What is an IEO, And Why is it Better Than an ICO?

Articles

The development of the crypto sector and its gradual transformation has had a tangible impact on many areas of the financial world. This steadily increases both the demand for innovative crypto solutions and crypto trading on the part of ordinary users.

Additionally, the interest of regulators is growing as a result of a number of force majeure, unpleasant situations in the crypto market. These incidents have caused a loss of confidence on the part of crypto traders and investors.

The loss of trust on the part of market participants has become a catalyst for the emergence of new ways of creating crypto projects that have similar features to existing ones but carry a different concept. One of these forms is IEO (Initial Exchange Offering).

This article will explain what is an IEO, what are its advantages and disadvantages, as well as the sequence of steps to start an IEO yourself.

Key Takeaways

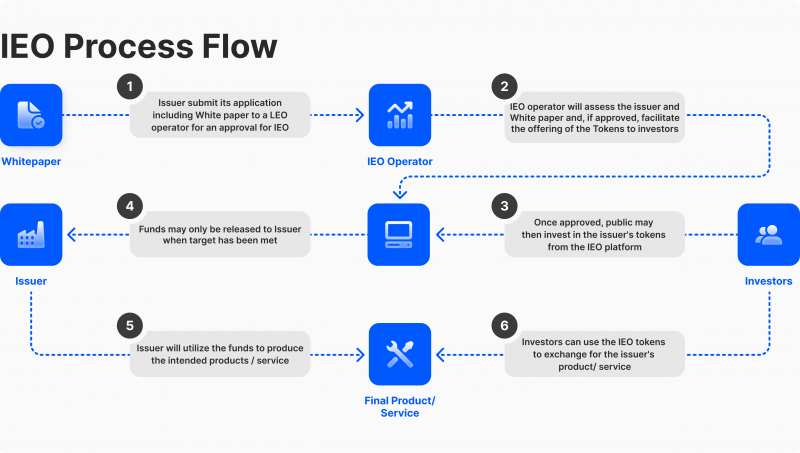

- IEO is the process of placing tokens through an exchange for subsequent sale, accompanied by the provision of investment funds by interested parties.

- The IEO process has some similarities to an ICO but is a new version of it, helping to provide some security guarantees to the company placing the tokens.

- IEO allows you to gain invaluable experience in the crypto sphere, as well as the knowledge necessary to work with crypto projects, in particular, to trade on crypto exchanges.

What is an IEO?

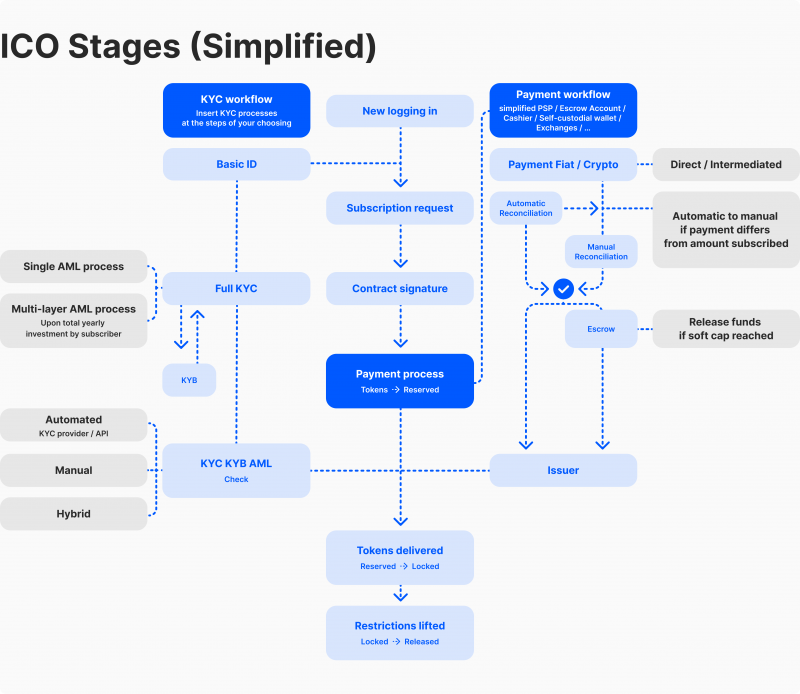

So, what does IEO stand for? An Initial Exchange Offering (IEO) is a method of selling tokens via a well-established cryptocurrency exchange platform. It aims to address the loss of trust in Initial Coin Offerings (ICOs) by offering investors a new method of conducting token sales.

While the objective of IEOs is the same as that of ICOs, the process and the conducting platform differ significantly. With IEOs, investors can leverage the credibility and security of the established exchange to participate in the token sale. IEOs can offer a more secure, transparent, and regulated way of investing in blockchain projects.

In light of the numerous fraud cases involving ICOs over the past few years, entrepreneurs and startups have preferred launching IEOs to raise funds in the cryptocurrency market. The ICO industry’s loss of confidence and trust among investors has prompted new companies to refrain from using ICOs for fundraising.

However, an IEO is not the only viable option, as several other alternatives have proven to be effective. These include security token offerings (STOs), initial token offerings (ITOs), and initial decentralised exchange offerings (IDOs). As such, the choice between IEOs and ICOs is not necessarily binary, and companies have a range of options to consider when seeking to raise capital in the cryptocurrency market.

The IEO is an evolutionary form of the ICO that came to replace it as a result of numerous trust issues in the conduct of the latter.

Selling Points and Shortfalls of IEO

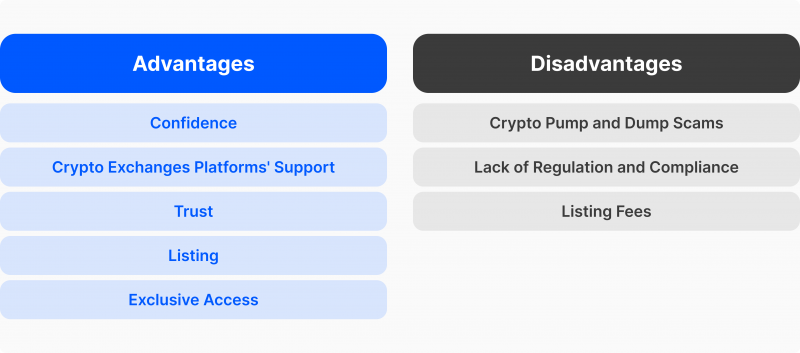

The IEO process is an innovation in launching new crypto projects. Just like ICO, it has its own peculiarities, advantages and disadvantages, as well as the nuances of conducting it, which creates the need to have the necessary knowledge base and experience before launching new crypto projects.

Let’s consider the pros and cons of IEO in detail below.

Selling Points of IEO

Let’s start with the positive aspects that the IEO process has to offer.

Confidence

When conducting token sales, investors are more likely to exhibit confidence and trust in the process if it is carried out through a reputable cryptocurrency exchange platform. In addition, such a choice also lends more legitimacy and credibility to the IEO campaign, thereby increasing the likelihood of attracting further investments in the future.

Given this, businesses and entrepreneurs must carefully consider the platform they choose to conduct their token sales, as it could significantly impact the overall success of their project.

Crypto Exchanges Platforms’ Support

The IEO model is executed through intermediary cryptocurrency exchange platforms, offering higher reliability and efficiency. These exchanges oversee transactions, ensure transparency, and minimise the risks of fraudulent activities.

Additionally, they may provide crucial support in development and IEO advertising, which can further enhance the success of the IEO. Hence, IEOs conducted through reputable exchanges will likely run smoothly and offer a more secure and streamlined fundraising mechanism for businesses and investors.

Trust

IEOs have replaced ICOs as a more trustworthy means of crowdfunding in the cryptocurrency industry. The primary advantage of IEOs is their credibility. Since IEOs are conducted on cryptocurrency exchange platforms, the exchange screens each project seeking to launch an IEO.

This is done to protect the exchange’s reputation by thoroughly scrutinising token issuers. As a result, IEOs have become a more reliable option for investors who seek to invest in legitimate cryptocurrency projects with a lower risk of fraud.

Investors seeking to participate in IEOs can find reassurance that the platform facilitating the offering has scrutinised the project. This serves to mitigate the risk of fraudulent activity. However, it remains imperative that investors conduct thorough research before making any investment decisions, as with any investment.

While IEOs provide a certain level of regulation, the possibility of project failure can only partially be eliminated. As such, investors are advised to exercise due diligence in their decision-making process.

Listing

It is customary for a cryptocurrency exchange, where an IEO is conducted, to list the coin after the conclusion of the crowd sale. This post-sale listing plays a vital role in the overall success of the IEO process and provides investors with a platform to trade the newly listed coin.

The listing process, subject to the exchange’s internal policies and regulations, generally involves thoroughly reviewing the coin’s technical specifications, market potential, and overall value proposition.

It is, therefore, imperative for the IEO issuer to ensure that their coin meets the exchange’s listing criteria and standards as well as according to IEO white paper requirements.

Exclusive Access

IEOs are exclusive investment opportunities offered only to the existing members of the exchange platform and are not available to the general public. This type of offering is designed to provide a secure and controlled environment for investors to participate in a new token sale.

Unlike ICOs, IEOs involve a vetting process by the exchange platform, which verifies the legitimacy of the project and its team before listing the token for sale. This allows investors to have more confidence in the project and its potential for success in the frame of cooperation with the best IEO exchanges.

Drawbacks of IEO

Well, now it’s time to look at a few significant disadvantages that the IEO process has over other crypto project launch formats.

Crypto Pump and Dump Scams

IEO has not eliminated the risk of crypto pump-and-dump scams. Such fraudulent activities are perpetrated by miscreants who fabricate hype around a cryptocurrency to generate interest and drive up prices, allowing them to sell their shares at a profit before prices plummet. Thus, it is paramount that investors exercise due diligence and remain vigilant to avoid falling prey to these scams.

Lack of Regulation and Compliance

When it comes to cryptocurrency exchange platforms, it’s essential to keep in mind that not all platforms are the same. While some platforms may prioritise strict due diligence and adherence to regulations, others may not.

Therefore, conducting research and carefully evaluating each platform before selecting the right one for the company is crucial. Doing so makes it possible to ensure that trust, investments, and personal information are placed in a reliable and secure platform that meets the needs and aligns with the company’s values.

Listing Fees

Listing fees may be significantly high in the context of reputable exchange platforms. Additionally, startups may be requested to remit commissions to the exchange platform following the sale of tokens. This implies that the costs of listing tokens on such platforms can be substantial, and startups should consider this aspect when making decisions.

So, high fees do not guarantee success on the platform, and startups should evaluate the costs and benefits of listing their tokens on any given exchange platform.

How to Launch an IEO? — Ultimate Guide

Now that you know what is an IEO and its advantages and disadvantages, it’s time to explore how to launch your own IEO project successfully through a series of sequential steps, each of which is an important aspect of shaping the entire process.

Market Scenario and Idea Analysing

Before launching an initial exchange offering, it is crucial to thoroughly analyse the project’s viability while also considering the current market scenario. Determining the market needs is critical to ensure that the currency addresses a gap in the market.

An in-depth market analysis can help ascertain whether the project is feasible and provide valuable insights into the potential risks and rewards associated with the offering. Therefore, conducting comprehensive market research and analysis is essential before initiating an initial exchange offering.

Moreover, prior to launching a new cryptocurrency, it’s essential to do a thorough market analysis and identify potential competitors’ strengths and weaknesses. This will help you to capitalise on the current market problems and address them through your project. You should also pay close attention to your marketing strategy.

During the planning stage, you need to think about how you can present your currency to potential investors in an engaging and attractive way. Your ultimate goal is to persuade investors to invest their capital in purchasing your token.

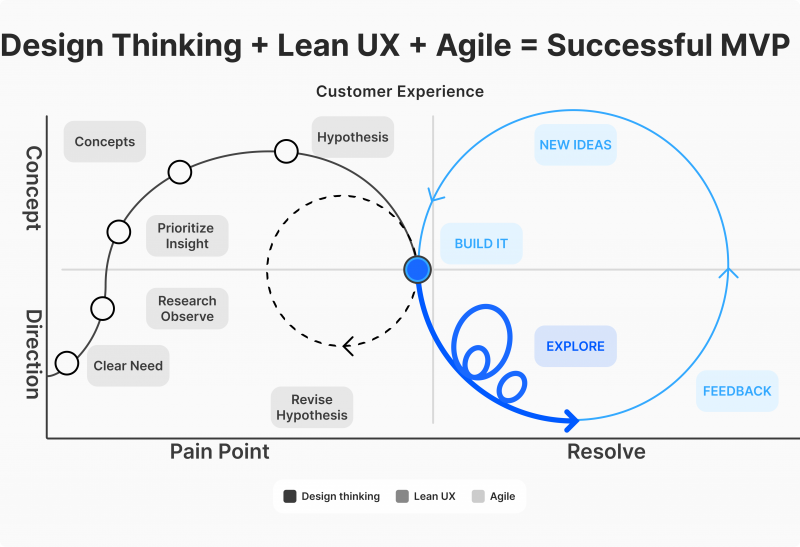

Getting MVP Ready

Well-established cryptocurrency exchanges exclusively enlist projects that have made significant strides. Consequently, when considering a launch on a crypto exchange platform, it is crucial to ensure that the minimum viable product (MVP) is either already available or in the development process.

This approach ensures that a project is deemed feasible and trustworthy by the exchange platform and the community, which is critical for its success.

Your project must be listed on top exchange platforms that meet specific requirements. To illustrate, consider the case of Bread (BRD), a cryptocurrency wallet provider. Before its IEO launched, the company had already developed a functional application that boasted a user base of over one hundred million.

Exchange Platform Selection

Once you have a solid concept and have made progress on the development phase (or have even created an MVP), the next significant step is selecting an exchange platform. This decision is critical since the platform you opt for will determine the speed of the competition and influence the direction of the IEO trend.

Thus, ensuring that the methods used for selecting, conducting due diligence, and engaging with investors suit your project is crucial. Choosing a trustworthy and dependable platform is paramount, as it will have full control over its users’ private keys. The industry’s leading exchange platforms include KuCoin Spotlight, Huobi Prime, Binance Launchpad and OKEx Jumpstart.

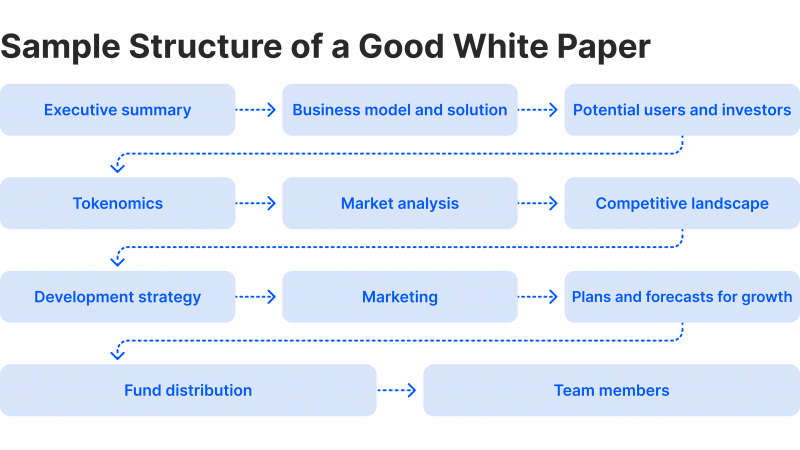

White Paper Drafting

Composing a meticulously researched and well-written white paper is crucial in launching a successful IEO. As mentioned earlier, a white paper is instrumental in facilitating investors’ comprehension and appreciation of your project, aiding their investment decisions. Like an academic paper, a white paper serves as both a selling proposal and a pitch and should be comprehensive, factual, and formally presented.

Website Designing and Developing

A website is essential for businesses that provide accessible information to potential investors and contributors. Therefore, ensuring that the website is the best possible representation of the project online is crucial.

This involves attention to several critical factors, such as the website’s design, user interface, user experience (UI/UX), loading speed, and security. A well-designed website with excellent UI/UX, fast loading times, and robust security features is integral to establishing a positive online presence, attracting and retaining visitors, and achieving the desired business objectives.

Think of your website as an online and easily understandable version of your white paper. It should be informative yet captivating, and it’s essential to keep people informed about the progress of your project. Consider hiring a professional web designer to create a site that impresses potential investors if needed.

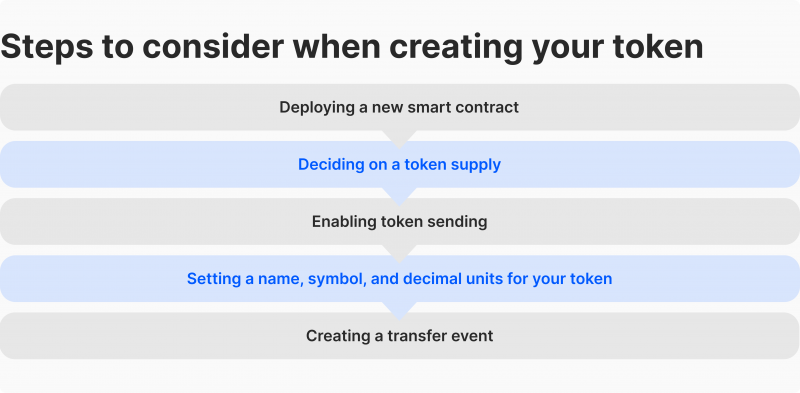

Tokens Development

Token development involves the creation of tokens for listing on exchange platforms intended for investors’ acquisition. Before embarking on this process, it is essential to determine the number of tokens to be issued and establish a system for determining their value.

Such considerations should be carefully evaluated to ensure the token development process is executed efficiently and effectively. Besides, it is paramount to conduct thorough research to identify the most appropriate exchange platforms for listing the tokens, which will help to maximise their potential value and appeal to investors.

Tokens are generated through various blockchain platforms, including NEO, Ethereum, EOS, etc. While Ethereum is a favoured choice, one may opt for other blockchain platforms to create their token. Selecting a blockchain platform that suits the specific requirements of the token being created is essential.

Funding

Determining a funding goal is of utmost importance to achieve success in an IEO sale. The number of tokens entering the IEO sale must be considered while deciding the funding goal. Adequate preparation is crucial to determining an appropriate funding goal, as it can aid in mitigating risks and avoiding failure.

Therefore, meticulous planning and a thorough understanding of the IEO process are imperative to ensure success in the sale.

Establishing your maximum funding requirement before you begin listing tokens on your exchange platform is essential. You should set a hard cap for funding, the highest amount of funds your project can raise. This will give investors confidence that you have a clear and realistic goal and that you’re not simply trying to grow as much money as possible.

Token Listing

Once the process of token minting is completed, the next step is to get them listed on various exchange platforms. It is essential to note that each exchange platform has its own set of rules and guidelines for listing tokens, so there’s a necessity to meet the requirements and criteria for selection to ensure that the tokens are accepted and available for trading on the exchange platforms.

Proper adherence to the exchange platform listing rules can also help enhance the tokens’ credibility and reliability, thereby boosting investor confidence and demand.

Upon completion of the platform’s due diligence checks and other necessary procedures, the tokens can be officially listed on the exchange, thereby allowing the initiation of sales.

Post-IEO Promotion

The last step is to actively promote the new crypto project with the help of powerful IEO marketing services and tools. These tools can include a wide range of tactics, such as using social networks to reach potential investors, distributing print advertising like banners and booklets, and utilising SEO and blogging tools to create high-quality articles covering topics related to your project. By using a combination of these tactics, you can increase your project’s visibility and attract the attention it needs to succeed.

Conclusion

IEO is an excellent modern tool that allows the procedure of token sale through a crypto exchange, which gives significant advantages to companies in the form of high security, exclusive privileges when placing tokens, as well as operational support from the exchange, which allows companies to have guarantees of honesty, transparency, and professionalism.

FAQs

What is an IEO?

The process of IEO is to sell tokens using some crypto exchange, followed by promotion.

What are the advantages of IEO?

IEO provides increased security for investors, the opportunity to list on the exchange and exclusive access to its offerings and shares.

What are the reasons entrepreneurs focus on launching IEOs?

IEO interests many entrepreneurs due to its ability to list tokens on an exchange, expand its customer base, and enhance its fundraising process, which makes it easier to launch a crypto project.