Liquidity Provider vs Market Maker: Key Differences

The forex industry has been the lifeblood of global commerce since the very creation of global markets. Today, every local and international business depends on the sturdiness, growth and overall health of the foreign exchange market. Investors, traders, corporations, and even entire governments can function properly because the forex market runs smoothly.

In this realm, distinguishing the role of a Liquidity Provider vs Market Maker is crucial, as both are fundamental to the industry’s vitality and efficiency.

Key Takeaways

- Liquidity providers are institutions that accumulate funds and distribute them on the forex market to fill the demand gaps.

- Market makers provide similar services but primarily utilise their substantial funds to buy and sell large currency volumes.

- LPs and MMs have some key differences, but both are essential institutions assisting forex market growth and stability.

Defining The Concept of Liquidity

To understand the inner workings of both forex company types, it is crucial to first grasp the underlying liquidity concept. Liquidity is by far the most critical metric in the forex field. It determines the activity, growth and profitability of the entire industry. Liquidity in forex also ensures that traders receive the best possible deals without having to wait or sacrifice their desired price quotes.

While some forex sectors are inherently liquid, including the Euro, GBP and US dollar, others might have a stricter time organically developing ample supply and demand. Moreover, numerous political, economic, and international factors might affect this intricate balance. In this case, some sectors within the forex market might experience downturns, struggling to achieve fair price quote offerings and bleeding its trader base.

Losing the optimal liquidity levels is a significant development for any sector or niche and must be addressed shortly before the currency at hand experiences significant pricing and inflation problems. Thus, the modern markets have created an entirely new company sector that handles this problem.

Both liquidity providers and market makers provide liquidity sourcing to various forex sectors, including local and international regions. These companies play a vital role in the long-term growth of the forex landscape, ensuring that multiple currencies don’t suffer from crippling inflation due to artificially created roadblocks and challenges.

Understanding The Liquidity Providers

Liquidity providers (LPs) are companies that exclusively specialise in sourcing liquidity to the forex market players. LPs represent a narrower niche of market makers, so most of the general public views these organisations as synonymous. However, LPs have a much narrower focus.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

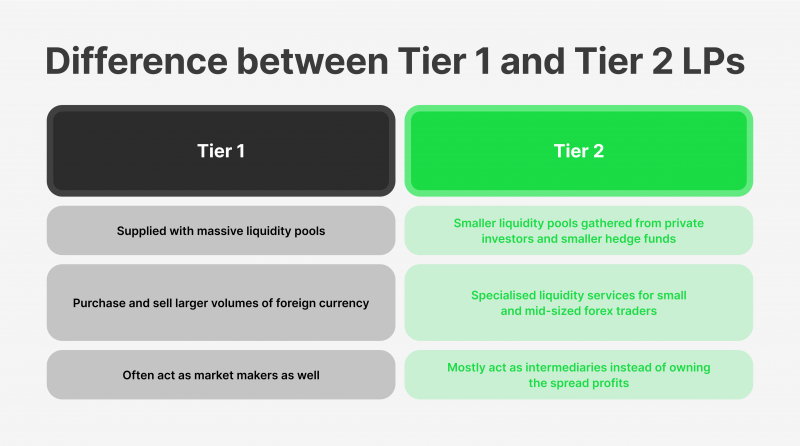

LPs come in two main categories – tier 1 and tier 2. The two types are primarily separated by their institutional capabilities and scopes. Tier 1 LPs are by far the largest organisations in this niche, capable of supplying the sector with massive volumes of liquidity. A tier 1 LP can single-handedly impact the price stability of minor currencies on the market with their ability to purchase and sell substantial amounts in short periods.

Tier 1 And Tier 2 LPs: What’s The Difference?

Tier 1 liquidity providers are also often market makers since they represent industry-leading financial institutions. They have the resources to impact the market fundamentally due to their international outreach and highly liquid reserves from other banking activities.

On the other hand, tier 2 LPs are a more recent addition to the equation. The 21st-century digital revolution has allowed small and mid-sized businesses to compete with established and capital-intensive industry giants. Today, even the smallest companies can theoretically become brokers, offer banking services, create e-commerce shops and much more. Previously, none of these activities were even accessible to companies with limited budgets. Tier 2 LPs are an excellent example of digital disruption, allowing smaller companies to liaise between tier 1 LPs and the general forex market.

Tier 2 LPs provide smaller levels of funding for appropriately smaller brokers, traders and investors. Instead of possessing the necessary liquid funds outright, tier 2 LPs create liquidity pools by negotiating with various large banks, private investors and hedge funds. They supply funds to digital exchange platforms in forex or sometimes create their platforms to maximise their profits.

Who Are Market Makers?

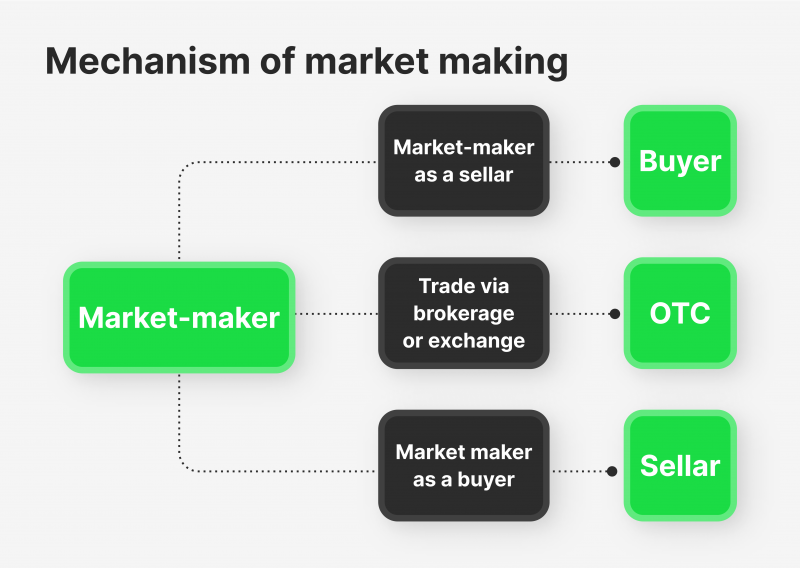

Conversely, market makers (MMs) conduct the same operations on the forex market, mainly for their benefit. MMs are extensive market players that have the power to impact entire sectors or sovereign regions in forex.

Institutions like JP Morgan and Goldman Sachs are perfect examples of the highest-tier MMs, as they influence numerous industries at the same time. These colossal companies work closely with federal and international banks to control interest rates, currency pairing ratios, spreads, etc.

These massive organisations utilise their ample cash reserves to manipulate the market in many ways. While their presence is primarily positive, controlling the currency prices from inflation, deflation or any other adverse movements, these dominant players can sometimes make significant mistakes. In this case, the negative effects are amplified, as the MM entities possess significantly larger forex volumes than any other institution worldwide.

MMs are also known to operate in multiple industries, aggregating their resources to produce a cross-industry synergy and consistency across markets. For example, the recent surge of market making in crypto has motivated large banks to invest in this sector, producing slightly more consistent pricing between forex and crypto industries.

Thus, market making in forex is a complex process which involves numerous variables and KPIs. These organisations largely utilise the forex market for their benefit, earning massive returns in the form of spreads on the open market.

However, they also have to tightly control the price changes, supply currencies that have short-term liquidity problems, and maintain the spread intervals, interest rates and the general equilibrium of the market. MMs are the very definition of the phrase – “with great power comes great responsibility”.

Liquidity Provider vs Market Maker: Why Does The Forex Market Need Both?

While MMs provide a broader range of services and LPs are much more specialised, both institutions are irreplaceable for the growth and long-term development of the forex industry. Top-tier liquidity providers across the globe ensure that this market does not go down with the frequently changing conditions.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

While the free market principle is mainly positive for the global market, some crises happen outside of the pure market demand and supply changes. In some instances, the forex market deals with political tensions, natural disasters, social changes and other events that shouldn’t be viewed as an ordinary course of market activities.

In these instances, it is vital to provide ample liquidity to stabilise the prices and ensure that healthy currencies don’t suffer from temporary shocks to the system. In this case, LPs and MMs are the first line of defence, supplying funds wherever and whenever required. This mutually beneficial system allows the modern forex economy to thrive despite the occasional bumps on the road.

Final Thoughts

While LPs and MMs provide liquidity in different forms and have distinct missions on the market, they are both critical players in the grand scheme of the forex landscape. From ensuring price stability to controlling the spreads and avoiding investor panic, these institutions are fundamental cogs in the global forex machine. Therefore, in the Liquidity Provider vs Market Maker debate, it’s clear that the forex industry relies on both to navigate and mitigate market challenges.

FAQ

What is the definition of a liquidity provider in forex?

A liquidity provider is an institution that supplies funds to the forex market, ensuring traders can buy and sell currencies without delays or price fluctuations.

What is the difference between a liquidity provider and a market maker?

A liquidity provider focuses on supplying funds to stabilize the market, while market makers actively buy and sell large currency volumes to control spreads and pricing.

Why are liquidity providers important in the forex market?

Liquidity providers ensure the forex market remains active, filling supply and demand gaps, maintaining price stability, and enabling seamless trading for all participants.