other for overnight loans, which has now lowered to 4.75%-5%. This makes it cheaper for banks to receive and issue loans for businesses and individuals.

Prime rate: the rate at which commercial banks charge creditworthy clients, often used for issuing credit cards and home equity lines of credit. The prime rate is expected to drop alongside the Fed rate cut.

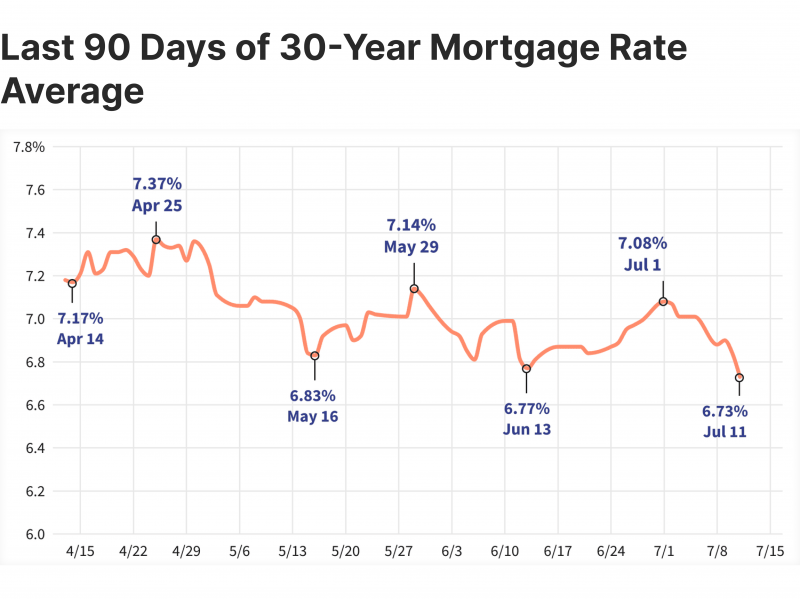

Mortgage rate: housing loans are indirectly affected by the Federal funds rate but are affected by long-term bonds. Therefore, mortgage rates are more likely to reduce after this decision.

Auto loans: like mortgages, automobile loans follow overnight loans and are expected to drop after reducing the Fed borrowing cost.

Fed Interest Rate Outlook 2024

The next Fed meeting on interest rates is going to be interesting because the market is already speculating about another half-percentage rate reduction.

The FOMC board members stated that it is difficult to decide today what will be decided on the upcoming Fed meeting schedule because the unemployment and inflation rates must be tested.

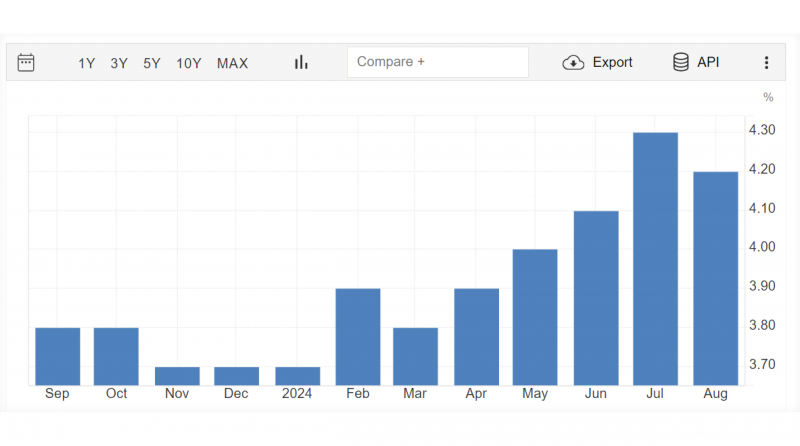

Unemployment Rates

Before the decision, the Federal Reserve was concerned about the increasing unemployment rate, which is currently standing at 4.2%. After being reduced to 3.7% last year, this indicator has been climbing the chart every month, reaching 4.3% in August and 4.2% in September.

Decision makers were split on this figure, as some wanted to fix the hiring problem before cutting the interest rate. However, reducing business borrowing costs can motivate spending and resolve the hiring problem.

Inflation Rates

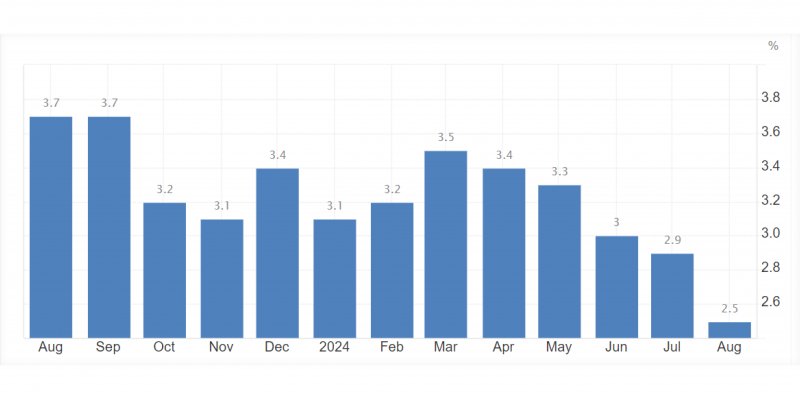

Earlier this year, the Federal Reserve set a 2% inflation rate target as a basis for any decision on interest rates. This year, the US inflation has improved considerably, reaching 2.5% in August for the first time since 2021.

It is crucial to watch the impact of the reduction in borrowing rate on inflation. As a rule of thumb, lower interest will motivate spending and investment, which can push inflation higher. However, the extent to which this rate is increasing must be tested.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Conclusion

The Fed meeting in September resulted in lowering interest rates, which many experts and economists predicted. In fact, the reduction was expected in the July meeting but was not applied due to unwelcoming economic figures.

However, the easing inflation and unemployment figures and the rising calls from the market triggered such a decision. Ultimately, this reduction is designed to motivate businesses and individuals to take cheaper loans, increase their expenditures and boost the economy.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.