How to Start White Label Forex Brokerage? – Step by Step Guide

The FX market rooted back to the 1970-s when the American president, Richard Nixon, came off the gold standard. Since then, the market has been transformed into a powerful industry empowering traders to capitalize on the ups and downs of currencies.

The Forex market as a fertile ground for newer businesses

FX daily trading volumes have surpassed the mark of $7 billion, while the overall market’s worth is moving towards $3 quadrillion. Unbelievable numbers that open new horizons for both traders and brokerage companies.

According to statistics, 90% of FX traders face losses, and the other 10% experience regular profits. Meanwhile, this market’s opportunities are always attention-magnets for millions of professional and beginner traders. Even failures are not reasons for giving up. Traders are looking for the second, third, or hundredth chance.

On the other hand, traders cannot access the market directly, selecting brokerage companies, empowering them with an ability to buy and sell currencies worldwide. There is another question – how to run a brokerage company, getting high chances to succeed in the market?

1. Creating a brokerage company: a step-by-step guide

Newer players need to understand what are the important stages to take into account. The process from an idea to a successful brokerage company includes the following steps:

- Glance over the target markets.

- Calculate the required capital to start brokerage firm.

- Access high liquidity.

- Connect a reliable payment processor.

- Outline the services you are going to offer.

- Enter the Forex market and get your first clients.

On the one hand, the stages are pretty clear for beginners; meanwhile, every step may contain a string of pitfalls to restrain your company’s development.

2. Dive into your target audience

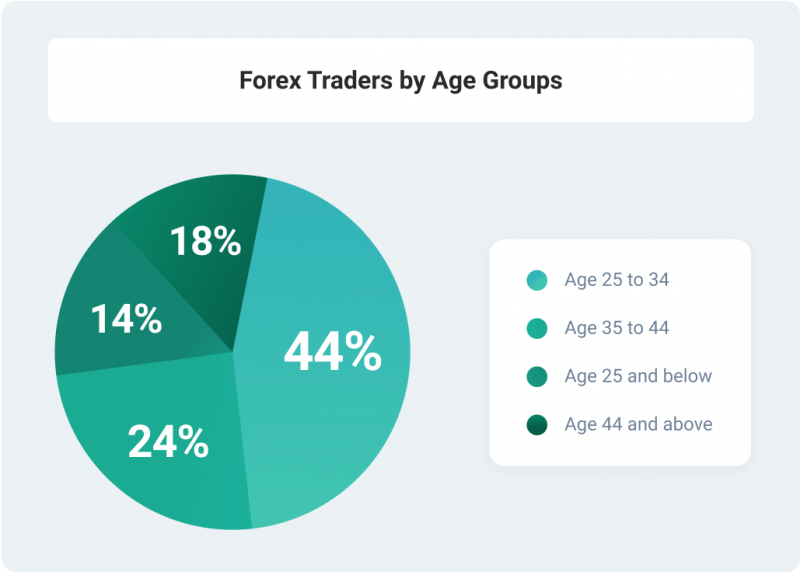

The Know Your Client policy is mostly related to legal issues but brokers need to comprehend who their potential clients are to adjust services to their personal needs and demands. While talking about official statistics, a portrait of a Forex trader displays a person of 25-34 years having less than 1 year of experience and spending at least 3-4 hours daily for trading. That is a generalized character, and newer players need to have a deeper understanding of these statistics:

- 45% of traders are aged 25-34, 24% are from 35 to 44, and 14% more are below 25;

- 52% of traders spend 3-4 hours for this process, 28% of FX representatives practice 1-2 hours;

- less than 8% of active traders have 4+ years of experience.

Furthermore, a brokerage company may be designed specifically for certain geographical areas, languages, etc. The more profound your previous market analysis is the higher chances for success you obtain.

3. What is the required capital to start Forex brokerage?

Financial issues are always of much account; this is why you need to calculate expected costs to run a Forex brokerage company. Your budget should include a bunch of steps:

- A company registration procedure may cost $1500 – $120 000, depending on a certain jurisdiction.

- Business owners need to select a trading platform that costs up to $200 000.

- A website creation and related services may take up to $50 000 more.

As such, the required capital for starting a brokerage firm may equal $370 000, while the exact budget depends on a list of stages that demand thorough calculation.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

4. A few words about liquidity

At first sight, Forex is a liquid market, as we are talking about fiat currencies. If to switch the attention to brokerage companies, the liquidity is referred to the depth of the order book. The more ask and bid offers are placed there, the higher chances traders get to buy and sell assets by the market price. Reliable liquidity providers connect your order book with the largest banking institutions and funds like BNP Paribas, Barclays, Goldman Sachs, etc. Deal with Tier-1 providers only.

5. Possible payment solutions

Traders need to obtain convenient ways to deposit and withdraw their funds from your company. As such, available payment solutions matter much. The array of payment gateways is broad enough but you need to select a reliable provider that guarantees safe and secure payments. Furthermore, take available payment options into account. For instance, it is a good point to enable your clients to refill accounts with bank cards, e-wallets, wire transfers, etc. The more methods are available, the more potential clients you get.

6. The scope of services to offer

Such a stage refers to the necessity of setting up the scope of services a broker is ready to offer for customers. Furthermore, the step is also related to creating a convenient and functional website, user-friendly UI, and other important features that influence an end-user’s choice.

7. Entering the market

When all the previous stages are completed, make your brokerage business ready to enter the Forex market. Test all the services and technical aspects, ensuring yourself everything is working correctly. Never be in a hurry, leaving enough time for the pilot version and bugs fixing. The competition level is high enough; this said excellent products functioning appropriately should be sent to the market only. The process required high-end promotion to attract traders’ attention to your product.

Download the free PDF guide covering the key decisions, common mistakes, and real costs of starting a brokerage.

Forex White Labeling: how to understand such a solution?

The given stages require sufficient experience and profound knowledge to reach success, as many newer business owners who run a brokerage company on their own face a failure at the end of their ways. Finance Magnates states that about 63% of beginner firms cannot pave the way to expected profits.

This is why a Forex broker White Label seems to be a more reasonable solution. First, what is the core of FX White Labeling? A newer business owner applies to an existing reliable Forex broker to use its trading platform and liquidity, offering services as a new brand. This model gains popularity rapidly, as beginners get high-end support and maintenance on every step. Let’s compare the principal pros and cons of this solution.

Key pros of White Labeling

The WL solution provides a new broker with the following advantages:

- Beginner business owners cut their costs, as they leverage the White Label trading platform, facing no necessity to purchase the product.

- Newer players obtain a high-quality platform effective for traders, getting an opportunity to develop their own brand.

- A brokerage company maintains its partners, helping fix problems and find the most beneficial solution at every stage.

Key cons of White Labeling

While talking about the weak points of the solution, the following aspects are outlined:

- Beginner brokers are charged fees (fixed price and/or fees from trading volumes).

- There is no guarantee a trading platform meets your expectations and target clients’ needs.

- Partners are dependent on a platform’s owner. Trading platforms require regular updates, maintenance works; this is why owners may require additional prices for such services.

Meanwhile, cons are rather optional and depend more on the company you are dealing with.

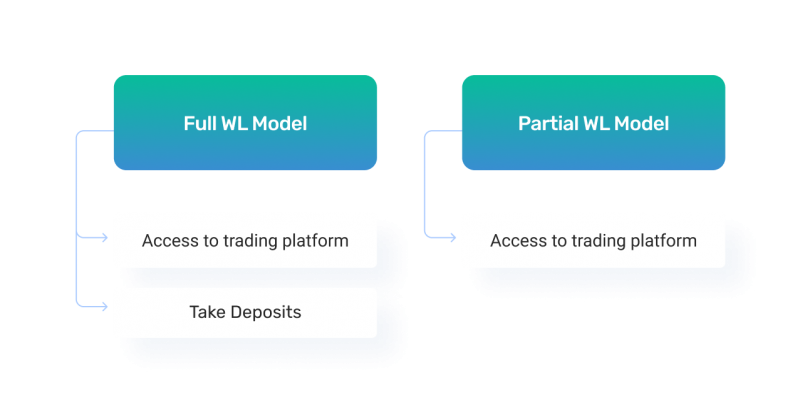

Partial and full WL models

When a newer business owner wishes to obtain an FX broker White Label, two cooperation models are available: full and partial. Let’s clear up the difference between those models.

It is all about the broker’s ability to take deposits. The partial model provides business owners with no possibility to take deposits (they get access to a trading platform only), while the full model enables clients to get both opportunities.

Consequently, we need to understand what is considered under the process of taking deposits, and why this factor is important enough. The first way allows sub-licensed brokers to process clients’ deposits on their own, and the second model shows that all deposits will be processed through the main brokerage company.

If we distinguish the main pros and cons of every model, brokers experience the highest simplicity (no payment providers are needed) and the opportunity to enter the market within the shortest terms. Furthermore, traders may rely more on a bigger, long-lived company. As for cons, the partial WL model destroys the anonymity principle, as traders’ personal information is accessible for a primary broker.

Eventually, both models have strong and weak points, and a newer broker should decide which solution corresponds with his (her) goals better.

Stages to implement your WL brokerage company

1. Find a provider company

The foremost concern is to find a reliable company that offers WL solutions for FX brokers. Glance over the reviews and brief characteristics of a primary broker to understand whether it is worth dealing with or not. Don’t make a hasty choice. Compare prices and packages offered by diverse providers to come up with the best decision.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

2. Select a trading platform

A trading platform is the core component of the WL partnership, as licensed platforms cost about $100 – 200 000. A Forex broker White Label enables newer players to cut costs, as you pay for using and maintaining a product. Sometimes, the savings reach $100-150 000, and that is extremely important for beginners. As for trading platforms, MT 4 and MT 5 are the two most popular solutions implemented by more than 70% of FX brokers. This is why select those products to empower your clients with cutting-edge instruments and tools.

3. Understand the costs

Costs directly depend on the scope of services you are going to order. For instance, some companies suggest turnkey Forex broker solutions, and this service includes all the stages, starting with a company creating. While talking about access to a trading platform, prices change drastically. The budget issue is entirely individual and should be discussed with a company you’ve fixed on.

4. Think over your experience and knowledge

Many brokers entirely rely on the owners of a trading platform, and that is among the most widespread mistakes. No matter how professional and trustworthy a company is, your way to success lies through professionalism and experience. Upgrade your skills constantly to understand the smallest details of the industry.

5. Dip into legal issues

Brokers should understand that the FX brokerage regulation depends on the country. Some jurisdictions tighten rules and requirements, while other countries create a fertile ground for newer players. This said you need to take your WL provider’s and your own business’s location into account. Experts recommend selecting jurisdictions that are reliable enough on the one hand and guarantee softer conditions from the viewpoint of the legislature.

Alternatives to a WL broker solution

A White Label model is a perfect solution for beginners to make a jumpstart on the market; meanwhile, this option can be inaccessible for a set of reasons. What are the possible alternatives?

- Turnkey solutions. Beginner players get a brokerage company ready to enter the market. A business owner purchases a trading platform, being not dependent on a primary broker.

- Interactive brokers. Such a model is considered as the basic partnership form between a newer player and a primary broker. This model implies referring clients, not working with them directly.

Bottom line: where to find a trustworthy WL provider?

Being ready to start brokerage firm, beginners need a powerful ally to rely on. The WL model excludes a set of risks and cuts costs. B2BROKER is a company that offers newcomers a wide range of solutions: WL trading platforms, liquidity, turnkey broker solutions, and other advanced opportunities. 450 institutional clients and 18 cutting-edge solutions show that a company is paving the right way.