FTX vs Binance: New $1.8 Billion Lawsuit Against Binance’s CZ

After the infamous collapse of FTX, the estate agency of bankruptcy proceedings has filed a lawsuit against Binance, the renowned crypto platform.

This time, the case against Binance’s ex-CEO Changpeng Zhao (CZ) demands $1.76 billion in damages for conspiring against the once-leading crypto exchange and contributing to its fallout.

The complication of the platform’s collapse story makes it harder to find strong evidence against CZ, considering the mismanagement claims. Will the FTX vs Binance lawsuit uncover new truths to this case?

FTX vs Binance Lawsuit

On 10 November, a lawsuit filed at a Delaware court cited a transaction between Binance and Alameda Research, a cryptocurrency trading firm co-founded by Sam Bankman-Fried, the founder of the FTX exchange.

The claim refers to the stock repurchase agreement in 2021, where Binance sold its FTX equity back to the exchange, and Alameda Research financed the payment. The Binance lawsuit states that the FTX affiliate was insolvent at that time and could not legally finance this sale, meaning that CZ received frauded money worth $1.76 billion.

Binance refused to comment further and only stated that this claim is false and that the company is ready to “vigorously” defend itself in court.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Binance’s Role in FTX Collapse

These claims add to the multiple lawsuits the exchange has faced over the last two years and shortly after CZ was released. Binance was sued by the Commodity Futures Trading Commission, the Securities and Exchange Commission and the Department of Justice for various regulatory breaches.

However, the lawsuit filed by FTX against Binance CEO Changpeng Zhao involves different aspects of financial misconduct, rivalry, and planned activity that led to FTX’s collapse.

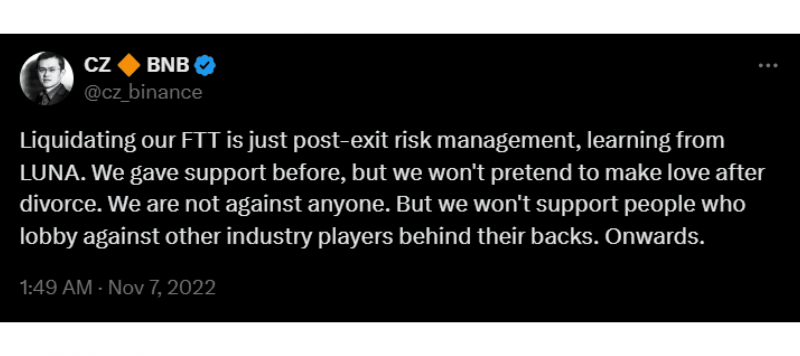

At the beginning of November 2022, Binance sold around 23 million FTT tokens (FTX’s native crypto) allegedly as a part of its 2021 equity exit strategy. However, many believe that CZ took advantage of the company’s influence to manipulate public opinion.

Moreover, liquidating a huge number of FTTs sparked massive selling pressures exacerbated by market panic and bankrupting the exchange.

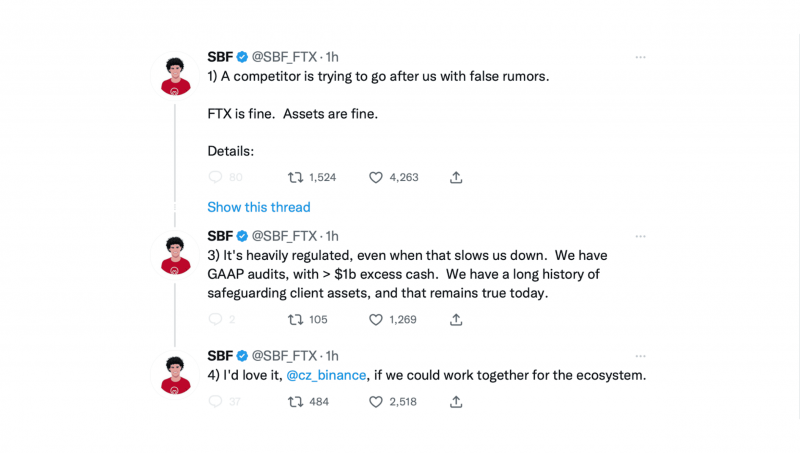

FTX’s founder, who is now serving a 25-year sentence, insisted that everything is fine and there are no liquidity issues at the company. He pointed out that it is “competitor false rumours”.

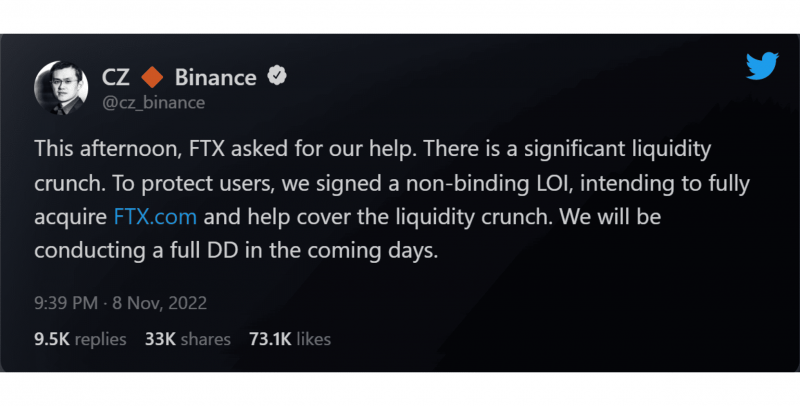

The next day, CZ announced a non-binding agreement to acquire FTX and assist with its liquidity issues to rescue the company. Shortly after that, they pulled out of this agreement due to financial complications, which depreciated investors’ and users’ trust and worsened the situation.

What Do We Know?

Proving evidence against Changpeng Zhao and Sam Bankman-Fried is going to be challenging. Finding a written note, text, or any form of communication between the involved parties to prove conspiracy will take time. However, the case presents various facts that bring doubts.

- The 2021 stock repurchase deal involved Alameda Research under Bankman-Fried’s supervision, which was known for using users’ deposits to fund payments.

- A top FTX executive revealed that Alameda was insolvent during the deal and was unable to finance the repurchase.

- CZ’s statement and tweets indicated that FTX is suffering financial problems that even the largest crypto platform could not navigate. Creating this negative impact caused the FTX token to drop from $24 to $2 in a few days.

- Binance liquidated over $2 billion USD-equivalent from FTT token sales, causing a ripple effect in the entire market. Consequently, many users and holders rushed to sell their tokens, and over $6 billion left the exchange in two days.

FTX Collapse: Conspiracy or Mismanagement?

It is hard to point the finger at the direct reason for the collapse, whether it is a competitor’s malicious strategy to dominate the market or irresponsible financial management by FTX.

One cannot overlook the significant impact of Binance’s activity in swaying public sentiment, considering the market was facing severe stagnation after the 2021 crypto boom.

However, misusing customer funds, including directing user deposits to cover trading losses and fund personal expenses, is a major misconduct for which Bankman-Fried and Ellison take responsibility.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Conclusion

A new FTX vs Binance lawsuit is looming. This time, the collapsed exchange is asking for a $1.8 billion compensation package for a repurchase deal that garnered fraudulent funds for Changpeng Zhao.

This Binance news takes into account the alleged conspiracy by ex-CEO CZ to inflate the FTT native token and cause a staggering high selling pressure and liquidity issues that led to FTX’s bankruptcy.

Will Binance’s co-founder face new charges straight after completing his sentence? Or will Binance continue its large market on regulators?

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.