Trading Platform Maintenance: In-house vs Outsourcing

Launching a brokerage firm is a lucrative business idea. Online trading is becoming widespread, and more users are accessing this space to earn active or passive income.

However, trading platform maintenance can be burdensome, requiring adequate technical knowledge to address system shortcomings and follow ever-changing market preferences and trends.

The server is the key component of your business, and you cannot overlook it or compromise cost-saving for performance. That’s why many brokers outsource maintenance, but is it better than in-house management?

Key Takeaways

- Trading servers are technical capabilities that ensure trades happen and connect you with traders and liquidity providers.

- Maintaining servers can be costly and time-consuming, requiring elite planning to manage them efficiently.

- In-house server management gives you flexibility and control over your platform but takes more time and resources.

- Outsource platform maintenance is more affordable and gives you access to dedicated technicians and support tools.

Understanding Trading Servers

Trading servers are dedicated computers or data centres that process financial transactions. They offer traders and brokers high performance and minimal latency, ensuring a smooth trading experience.

Servers connect brokerage firms with liquidity providers, financial institutions, and trading venues, using ultra-fast API connectivity and messaging protocols that update prices, newsfeeds, and order status.

This intricate system works in the background, allowing traders to view markets, select securities, place orders and manage their funds from the trading platform.

The larger the platform, the more robust it must be. FX trading servers handle large volumes of market data, execute trades in real-time, and provide a seamless order management system.

Why is Trading Platform Maintenance Necessary?

With changes in market trends, customer preferences, and regulatory frameworks, maintenance becomes vital. It includes hardware optimisation, software updates, and cybersecurity measures to enhance trading performance and adhere to financial laws.

Trading software maintenance is essential to ensure system stability, security, and efficiency, especially in financial markets that operate 24/7. This requires regular monitoring to prevent unexpected downtime, system crashes, security breaches, and trading disruptions.

Without proper system management, trading platforms may experience slow execution speeds, high latency, or security vulnerabilities. As brokers process transactions involving a time-sensitive, tremendous amount of money, any delay can lead to massive financial loss.

Routine updates optimise system performance, fix bugs, and improve user experience. Investors are more likely to trust your platform if you proactively maintain the server and ensure a seamless trading experience for all users.

Technical Aspects

Several technical aspects are running simultaneously as traders buy and sell assets, interact with financial markets, and manage their funds.

Payment services, interactions with digital wallets, sourcing liquidity, updating price charts, reflecting market conditions, and a bunch of other activities happen in the background.

Keeping these instances running smoothly requires advanced knowledge and expertise in system development operations (DevOps), data analysis, risk planning, tracking and monitoring, software development, and security protocols.

Here’s a quick glance at the technical details behind trading servers.

- Software Updates: Patches to fix bugs and enhance functionality.

- Server Management: Fast processing and trade execution.

- Security: anti-DDoS protection, encryption, and firewalls.

- Data Handling: Secure market data and trade execution logs.

- Recovery: Backup solutions to prevent data loss.

- Scalability: Handling changing trade volumes.

- API: Seamless connection with liquidity sources and third-party service providers.

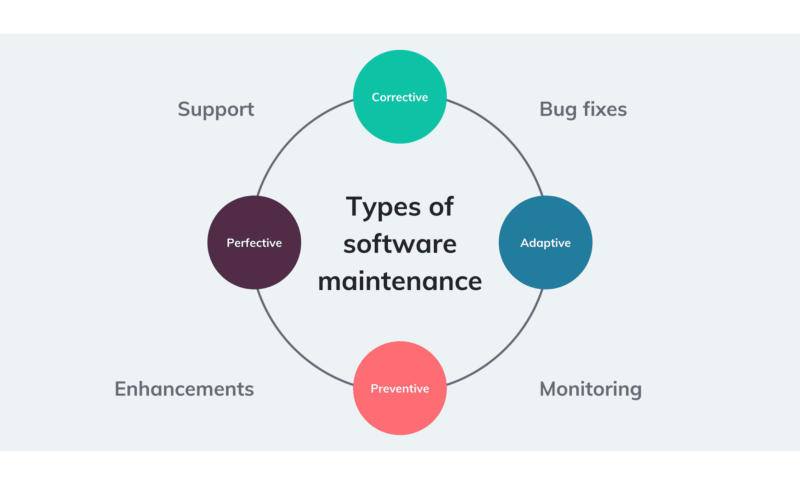

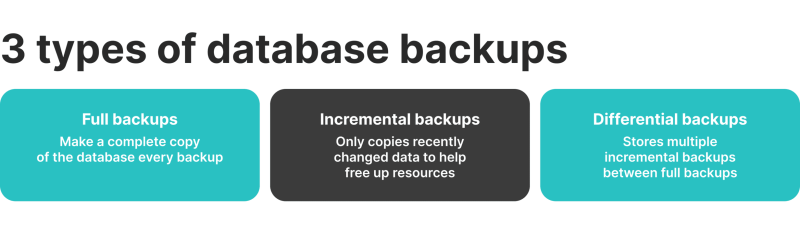

Types of Trading Software Maintenance

Brokers undertake different types of system maintenance. Not every platform service is intended to fix current errors. Some are done to prevent malfunctions, while others are implemented to improve the service.

Corrective

The most common type of server maintenance. It addresses arising system issues, such as software bugs, system crashes, and trading errors. These fixes ensure that the trading platform remains stable and functional.

These malfunctions require immediate attention because they affect service provision, and prolonged disruptions can lead traffic away from your website.

This could be price issues between real-time markets and the position summary when placing an order, requiring developers to identify and fix bugs causing this discrepancy.

Preventive

It is an onward-looking approach that entails measuring system key indicators, assessing their performance, and implementing necessary changes to ensure uninterrupted service.

Preventive server maintenance can include fixing minor issues that can escalate if left unattended, routine system checks, performance optimisations, and security updates to prevent failures before they occur.

Brokers can conduct internal and code audits to evaluate current performance and identify weaknesses before breaches happen.

Perfective

This type of service addresses user expectations and changing preferences. As such, brokers may add a new feature or introduce a refined version of an existing function to align with current trends.

At the same time, it may include removing obsolete functions that are not required anymore and only keeping relevant ones that serve users.

This may include enhancing UX/UI, redesigning interfaces, improving speed, and adding new features based on user feedback.

Adaptive

This maintenance type aims at accommodating and adapting to new technologies, market introductions, and regulatory frameworks needed to operate legally and efficiently.

They may include shifting to cloud storage, operating system changes, hardware and software upgrades, and legally required procedures.

Adaptive measures are crucial to remain competitive and ensure compatibility with evolving market conditions, regulatory updates, and new trading technologies.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Platform Service Process

Trading platform management requires a systematic approach. While developers and teams implement changes differently, ensuring a clear step-by-step process is vital for data logs and quality assurance.

- Issue Identification: Monitoring tools detect system anomalies or technical inefficiencies and send alerts for further inspection.

- Diagnosis and Analysis: Engineers assess logs and user reports to determine the root cause of the issue and evaluate its impact.

- Planning and Design: Planning security patches and code fixes to update the software or optimise the system.

- Implementation and Updating: Conducting bug fixes or code updates necessary to resolve the current issue.

- Testing: Stress-testing to verify system reliability before deploying the planned update.

- Deployment and Monitoring: Releasing updates and monitoring system performance in case of malfunctions.

- User Feedback: Gathering input from traders to improve future strategies and ensure system updates align with user needs.

Costs of Trading Server Maintenance

Maintaining a trading platform involves several costs, which vary based on infrastructure, security, and compliance needs. High-performance servers require significant investment, which can be outsourced or done through internal teams. Let’s review the expected server-related costs.

Infrastructure Costs: Maintaining ultra-fast processing servers and cloud hosting is essential for seamless trading operations. Their costs vary depending on whether a business uses dedicated servers, cloud-based solutions, or data centre hosting.

Estimated Cost: $1,000 – $15,000/month.

Security Expenses: Robust security measures, including firewalls, air-tight encryption, and penetration testing, protect against cyber threats and data breaches. You also need to conduct regular security audits to ensure compliance and mitigate possible risks.

Estimated Cost: $5,000 – $20,000/year.

Maintenance & Licensing: Trading platforms require continuous updates, bug fixes, and third-party services to maintain optimal functionality. There are also licensing costs to integrate trading servers into your systems.

Estimated Cost: $5,000 – $100,000/year.

IT Staff & Support: A dedicated in-house team or outsourced service provider is necessary for 24/7 technical support, timely troubleshooting, and regular platform monitoring. Salaries and outsourcing fees can vary based on the experience and level of support required.

Estimated Cost: $50,000 – $200,000/year.

Regulatory & Compliance Costs: Ensuring adherence to financial regulations requires periodic audits, legal consultations, and quality certification renewals, preventing legal risks and penalties. These fees vary according to jurisdictions and business size or type.

Estimated Cost: $5,000 – $50,000/year.

Performance Optimisation & Monitoring: You need to integrate tracking tools to optimise network performance, reduce latency, and improve trade execution speeds. Investing in high-performance tuning tools allows you to compete effectively in the market.

Estimated Cost: $3,000 – $20,000/month.

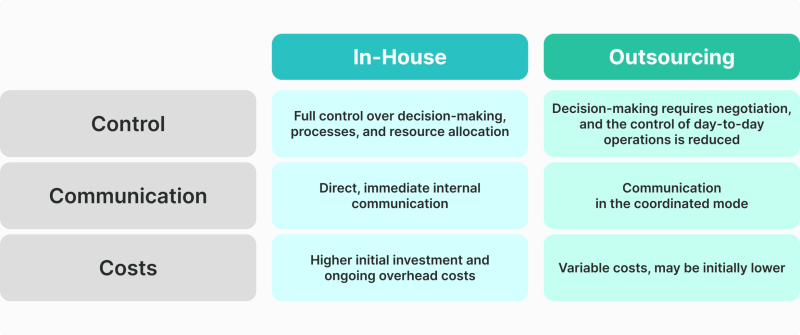

In-House vs Outsourcing Trading Platform Management

A crucial decision that you must make when planning your trading server management is whether to use an in-house team or outsource maintenance to a third party. The answer depends on a variety of factors and reasons.

Outsourcing server service is fast and reliable in managing your software infrastructure, while internal housekeeping gives you ultimate control over all technical aspects. Let’s compare and contrast.

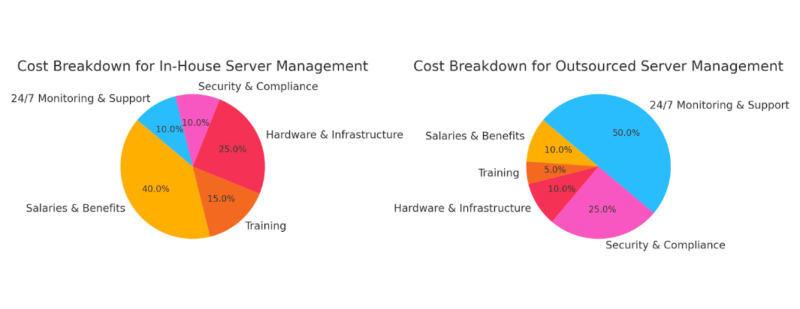

Costs

Internal maintenance involves high operational costs, including salaries, infrastructure upgrades, hardware and software, and security measures.

Outsourcing minimises overhead costs by delegating IT tasks to an expert team, reducing salaries, technical hardware costs, and other fixtures. However, you need to carefully consider the service fees.

Security

You need highly qualified in-house team members to ensure air-tight security measures and safeguard your system, which can be challenging.

Relying on third-party maintenance gives you access to professionals who can regulatory monitor systems, provide updates, and ensure superior security all the time.

Compliance

Complying with regulations using in-house teams entails having reliable legal and technical teams who can keep up with the most recent regulatory changes and implement those requirements.

However, external service providers are usually more aware of financial jurisdictions and can provide comprehensive guidance to comply with SEC, FCA, MiFID II and other financial frameworks.

Scalability

Internal teams are more flexible when upscaling or downscaling your operational bandwidth, but implementation can take longer. On the other hand, outsourced maintenance teams are better suited to respond faster to your changing business needs without compromising performance.

Maintenance

In-house maintenance requires technically skilled personnel and advanced systems to monitor activities, fix bugs, handle updates, and apply security patches, which can be resource-consuming and costly.

Trading software outsource teams reduce your maintenance costs and ensure your systems are within the safe hands of highly experienced engineers and developers.

Technical Requirements

Server management using internal teams requires advanced technical knowledge and continuous training, besides significant investment in hardware and software, creating cost and time constraints.

Outsourcing grants access to a pool of experts with up-to-date skills who already have advanced systems to address your technical requirements.

Performance

With internal teams, you have more control over platform insights, performance, and analytics, but you need resources that deliver on these expectations.

Therefore, third-party maintenance brings expertise and specialised staff who can address your needs and enhance your platform more efficiently.

Time Horizon

In-house development and service are well-suited for long-term projects because hiring and training to develop trading platforms with internal teams can take several months.

External expert management can deploy your platform much faster because they use and customise pre-built layouts that can be modified to your requirements and release updates quickly.

Verdict: Which One Shall You Choose?

Deciding between in-house and outsourced trading platform maintenance depends on budget, expertise, and objectives.

In-house teams offer full control but come with high costs and resource demands. Moreover, they suit projects that do not need immediate launch.

Outsourcing provides expert support, cost savings, and continuous monitoring without requiring internal infrastructure. If you want a cost-saving solution to enhance your platform operations, external teams can manage your security, compliance, and scalability requirements more effectively.

Software Development: In-House vs Outsourcing vs White Label | Crypto Expo Dubai 2022

B2BROKER CPO Ivan Navodnyy discusses software development and the pros and cons of different models.

Software Maintenance Checklist

A structured software maintenance checklist ensures trading platforms operate efficiently and securely and adhere to regulations.

You need to ensure real-time monitoring, cybersecurity measures, data backup, performance optimisation, ongoing system updates, and frequent audits. Here is what an average checklist looks like.

Real-time Tracking

Real-time monitoring tracks server performance, trade execution speed, and potential system failures. Automated alerts notify administrators of latency issues, failed transactions, or suspicious activities.

This proactive approach minimises outages, reduces downtime, enhances trading accuracy, and ensures uninterrupted operations, allowing for swift issue resolution before they impact market participants.

Cybersecurity Measures

Robust security systems protect from hacking, fraud, and breaches. These measures include firewalls, 2FA authentication, SSL encryption, and Anti-Distributed Denial of Service (anti-DDoS) protection.

You also need to ensure compliance with security standards and safeguard sensitive user information to boost client trust in the trading platform.

Data Backup

Periodic data backups prevent information loss due to hardware failures, cyberattacks, or unexpected service disruptions.

Whether you use cloud-based or offline backup solutions, you must monitor trade logs, user data, and financial records. You can do so by implementing automated and encrypted storage to reduce recovery time and ensure business continuity in case of a system failure.

A hot backup is a real-time, continuously updated storage system that can take over instantly if the main server fails, ensuring zero downtime. On the other hand, cold backup is offline stored separately and requires manual activation, making it more secure against cyber threats.

Performance Optimisation

Optimising platform performance involves reducing latency, improving execution speed, and ensuring system efficiency under heavy market demand.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Conduct regular hardware upgrades, network testing, and software refinements to keep trading platforms responsive. Continuous tuning enhances user experience, minimises order slippage, and supports high-frequency trading strategies.

Ongoing System Updates

Regular updates enhance security, functionality, and regulatory compliance. It also ensures that your platform aligns with the most recent market trends and preferences.

Updates include bug fixes, feature enhancements, and performance improvements to keep trading platforms competitive. Lack of updates can expose vulnerabilities, leading to security risks and operational inefficiencies.

System Audits

Frequent audits evaluate security protocols, compliance adherence, and system efficiency against industry standards. These assessments compare system parameters to chosen benchmarks to detect potential weaknesses.

Audits also improve operational reliability by identifying optimisation opportunities and ensuring the platform meets financial regulations to operate legally.

B2BROKER: Full-Managed Trading Platform Maintenance

B2BROKER offers a dedicated trading server solution that excels in numerous execution platforms and technologies and caters to different brokerage needs.

With advanced monitoring tools, real-time tracking, elite security measures, and low-latency order processing capabilities, B2BROKER enables you to optimise your platform effectively and efficiently.

Whether you are launching a new brokerage and looking for cost-saving trading infrastructure or already have an existing server that needs constant updating, B2BROKER is your best bet!

MetaTrader Maintenance

MetaTrader 4 and 5 are the oldest and most commonly used trading software. They power operators in Forex, commodities, stocks, equities, and CFD trading venues. However, due to their complicated structure and build, MetaTrader servers can be challenging to manage.

Therefore, B2BROKER offers a fully managed trading software service, from proper installation to ongoing maintenance, frequent updates, and 24/7 monitoring to ensure your platform operates at full capacity.

cTrader Maintenance

cTrader is rising in popularity and is on track to become the most used trading platform by brokers and traders alike. It offers user-friendly interfaces, intuitive designs, interactive charts, and helpful tools.

Getting an internal team to install and maintain a server takes time and money. However, B2BROKER makes it easier and faster to integrate a cTrader server to launch your brokerage platform and compete more effectively.

With cTrader experts and developers, you can customise your trading conditions, optimise mobile trading performance, provide top-tier liquidity, and enhance the onboarding experience.

That’s not all! While cTrader and MetaTrader are the leading trading platforms, B2BROKER supports more execution and aggregation technologies and engines to further optimise your platform.

You can use end-to-end maintenance and service across PrimeXM XCore, OneZero, Centroid, B2CONNECT, and B2TRADER, giving you more tools to improve your liquidity connectivity and order management.

Final Remarks

Trading platform maintenance is essential for your brokerage’s security, performance, and compliance. You must regularly monitor and update your software, features, services, and layouts to align with user preferences and changing market needs.

However, you must decide between in-house and outsourced server management based on costs, scalability, and regulatory requirements.

Third-party software service providers are cost-efficient, reliable, and more convenient in ensuring a high-performance trading platform.

FAQ

Is outsourcing trading servers a good idea?

Outsourcing trading software services can be a smart decision for brokers looking to reduce operational costs, enhance security, and access expert maintenance. It ensures high uptime, scalability, and compliance with financial regulations without hefty in-house expenses.

What are the pros and cons of outsourcing maintenance?

The main advantages are cost efficiency, 24/7 expert support, enhanced security, and reduced downtime. In contrast, it gives less control over infrastructure, with some risks related to dependency on third-party providers.

Why do brokers outsource their software maintenance?

Brokers outsource software maintenance to reduce costs, access professional support, ensure continuous system updates, enhance cybersecurity, and maintain compliance with financial regulations.

It allows brokers to focus on core business activities while delegating technical support, monitoring, and system updates to professionals.

How is trading server maintenance done?

It involves diagnosing and resolving system issues, preventing downtime, conducting software updates, deploying security patches, and performing optimisation tests to ensure high performance all the time.