Forex Economy Calendar User Guide

Engaging in the vibrant milieu of the FX market entails more than mere instinct and experience; it requires a multifaceted array of tools to inform trading decisions.

Among these useful tools is the Forex economic calendar, which serves as a vital resource for traders looking to anticipate market movements. Whether one is strategising trades, mitigating risks, or striving to understand the economic factors influencing currency prices, the economic calendar acts as a daily guide in the expansive realm of Forex trading.

This article will reveal the concept of the FX calendar and what insights it can give in practice in trading. You will also learn when it is used and how to read it correctly.

Key Takeaways

- The Forex economic calendar is crucial for traders strategically planning their trading activities providing timely information about significant economic events.

- Utilising the economic calendar enables traders to understand how various economic patterns, government decisions, and financial reports impact currency markets.

- The economic calendar offers customisation options, allowing traders to filter events based on their interests and trading practices and setting alerts for upcoming financial events.

What is Forex Economy Calendar?

The Forex economic calendar is a vital tool traders and investors use in the FX market to track scheduled economic events that can influence currency valuations. These events include economic metrics, monetary policy decisions, and various financial reports from government agencies and private organisations.

The Forex calendar is essential for traders looking to manage risks and capitalise on opportunities arising from economic announcements. By understanding when significant events are scheduled and their potential impact on the market, traders can better position themselves to respond to currency fluctuations.

It’s a fundamental component of the technical and fundamental analysis toolkit in Forex trading, enabling traders to strategise more effectively and potentially increase their returns while mitigating losses.

Utilising the Forex calendar effectively requires awareness and preparation. Traders often align their trading operations with releasing high-impact data to exploit market volatility.

For instance, if a central bank is expected to raise interest rates, a trader might position themselves to buy the currency ahead of the announcement, anticipating appreciation due to higher yields attracting investors.

Conversely, unexpected news can cause rapid currency depreciation, necessitating quick adjustments or risk mitigation strategies such as stop-loss orders. Ultimately, the calendar serves as a guide for potential market movements and a critical risk management tool, helping traders avoid costly surprises by staying informed about the economic landscape.

Because charts can move unpredictably in the first few minutes after a Forex report is released, it’s paramount to have a sufficient deposit and a broad stop-loss to manage this volatility and wait for a clear trend direction.

Insights Provided by the Forex Economic Calendar

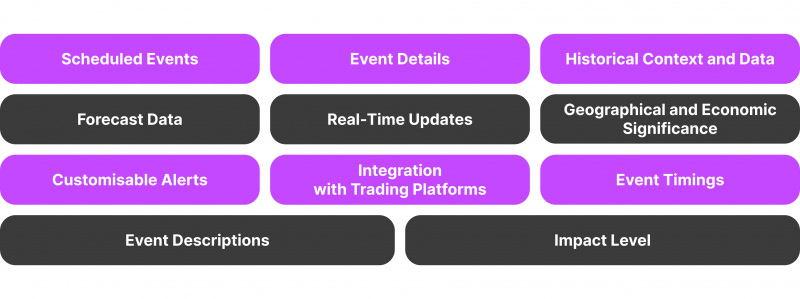

The Forex calendar is an indispensable tool for traders in the Forex market, offering detailed insights that inform trading choices and risk management. Here’s a deeper look into the various insights provided by an economic calendar:

Scheduled Events

The calendar is an invaluable tool for traders, offering precise scheduling of upcoming economic events right down to the minute. This level of detail is essential for traders who rely on timely information to make quick decisions.

Additionally, the calendar lists regular releases such as monthly employment reports, quarterly GDP updates, and annual budget statements. This comprehensive information helps traders anticipate periods of potential high volatility and prepare accordingly.

Event Details

Each event in the calendar specifies whether it involves the release of a report, an update of an economic indicator, or a decision by a central bank. This information assists traders in predicting the potential market response.

Events are typically categorised based on their anticipated impact on the market, ranging from low to medium to high. This classification enables traders to effectively prioritise their attention and adjust their trading methods appropriately.

Historical Context and Data

The calendar offers access to valuable historical data from previous events, which is essential for conducting trend analysis and predicting how similar events may impact the market in the future.

Traders can use this historical data to compare outcomes with previous data and forecasts. This comparison helps them assess the strength or weakness of an economic indicator, which in turn influences their decisions regarding long or short positions in the market.

Forecast Data

Before an upcoming event, economic calendars frequently present the consensus forecast derived from prominent economists. This consensus forecast serves as a valuable benchmark for evaluating the actual release.

Some calendars display a single consensus forecast and provide a range of projections. This range showcases the diversity of expectations among economists and highlights the potential for increased market volatility if the actual data deviates significantly from this range.

Real-Time Updates

Upon the instant release of data, the economic calendar promptly updates to provide the latest information, which is crucial for traders who need to make rapid, informed decisions.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Additionally, real-time updates enable traders to monitor market reactions as they happen, offering valuable insights into market sentiment and trader behaviour.

Geographical and Economic Significance

The calendar offers a wide range of events from major economies and emerging markets, providing traders with a comprehensive perspective essential for those dealing with multiple currency pairs.

It features essential indicators like inflation rates, unemployment figures, manufacturing data, and consumer spending, all of which play a crucial role in evaluating economic well-being and the strength of a currency.

Customisable Alerts

Traders can create notifications for particular events, which helps them stay informed about significant developments that could impact their trading activities. They can customise the calendar by filtering events based on the country, impact level, or type of event, enabling them to align the calendar with their individual trading requirements and areas of interest.

Integration with Trading Platforms

By directly integrating the calendar data into trading platforms, traders can conveniently access the information alongside their trading tools. This integration streamlines the decision-making process by allowing traders to make deliberate decisions without switching between applications or platforms.

Advanced trading platforms may provide sophisticated tools for analysing the potential impact of specific events on specific currency pairs. These analytical tools can significantly enhance strategic planning by enabling traders to assess and anticipate the effects of economic events on their trading positions.

Event Timings

The calendar provides precise date and time information for each event, ensuring users know the exact timing of economic data releases and scheduled events. The displayed times are often customised to the user’s specific time zone to prevent any timing errors.

Event Descriptions

Each entry clearly indicates whether it is an economic indicator, a government report, a policy decision, or a speech by a prominent figure, offering precise and comprehensive information.

Additional elaboration is provided for each event, outlining its significance in economic analysis and its typical impact on different currency pairs. This assists traders in comprehending the potential market fluctuations that may occur.

Impact Level

Events in the financial markets are evaluated based on their anticipated impact on market volatility, categorised as low, medium, or high. This classification assists traders in forecasting the potential level of market fluctuations and developing suitable trading strategies.

It also involves looking back at how comparable events have historically impacted the Forex market, providing valuable insights into how future events could affect market dynamics.

Practical Applications of Forex Economic Calendar

The Forex economic calendar is an essential tool for currency traders, enabling them to anticipate market movements and manage risk effectively. Here’s how traders practically apply the information from an FX calendar:

Pre-Trade Analysis

Traders stay informed about upcoming economic announcements such as GDP, inflation, employment figures, and central bank decisions to anticipate potential impacts on the currency pairs they are trading. By being aware of the timing of these critical releases, traders can strategically plan their trading activities around these events.

When anticipating the effects of an upcoming event, traders may choose to adjust their trading strategies. For high-impact events, they might opt to tighten stop-loss orders, reduce position sizes, or refrain from entering new trades until after the data is released to minimise potential risks.

Risk Management

Economic calendars play a crucial role when predicting volatility by providing insight into the expected impact of upcoming events. This information enables traders to make informed decisions about managing risk, such as setting suitable stop-loss levels and determining when to refrain from participating in the market.

In preparation for heightened volatility, traders often use hedging strategies to safeguard their investments from unfavourable market movements. For instance, they may opt to establish offsetting positions or employ options to protect against unforeseen losses.

Capitalising on Opportunities

Regarding news trading, traders frequently leverage economic releases as potential entry points for benefiting from significant price fluctuations. They can strategically capitalise on swift currency movements by accurately predicting the market’s reaction to news releases.

In addition, advanced traders may take advantage of currency pricing inconsistencies around prominent economic news items by participating in arbitrage. This involves exploiting the price differentials between various markets or brokers to generate profits.

Post-Event Analysis

Following an economic event, traders comprehensively evaluate the impact on currency pairs. This involves thoroughly analysing how the actual data aligns with forecasts and historical data while assessing the market’s response to the event.

Subsequently, traders may fine-tune their trading algorithms based on the observed outcomes and market dynamics. This refinement process could encompass adjustments to stop-loss parameters, entry points, or the timing of trades about economic announcements.

Long-Term Planning

Economic calendars are valuable tools for trend analysis, as they offer a comprehensive view of financial performance trends over an extended period. Traders leverage this data to anticipate and adapt to long-term market movements, refining their long-term trading strategies.

Moreover, comprehending the macroeconomic landscape empowers traders to make well-informed choices about the currency pairs to engage with and the optimal timing for trading. For instance, if a country consistently demonstrates robust economic growth, its currency will likely appreciate over time.

Real-Time Decision-Making

When significant economic data is released, traders must be able to act swiftly. A financial calendar that is constantly updated in real-time enables them to respond immediately to breaking news, capitalising on sudden price surges and drops.

Understanding the timing of essential announcements allows traders to steer clear of high slippage periods. During these times, orders are more prone to being executed at a price different than anticipated due to rapid price fluctuations.

Educational Tool

The economic calendar is an essential tool for new traders, providing valuable insights into the relationship between events and market fluctuations. By regularly consulting the FX calendar, new traders can better understand how various economic indicators impact the financial markets.

Additionally, consistent use of the economic calendar can help traders develop a disciplined approach to their trading activities. This involves thorough preparation and research before making any trading decisions, which is fundamental to achieving success in the financial markets.

Reading a Forex calendar effectively can significantly enhance your trading strategy by helping you anticipate market movements and manage risk. Here’s a step-by-step guide on how to utilise this essential tool:

How to Read an FX Economic Calendar?

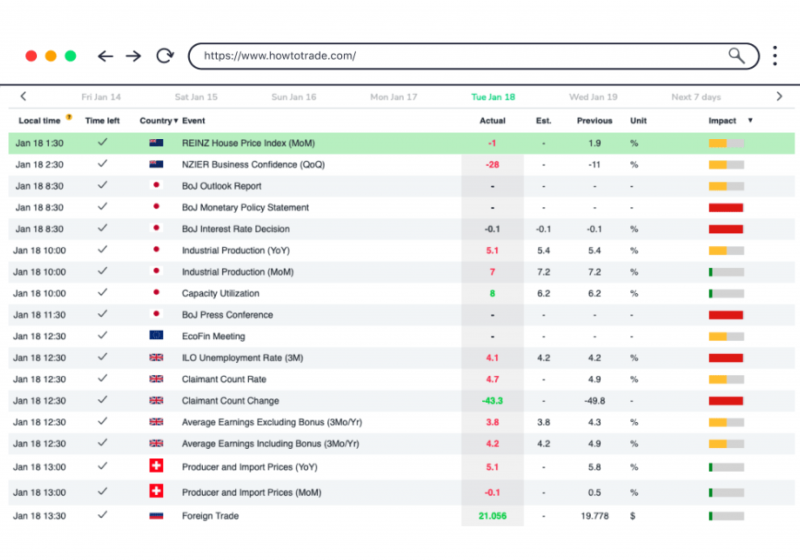

Reading a Forex economic calendar effectively can significantly enhance your trading strategy by helping you anticipate market movements and manage risk. Here’s a step-by-step guide on how to utilise this essential tool:

1. Check the Date and Time

Make sure to adjust the daily Forex economic calendar to your local time zone. This is important for accurately tracking the data release about your specific time zone. By doing this, you can be well-prepared to take action when the market is in motion.

2. Identify the Impact Level

Volatility indicators are used to assess the potential impact of economic events on the market. These events are typically categorised as low, medium, or high impact, often represented by icons such as bullheads.

A single bullhead signifies low impact, two indicate medium effects, and three represent high impact. High-impact events are significant for traders to monitor, as they have the potential to cause massive market imbalances.

3. Understand the Event

Each entry usually contains a brief overview of the economic occurrence, such as releasing GDP data, unemployment rate announcements, or decisions regarding central bank interest rates. Understanding the significance of these events can assist in forecasting the potential impact on different currencies.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Specific calendars comprehensively explain the event’s significance and historical implications, which can be extremely valuable in evaluating its potential influence on the market.

4. Analyse the Data

The majority of calendars typically display three important figures for each event:

Previous: This represents the most recent data point for the specific event, providing a historical context for the upcoming release.

Consensus: This figure reflects the average forecast from various market analysts and economists. It serves as an indicator of market expectations leading up to the event.

Actual: This number denotes the real-time data released. It provides the most current information about the economic indicator.

Regarding market reactions, significant deviations between the actual data and the consensus forecast can lead to notable movements in the market. A result surpassing the consensus forecast can strengthen the relevant currency, while a result that falls short of expectations can weaken the currency.

5. Customise and Filter

Use relevance filtering to apply specific filters that allow you to focus solely on the events that align with your trading strategy or the currency pairs you are keenly interested in.

Similarly, take advantage of the alert setup feature offered by many calendars, which enables you to configure notifications for upcoming events. This ensures you stay informed and don’t miss essential data releases.

6. Regular Review and Adjust

After the event, conducting a post-event analysis is essential to review how the market reacted to the data release. This analysis can offer valuable insights into how future data releases might impact the markets.

Besides, adjusting your trading strategies based on historical data and market responses is crucial. By doing so, you can refine your strategy to take advantage of market volatility better or to protect against future risks.

Conclusion

Forex economic calendar is an indispensable tool for currency traders, providing vital information that helps anticipate market movements and adjust trading tactics as appropriate. By incorporating this calendar into your daily trading routine, you can stay ahead of economic announcements that influence market conditions, manage risks more effectively, and exploit trading opportunities from these events.

Whether you’re a novice trader looking to understand market dynamics or an experienced investor seeking to refine your approach, the FX calendar is a critical resource that enhances decision-making and can significantly influence your trading success.

FAQ

What is an economic calendar in Forex?

A Forex calendar is a schedule of upcoming economic happenings and financial statements relevant to currency markets, including information about the event’s time, date, nature, etc.

Can I set alerts with an economic calendar FX?

Yes, many calendars offer customisation options that allow you to set alerts for upcoming economic events.

Are there mobile apps available for the FX economic calendar?

Yes, many financial news websites and Forex trading platforms offer mobile apps with such calendars.

How does a Forex Economic Calendar differ for various trading regions?

Economic calendars can be customised to show events from specific regions, making them relevant for traders focused on particular currencies or economic zones.