The Difference Between Hedging and Netting on MT5

Articles

Trading in the Forex market is associated with several risks and challenges. It is the largest financial market, with millions of investors and businesses involved in it, making it an extremely dynamic marketplace.

In general, trading entails maximising your gains and minimising your losses. However, some FX investors follow extra precautions with hedging and netting techniques.

These practices help offset unexpected losses and reduce the chances of a position insolvency. Let’s go through the difference between hedging and netting and which one is better for you to protect your funds in the Forex market.

Key Takeaways

- Hedging and netting are two loss-mitigation strategies that allow traders to offset their losses in the Forex market.

- Hedging and netting entail opening new market orders, opposing to a currently losing one.

- Hedging in MT5 registers every newly executed order separately.

- Netting in MT5 registers all orders together in one position, where all changes are reflected.

What is a Hedging Account?

Hedging is when a trader opens multiple market positions with the aim of mitigating losses in one by opening another order in the opposite direction. Creating a hedge entails executing more than one order for the same currency.

This way, if the market moves in an unfavourable trend and the position loses, the other position earns from the market direction. These orders are counted as two separate orders in the trader’s transaction history.

Traders can either directly open both positions at the same time or open the opposite position when the market starts moving sideways.

How Hedging Works with an Example

Assume you buy 1 lot of the EUR/USD pair. You can place a sell order straight ahead after a few hours or wait until the market swings unfavourably.

You place a sell order for 0.5 lot on the same pair. Now, you have two EUR/USD positions in opposing directions. If the market starts a downward trend, your buy order will struggle because prices are decreasing, and it will record losses on 1 lot.

You can close the initial order and keep the other one. This way, not only did you limit your losses but also compensated some from the gains you earned on the sell order.

Alternatively, if you predict the dip to be temporary and that the market will recover, you can wait a little bit until you receive a clear signal to close either of the orders.

What is a Netting Account?

Netting in Forex entails executing multiple orders but in the same position to mitigate losses. Thus, if a trader makes contradictory orders, they affect the initially executed one and are not processed as a separate new order.

Unlike hedging, the netting system might be a bit complex in understanding how multiple orders can be executed in a single position. However, you can imagine it like adjusting the existing order. In the end, it is recorded in the trader’s transaction log as one transaction.

Trading with a netting shows the trader the net outcome from the position, including the several orders processed on the same order.

How Netting Works with an Example

Let’s say you are trading 1 lot of the EUR/USD pair, and after a few hours, the market moves unexpectedly against your will and the buy position starts losing.

You can process a sell order for 0.5 lot on the same currency and position, adjusting the existing order and showing you the net outcome of your trade.

In this example, you will get a net of 0.5 EUR/USD long position because the second order deducted 0.5 lot from the initial one. You can process multiple orders in the same position, and the trading software will automatically close and adjust your net trade position.

Forex Hedging and Netting in MetaTrader 5

Hedging and netting can be implemented directly in the trading platforms, where an investor can directly enable this feature while activating their account. MetaTrader 5 is a popular software for hedging and netting your FX trading strategy.

However, it is crucial to ensure that your MT5 broker facilitates this option on their platform, especially when running a live account and not a demo account.

Forex traders in the US usually face challenges when hedging their trades. In 2009, the US financial regulator passed a law that prohibits hedging or opening multiple positions in the Forex market with the same currency. This was justified by ensuring the market and price integrity and fairness.

The restrictions apply to Forex brokers in the United States. Therefore, non-US brokerage firms and trading systems offer Forex netting and hedging, such as MetaTrader 5.

How to Use MT5 Hedging and Netting

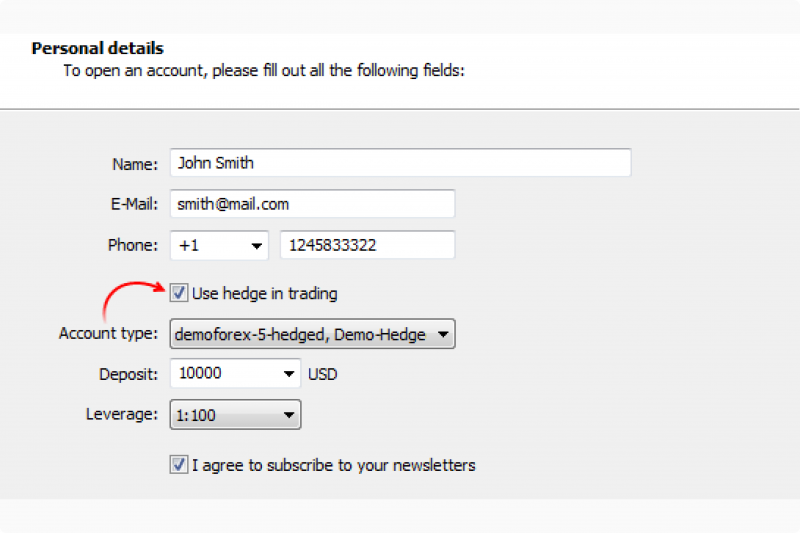

MT5 hedging and netting can be activated when creating a user, usually by opting to “hedge” while launching a live or demo trading account.

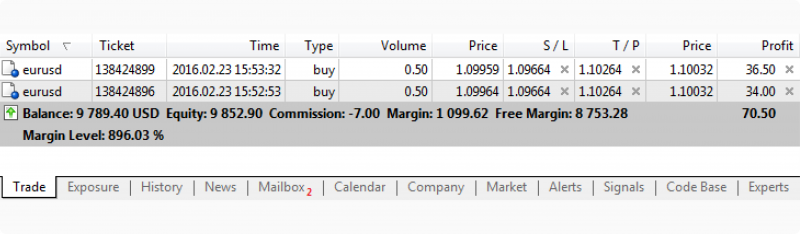

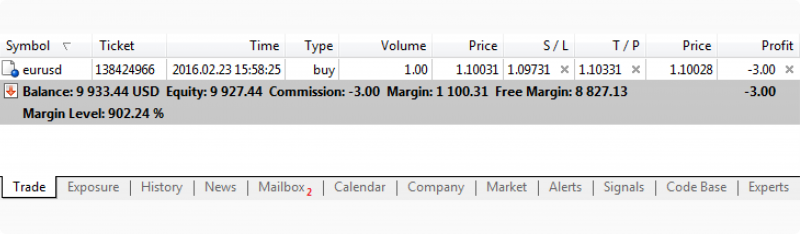

To hedge a position, you can execute a new order on the same asset, which creates a new separate market position, opposing the one you already have. You can see it in your transaction log, which shows two activities below.

However, if the netting option is activated, you can execute a new position on the same currency pair in the opposite or same direction.

Then, the system will automatically adjust your existing position according to the newly created one. If you long EUR/USD and you executed a new “sell” order, the software will decrease the initial position according to how much you executed in the second one.

However, if you execute a new “buy” order, the software will increase your existing position with the amount you processed the second time.

Regardless of the order type you are processing, your transactions will show one record, as shown below.

Hedging vs Netting Account: Which One is Better?

Netting and hedging are popular approaches to safeguard your Forex trading positions, allowing you to turn losses into gains. If you are wondering which one is better for you, consider weighing out the advantages and disadvantages of each method.

Pros & Cons of Hedging

The hedging system allows you to execute opposing positions for as many currency pairs as you want. You can counter your open position, as well as trade other pairs with positions on both sides.

Additionally, you can set stop-loss and take-profit levels for each position separately, giving you more control over your trading session.

On the other hand, the ability to have multiple open positions of the same currency will crowd your activity log and make it harder for you to keep up with each order’s profitability, take-loss limits and breakeven point.

Pros & Cons of Netting

Netting is usually more straightforward, and one of its major advantages is that all your transactions and orders are recorded in only one position, showing the net outcome of the trade.

You can easily calculate the take-profit, stop-loss, and breakeven point because you are dealing with one market position.

On the other hand, you cannot place multiple stop-loss and take-profit points for each order because, practically, you have one position where all your adjustments are applied.

Conclusion

Hedging and netting in Forex trading allow you to limit your losing market positions by opening contradictory orders, turning your losses into gains.

The difference between hedging and netting on MT5 is that every new trade you execute is registered separately as a new order in hedging, while netting merges all your activity in a single position.

This concept might seem complicated for the beginner trader. However, it can be easily implemented on the MT5 terminal, which can be combined with stop-loss limits to mitigate your losses.