Top 20 KYC Providers for Your Business

Articles

In today’s digital age, the importance of robust Know Your Customer (KYC) procedures cannot be overstated. With the rise of online transactions and the increasing need for secure identity verification, KYC providers are pivotal in ensuring the integrity of financial transactions and safeguarding against fraudulent activities.

This article explores the top 20 KYC providers, including crypto KYC providers, who offer comprehensive solutions to meet the evolving needs of businesses across various industries.

Key Takeaways

- Modern KYC solutions use advanced technologies such as facial recognition and biometric authentication.

- KYC software solutions offer various benefits, including combating money laundering, preventing fraudulent activities, protecting customer data, and simplifying the identification process.

- KYC providers cater to various industries such as finance, e-commerce, healthcare, gaming etc.

KYC Technology

KYC, or “Know Your Customer,” is a crucial process used by financial institutions and businesses to verify customers’ identities. In an age of cyber threats and financial crimes on the rise, KYC technology serves as a cornerstone for ensuring compliance with regulations and mitigating risks associated with illegal activities such as money laundering and fraud.

KYC procedures encompass various elements, including identity verification and record-keeping. Modern KYC solutions use advanced technologies such as facial recognition and biometric authentication to enhance the accuracy and efficiency of KYC verification software.

By maintaining comprehensive records of customer identities, top KYC providers help organisations combat illicit activities and uphold the integrity of financial systems.

Benefits of Using KYC Technology

Adopting KYC software solutions offers numerous benefits. From combating money laundering to preventing fraudulent activities, KYC solutions are crucial in safeguarding customer data and maintaining regulatory compliance. Some key benefits of KYC technology include:

Fighting Money Laundering: KYC processes help to verify the identities of customers, thereby reducing the risk of money laundering and illicit financial activities.

Preventing Fraudulent Activity: By implementing robust KYC processes, businesses can detect and prevent fraudulent activities such as phishing, identity theft, and payment fraud.

Protecting Customer Data: Decentralised KYC solutions prioritise the security and confidentiality of customer data, helping businesses build trust and credibility with their clientele.

Simplifying the Identification Process: Advanced KYC technology streamlines the identification process, making it faster, more efficient, and less prone to errors.

Protecting from Unauthorised Access: KYC providers offer additional security measures such as two-factor authentication to prevent unauthorised access and protect customer accounts from cyber threats.

KYC regulations originated from years of unchecked financial crimes. The initial guidelines were drafted in 1970 when the U.S. passed the Bank Secrecy Act (BSA) to prevent money laundering.

20 Best KYC Providers

As the demand for integrating KYC solutions continues to grow, numerous providers offer innovative services tailored to the unique needs of businesses across industries. Here are the top 20 industry-leading KYC providers:

1. Trulioo

Trulioo is an international company that provides electronic identity verification (eIDV) and KYC solutions. Founded in 2011, It aims to help organisations verify their customers’ identities and comply with regulatory requirements.

Trulioo’s platform offers various identity verification services, including document and biometric verification and data intelligence. By using advanced technology and data sources from around the world, Trulioo enables businesses to verify individuals’ identities in real time.

The company serves various industries, including finance, e-commerce, healthcare, and gaming, helping businesses onboard customers securely. Trulioo has gained recognition for its innovative approach to ID verification software and has received several accolades for its services.

2. Shufti Pro

Shufti Pro is a company that specialises in identity verification and authentication solutions using AI and machine learning technologies. It offers various services, including KYC verification, AML screening, and fraud prevention. Their services are commonly used by businesses in finance, e-commerce, and fintech industries.

The company aims to provide seamless and secure identity verification solutions while minimising end-user friction. Their technology is designed to detect forged or tampered documents and prevent identity theft.

3. iDenfy

Similar to other identity verification companies, iDenfy offers services such as KYC procedures, AML screening, and fraud prevention. The company’s solutions typically involve document verification, facial recognition, and biometric authentication to verify the identity of individuals in real time. iDenfy’s technology is designed to be fast, accurate, and user-friendly, helping businesses onboard customers securely and comply with regulatory requirements.

iDenfy serves various industries, including finance, e-commerce, gaming, and telecommunications.

4. ComplyCube

ComplyCube presents a robust identity verification platform tailored to simplify businesses’ AML and KYC compliance procedures. Through its suite of features, enterprises can authenticate customer identities seamlessly using ID documents, biometrics, and government databases.

This software-as-a-service (SaaS) solution merges trusted data sources with expert human oversight to assist businesses in attaining global AML/CTF compliance.

With ComplyCube’s outreach capabilities, businesses can conduct thorough checks on individual clients within a single KYC session, streamlining the process. The platform intelligently determines the requisite data to collect and dispatches a secure, personalised link to clients, facilitating the completion of the KYC session.

Available checks encompass AML Screening, PEP Checks, Address Verification, Identity Document Proofing, and comprehensive identity verification measures. With a 98% client onboarding success rate and global coverage spanning 220+ countries, these features position ComplyCube as an indispensable tool for businesses seeking reliable and efficient AML and KYC providers.

5. KYC-Chain

KYC-Chain is a company that provides blockchain-based identity verification and compliance solutions, primarily focusing on Know Your Customer processes.

Founded in 2015, KYC-Chain offers a platform which utilises blockchain technology to securely store and verify customer identity data, reducing the risk of data breaches and identity theft. KYC-Chain’s solutions include identity verification, document authentication, risk assessment, and ongoing customer data monitoring.

It serves a variety of industries, including finance, fintech, cryptocurrency, and e-commerce, helping organisations of all sizes implement efficient and compliant KYC processes.

The company aims to use the benefits of blockchain technology to revolutionise identity verification and compliance processes in the digital age.

6. Unit21

Founded in 2018, Unit21 offers a comprehensive solution that uses artificial intelligence and machine learning technologies to help businesses combat various types of fraud, including payment fraud, account takeover, identity theft, and money laundering.

The platform provided by Unit21 enables businesses to monitor and analyse user behaviour and transaction data in real-time, detecting suspicious activities and fraudulent behaviour. Unit21 helps businesses identify patterns and anomalies indicative of fraudulent activities.

Unit21 serves various industries, including banking, fintech, e-commerce, cryptocurrency, and online marketplaces.

7. Fractal ID

Fractal ID, a KYC/AML provider developed by the German fintech company Fractal, boasts an impressive conversion rate of 40%, surpassing industry standards. This platform offers swift and precise global verification, employing OCR and facial recognition technologies to validate passports and national IDs efficiently. Moreover, Fractal ID adheres to KYC/AML regulatory requirements at the banking level and ensures compliance with GDPR regulations.

Fractal ID supports multiple levels of verification, each customisable with various add-ons. These levels of verification directly impact the user’s data-sharing requirements and subsequently influence their interaction with the Fractal ID platform.

8. Sumsub

Founded in 2015, the Sumsub platform offers a range of features, including document verification, facial recognition, biometric authentication, and screening against various global sanctions and watchlists.

Sumsub serves a diverse range of industries, including finance, fintech, e-commerce, cryptocurrency, and gaming. The company prioritises user experience, data security, and compliance effectiveness in its offerings, aiming to provide reliable and scalable solutions for identity verification and compliance.

9. Seon

Seon is a company specialising in fraud prevention and detection solutions, particularly in online identity verification and risk management. Founded in 2015, Seon provides a platform that helps businesses identify and mitigate various fraudulent activities, including account takeover, payment fraud, identity theft, and synthetic fraud.

The Seon platform offers KYC tools and features to analyse user behaviour, detect suspicious activities, and prevent fraudulent transactions. These tools include device fingerprinting, IP geolocation, email and phone number verification, transaction monitoring, and machine learning algorithms for fraud detection.

Seon serves various industries, including finance, e-commerce, online gaming, travel, and telecommunications. The company prioritises accuracy, scalability, and ease of integration in its offerings, aiming to empower businesses to detect and prevent fraud while maintaining a seamless user experience for their customers.

10. Ondato

Founded in 2016, Ondato offers a comprehensive platform that uses artificial intelligence and machine learning technologies to streamline business identity verification processes.

Ondato’s platform includes features such as document verification, facial recognition, biometric verification, and screening against various global sanctions and watchlists.

Ondato caters to various industries, including banking, fintech, cryptocurrency, e-commerce, and telecommunications, helping organisations of all sizes implement robust identity verification processes and safeguard against fraudulent activities.

11. IDwise

IDWise is pioneering in revolutionising remote digital customer onboarding through its cutting-edge automated AI-based global identity verification and e-KYC solution.

Their commitment to utilising the latest advancements in AI technology sets them apart, empowering trust across some of the world’s largest and fastest-growing markets, with a strategic focus on developing markets in the Middle East, Africa, and Southeast Asia.

Headquartered in London, UK, IDWise boasts a dynamic team of 35 dedicated “IDWisers” operating across four countries. Their client base includes large enterprises, encompassing six countries and various industries, including fintech, crypto, transport, and logistics. IDWise has facilitated over 3 million digital onboardings through its platform within a year since its inception.

12. Refinitiv

Formerly known as the Financial and Risk business division of Thomson Reuters, Refinitiv was acquired by a consortium led by Blackstone Group LP in 2018. The company offers various products and services to financial institutions, corporations, governments, and individuals.

Refinitiv provides real-time and historical market data, including stock prices, indices, commodities, foreign exchange rates, and fixed-income securities data. Traders, analysts, and investors widely use this data for market analysis and decision-making.

It also offers trading platforms, execution systems, and investment management solutions for buy-side and sell-side firms. These platforms enable users to execute trades, manage portfolios, and access market research and analytics.

Refinitiv provides risk management solutions, including credit, market, liquidity, and compliance risk management tools. It also offers solutions for anti-money laundering, know-your-customer, and sanctions screening.

13. ComplyAdvantage

Established in 2014, ComplyAdvantage is a leading RegTech company headquartered in London. It specialises in robust KYC solutions to combat financial crime. Using advanced technologies like AI and machine learning, it assists organisations in fulfilling regulatory obligations and detecting fraud.

The company has expanded globally, offering services including AML onboarding, transaction monitoring, and real-time sanctions screening. Strategic partnerships with sync. and Kompli-Global have strengthened its offerings.

14. Mitek

Mitek Systems, Inc. is a global leader in mobile capture and digital identity verification solutions. Founded in 1986 and headquartered in San Diego, California, Mitek specialises in developing technologies enabling organisations to verify and authenticate identity documents, such as driver’s licences, passports, and ID cards, using mobile devices.

Mitek’s flagship product is Mobile Verify®, which allows users to capture and authenticate identity documents through a mobile app. Mitek’s solutions are used by various industries, including financial services, fintech, healthcare, and e-commerce.

In addition to Mobile Verify®, Mitek offers other solutions such as Mobile Deposit®, which enables users to deposit checks remotely using their mobile devices, and Mobile Fill®, which allows users to autofill forms using their mobile cameras.

15. Fenergo

Fenergo is a leading provider of client lifecycle management (CLM) software solutions for financial institutions. Founded in 2009 and headquartered in Dublin, Ireland, Fenergo specialises in developing technology platforms that help banks, asset managers, and other financial institutions streamline client onboarding, regulatory compliance, and data management processes.

Fenergo’s CLM platform offers a comprehensive suite of modules and tools to automate and digitise the end-to-end client lifecycle management process. This includes client onboarding, KYC compliance, AML screening, regulatory compliance, data governance, and client data management.

Fenergo’s solutions are used by some of the world’s largest financial institutions to manage regulatory compliance and client data across multiple jurisdictions and business lines. The company has received recognition for its innovative approach to CLM and has earned numerous awards in the financial services industry.

16. Fugu

Fugu Risk arises as a reliable guardian of transaction security. Headquartered in Israel, this company specialises in post-checkout payment tracking solutions through its innovative platform, FUGU. By meticulously tracking payments, FUGU empowers online sellers to overcome fraud and false declines confidently.

Catering to a diverse clientele ranging from eCommerce websites and payment gateways to SaaS providers and financial institutions, Fugu Risk’s solutions offer unparalleled protection across multiple industries. From mitigating chargeback liabilities to ensuring secure transactions in the gaming and investment sectors, Fugu Risk stands as a beacon of trust and reliability in online payments.

FUGU adapts to its clients’ unique needs with remarkable flexibility. Whether accessed through the cloud or deployed on-premises for Windows or Linux systems, Fugu’s solutions seamlessly integrate into existing infrastructures. From real-time chat assistance to comprehensive FAQs and forums, Fugu Risk ensures that its clients receive the guidance and support they need to overcome the complexities of online transactions with ease.

17. Know Your Customer

Know Your Customer revolutionises digital onboarding for financial institutions and regulated organisations worldwide, entering the next generation of compliance solutions. Their platform empowers compliance teams to safeguard their businesses efficiently by streamlining KYC and AML checks for individual and corporate customers.

They enhance operational efficiency while ensuring regulatory compliance by centralising the onboarding process into a remarkably user-friendly platform. Through Know Your Customer’s cutting-edge technology, they drastically reduce the time required to onboard new corporate clients, slashing the industry average from 26 days to just 1 day. This acceleration translates into significant cost savings for their clients, allowing them to allocate resources more effectively.

Headquartered in Hong Kong, with additional offices in Singapore, Shanghai, and Dublin, Know Your Customer has established itself as a global leader in the field, renowned for its excellence and innovation. Their extensive client portfolio includes banking, FinTech, insurance, payments, real estate, asset management, and legal firms operating in 18 jurisdictions worldwide.

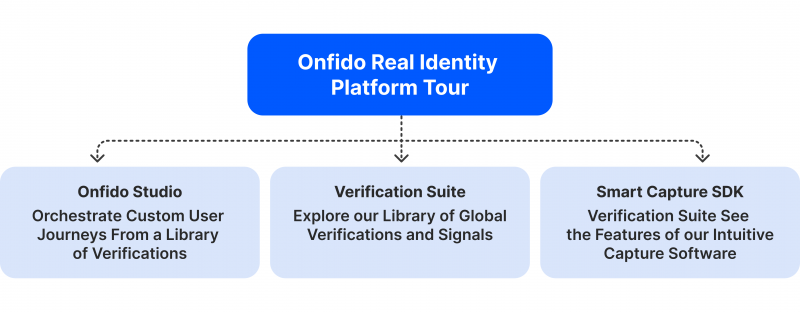

18. Onfido

Founded in 2012, Onfido provides document verification, facial biometrics, and fraud detection. The company’s platform uses machine learning algorithms to analyse identity documents and facial biometrics, allowing businesses to verify the authenticity of documents and match them to the individual presenting them.

Onfido serves various industries, including finance, e-commerce, the sharing economy, and healthcare.

The company has received recognition for its innovative approach to identity verification and has been named one of the leading KYC providers in the industry.

19. Pliance

Pliance is a Swedish-based company that provides business compliance solutions, particularly in AML and KYC regulations. Founded in 2016, Pliance offers a platform that helps companies automate their compliance processes, reduce manual workloads, and ensure adherence to regulatory requirements.

The Pliance platform offers a range of features, including customer due diligence, transaction monitoring, sanctions screening, and risk assessment. It serves various industries, including fintech, banking, e-commerce, and cryptocurrency.

20. Quantifind

Quantifind is a company that specialises in providing data analytics and insights for businesses, particularly in marketing and risk management. Founded in 2009 and based in California, Quantifind uses advanced analytics and machine learning techniques to help organisations make data-driven decisions and identify growth or risk mitigation opportunities.

Quantifind’s solutions are designed to analyse large volumes of data from various sources, including social media, news articles, customer feedback, and financial data, to extract actionable insights and trends.

The company’s platform offers capabilities such as sentiment analysis, predictive modelling, anomaly detection, and network analysis, enabling businesses to uncover hidden patterns and correlations in their data.

Criteria Used for Selection

Several key factors were considered when ranking the top KYC providers, including the comprehensiveness of identity verification solutions offered, the accuracy and reliability of their data sources, the efficiency of their onboarding processes, the flexibility of their integration options with existing systems, the level of regulatory compliance they ensure, the scalability of their services to meet varying business needs, the quality of their customer support and training resources, the cost-effectiveness of their solutions, and the overall reputation and track record of the provider in the industry.

Conclusion

The landscape of KYC technology is continually evolving, with providers offering innovative solutions to meet the growing demands of businesses worldwide. Using advanced technologies and robust security measures, these top 20 KYC providers are helping organisations combat financial crimes, protect customer data, and maintain regulatory compliance. Ultimately, KYC is not just a regulatory obligation but a strategic imperative for businesses seeking to thrive in the modern digital age.

FAQ

How do I choose a KYC provider?

Consider your business size and reach. If you run a small business, you might not need a KYC provider offering many services. Check industry requirements, as different industries have different KYC rules. Lastly, review your budget. KYC providers come at different prices.

What are the three tiers of KYC?

Tier 1 accounts allow daily transactions of N50,000 (yes, inflow and outflow) and can hold a total of N300,000. Tier 2 accounts allow daily transactions of N200,000 (that’s both inflow and outflow) and can hold a total of N500,000. A Tier 3 account is the best place to be.

What are the three main components of KYC?

This is often referred to as the three components or pillars of KYC: the Customer Identification Program (CIP), Customer Due Diligence (CDD), and Ongoing Monitoring.

What is the difference between KYC & AML?

The main difference between KYC and AML is purpose: KYC is performed as part of a financial institution’s due diligence before entering into a transaction with another party, while AML compliance checks are conducted on customers who have already been identified as high risk for money laundering purposes.