Understanding Exchange-Traded Derivatives

Articles

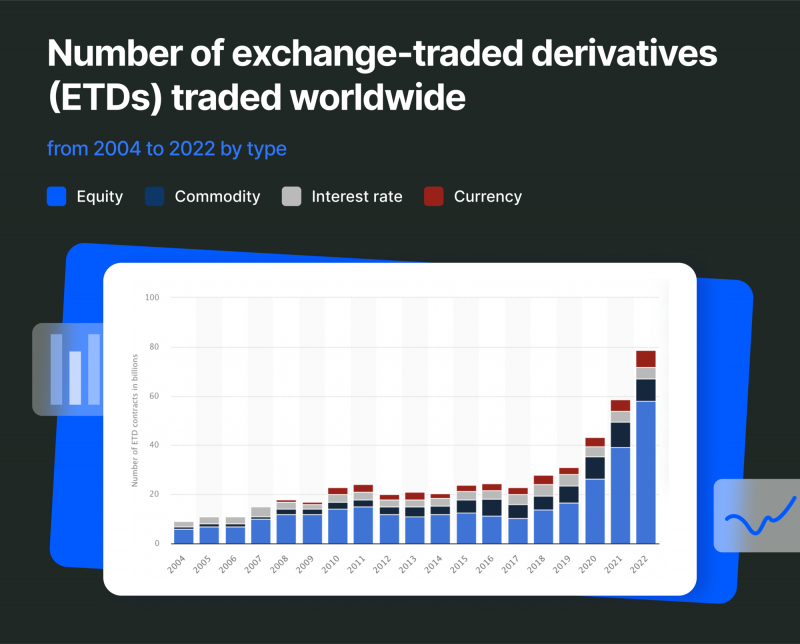

Trading derivatives has become very popular, and no wonder why: it offers flexible investment options, significant returns and many opportunities for trading in highly liquid markets. However, as with any financial instrument, profound knowledge of the market is crucial for successful trading. In this article, we will discuss derivative trading, learn the types of derivatives, and discuss where to trade ETDs (Exchange-Traded Derivatives).

Key Takeaways

- Derivatives are agreements, the value of which is based on the fluctuations in prices of their base assets.

- Derivatives can be of two types: ETDs and OTCs.

- ETDs come in many subtypes, such as ETD stock, index-related ETD, etc.

- ETDs and OTC derivatives differ regarding market accessibility, transparency, regulations, etc.

What Is An Exchange-Traded Derivative?

Derivatives are financial agreements that gain or lose their value based on changes in the prices of their base assets (currency, stocks, bonds, etc.).

Exchange-traded derivatives (ETDs) and Over-the-counter (OTC) derivatives are two types of derivatives.

ETDs are agreements, such as options and futures contracts, with predefined contract terms, including contract size, expiry date, and settlement methods.

As the name implies, ETDs are traded on a regulated exchange and are subjected to market and authority regulations.

Benefits of Trading ETDs

Exchange-traded derivatives contracts are very advantageous investments. Here are some key benefits of ETDs:

Standardisation – Each ETD’s contract has a specified expiration date, defined settlement process and lot size. The stock exchange establishes all these and other rules and regulations, resulting in consistency that eliminates any difficulties for market participants and the exchange regarding contract customisation.

High liquidity – The ETD market is highly liquid, meaning that ETDs have considerable market depth. This enables the traders to quickly match counterparties to fulfil their orders at good prices without significant loss.

Regulations – The ETD market is controlled by market regulators responsible for publishing daily information about trades in the market. For instance, the Securities and Exchange Board audits the market in India. This regulation makes it difficult for the big players to be involved in illegal or unfair trade practices.

Reduced risks – ETDs involve parties dealing through an intermediary, eliminating counterparty risk and reducing default chances due to contractual obligations with a credible exchange.

Types Of ETDs

Exchange-traded derivatives are traded worldwide in different stock exchanges and come in many types. Let’s look at each type more closely.

Stock ETDs

These derivatives come in various forms, including stock options and forwards. Swaps are typically not traded on an exchange but can be part of over-the-counter transactions. Stock forwards and options allow for highly leveraged bets on a stock’s price movement, predicting its future value. Worldwide stock derivatives are considered leading indicators for predicting stock movements.

Index ETDs

Index-related derivatives allow investors to buy or sell the entire portfolio of stocks instead of buying or selling futures and options in a specific stock. You can purchase or sell both index forwards and index options, but unlike stock options, index derivatives cannot be settled in kind since their physical delivery is impossible. Commonly traded index-related derivatives include the S&P 500, Nikkei, Nasdaq, and Nifty 50.

Currency ETDs

Derivatives contracts for currencies are widely listed on exchanges for trading, allowing investors to trade long or short on these currency pairs. The over-the-counter market offers many contracts, while the exchange-traded derivatives market focuses on a few popular currency pairs. Standardised agreements are provided for these highly traded pairs, ensuring their liquidity.

Commodities ETDs

Commodities are widely used for derivative trading in most countries, with the first derivative exchange being the Chicago Board of Trade. Multiple exchanges offer trading opportunities in thousands of commodities, making it difficult to trade. Commodities markets were initially used to hedge risks but have recently become highly speculative. Exchange-traded derivatives, which involve commodities as the underlying asset, are traded on price fluctuations.

Real Estate ETDs

Real estate derivatives were a significant factor in the 2008 economic meltdown. They were listed on major US exchanges and were widely traded. Recently, Eurex listed a new derivative type — Property Index Futures. Despite their association with the economic meltdown, many investors still consider them a good investment, as they offer a decent trading volume and diversify portfolio risks.

ETDs vs OTCs

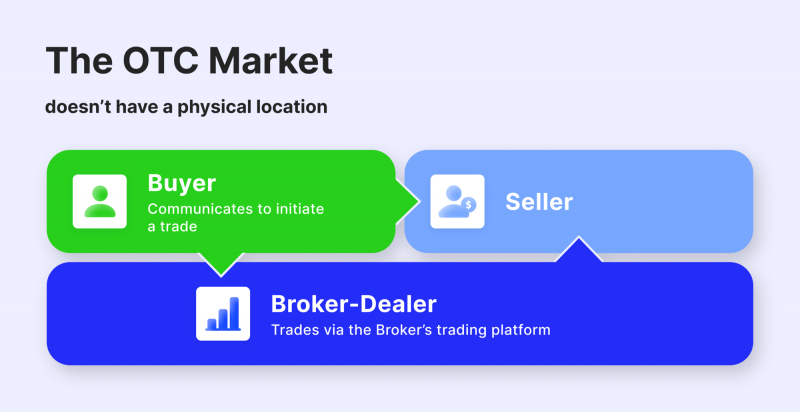

Essentially, there are two varieties of derivatives: Exchange-traded Traded Derivatives (ETDs) and Over-the-counter (OTC) derivatives. The first one is subject to standardised terms and conditions and, therefore, is traded in the stock exchanges, and the second variety is traded directly between private counterparties with no formal intermediary.

OTCs are contracts that are privately agreed upon between two parties. They offer greater flexibility in terms of contract customisation, allowing counterparties to tailor the terms to their specific needs.

Let’s discuss some of the key differences between ETDs and OTCs.

Accessibility

ETD contracts are available for both retail investors and big investment organisations. They can be bought and sold on a regulated brokerage, so many traders and investors can easily get them.

OTCs are mainly available to big players in the market, like large corporations and major financial organisations. The OTC market is usually more complicated and needs a lot of expertise and money from investors, which makes it harder for regular traders to get involved.

Standardisation and Customisation

Standardisation is an essential feature of ETDs that helps increase their liquidity and enhances the determination of their value. The contract rules are already set and transparent, making it easier for everyone to trade. On the other hand, OTCs allow for more personalisation. Trading parties can discuss specific terms, creating contracts designed to manage individual risks. However, the absence of a standardised way of trading with OTCs can make it harder to buy and sell them, increase the risks, and possibly make it more expensive to make transactions.

Counterparty Risk

The third-party involvement in ETD trading eliminates the default risks for investors. The exchange acts as an intermediary: the stock exchange contractually binds purchasers and sellers and thus ensures a smooth trade for both parties. In addition, all the traders, exchanges, and brokerages have to follow the same rules and get checked regularly by auditors. This makes sure that your investment is safe and dependable.

Contrarily, OTC derivatives depend on obligations between two parties, which poses a risk of the other party not fulfilling their part of the agreement. Financial market participants must carefully evaluate the credibility and trustworthiness of their OTC counterparties.

Liquidity and Transparency

The information about ETD prices and volumes is public, which means a high level of transparency that facilitates market efficiency.

Nonetheless, the market for OTC derivatives is decentralised and less transparent than the ETDs’. This makes it hard to get comprehensive price information and might result in lower liquidity.

Regulatory Control

ETDs are regulated by administrative bodies to promote fair markets, protect investors, and maintain market integrity. At the same time, OTCs face varying levels of oversight, potentially leading to inconsistencies and risks due to a lack of consistent regulation.

Conclusion

ETDs are traded on most exchanges, such as the Bombay Stock Exchange, CME, or the Intercontinental Exchange (ICE), and can bring you good returns if you implement good trading strategies. ETDs might be less risky than OTCs due to standardisation, reduced counterparty risks and better market accessibility. However, for successful trading, you must have a profound knowledge of the trends in the financial markets and define your investment objectives.

FAQ

What are Exchange-Traded Derivative Contracts?

Exchange-Traded Derivative Contracts (ETDs) are standardized financial agreements traded on regulated exchanges. These include options and futures, whose value depends on the price fluctuations of underlying assets like stocks, indices, currencies, or commodities.

What are the benefits of trading ETD derivatives?

ETD derivatives offer high liquidity, reduced risks, transparency, and standardized contract terms.

How do Exchange-Traded Derivative Contracts differ from OTC derivatives?

ETDs are standardized and traded on regulated exchanges, offering more liquidity, transparency, and lower risk. OTC derivatives are privately negotiated, allowing customization but with higher counterparty risks and less market transparency.