Top Trader’s Room Features: How to Choose the Best One

In brokerage infrastructure, the trader’s room handles everything clients don’t see on the chart — onboarding, deposits, withdrawals, KYC, IB tracking, and account-level analytics. Without it, a broker can’t scale, automate compliance, or offer even a baseline user experience.

As competition increases across multi-asset platforms, brokers are looking for client portals that support faster activation, modular integrations, and enterprise-grade security. But too many trader’s rooms still fall short on flexibility or require months of custom development.

In this article, we break down what a trader’s room actually includes and which features matter most.

What is a Trader’s Room Solution?

A trader’s room is the client-facing control panel of a brokerage. It’s where clients register, complete KYC, deposit and withdraw funds, manage trading accounts, track performance, and interact with the platform's core services.

While it’s sometimes called a “client cabinet” or “client area,” its role goes far beyond UI—it’s a mission-critical tool for onboarding, compliance, and retention. For most users, it’s the only part of your infrastructure they ever directly interact with outside of the trading terminal.

From the broker’s perspective, the trader’s room is the interface that connects your front office to your back office. It integrates payments, CRM, verification tools, trading platforms, and IB systems into a single environment, creating a seamless client experience while reducing operational overhead.

At scale, this system needs to be secure, modular, and deeply integrated across the full lifecycle:

registration → activation → funding → trading → withdrawal → retention.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Core Trader’s Room Features

Not all trader’s rooms are created equal. The features below are non-negotiable for brokers that want to scale efficiently, stay compliant, and deliver a premium client experience.

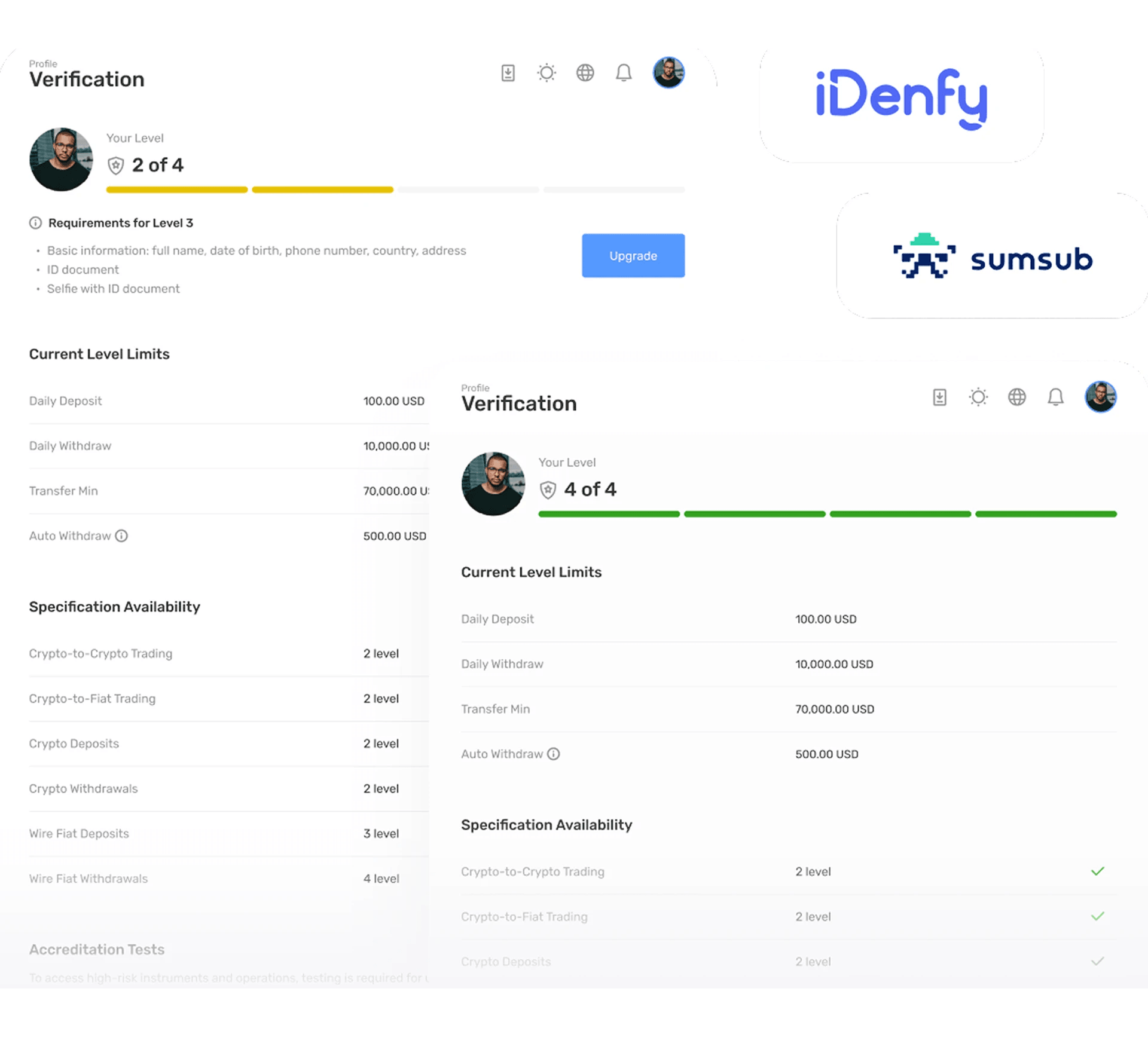

1. Seamless KYC and Onboarding

First impressions matter. A good trader’s room integrates with leading KYC/AML providers to automate client verification, support multilingual document flows, and handle resubmissions and approvals, without creating bottlenecks. Everything should be mobile-ready and frictionless.

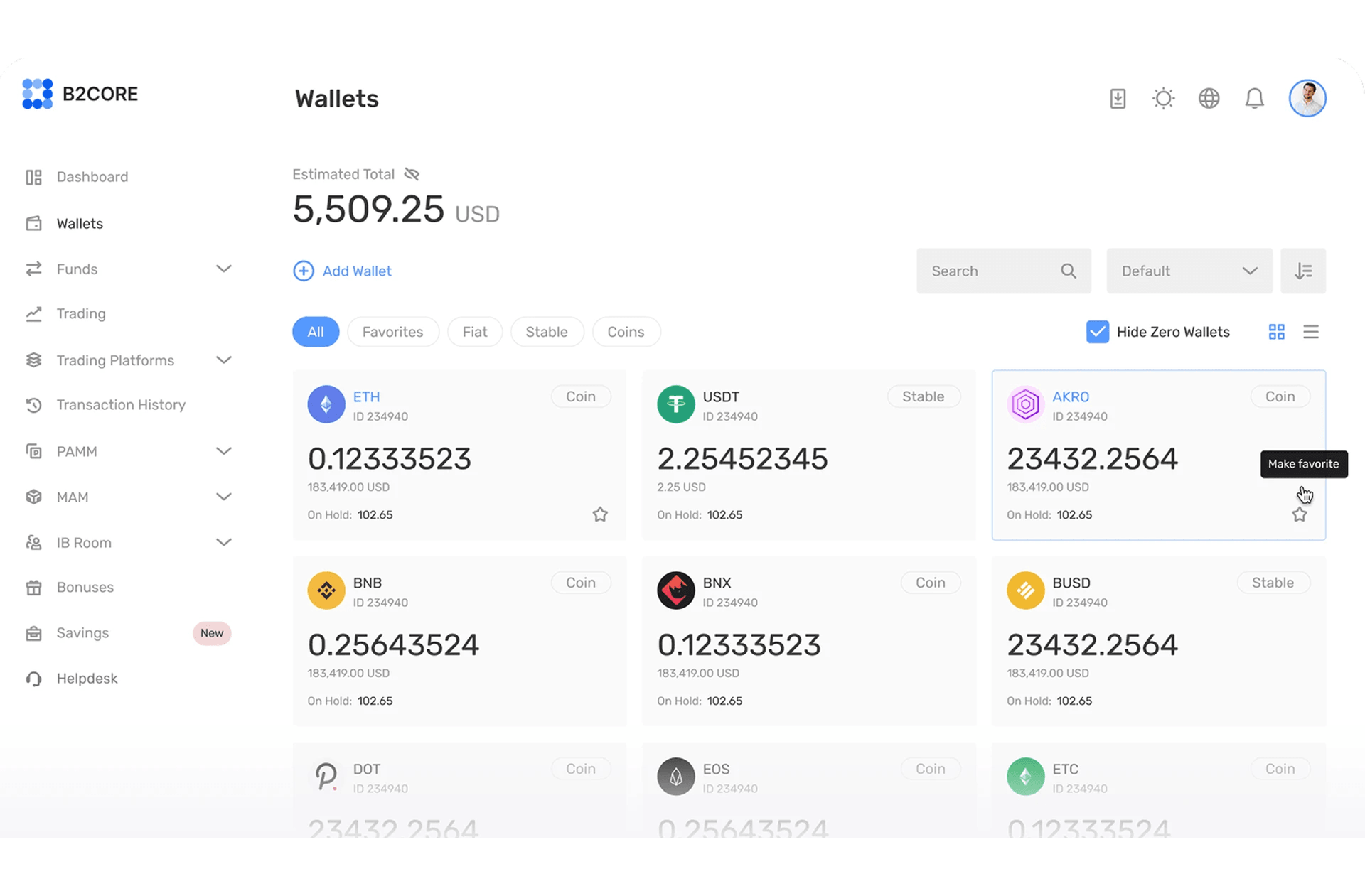

2. Multi-Asset Wallets with Real-Time Sync

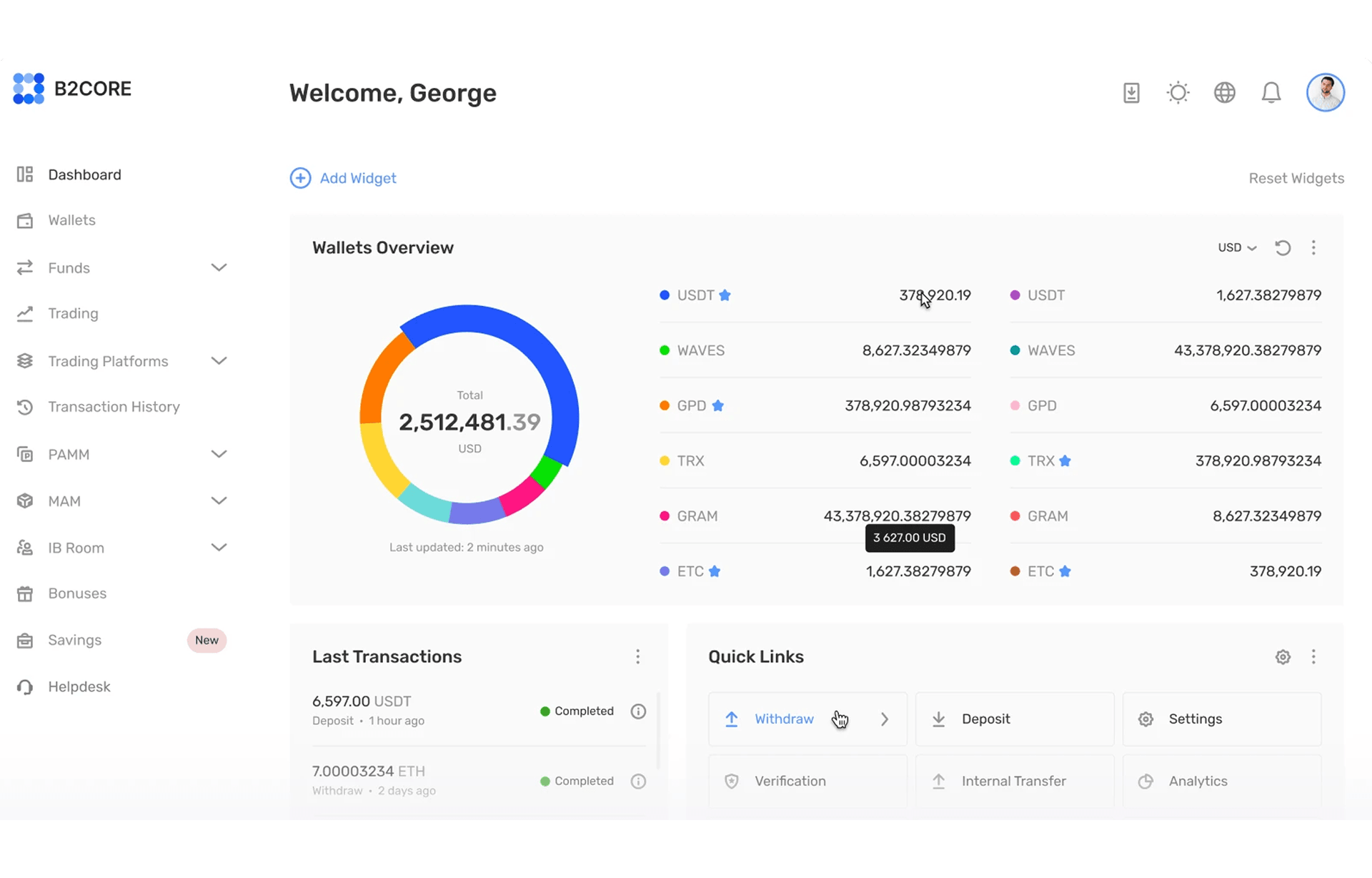

Users expect fast deposits, instant balance updates, and native multi-currency support (including crypto). A proper trader’s room acts as a hub for all balances, reflecting activity across wallets, trading accounts, and commissions without lag or mismatches.

Your trader’s room should integrate with multiple PSPs and gateways and intelligently route payments based on geography, currency, or amount.

3. IB and Affiliate Portal

For most brokers, IBs drive the bulk of organic growth. A powerful trader’s room provides built-in tools for referral tracking, commission distribution, tiered rewards, and performance analytics, turning every trader into a potential partner.

4. Back-Office Sync and CRM Integration

The trader’s room doesn’t exist in a vacuum. It must sync in real time with your CRM, risk engine, and compliance stack. Every deposit, trade, or support ticket should update dashboards and trigger workflows behind the scenes.

5. Customisability and White Label Readiness

You need to adapt to different client segments (retail, institutional, MAM managers) and multiple brands. A modern trader’s room offers white-label flexibility, language packs, role-based permissions, and UI elements you can tailor without touching code.

6. Built-In Support and Communication Tools

Integrated live chat, ticketing, and announcements (KYC updates, margin changes, outages) improve user satisfaction and reduce your support team’s load. Clients shouldn’t need to open a separate tab just to ask a question.

How the Trader’s Room Powers Your Brokerage Operations

The trader’s room is the operational front-end of your brokerage. Done right, it aligns your trading infrastructure with your business workflows and keeps everything running smoothly from deposit to trade to withdrawal.

Streamlined Client Lifecycle Management

From registration and verification to deposit, trading, and withdrawal, the trader’s room ties every step of the client journey into one cohesive flow. You reduce onboarding friction, automate approvals, and maintain regulatory compliance — all while keeping the experience intuitive for users.

Real-Time Data Sync with Trading Platforms

Your trader’s room must integrate tightly with MT4, MT5, cTrader, or your proprietary platform. Clients should see real-time updates on equity, margin, order status, and trade history. On the backend, your risk team needs accurate data to monitor exposure, P&L, and funding flows.

Unified Back-Office Visibility

For your staff, the trader’s room provides a control panel: support agents can track client tickets, compliance teams can monitor KYC flows, and finance can review wallet balances and withdrawals. When integrated with a proper CRM and risk engine, the trader’s room becomes a full business cockpit.

Revenue Infrastructure for Brokers

With proper configuration, the trader’s room becomes a revenue center. You can track IB referrals, set up cashback or rebate logic, monitor trading volume for loyalty programs, and even upsell additional services like copy trading or managed accounts.

Looking to Upgrade Your Trader's Room?

See how B2CORE can streamline your onboarding, payments, KYC, and multi-account management — from one dashboard.

How to Choose the Right Trader’s Room Provider

Choosing the right provider can make the difference between a scalable brokerage operation and one stuck with fragmented systems and constant tech headaches.

Here’s a practical framework for evaluating your options:

- Crypto + Fiat Support: Can the provider handle both fiat and digital assets natively? If you’re planning to run a multi-asset operation, this is non-negotiable.

- Platform Integrations: Make sure they support your trading stack — MT4, MT5, cTrader, or any proprietary terminals. Bonus points for real-time data sync and user-friendly account creation flows.

- Speed to Launch: Some providers need months of setup. Others can get you live in weeks. Ask for typical onboarding timelines and implementation scope.

- Compliance & KYC: Are ID verification, document uploads, and AML workflows baked into the product? Can you plug in third-party providers like SumSub or ShuftiPro?

- IB Management & Multi-Account Handling: Can you easily onboard, manage, and reward introducing brokers? What about segmenting clients into user groups and controlling access?

- SLAs and Uptime Guarantees: Institutional clients won’t tolerate outages. Ensure your provider commits to strong uptime SLAs and offers responsive support.

B2CORE’s Trader’s Room: Built for Brokers

All-In-One CRM & Back Office for Brokers and Exchanges

Fully Customisable Trader’s Room with Modular Features

Built-In IB Module, KYC, Payment Integrations, and Reporting Tools

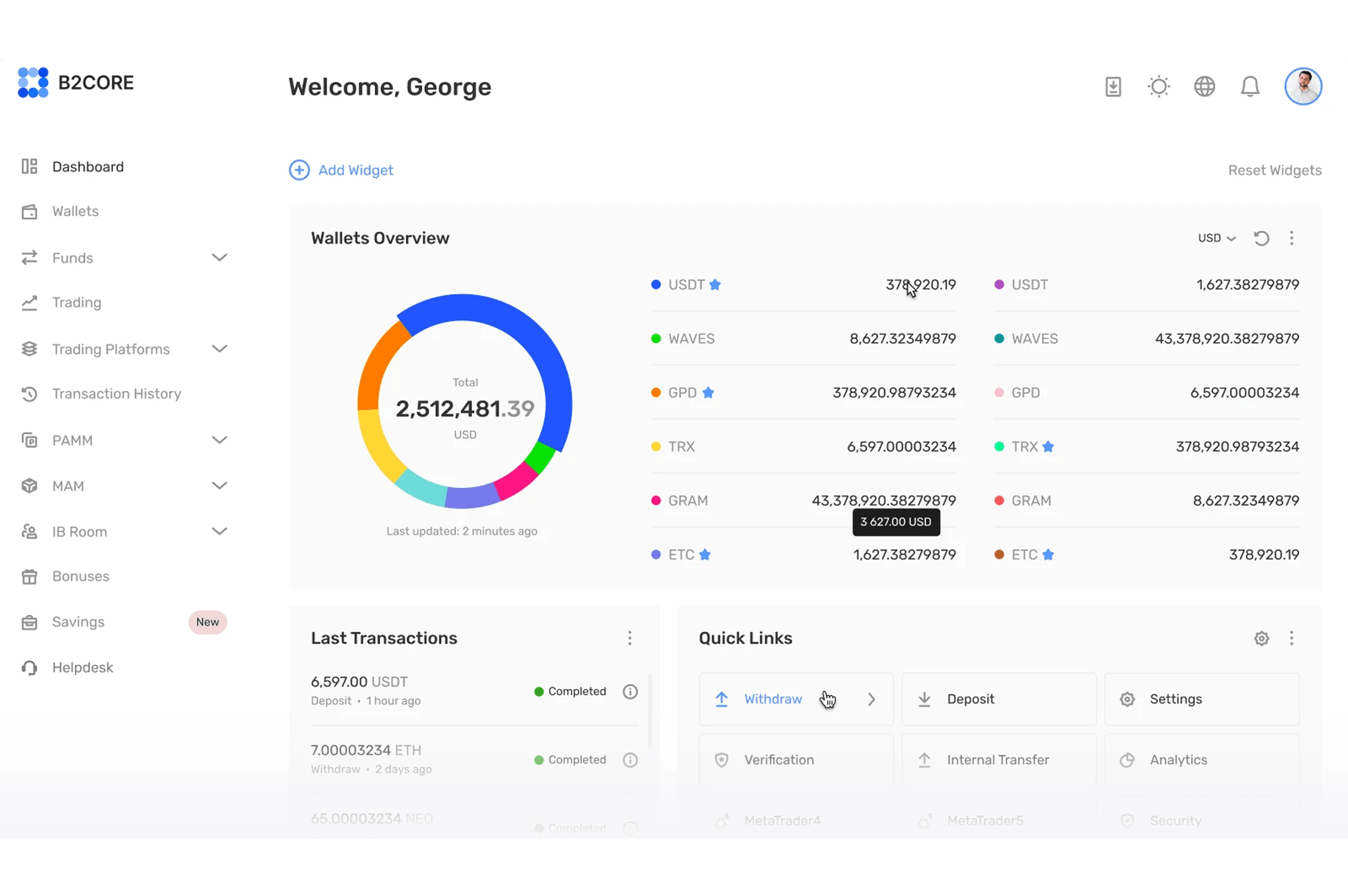

Intuitive Interface that Boosts Client Engagement

Most trader’s rooms do the bare minimum — let traders deposit funds, check balances, and maybe download a report or two. That’s not enough in 2025.

B2CORE’s Trader’s Room was built for modern brokerages that need more than just a dashboard. It’s a flexible client hub that lets you serve thousands of users across platforms, asset classes, and jurisdictions, all while reducing back-office overhead.

Unified System Architecture

Most brokerages still operate with disjointed systems: one for CRM, another for KYC, a third for payments. This creates operational inefficiencies and exposes clients to inconsistent experiences. B2CORE replaces that patchwork with a unified Trader’s Room infrastructure. It is built to manage thousands of accounts in real time, across multiple asset classes and platforms.

Whether you're offering MT4, MT5, or cTrader, B2CORE supports full trading account integration, internal fund transfers, and role-based access from day one. No custom development required.

A True Operational Dashboard

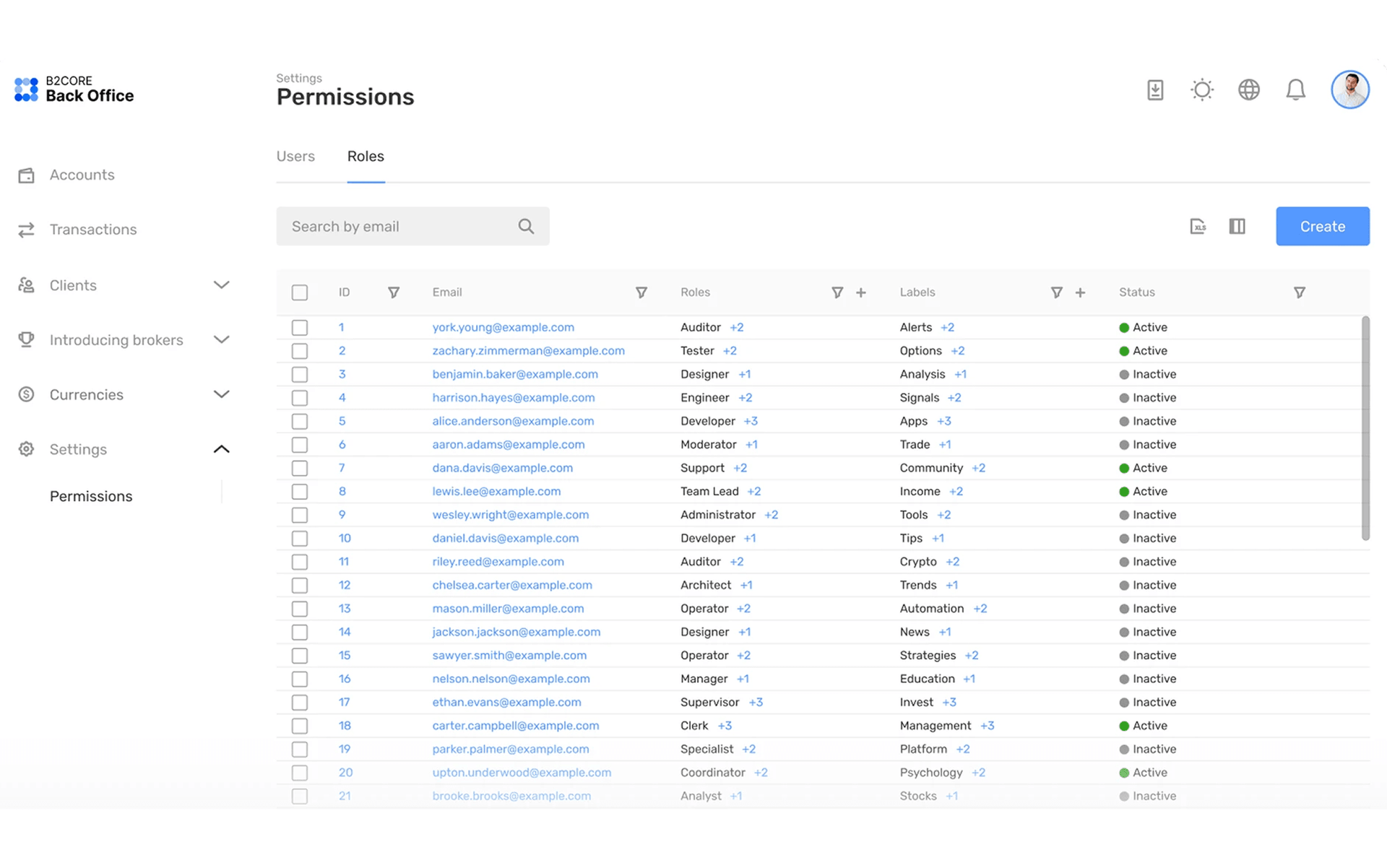

Through the admin panel, brokers can see everything in real time: who logged in, which documents are under review, and what withdrawal requests are in the queue. You can filter clients by status, monitor user activity, freeze accounts, and send notifications.

The system is designed with role-based access, so you control exactly what each team member can see or manage. This reduces risk, improves internal oversight, and helps you scale your team without losing transparency.

Seamless Integration with Everything You Need

B2CORE integrates with:

- Trading platforms: MT4, MT5, cTrader, B2Trader

- Payment systems: B2BinPay, card processors, local PSPs

- KYC/AML providers: SumSub, ShuftiPro, iDenfy

- Messaging and notifications: Telegram, Slack, SMS

- Custom APIs for your own tools and services

This allows you to unify your stack around a single core system and reduce the complexity of managing multiple platforms.

Launch Faster with B2CORE

B2CORE’s Trader’s Room gives you everything you need to launch quickly: seamless onboarding, powerful wallet and payment integrations, flexible account management, and a trader experience that feels polished from day one.

Whether you're scaling across jurisdictions or serving multiple client segments, B2CORE adapts to your business—not the other way around.

Ready to Launch or Scale Smarter?

B2CORE helps brokers accelerate go-to-market, cut operational drag, and deliver a modern trading experience.