How to Accept Crypto Payments as a Business: 2026 Guide

Cryptocurrency payments are no longer just for tech enthusiasts — they’re becoming a mainstream option for businesses worldwide. With faster transactions, lower fees, and global reach, digital currencies like Bitcoin, Ethereum, and stablecoins are transforming how businesses handle payments.

2026 marks a turning point as regulatory clarity, fintech integration, and blockchain innovations make crypto payments more accessible than ever.

This guide will walk you through why 2026 is pivotal for crypto adoption, how to set up your crypto payment infrastructure, and key trends shaping the future of digital payments.

Key Takeaways

- 2025 brings faster, cheaper transactions thanks to Layer 2 scaling solutions like Lightning Network for Bitcoin and Polygon for Ethereum.

- Companies can accept crypto payments via a secure wallet or a Bitcoin payment gateway like BitPay, Coinbase Commerce, or CoinGate for automated processing.

- Stablecoins (USDT, USDC, DAI) and CBDCs offer price stability, making crypto payments easier to integrate into mainstream commerce.

Why 2026 is a Pivotal Year for Crypto Adoption in Business?

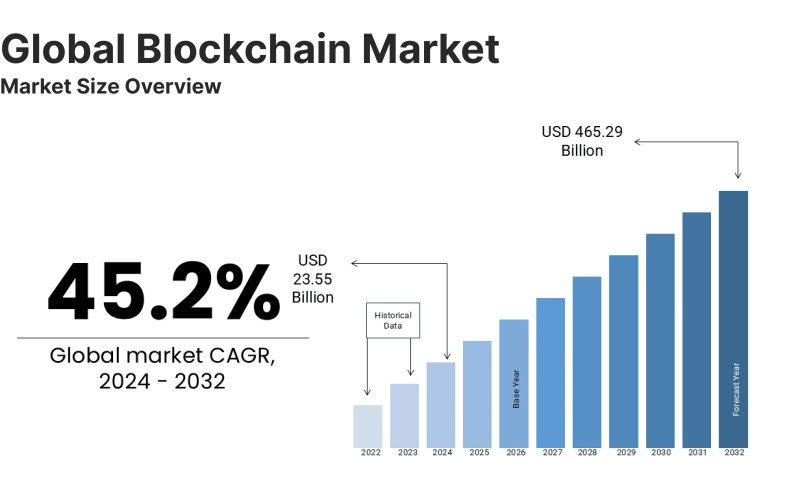

2026 is a pivotal year for crypto adoption as it marks the convergence of regulatory clarity, technological innovation, and mainstream financial integration. Governments across the globe have begun implementing comprehensive and supportive regulatory frameworks that reduce legal uncertainties and bolster consumer confidence.

This evolving legal landscape provides much-needed protection against fraud and misuse and encourages businesses to venture into crypto payments with greater assurance, effectively setting the stage for widespread adoption.

At the same time, significant technological advancements have transformed the crypto ecosystem. Improvements in scalability, such as Layer 2 solutions, have dramatically increased transaction speeds and reduced fees, while enhanced blockchain protocols offer unprecedented levels of security.

These developments have addressed many limitations that previously hindered cryptocurrencies from being used as everyday payment methods, turning them into reliable tools for global commerce.

Moreover, 2026 sees unprecedented integration between traditional financial institutions and the crypto world. Major banks, payment processors, and fintech companies actively incorporate digital coins into their service offerings, creating hybrid systems that facilitate smooth conversions between fiat and crypto.

Such institutional endorsement not only lends credibility to cryptocurrencies but also meets the growing demand from a new generation of tech-savvy consumers who are eager to use digital currencies in their daily transactions.

The global cryptocurrency payment market is expected to surpass $10 billion by 2030, driven by increasing demand for fast, borderless, and secure transactions.

Types of Cryptocurrencies to Consider for Accepting As A Business

When considering which cryptocurrencies to accept as a business, it’s important to evaluate each option based on factors like market adoption, volatility, transaction speed, and integration ease.

Here’s a detailed breakdown of the main categories:

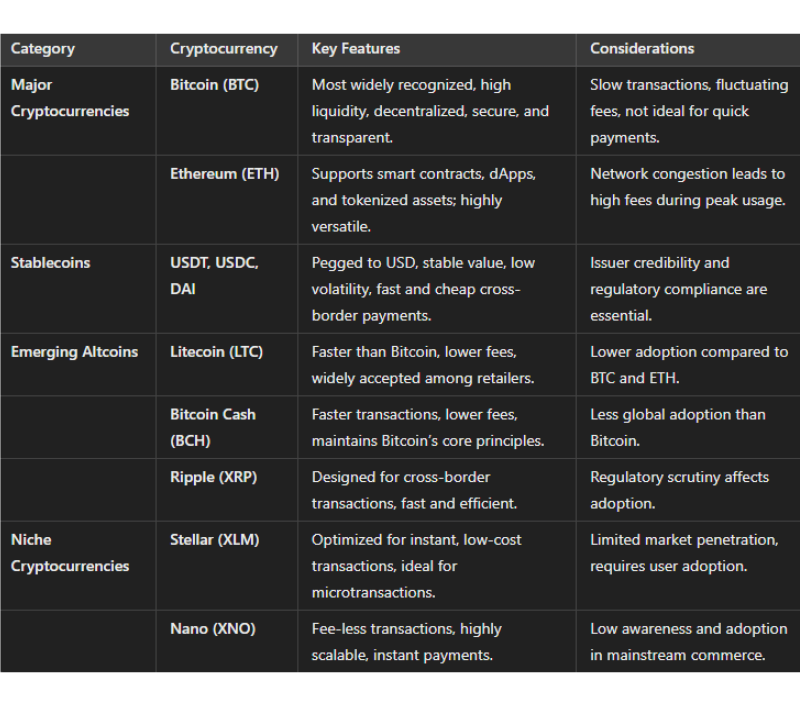

Major Cryptocurrencies

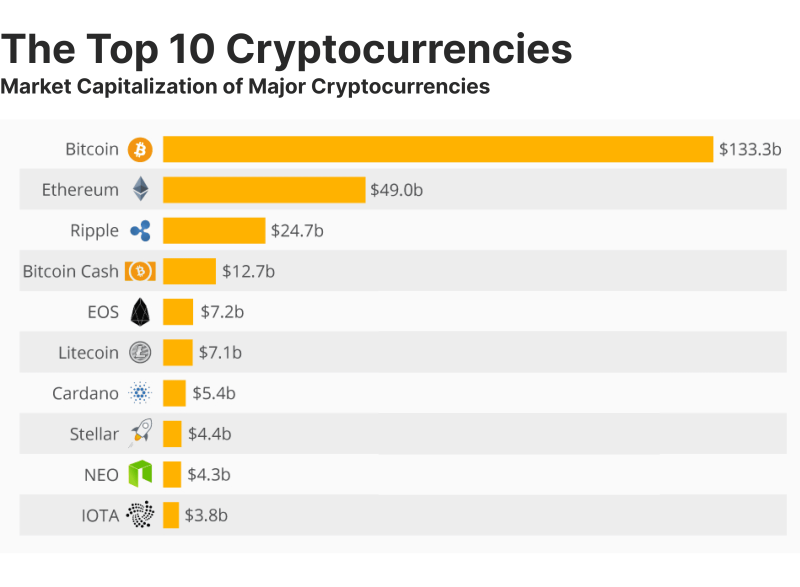

Bitcoin (BTC) remains the most widely recognised cryptocurrency and enjoys the highest consumer trust. As a decentralised digital asset, Bitcoin provides security and transparency, making it a reliable choice for businesses looking for a long-term store of value.

However, while Bitcoin offers high liquidity, its network can be slow, and transaction fees fluctuate, which may not be ideal for businesses that require quick and cost-effective payment processing.

Ethereum (ETH) goes beyond basic transactions by enabling smart contracts, which allow businesses to automate payments, enforce agreements, and streamline processes without intermediaries.

Its blockchain also supports a vast ecosystem of decentralised applications (dApps) and tokenised assets, making it a valuable tool for businesses seeking innovation. Nevertheless, Ethereum’s network congestion during peak usage can lead to high transaction costs, potentially affecting operational efficiency.

Stablecoins

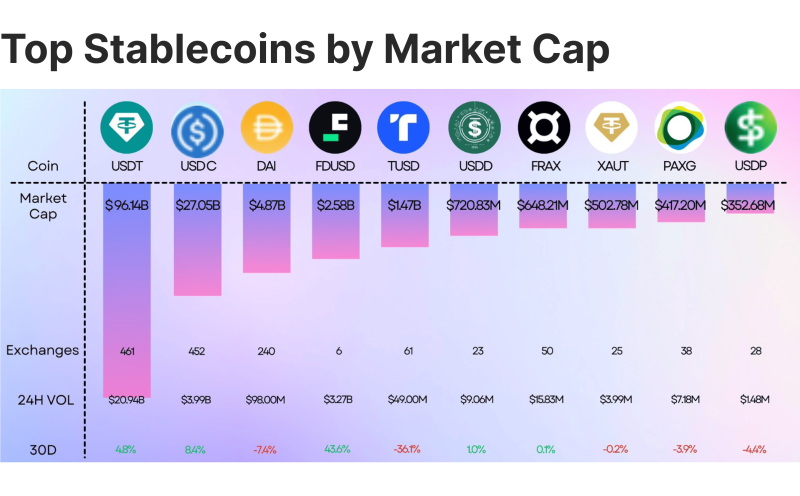

Stablecoins provide businesses with the stability of fiat currencies while maintaining the benefits of blockchain transactions. Digital assets such as USDT (Tether), USDC (USD Coin), and DAI are pegged to the US dollar, ensuring their value remains predictable. This makes them an excellent option for everyday transactions, reducing the risks associated with cryptocurrency price volatility.

Beyond that, stablecoins facilitate faster and cheaper cross-border payments, which can benefit businesses operating in global markets. However, ensuring that the stablecoin issuer is reputable and compliant with regulatory standards is crucial to mitigate potential legal and financial risks.

Emerging Altcoins and Niche Cryptocurrencies

Alternative cryptocurrencies (altcoins) offer benefits that can enhance transaction speed and reduce costs. Litecoin (LTC), Bitcoin Cash (BCH), and Ripple (XRP) are popular alternatives to Bitcoin, often providing faster transaction confirmation times and lower fees, making them suitable for retail businesses and high-volume transactions.

While these altcoins have their advantages, they do not enjoy the same level of global adoption as Bitcoin and Ethereum, so companies should evaluate their customer base before integrating them.

Plus, some cryptocurrencies are explicitly designed for payment efficiency. Stellar (XLM) and Nano are optimised for instant, low-cost transactions, making them ideal for businesses that handle frequent microtransactions or operate in industries with tight margins.

These specialised payment coins can help reduce overhead costs, but their market penetration is relatively low, meaning that businesses should assess whether their customers are willing to use them before adoption.

How to Set Up Crypto Payment Infrastructure for Your Business?

Cryptocurrency payments provide businesses with lower transaction fees, faster settlements, and global accessibility. Setting up an efficient crypto payment infrastructure requires selecting the right payment method, ensuring compliance, securing transactions, and educating both employees and customers.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Here’s how to do it effectively.

Choosing the Right Crypto Payment Method

Businesses have two primary options: accepting direct payments via a crypto wallet or using a third-party crypto payment processor.

Direct Payments via Crypto Wallet

This method allows businesses to receive cryptocurrency directly into their wallets, eliminating intermediaries and processing fees. To implement this, businesses need a secure wallet — hot wallets for frequent transactions and cold wallets for safe long-term storage. To facilitate payments, the wallet address (QR code or alphanumeric string) must be displayed at checkout or on invoices.

While this method offers full financial control, businesses must manually track transactions and confirm payments before fulfilling orders. Additionally, cryptocurrency prices fluctuate, meaning funds may lose value before they are converted to fiat.

Using a Crypto Payment Processor

For businesses looking for automation and easier accounting, third-party payment processors like BitPay, Coinbase Commerce, CoinGate, and NOWPayments provide seamless solutions. These platforms handle payments, automate currency conversion, and integrate with business systems, making them ideal for online stores and physical retailers. Businesses must register with a provider, link a bank account, and integrate the gateway with their website or point-of-sale system.

This method reduces exposure to crypto volatility since payments can be instantly converted into fiat currency. However, businesses should consider potential transaction fees and regulatory requirements associated with these platforms.

Selecting Cryptocurrencies to Accept

The choice of cryptocurrencies should align with business needs and customer preferences. However, Bitcoin (BTC) is the most widely recognised option, with higher fees and slower processing times.

Ethereum (ETH) supports smart contracts and decentralised applications, but transaction costs fluctuate. Stablecoins (USDT, USDC, DAI) provide price stability, making them reliable for businesses that want to avoid market volatility.

Altcoins (LTC, XRP, BCH) offer lower fees and faster transactions, making them practical for frequent payments.

Integrating Crypto Payments with Your Business Model

Online Stores and E-Commerce

E-commerce businesses can integrate crypto payments through payment processors that offer plugins and APIs for platforms like Shopify, WooCommerce, Magento, and BigCommerce. Once the gateway is installed, businesses should conduct test transactions to ensure a smooth customer experience.

Brick-and-Mortar Stores

Retailers can use point-of-sale (POS) systems or mobile payment apps to implement crypto payments. Crypto-compatible POS terminals such as BitPay’s Checkout App or Pundi X POS enable customers to scan a QR code and pay instantly. Businesses should always confirm payment before completing sales.

Freelancers and Service-Based Businesses

Freelancers and consultants can accept crypto through invoicing platforms like CoinGate and BitPay, which generate crypto payment links for clients. After receiving payment, businesses can decide whether to hold the crypto or convert it to fiat.

Ensuring Compliance with Legal and Tax Regulations

Regulatory compliance varies by country, and businesses must adhere to legal frameworks to avoid penalties. Some jurisdictions require businesses to register with financial authorities when dealing with crypto payments. If using a payment processor, businesses should ensure compliance with KYC and AML regulations.

Since crypto payments are often taxable, businesses must track all transactions, report capital gains or losses, and maintain accurate financial records. Using crypto-friendly accounting software simplifies reporting and ensures transparency. Consulting a legal or tax expert is recommended for businesses operating in multiple jurisdictions.

Implementing Security Best Practices

Since cryptocurrency transactions are irreversible, strong security measures are essential to prevent fraud and unauthorised access.

Secure Wallets

Businesses should use a hot wallet for daily transactions, but secure large holdings in cold wallets like Ledger or Trezor, which are stored offline and less susceptible to hacking.

Protecting Private Keys

Private keys should never be shared or stored on internet-connected devices. Businesses processing large transactions can implement multi-signature wallets, requiring multiple approvals before authorising payments.

Fraud Prevention

To enhance security, businesses should enable two-factor authentication (2FA) for all crypto accounts and verify transactions before shipping goods or providing services. Regular transaction monitoring helps identify suspicious activities, and fraud detection tools can assist in securing business assets.

Managing Volatility and Converting to Fiat

Since crypto prices are volatile, businesses need strategies to minimise financial risk. One option is to accept stablecoins such as USDT, which maintain a steady value.

Another approach is to use payment processors that auto-convert crypto to fiat, ensuring businesses receive a fixed amount regardless of price fluctuations. Some businesses also adjust product pricing dynamically based on crypto exchange rates.

Educating Employees and Customers

For smooth adoption, businesses should train employees to process crypto payments, identify fraudulent transactions, and handle refunds. Employees handling finances should also understand volatility risks and security measures.

Customers should receive clear instructions at checkout explaining how to complete a crypto transaction. Businesses can create FAQs and offer customer support to assist those unfamiliar with crypto payments. Simplifying the process encourages wider adoption.

Future Trends in Crypto Payments — What Businesses Should Expect

The evolution of crypto payments is shaping the future of commerce, with emerging trends driving widespread adoption and efficiency. Businesses that embrace these innovations will gain a competitive edge by offering seamless, cost-effective, and secure payment options.

Here’s how crypto payments evolve and what businesses can expect in the coming years.

The Rise of Stablecoins in Daily Transactions

Stablecoins are becoming a preferred choice for businesses and consumers due to their price stability, fast transactions, and low fees. Unlike Bitcoin or Ethereum, which experience frequent price fluctuations, stablecoins like USDT, USDC, and DAI maintain a steady value by being pegged to traditional currencies.

More retailers and e-commerce platforms will integrate stablecoins as a mainstream payment option in the coming years. Traditional payment networks such as Visa and Mastercard expand their stablecoin-based payment systems, bridging the gap between fiat and crypto.

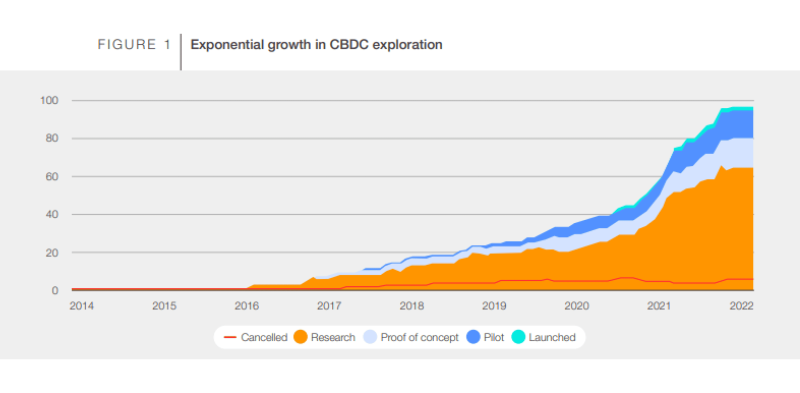

Meanwhile, central banks are working on regulated CBDCs that could compete with stablecoins, giving businesses additional options for accepting digital payments.

Growing Role of Central Bank Digital Currencies (CBDCs)

Governments worldwide are accelerating the development of CBDCs, with China’s digital yuan and the European Union’s digital euro leading the way. Unlike decentralised cryptocurrencies, CBDCs are issued and controlled by central banks, offering businesses a regulated and stable form of digital money.

As CBDCs become more widespread, businesses may need to adapt their payment systems to accept them. Some countries may even mandate CBDC acceptance for businesses operating within their jurisdiction.

At the same time, financial institutions are working on hybrid solutions that allow seamless CBDC-to-crypto conversions, making it easier for businesses to support multiple digital currencies.

Development of Layer 2 Scaling Solutions

The biggest barriers to widespread crypto payment adoption have been slow transaction speeds and high network fees, particularly on Bitcoin and Ethereum. Layer 2 scaling solutions address these issues by enabling instant and low-cost transactions.

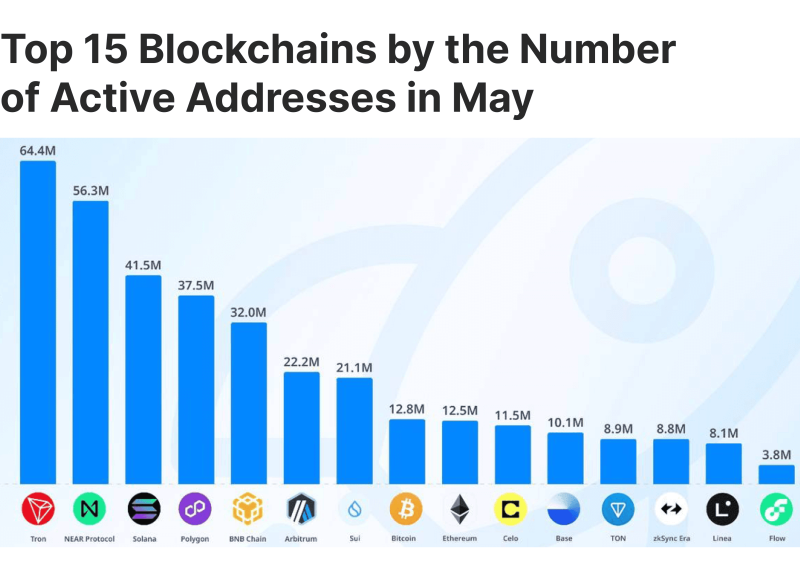

Bitcoin’s Lightning Network and Ethereum-based solutions like Polygon, Arbitrum, and Optimism drastically improve transaction efficiency. These technologies reduce fees and improve processing speeds, making crypto payments as fast and seamless as credit card transactions.

Crypto Payment Cards and Hybrid Payment Systems

A major challenge in crypto adoption is the lack of direct spending options. Crypto debit and credit cards, offered by companies like Crypto.com, Binance, and Coinbase, solve this issue by converting crypto to fiat at the point of sale, allowing customers to spend their crypto anywhere traditional cards are accepted.

As banks and financial bodies continue partnering with crypto firms, more users will gain access to these crypto-to-fiat payment solutions. This will increase mainstream adoption, making it easier for businesses to accept crypto payments without having to handle digital assets directly.

Additionally, businesses may introduce loyalty programs and reward systems that issue crypto-based incentives instead of traditional points, enhancing customer engagement and retention.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Regulatory Clarity and Institutional Adoption

Many businesses have been hesitant to accept crypto due to uncertain regulations. However, governments worldwide are now working to establish clear tax policies, AML regulations, and KYC requirements for crypto transactions.

With financial institutions and large corporations integrating crypto into their payment infrastructure, smaller businesses will feel more confident in doing the same. Regulatory clarity will reduce legal risks, improve compliance, and create a more predictable environment for crypto transactions.

Web3 and Decentralised Commerce for Payments

Web3, the decentralised internet powered by blockchain technology, is reshaping digital payments by eliminating intermediaries and enabling direct user transactions. Smart contracts, decentralised marketplaces, and NFT-based transactions will become integral to online commerce.

Gaming, digital art, and fashion brands are already experimenting with NFT payments and tokenised assets, allowing customers to purchase digital goods and services using blockchain-based ownership. E-commerce platforms will integrate Web3 wallets like MetaMask and Phantom, making it easier for users to pay in crypto without relying on centralised platforms.

Businesses that adopt Web3 technologies will gain an edge in the growing decentralised economy, attracting younger and tech-savvy customers.

AI and Machine Learning for Crypto Payment Processing

Artificial intelligence (AI) is becoming essential in crypto payment processing, helping businesses optimise transactions, manage volatility, and enhance fraud detection. AI-powered systems can automatically analyse real-time data to adjust exchange rates, ensuring businesses get the best value when converting crypto to fiat.

Additionally, AI-driven fraud detection tools improve security by identifying suspicious transactions and preventing unauthorised access. AI will also play a role in automating crypto tax reporting, reducing the complexity of tracking transactions and ensuring compliance with regulatory requirements.

By integrating AI-based financial tools, businesses can reduce risks, improve operational efficiency, and enhance security in crypto transactions.

Development of Crypto Payroll Systems

As more employees and freelancers demand payment in crypto, businesses are turning to crypto payroll solutions like Bitwage, Deel, and OnJuno to automate salary payments. These services allow companies to pay workers in crypto while ensuring tax compliance and regulatory adherence.

Crypto payroll is particularly useful for remote workers, international freelancers, and tech industry professionals, offering faster cross-border transactions and lower fees than traditional banking systems.

Stablecoin-based payroll solutions are gaining traction, allowing employees to receive stable digital payments without worrying about market volatility. As adoption increases, crypto payroll will become a key component of the global digital economy.

Conclusion

The shift toward crypto payment processing is accelerating, and businesses embracing digital currencies will now gain a significant edge in the evolving financial landscape.

Integrating a secure cryptocurrency payment gateway can open doors to new customers, lower fees, and seamless global transactions, whether you’re a retailer, freelancer, or service provider.

As 2026 ushers in regulatory clarity, CBDCs, and improved blockchain technology, now is the perfect time to take Bitcoin payments, integrate a crypto payment gateway, and future-proof your business.

FAQ

What is the easiest way to accept crypto payments as a business?

The easiest way is to use a Bitcoin payment processor like BitPay, NOWPayments, or Coinbase Commerce, which automates transactions and converts crypto into fiat if needed.

Do I need a special license to accept cryptocurrency payments?

Regulations vary by country, but most businesses can accept crypto without a special license. However, compliance with tax laws and KYC/AML rules is essential.

How do I manage volatility when accepting Bitcoin payments?

To minimise volatility risks, businesses can convert crypto to fiat instantly using a crypto payment gateway or accept stablecoins like USDC and DAI.

Are crypto payments secure?

Yes! Blockchain-based transactions offer high security and fraud protection. However, businesses should use secure wallets, two-factor authentication, and multi-signature approval for added safety.

Can small businesses accept crypto payments?

Yes. Many small businesses and freelancers take Bitcoin payments using simple invoicing tools like CoinGate and BitPay, making crypto payments accessible for all.