The Winning Business Plan for Forex Company

The idea of forming your own Forex brokerage company is both exciting and challenging. Before taking the first steps, it’s more than important to craft a business plan, which will serve as the compass that will guide you through the complexities of this thriving industry.

A well-structured business plan is not just a document; it is a strategic roadmap that guarantees the success and sustainability of your undertaking.

The winning plan should provide a deep understanding of the Forex brokerage business model’s nuances, exploring key elements such as a swift and reliable Forex trading platform, the significance of getting a Forex broker licence, and the selection of advanced software solutions.

Key Takeaways

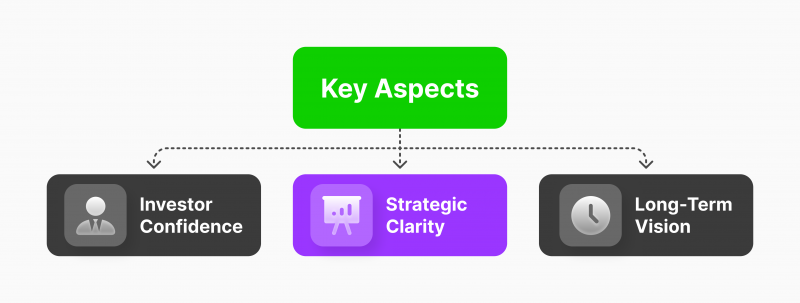

- A well-structured business plan instils confidence in potential investors, offering them a transparent view of the business’s objectives, risks, and rewards.

- Crafting a business plan encourages entrepreneurs to define a clear strategy for conducting business operations.

- Beyond immediate gains, a business plan provides a roadmap for long-term success.

How to Start Your Own Forex Brokerage

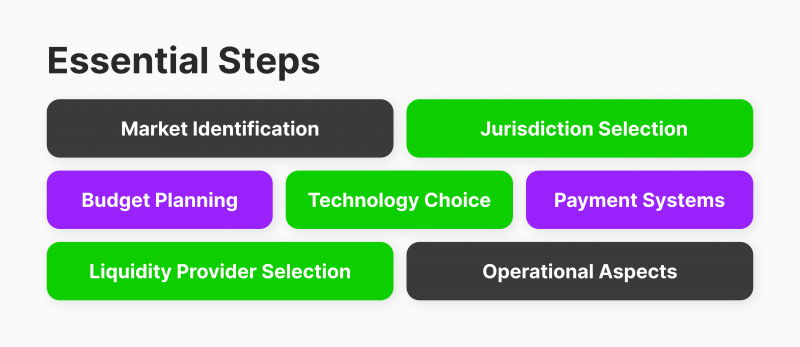

Think about these tried and tested steps for a successful startup of your forex brokerage firm:

Market Identification

Targeting the desired market is the central point for any new forex trading business. Finding potentially profitable consumers and determining a lucrative target market is time-consuming, but it is crucial for growing the brokerage scale. Simultaneously, acquiring a thorough understanding of the market’s outstanding competitors is essential.

Jurisdiction Selection

Choose the country where your business will be based, bearing regulatory requirements and legal considerations. Be ready to fulfil all the rules needed to obtain a Forex broker licence because you won’t be able to cover all functions without having a valid licence.

Budget Planning

Determine the startup budget for your Forex brokerage, including licensing fees, technology costs, and operational expenses. Confirming that you have enough capital to meet jurisdictional requirements and cover initial operating costs and setup charges is imperative.

Technology Choice

Choosing a foreign exchange technology provider is another crucial step. Aligning with partners who understand your business objectives and can provide a robust forex infrastructure with the necessary technology is essential. A successful partnership in this regard can significantly boost your company’s earnings.

Payment Systems

Establishing a business relationship with a payment processor is critical for brokers, as they regularly handle financial transactions with clients. Offering a variety of deposit and withdrawal methods based on client preferences is essential, influencing their decision to engage with a broker.

Brokers should incorporate innovative and popular payment channels, such as Crypto, e-wallets, and money orders. Exploring payment choices that align with your brokerage plan is advisable.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Liquidity Provider Selection

Select a reputable liquidity provider to ensure smooth transaction flows within your brokerage. Partnering with a multi-asset liquidity provider proficient in handling various trading products, including Forex trading, Crypto, stocks, oil, metals, and more, is essential.

Look for a provider equipped with reliable foreign exchange technology, ensuring top-notch performance, enhanced execution speed, and robust technical support. This strategic choice contributes significantly to your brokerage’s overall quality and success.

Operational Aspects

Once these foundational steps are completed, you can proceed to set the operational side of your trading business:

- Set up a Forex trading website and platform.

- Hire an IT and finance staff.

- Obtain a virtual or physical office space.

B2Broker’s experienced staff can provide complete guidance, ensuring your FX brokerage starts with a high-quality infrastructure.

Components of a Business Plan For Forex Company

After understanding the fundamental steps for establishing a Forex trading firm, let’s discuss how to create a prospective business plan. Here are the main sections:

1. Executive Summary

The executive summary provides a concise overview of your Forex trading business, summarising key points such as your business concept, goals, and financial projections. It serves as a snapshot for potential investors or partners, offering a quick glimpse into the essence of your project.

2. Vision Statement

Craft a compelling vision statement outlining your Forex brokerage firm’s long-term ambitions and goals. This statement should articulate the direction you envision your business heading and the impact you aim to make in the dynamic Forex market.

3. Mission Statement

Your mission statement should define the purpose of your Forex brokerage firm. It summarises the values and principles that guide your business operations, giving internal and external stakeholders clarity about the firm’s motivation.

4. Company Structure

Detail the organisational structure of your Forex brokerage, outlining the hierarchy of positions and their respective roles. This section provides insight into how your business is organised.

5. Roles and Responsibilities

Specify the roles and responsibilities of key individuals within your Forex business, including management, sales, and operational staff. A clear description of duties ensures efficient day-to-day operations and accountability.

6. Products and Services

Enumerate the range of products and services your Forex brokerage will offer. This section should provide a comprehensive overview of your offerings, including trading platforms, analytical tools, and any additional services that set your firm apart.

7. Market Investigation

Conduct a thorough market analysis, delving into the Forex market dynamics. Spot your target audience (demographic information, buying habits, and purchasing power), analyse competitors (their strengths, weaknesses, and market share), and highlight market trends that may affect your business. A thorough market research is the key to strategic decision-making.

8. Sales and Marketing Strategies

Outline your marketing and sales strategy, detailing how you plan to attract traders to your platform. This section should encompass digital marketing, advertising, and any promotional activities to build brand awareness and acquire a customer base.

9. Financial Projections

Present detailed financial projections, including revenue forecasts, expenses, and profit margins. This section is crucial for potential investors, providing a clear picture of your Forex brokerage firm’s financial viability and growth potential.

10. Sales Forecast

Provide a detailed breakdown of your sales forecast, including anticipated growth over specific periods. This section outlines the revenue projections and represents your business’s expected performance.

11. Risk Analysis – Final Step in Business Plan

Provide a thorough risk analysis demonstrating the viability and logic behind your trading business model. This includes assessing the potential risks involved and outlining strategies to mitigate them. Including this analysis in your plan provides transparency and assists investors in evaluating the likelihood of your trading business’s success relative to the assumed risks.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Why Forex Traders Need a Business Plan

Even for seasoned traders, the act of creating and adhering to a comprehensive forex trading business plan offers numerous advantages.

First, crafting a business plan prompts a thorough review and solidification of your trading activities and goals. This process allows you to assess and refine your strategies, ensuring alignment with your primary objectives. It serves as a valuable exercise in self-reflection and strategic planning.

Also, a well-structured trading business plan can be a powerful tool for attracting new investors to finance your trading activities. If your project proves successful during its initial testing and trading period, it becomes a compelling document to showcase to potential investors.

Additional funds injected into your trading business can enhance access to better trading spreads, information, and customer service, ultimately leading to more lucrative trading opportunities.

Final Remarks

In the trading community, creating a robust business plan for Forex company is a fundamental step for ambitious entrepreneurs. The significance of this document extends beyond its role in securing initial investment; it is a strategic roadmap that outlines clear objectives and operational strategies.

Whether you are a seasoned professional or a newcomer to the Forex market, an accordingly crafted business plan is your guide through the complexities of forming and sustaining a successful Forex brokerage.

FAQ

How do I write a forex business proposal?

Evaluate yourself;

Choose your trading style;

Pay attention to trading times;

Use stops and limits;

Identify currency pairs to trade;

Plan for rollover rates;

Know the regulations where you trade.

How to start a forex trading company?

Step 1: Learn the fundamentals of forex trading.

Step 2: Choose a reliable Forex broker.

Step 3: Open a demo account and practice trading.

Step 4: Open a live account and fund it.

Step 5: Develop a trading plan and follow it.

What should be included in a forex trading plan?

In short, a trade plan means setting parameters for getting into and out of trades, how much money you’re putting at risk, and a profit strategy.

What is a business plan for a trading platform?

A trading business plan should include the following elements: your trading goals, your trading strategy, your risk management, your trading capital, your trading tools, and your performance evaluation.