Micro-Investing: Does It Really Work?

The investment world is complex and constantly changing, forming new concepts and approaches to making money and offering the public new markets. This not only boosts the total asset capitalisation but also offers fresh prospects for both novice and seasoned investors.

As many newcomers to the market today do not have a large initial capital to work within the traditional investment model, a micro-investing strategy has recently emerged to solve this problem.

This article will explain a micro-investing strategy, its characteristics, and how it differs from the traditional investing model.

Key Takeaways

- micro-investing enables individuals to start investing with minimal funds, often using spare change, making it accessible for beginners and those with limited capital.

- With features like round-ups and scheduled contributions, micro-investing platforms simplify investing, making it easy to build a consistent habit with little effort.

- While ideal for beginners, micro-investing can be combined with traditional investments to enhance financial growth and achieve larger, long-term financial goals.

What is Micro-Investing?

Micro-investing is an investment strategy that allows individuals to invest small amounts of money regularly, typically through micro-investing apps or online platforms. Unlike traditional investing, which often requires a substantial initial sum, this approach lowers the barrier to entry by enabling people to invest with just a few dollars or even spare change.

This strategy has gained popularity largely due to the accessibility and convenience it offers. Traditional investing can seem daunting for many people, especially with high initial investment requirements and the perceived complexity of managing a portfolio.

Micro-investing simplifies this by breaking down financial barriers and enabling individuals to start investing with very little money and financial knowledge. It turns everyday spending into a potential savings strategy, where spare change and small amounts are automatically invested over time.

This not only makes it easier to start but also helps people who may feel they lack enough funds or expertise to begin investing meaningfully. Starting a micro-investing journey can be a small step, but it’s a significant achievement that inspires and motivates you to continue.

Micro-investing isn’t intended to replace traditional investing but rather to complement it, especially for younger or budget-conscious investors. As individuals become more comfortable with micro-investing, they may expand their strategies to include traditional investment accounts or retirement funds.

In this way, micro-investing can serve as an educational stepping stone, helping users become familiar with investing concepts like risk, diversification, and compounding returns. For many, it’s the first step toward financial independence, making investing approachable and achievable with limited resources.

micro-investing allows you to start with as little as $1, often using spare change from daily purchases.

Key Features of micro-investing Strategy

The micro-investing strategy is a fairly widespread tool for multiplying personal capital among different types of investors, particularly due to its characteristics. Among them are the following:

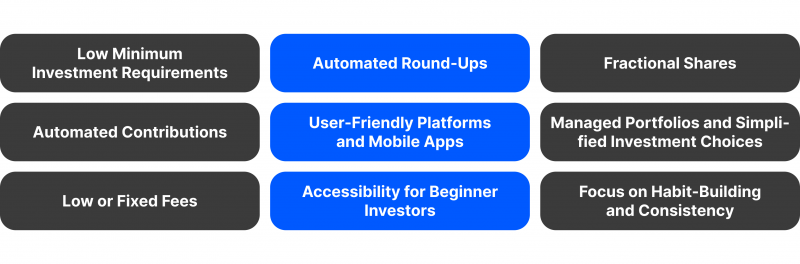

Low Minimum Investment Requirements

Unlike traditional investing, which regularly requires a sizeable initial investment, micro-investing allows people to start with minimal amounts. This makes it accessible to individuals who might not have large amounts to invest upfront, such as students, young professionals, or people with limited income.

With the ability to invest just a few dollars or even cents at a time, this strategy opens the door for people to begin building wealth early without needing significant capital. By starting small, investors can form consistent habits that will help grow their investment over time.

Automated Round-Ups

Many micro-investing apps use a round-up feature, where each transaction made with a linked debit or credit card is rounded up to the nearest dollar, with the spare change invested. For example, a purchase of $5.50 would be rounded up to $6.00, with the extra $0.50 automatically invested.

This method allows users to invest passively without even noticing it. Over time, these small contributions can compound and grow significantly, turning everyday purchases into opportunities to build wealth. The round-up feature especially appeals to those who may find it challenging to set aside larger sums for investing.

Fractional Shares

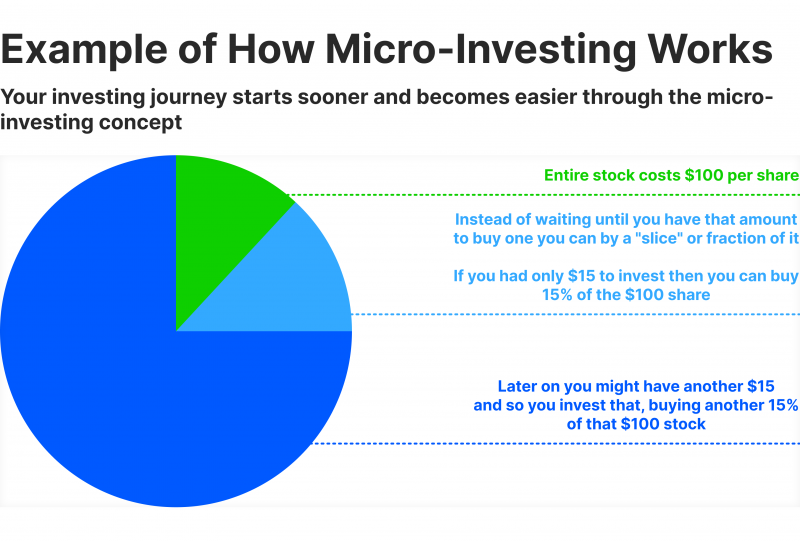

Micro-investing platforms allow users to buy fractional shares, meaning they can own a portion of a stock or ETF (Exchange-Traded Fund) without purchasing a full share, which can be costly, especially for popular stocks with high prices.

By enabling the purchase of fractional shares, micro-investing platforms make it possible for users with smaller budgets to build a diversified portfolio of assets, including big-name companies they may not otherwise be able to afford. This feature also helps diversify investments and reduce risk, as users can spread their money across multiple assets rather than putting it all into one.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Automated Contributions

In addition to round-ups, most platforms let users schedule regular contributions, such as weekly or monthly deposits. Investors can choose the amount and frequency, allowing them to contribute steadily without remembering or actively initiating each investment.

This automation makes it easy for investors to stick to a plan and build their portfolio over time. Consistent contributions harness the power of dollar-cost averaging, which reduces the impact of market volatility by investing at regular intervals. The automated nature of this feature makes it appealing to busy individuals who want to invest without actively managing their accounts.

User-Friendly Platforms and Mobile Apps

Micro-investing apps are designed to be highly intuitive and user-friendly. These apps generally feature simple, visually appealing interfaces that make investing accessible to people who may not have much experience with finances or investing.

By making the process straightforward, these platforms empower beginners who may feel intimidated by traditional investing platforms. Many apps also offer educational resources, step-by-step guidance, and basic investment insights, making it easy for users to understand where their money is going and how their investments are performing. This accessibility encourages broader participation in the market, especially from younger generations.

Managed Portfolios and Simplified Investment Choices

Micro-investing platforms offer pre-built portfolios or simplified investment options for various risk levels. These portfolios are managed by professionals and consist of a diversified mix of assets. Some apps even include risk assessment tools to help users choose portfolios that match their goals and risk tolerance.

For novice investors or those without the time or knowledge to research individual stocks, managed portfolios provide a convenient way to start investing. By offering diversified portfolios with a range of risk levels, these platforms make it easy for users to align their investments with their financial goals and risk tolerance without worrying about active management.

Low or Fixed Fees

While micro-investing platforms often charge fees, these are usually low or fixed. This could be a small monthly subscription (e.g., $1–$3 per month) rather than a percentage-based fee. However, even small fees can impact returns significantly for accounts with very low balances.

Low or fixed fees make this strategy accessible and predictable, especially for beginner investors. However, users need to be aware of the impact of these fees on smaller balances, as they can erode returns over time if the account balance is low. This makes fee structures an essential consideration for anyone.

Accessibility for Beginner Investors

By lowering financial and knowledge barriers, micro-investing is particularly appealing to beginners who might feel excluded from traditional one. Most platforms cater to new investors with easy-to-follow guides, educational content, and simplified investment options, giving them the necessary resources to start confidently.

Accessibility is its core appeal, as it allows those lacking experience or capital to start investing in a low-risk environment. This makes it easier for beginners to build confidence and learn the basics of investing as they go, fostering a more financially literate and investment-ready generation.

Focus on Habit-Building and Consistency

Micro-investing is designed to build the habit of saving and investing consistently, even if the initial contributions are negligible. The ability to automate contributions, invest spare change, and have access to a user-friendly platform encourages users to view investing as a regular part of their financial routine.

By fostering consistency and making investing feel more like a habitual, small-scale activity, this strategy encourages people to stick with it for the long term. Over time, these small investments can add up through the power of compounding, helping users build wealth gradually.

This habit-forming approach can also motivate users to increase their contributions as they grow more comfortable with investing.

Micro-investing and Traditional Investing — Comparison Analysis

Micro and traditional investment in financial markets have their own peculiarities and differences. Let’s discuss them below.

Initial Investment Requirements

Former strategy typically requires meagre starting capital, often as little as a few dollars or spare change. It’s accessible to people who may not have large sums to invest upfront, which makes it particularly popular among beginners, young professionals, and those with limited disposable income.

The latter one often requires a more substantial initial investment, significantly if investing in individual stocks, mutual funds, or real estate. Many brokerage accounts and investment products have minimum balance requirements, sometimes ranging from a few hundred to several thousand dollars.

Investment Options and Flexibility

In the former, investment options are typically limited to fractional shares of stocks, ETFs, or pre-built portfolios. Some platforms may only offer a few choices, such as conservative, moderate, and aggressive portfolios, to keep things simple.

Latter offers a wide range of investment options, including individual stocks, bonds, mutual funds, ETFs, REITs (Real Estate Investment Trusts), commodities, and more. Investors can create customised portfolios based on their unique goals and risk tolerance.

Fees and Costs

Micro-investing fees are often fixed and relatively low, such as a monthly subscription fee ranging from $1 to $5. However, these fees can represent a larger percentage of returns, especially on low balances, reducing the impact of smaller investments.

Traditional brokers typically charge commissions or management fees based on a percentage of assets under management, which may be more cost-effective as the account balance grows. Investors may also incur trading fees if buying and selling individual stocks, though some brokers now offer commission-free trades.

Automation and Hands-Off Investing

Many micro-investing platforms offer automated features like round-ups, scheduled contributions, and pre-built portfolios that don’t require active management. This hands-off approach is ideal for busy individuals or beginners who prefer not to manage investments themselves.

While some traditional brokers offer automated portfolios (such as robo-advisors), many investment options require more active involvement. Investors may need to track performance, rebalance their portfolio, and stay informed about market trends if managing individual stocks or mutual funds.

Returns and Growth Potential

In micro-investing, due to small initial contributions, returns can be slower to grow, and the impact of fees can reduce overall gains, especially for small balances. Microinvesting is generally more suited to long-term, gradual growth rather than rapid wealth accumulation.

Traditional approach with a larger initial capital, diverse asset options, and potential for higher contributions can yield higher returns. Investors can more easily implement growth, dividend, and sector diversification strategies to maximise returns.

Risk Management and Diversification

Most micro-investing platforms offer managed portfolios with built-in diversification across stocks and bonds, helping to manage risk for beginner investors. However, customisation may be limited, and the reliance on a single platform could present risks if not periodically reviewed.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

In the case of traditional, investors have complete control over risk management strategies. They can customise their portfolio by balancing various asset classes, diversifying across sectors and geographies, and adjusting based on market conditions or personal circumstances.

Educational Component and Financial Knowledge

Many micro-investing platforms provide essential educational resources to help beginners understand investing fundamentals. However, due to the simplified options, users may not gain in-depth financial knowledge.

Speaking of traditional investing, investors can delve deeper into market research, analysis, and personalised investment strategies. Managing a conventional investment portfolio requires a stronger understanding of financial markets, which can lead to a greater mastery of investing concepts over time.

Accessibility for Different Financial Goals

Micro-investing is great for those with short-term goals, limited funds, or a desire to establish a saving and investing habit. It suits individuals focused on small, consistent contributions and long-term gradual wealth accumulation.

Traditional investing is better suited for larger, more specific financial goals, like retirement, real estate purchases, or building an extensive investment portfolio. It can support various strategies, from aggressive growth to income generation.

Who Should Use Each Approach?

Micro-investing is best for beginners, young adults, students, or anyone looking to start investing with minimal funds. It’s also useful for individuals who prefer a hands-off approach or wish to complement their traditional investments with small, regular contributions.

Traditional investing is appropriate for those with sufficient capital, a moderate to advanced understanding of financial markets, and specific financial goals. It’s also suitable for investors who want more control over their portfolios and the flexibility to implement various investment strategies.

Conclusion

Micro-investing has emerged as a powerful tool for individuals looking to start their investment journey with minimal capital and experience. This strategy is particularly effective for new or young investors who want to develop consistent investing habits and gradually grow their portfolios over time.

However, while micro-investing is an excellent starting point, it’s often best viewed as a complement to traditional investing rather than a replacement. By combining both approaches, investors can leverage the accessibility and ease of micro-investing with the expansive options and growth potential of traditional investing.

FAQ

Is micro-investing safe?

Yes, it is generally safe, but choosing a reputable platform regulated by financial authorities is essential.

Can micro-investing help me build wealth?

It can help build wealth over the long term, especially if you consistently contribute and reinvest returns.

How does micro-investing compare to traditional investing?

Micro-investing is more accessible, automated, and beginner-friendly, whereas traditional investing offers more options, flexibility, and growth potential.

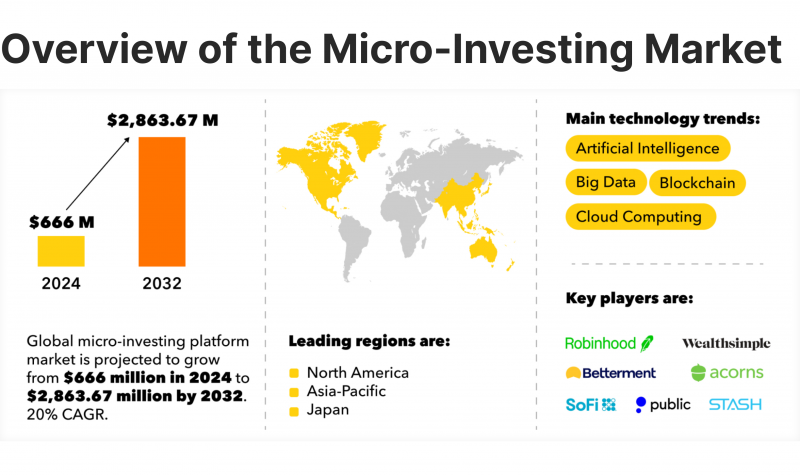

What are some popular micro-investing platforms?

Popular platforms include Acorns, Stash, and Robinhood.

Can I use micro-investing alongside traditional investing?

Yes, many people use this strategy to build habits and accumulate initial capital while investing in traditional accounts for more diverse, long-term goals.