How The Concept of Open Banking Shapes The Financial Industry

Banks face fierce competition from decentralised economies, and the only way to remain in business is to introduce cutting-edge technologies and services that resonate with end-users and retain customers.

The concept of open banking is becoming increasingly popular thanks to the lowered access to quick data processing and instant analysis capabilities.

Open banking helps secure user data, offers personalised services and provides innovative financial solutions for individuals and businesses. This model utilises the power of APIs to interconnect servers and platforms to facilitate transparent, open banking payments and processing.

Let’s dive deeper into the concept of open banking systems and what are the current trends shaping the financial service sector.

Key Takeaways

- Open banking is sharing financial information with third-party providers to offer advanced services and innovations.

- This technology allows financial institutions to improve loan issuance, enhance credit score assessment, and offer personalised services.

- APIs facilitate open banking operations by facilitating financial data exchange and ensuring safe data processing.

Understanding Open Banking Meaning

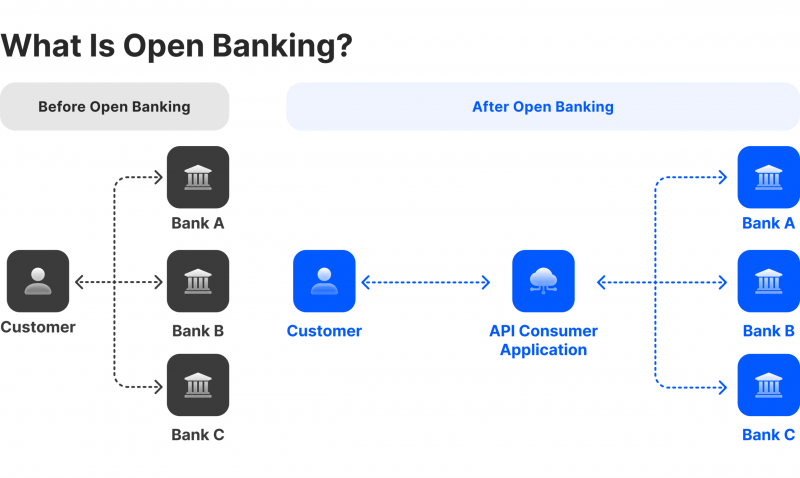

Open banking means allowing third-party service providers to gain access to financial information from banking systems and databases to offer advanced marketing, customisation, and financial services.

APIs (application programming interfaces) play a major role in connecting banking and non-banking financial institutions with service providers.

This idea started prevailing alongside the modern practices in open data management, transparent operations and user ownership. The concept of open banking came with the increasing popularity of digital banking and decentralised economies.

Additionally, this model improves customer satisfaction by offering personalised services powered by a broad network of multiple interconnected financial institutions.

Open market banking makes online payments faster, improves transparency and trust and offers sophisticated risk management. Juniper Research reported that this sector is projected to grow by 479% between 2022 and 2027 after an estimated $57 billion in open banking payments.

Despite the risks of exposing customer data to third-party operators, which can compromise their financial and personal safety, the technology is set to continue growing with air-tight security systems and protocols.

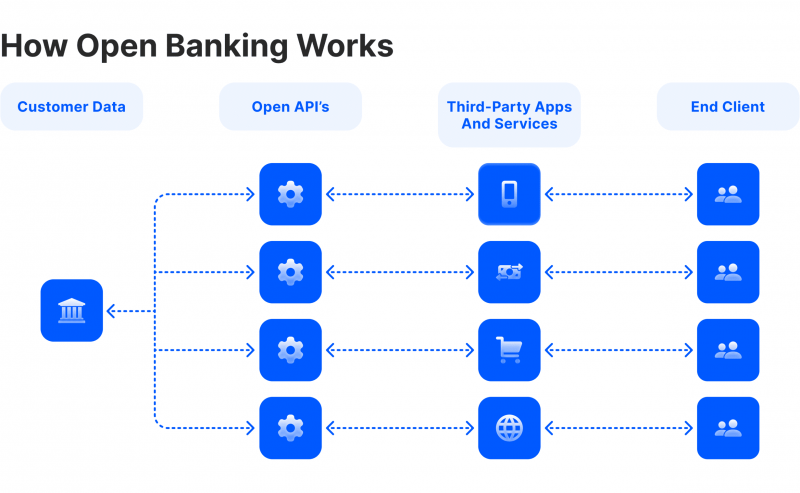

How APIs Make The Concept of Open Banking Work?

The application programming interface is a key component of open banking, providing banks and other financial institutions with a technological ecosystem to exchange data rapidly and safely.

In essence, this model aims to decentralise traditional centralised banking systems and move data from closed structures to publicly shared environments. Centralised financial institutions use private servers, which makes third-party integration quite challenging.

Therefore, by decentralising these databases and using APIs, external applications can be easily integrated into financial systems to interact with the data and provide the intended services.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Open banking APIs come in three types:

- Data API: Providing limited access to account data, payment history and balance.

- Transaction API: Facilitating online transactions and initiating direct debiting and settlements.

- Product API: Gives access to financial instruments, products, rates, etc., to generate informative breakdowns and guidelines.

Use Cases of Open Banking Services

Open banking might seem like a brand-new invention. However, there are several applications that use an open banking platform to facilitate the following financial services.

Payment Services

Initiating direct online payments from a banking account without using a payment gateway. This can make transactions faster and cheaper because it eliminates one intermediary from the entire process.

Account Aggregation

Account managers and financial advisors can pull financial and capital data from numerous sources and clients’ accounts to provide a more detailed picture of the user’s financial situation. This can help make informed decisions and fact-based investments.

Loans & Credits

Using technology and fast API processing can lead to faster loan assessment and issuance. Banks and other financial institutions can offer personalised interest rates and loan conditions based on the user’s operations and activities.

Moreover, open banking technology can empower a more automated and transparent credit score evaluation and guidance.

Automated Financing

Banks can offer users better expense management tools that track users’ spending and offer budget planning that suits their preferences and income.

This can lead to more accurate reports and reviews for recurring payments and expenses without manually entering them.

Personalised Services

Open banking helps retailers and bankers offer customised services to boost customer satisfaction and retention. These offerings may include loyalty programs, bonus rewards and tailored financial advice.

Elevated Security Levels

With automated systems and timely data analysis, networks can detect anomalies much faster and execute a quick course of action to minimise financial damages or user data exposure.

Additionally, decentralising organisational and governmental open charges and expenses can boost confidence among users and customers. However, some companies might not want to share classified financial information for competitive reasons.

Who Uses Open Banking Systems?

The concept of open banking elevates the traditional banking system, especially with the rise of decentralised economies and cryptocurrencies that many believe will overtake centralised finance.

Individuals and end-users are the first beneficiaries of open banking. They will be able to access a wide range of advanced financial products and services powered by third-party providers. These features can include detailed budgeting, simplified loan applications, and automated recurring payments.

Startups and small businesses can also benefit from open account services to automate some financial tasks at lower costs. This may include invoicing, collecting receivables, scheduling payables, assessing users’ profiles, and KYC and AML screening.

Moreover, banks and non-bank financial institutions can extend their offerings to retain more customers by improving customer service, automating loan requests, interest rate assessment, and other features to modernise their services and interactions with end-users.

These utilities require FinTech companies to plug their infrastructure into multiple financial systems and servers to provide innovative technologies and promote user data security.

The first open banking initiative roots back to the 1980s when the German Federal Post Office (Deutsche Bundespost) ran a test, “My Bank in The Living Room”, using external computers and 2,000 users to make transactions from home using the TVs and a unique code, which was described as the first step into open banking and self-services.

The Growth of Open Market Banking

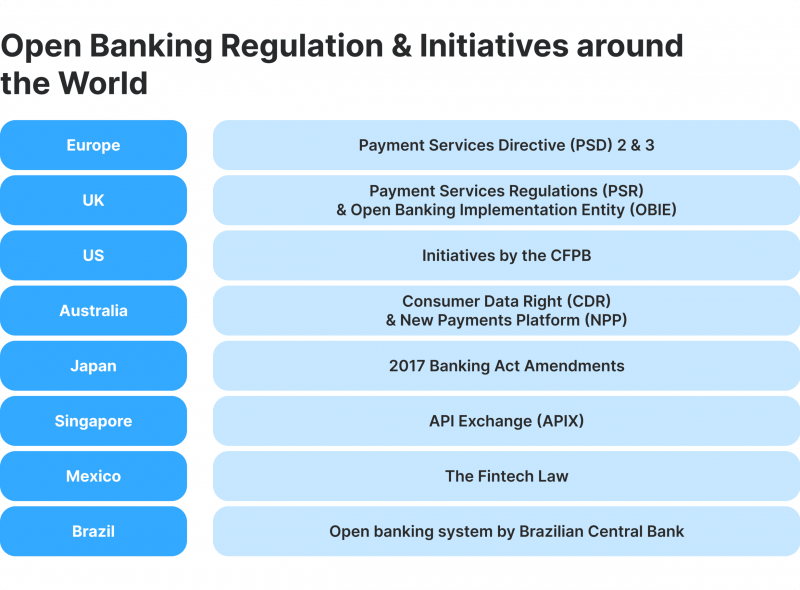

Today, open banking is almost everywhere, and regulators around the world have established guiding principles and regulations to promote its safe use.

In Europe, the first regulations came into force in 2018 with the updated Payment Services Directive (PSD2), which introduced “Strong Customer Authentication” and created a more transparent, competitive, and safe payment environment.

In 2023, another batch of regulatory improvements was introduced, including the revised PSD3, which carried reforms to the payment services regulations.

The UK has been leading the modernisation of the banking industry. In 2017, the Payment Services Regulations (PSRs) were introduced to adopt the European PSD2 into UK standards.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

2018, the Open Banking Implementation Entity was established to develop and maintain a fair, competitive and transparent open banking infrastructure.

In the US, regulations arrived a bit later, as the focus was establishing secure data transfer by creating the Financial Data Exchange (FDX) in 2018.

Some regulatory reforms for open banking initiatives were introduced. However, fully-fledged frameworks are anticipated to be introduced in 2024 to increase the competitiveness of financial service providers and ensure a secure financial data exchange and online banking operations.

In Asia, Japan, South Korea and Singapore are leading the race for open banking innovations. In Japan, the Banking Act amendments came in 2017, requiring banks to cooperate with third-party service providers, which spurred a vast FinTech shift and innovative collaborations.

However, South Korea announced a full-scale industrial transition to open banking in 2019, spanning 120 operators of FinTech startups, banks, credit/debit card issuers and investment corporations.

Conclusion

The concept of open banking sets traditional banks on par with the recent developments in decentralised finance and elevates online monetary services. This introduction is led by financial service providers and tech companies who use API to access the banking system’s database, process operations and create cutting-edge services.

This allows banks to offer advanced functionalities, including automated loan applications, personalised budgeting and financial planning and automated payment initiation services.

Despite the fear of sharing user personal and financial data with third parties, governments are introducing comprehensive regulations to ensure data privacy and back-check API integrations and providers.

Recommended articles

Recent news