How to Calculate Profit and Loss for Your Trading Positions

Trading with one market position is usually easy to get around and calculate your returns because the numbers are in front of you. However, having multiple open orders, margin accounts, and broker fees makes it more challenging to understand cash flow.

Learning how to calculate profit and loss is a mandatory skill that you must excel in to measure your success in trading and make decisions that improve your profit percentage and manage your risks more effectively.

In this article, we will explain P&L in trading and how to calculate it.

Key takeaways

- Trading P&L refers to the profit and loss resulting from trading activities.

- Tracking your position’s value and changes is crucial to understanding the profit and loss statement.

- Unrealised and realised P&L play a major role in measuring your activities, including price action, broker’s fees and leverage.

Understanding Profits and Loss in Financial Trading

Profit and loss are essential terminology used for multiple purposes and concepts. It is a straightforward method to compare the total revenue and expense when undertaking a certain financial activity, like trading.

When you open a market order, the position’s value will rise and fall depending on the industry updates and trading dynamics. Consequently, you will generate profits if the market moves in your direction or losses if things do not move your way.

When trading Forex, your position will hold the mark-to-market value, reflecting the gain/loss you will realise upon closing the order. If you have a long position, your marked price is the amount at which you will sell and liquidate, while for short positions, it is the price at which you will buy to close.

What Does Open P&L Mean?

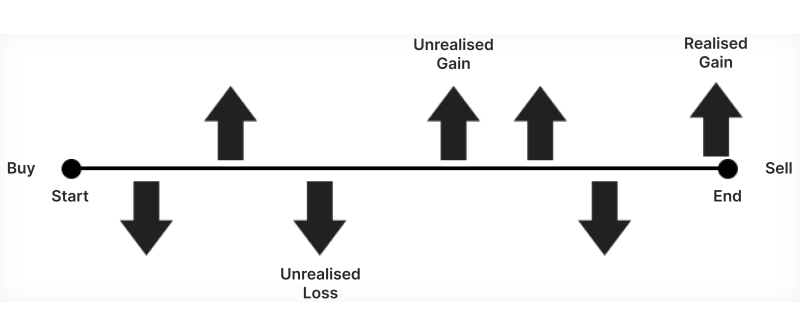

Open P&L refers to the unrealised profits or losses from active open trading orders, determined by the difference between the entry price and current market value.

When you execute a market order, its value fluctuates as prices change. However, these rises and falls are reflected in your order only and not in your trading account as long as the order is open.

For long positions, the open P&L increases as prices rise, while for short positions, it grows when prices fall. Open profits and losses change in real-time according to market conditions and become realised when you close your position.

It is a merely critical metric to assess ongoing performance, manage risks, and make informed decisions.

Key Terms for P&L

When analysing your trading P&L, you will come across different terminologies that you must understand. Let’s introduce them:

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

- Entry Price: The cost at which a trade is initiated.

- Exit Price: The price when the trade is closed.

- Position Size: The volume (lot size) of the executed order.

- Trading Fees: Broker’s fees and expenses that affect net income.

Component of Forex Profit and Loss Calculation

There are various elements that you must consider when you calculate P&L, including realised and unrealised gains, trading with leverage and brokerage costs.

Comprehending these concepts allows you to understand how much you can make from Forex trading.

Realised P&L

The realised profit and loss represent the real value of your position after liquidating it, which is calculated by subtracting the entry price from the selling price and adjusting it with the transaction fees and lot size.

This value is reflected in your trading balance, indicating the outcome of your trading activity.

Unrealised P&L

The unrealised profit and loss percentage represents the current value of your position, as the market fluctuates as long as the position is open. It is calculated similarly to realised P&L, subtracting the entry price from the exit value.

However, it is a hypothetical measurement to understand the real-time outcome of your trading activity that is not reflected in your trading account yet.

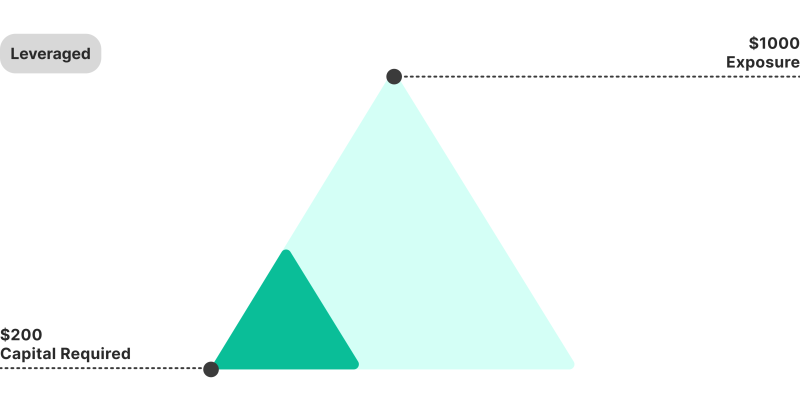

Leverage

The leverage is the financial investment your broker contributes when opening a large-volume trading order. It allows you to explore high-value market opportunities without paying the full entry price.

Leverage plays a significant role when you calculate gains and losses in a margin account, where you need to maintain a certain balance to keep the leveraged position active.

Transaction Fees

Trading costs in Forex include spreads, commissions, swaps and other expenses incurred by the broker to finance certain activities, like keeping the position open overnight.

These fees directly impact your P&L calculations, and underestimating them is a major mistake because they can offset your net profit.

How to Calculate Profit and Loss?

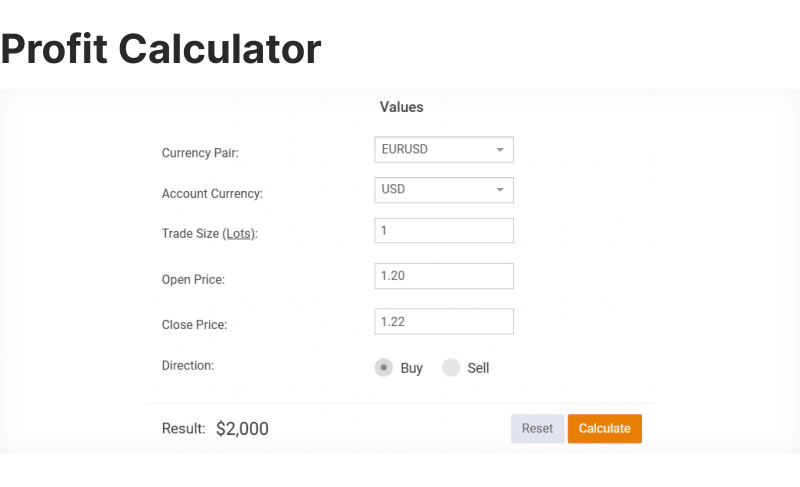

Measuring your position value can be done using a Forex profit loss calculator or a simple equation if you have one market order. However, the method will differ slightly between long and short positions and leverage usage.

Let’s explain with an example: If you buy 1,000 units of a currency pair at 1.20 and sell them at 1.21.

For Long Positions

When you have a long (buy) position, you realise gains when the current market price is higher than the entry value. Your Forex profit formula can be as follows:

P&L = (Exit Price − Entry Price) × Position Size

P&L = (1.21 – 1.20) × 1,000 ⇒ 10

You gain $10 as a gross profit from closing your position because the market surged enough to secure some gains.

For Short Positions

When you have a short (sell) position, you realise gains when the current market price is lower than the entry value. Your earnings, using the above hypothetical numbers, can be calculated as follows:

P&L = (Entry Price − Exit Price) × Position Size

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

P&L = (1.20 – 1.21) × 1,000 ⇒ −10

You lost $10 from your trading position because the market surged, and to close your position, you must buy at a higher price.

Common Mistakes to Avoid

Finding your position’s P&L is usually straightforward, especially using an FX profit calculator. However, if you have multiple active orders, use a margin account or are subject to Forex rollover fees, it can be easy to be confused. Let’s go through common mistakes that traders make.

- Ignoring Transaction Fees: Spreads, commissions, or swap charges can inflate perceived profits and can be overlooked.

- Overlooking Conversion Rates: Currency conversions play a major role in trading expenses, affecting the actual P&L.

- Focusing Only on Unrealised P&L: Current numbers shown on positions can be misleading without calculating additional costs.

- Inadequate Record-Keeping: Not using an FX profit calculator or tools to track and update P&L accurately can lead to errors.

- Misusing Leverage: Uncalculated leverage usage can lead to amplified losses without generating sufficient gains.

Importance in Risk Management

Trading P&L plays a vital role in risk management, especially in volatile markets and fast-paced environments. You can use these calculations to assess performance, set reasonable financial targets and identify loss limits.

You can track the unrealised profit and loss to decide whether to keep or liquidate the position in conjunction with market updates and price action. Therefore, you need to monitor multiple factors simultaneously.

Conclusion

The profit and loss in trading orders refer to the position’s value due to investing activities, including realised and unrealised gains. You can use this measurement to track your order’s performance and make fact-based decisions.

Knowing how to calculate profit and loss and use its formula is crucial. However, you must include the leverage cost price, brokerage fees and conversion rates. Unrealised P&L is not a sufficient indicator of your financial performance and can often be misleading when adjusting and finessing your risk profile.