What Are Forex Majors And Minors, and How to Find The Best Trading Pair?

FX trading requires analysing and tracking multiple currency pairs. Some currencies are highly liquid and strong, driven by significant trading volumes, while others lack sufficient demand, leading to lower value when paired with stronger currencies. Currency pairs are categorised into specific groups based on various factors, such as demand, volatility, liquidity, and their overall significance in the market.

This article will explain what Forex major and minor exchange pairs are, their characteristics, and what steps you need to take to find the perfect pairs to trade.

Key Takeaways

- FX majors are the most popular currency pairs on the market, with the largest trading volume and many fluctuations at a given moment.

- FX minors are less dynamic trading pairs with low liquidity and attractiveness among market participants.

- The choice of the optimal trading pair depends primarily on the specific market sentiment prevailing at the time of trading, particularly on trading volumes.

What Do Forex Majors And Minors Stand For?

In the FX market, currency pairs are categorised into three major classes: majors, minors and exotic. This classification is primarily determined by the trading volume of each pair and the significant economic contribution of the currencies involved.

Major pairs are two currencies, each of which significantly influences a particular country’s global economy and monetary policy. Such currencies have high liquidity and play a decisive role when choosing a trading strategy on the FX market.

Minor pairs include currencies with the least demand and have low trading volumes. Such instruments have little influence on global FX transactions, settlements, or private investment and trading initiatives.

Exotics pairs are a combination of one currency of a country with a developed economy and one currency of a country whose economy is developing and can potentially strengthen the national monetary unit.

Key Characteristics of Forex Major Pairs

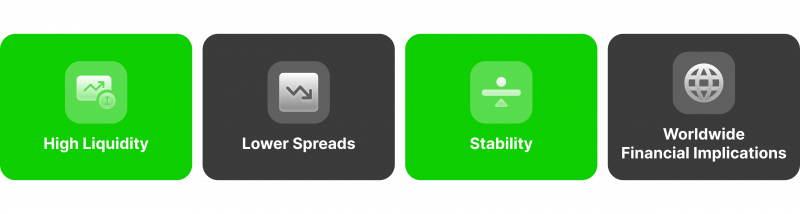

FX major pairs, representing the currencies with the greatest liquidity, have several characteristics that determine their nature and specifics of operation:

High Liquidity

The largest currency pairs are the most heavily traded in the FX market, making them the most liquid FX pairs. This high level of liquidity means that traders can buy and sell these currency pairs quickly and easily without significantly impacting their prices.

Lower Spreads

Major currency pairs are known for their high liquidity, meaning they are highly traded and, as a result, typically have lower spreads. Spreads refer to the difference between a currency pair’s buying and selling price. Lower spreads are advantageous for traders as they help to reduce trading costs, making major pairs a popular choice for many FX traders.

Stability

The currencies in question are typically backed by solid and stable economies, which results in lower levels of volatility when compared to lesser-known or less stable currency pairs.

Worldwide Financial Implications

The currency pairs involved in foreign exchange trading represent the world’s largest economies, such as the US dollar (USD), Euro (EUR), Japanese yen (JPY), British pound (GBP), Australian dollar (AUD), Canadian dollar (CAD), and Swiss franc (CHF).

These currency pairs are closely tied to global economic events and news, and their exchange rates are influenced by factors such as interest rates, inflation, geopolitical events, and financial data releases.

Examples of Forex Major Pairs

There is a rather large list of currencies that belong to the category of FX majors. Among them are the following:

EUR/USD

The most widely traded currency pair in the world is the EUR/USD, representing the economic relationship between the Eurozone, which consists of the countries that use the euro as their official currency, and the United States.

This currency pair is highly liquid and serves as a key barometer for the global economy due to the significance of the Eurozone and the United States in international trade and finance.

GBP/USD

The term “Cable” is a colloquial reference to the exchange rate between the British pound (GBP) and the US dollar (USD). It reflects the economic relationship between the United Kingdom and the United States, particularly regarding trade, investment, and overall economic health.

USD/JPY

The USD/JPY currency pair equates to the exchange rate of the US dollar against the Japanese yen. The economic policies of both the United States and Japan heavily influence this pair. Fluctuations in interest rates, inflation, trade balances, and other economic indicators in both countries can significantly impact the value of the USD/JPY pair.

USD/CHF

The currency pair containing the Swiss Franc (CHF) and the US Dollar (USD) is commonly referred to as the “Swissie.” This pair is often considered a safe-haven currency, particularly during market fluctuations and uncertainty. The Swiss Franc is known for its stability and is sought after by investors seeking a safe investment during turbulent market situations.

AUD/USD

The AUD/USD currency pair represents the value of the Australian dollar to the US dollar. This exchange rate is caused by multiple variables, with commodity prices playing a significant role. Notably, fluctuations in the prices of metals and agricultural products can impact the value of the Australian dollar against the US dollar.

USD/CAD

The USD/CAD currency pair represents the value of the US dollar to the Canadian dollar. This exchange rate is heavily influenced by oil prices, given that Canada is a major oil exporter. Fluctuations in oil prices can significantly impact the value of the Canadian dollar and, consequently, the USD/CAD exchange rate.

NZD/USD

The NZD/USD currency pair indicates the exchange rate of the New Zealand dollar against the US dollar. This currency pair is modulated by several influences, with a significant influence stemming from New Zealand’s agricultural exports.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The New Zealand economy is heavily reliant on agricultural products such as dairy, meat, and wool, and fluctuations in the prices of these exports can impact the value of the New Zealand dollar to the US dollar. Factors such as global commodity prices, interest rate differentials, and market sentiment also play a role in shaping the movement of this currency pair.

Key Characteristics of Forex Minor Pairs

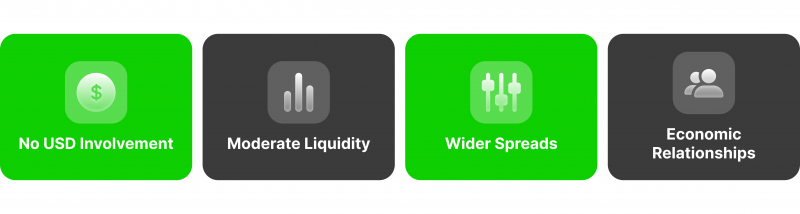

Like major pairs, minor pairs also have distinctive characteristics and properties, as described below.

No USD Involvement

Minor currency pairs are those that do not pertain to the US dollar (USD) and are, therefore, distinct from the major currency pairs, which all involve the USD.

Moderate Liquidity

Even though minor currency pairs may not have the same level of liquidity as major pairs, they still provide sufficient liquidity to support trading activities with a reasonable level of ease.

Wider Spreads

Minor currency pairs typically have wider spreads than major pairs because they have lower trading volumes. This means that the cost of trading minor currency pairs can be higher due to the wider difference between the buying (ask) and selling (bid) prices. As a result, traders may need to consider the impact of wider spreads when trading minor currency pairs.

Economic Relationships

The foreign exchange market offers trading opportunities through minor currency pairs, representing economic connections between countries. These pairs often respond to geopolitical or macroeconomic developments within the regions of the involved currencies, presenting potential opportunities for traders to capitalise on market movements.

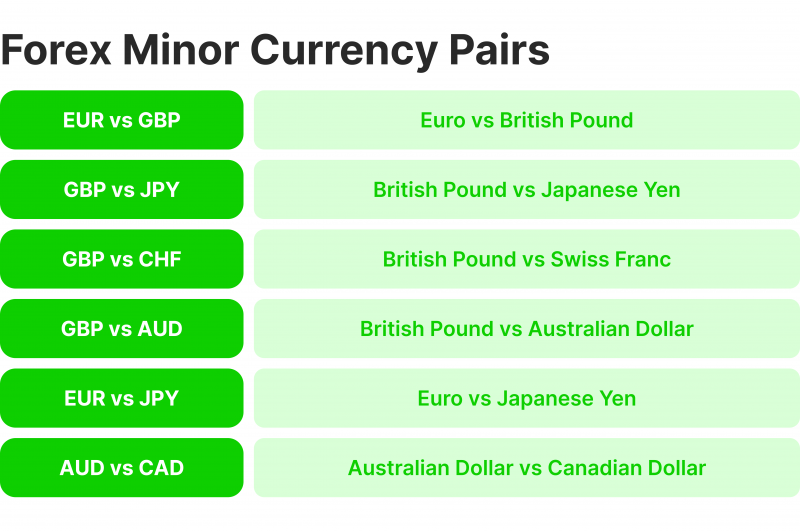

Examples of Forex Minor Pairs

The list of minor pairs is also quite broad and includes the following currency pairs traded on the FX market:

EUR/GBP

Their currency exchange rates reflect the economic relationship between the Eurozone and the United Kingdom. The value of the Euro and the British Pound frequently fluctuates based on events that impact either Europe or the UK, such as the ongoing Brexit negotiations.

Businesses, investors, and policymakers closely watch this exchange rate, as it significantly affects trade, investment, and overall economic stability.

EUR/JPY

The correlation between the Eurozone and Japan is intricately tied to various economic factors, including trade, investment, and monetary policies. Financial indicators and data from both regions influence market dynamics and investment decisions.

This relationship is affected by factors such as exchange rates, trade balances, and overall economic performance, which can significantly impact global financial markets.

GBP/JPY

The currency pair is well-known for its high level of volatility because it involves two currencies sensitive to economic news and market scenarios. This currency pair is often influenced by the overall risk sentiment in the market, which can impact its movement and trading behaviours.

EUR/AUD

The Eurozone’s currency value in the FX market is affected by various factors, including European economic policies and Australian commodity prices.

The Eurozone’s economic performance is a key determinant of the value of its currency relative to the Australian economy. Similarly, fluctuations in Australian commodity prices can significantly impact the exchange rate between the Eurozone and Australia.

CHF/JPY

The currency pair combines the Swiss franc (CHF) and the Japanese yen (JPY), considered safe-haven currencies and often sought after during market uncertainty.

Global risk expectations and the monetary policies of both Switzerland and Japan strongly determine the exchange rate of this currency pair. Market participants closely monitor economic and geopolitical developments to gauge the resilience of these currencies relative to each other.

AUD/JPY

The economic and diplomatic ties between Australia and Japan severely affect their relationship. Various factors, such as the trade of commodities, market sentiment, and the overall risk environment, often influence this connection.

Furthermore, changes in commodity prices can also play a crucial role in shaping the dynamics between the two countries.

GBP/CAD

The exchange rate of GBP/CAD represents the value of the British pound sterling relative to the Canadian dollar. This currency pair is susceptible to fluctuations in oil prices, given Canada’s significant oil reserves and the UK’s status as an oil importer.

Additionally, economic data released from both the UK and Canada, such as GDP figures, employment reports, and inflation data, can significantly impact the exchange rate of GBP/CAD.

Key Characteristics of Forex Exotic Pairs

Here are the main characteristics and properties of exotic pairs:

Relies on a Major Currency

Exotic pairs commonly come with one major currency, such as the U.S. Dollar (USD), Euro (EUR), or British Pound (GBP), paired with a less widely traded currency.

Low Liquidity

Due to less frequent trading, exotic pairs have lower liquidity, eventually leading to slippage and more volatile price movements.

Wider Spreads

The lower liquidity and higher perceived risk of exotic pairs result in wider spreads, making the cost of trading these pairs higher.

Economic and Political Sensitivity

Currencies in exotic pairs are often sensitive to regional economic situations, political instability, and geopolitical circumstances, which can lead to sharp price fluctuations.

Examples of Forex Exotic Pairs

Here are some examples of exotic pairs FX:

USD/TRY)

Many factors, such as Turkish economic policies, inflation rates, and various political events, shape the evolving relationship between the United States and Turkey. These elements significantly influence the dynamics between the two countries and have far-reaching implications for their diplomatic and economic ties.

EUR/TRY

The exchange rate between the Euro and the Turkish Lira is dictated by various determinants, reckoning economic projections from the Eurozone and domestic monetary and fiscal circumstances in Turkey. This means that changes in the Eurozone’s financial performance and Turkey’s internal affairs can impact the value of the Turkish Lira in relation to the Euro.

USD/THB

The USD/THB currency pair represents the US Dollar exchange rate against the Thai Baht. This exchange rate is heavily influenced by various factors, including Thailand’s tourism industry, economic policies, trade relationships, and geopolitical affairs. The Thai Baht is impacted by the health of Thailand’s economy, interest rates set by the Bank of Thailand, and global market trends. Understanding these factors is crucial for anyone trading or conducting business involving the USD/THB currency pair.

USD/MXN

The relationship between the United States and Mexico is complex, multifaceted, and influenced by various factors. These include trade agreements, economic data from Mexico, and the diplomatic and political relations between the two countries.

Exotic currencies represent the currencies of both undeveloped countries and a specific few developed countries.

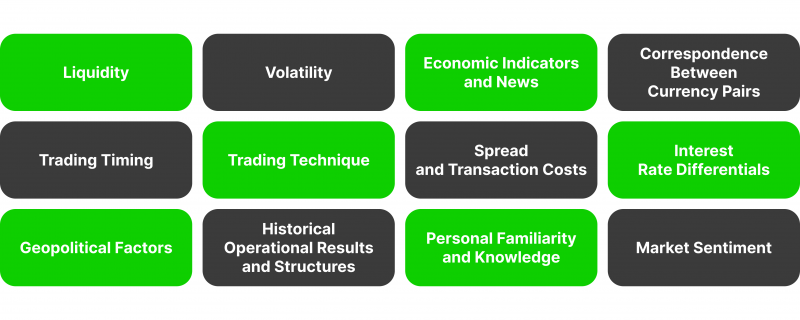

How to Find The Perfect Trading Pair?

Consider various factors when choosing a currency pair for trading. A trader’s decision is influenced by these factors. Understanding these factors can assist traders in making well-informed choices that align with their trading strategy, risk aversion, and market dynamics.

Such factors include the following:

Liquidity

Highly liquid currency pairs, such as major pairs (e.g., EUR/USD, GBP/USD), are generally preferred by traders because they offer tighter spreads and easier execution of large trades. Less liquid pairs, like exotics, can have wider spreads and more volatile price movements.

Volatility

Traders may choose currency pairs based on their volatility levels. High fluctuation pairs offer more attractive investment prospects and higher risk. Low volatility pairs are generally more stable but may provide fewer trading opportunities.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Economic Indicators and News

Traders often select pairs influenced by upcoming economic reports or news events. For example, a trader might select to trade USD/JPY during a U.S. Federal Reserve announcement.

Correspondence Between Currency Pairs

Understanding correlations helps traders avoid doubling their risk or placing contradictory trades. For instance, trading EUR/USD and GBP/USD simultaneously might expose the trader to similar risks, as these pairs regularly move in the same direction.

Trading Timing

Traders might select pairs based on the time of day they trade. For example, EUR/USD is highly active during the overlap between the London and New York sessions, making it ideal for day traders.

Trading Technique

The choice of currency pair should align with the trader’s strategy. For example, a scalper might prefer particularly liquid pairs like EUR/USD, while a swing trader might focus on pairs with more pronounced trends.

Spread and Transaction Costs

Traders often choose pairs with lower spreads to minimise transaction costs, especially if they are frequent traders. Major pairs commonly carry the lowest spreads, making them popular among retail traders.

Interest Rate Differentials

Interest rate differentials can lead to carry trades, where market players buy a currency with a heftier interest rate and sell one with a lower rate. Pairs with significant interest rate differences, like AUD/JPY, are popular for this strategy.

Geopolitical Factors

Traders might select or avoid certain pairs based on geopolitical risks. For instance, political uncertainty in a country might deter traders from its currency, while stability might attract them.

Historical Operational Results and Structures

Traders often analyse past data to determine trends, support and resistance levels, and patterns. Pairs with clear historical trends might be preferred for technical analysis.

Personal Familiarity and Knowledge

Traders might choose pairs they are more familiar with, where they can better anticipate market moves. For instance, a trader familiar with European markets might prefer EUR-related pairs.

Market Sentiment

Traders might select pairs based on current market sentiment, whether it’s bullish, bearish, or uncertain. Sentiment indicators and news headlines often guide these decisions.

Conclusion

Finding the perfect trading pair in the FX market consists of gaining insight into the structure of FX majors and minors. Major pairs, such as EUR/USD and GBP/USD, offer superior liquidity and narrower spreads, making them a popular choice for many traders due to their predictability and stability.

Minor pairs, like EUR/GBP and GBP/JPY, furnish means to extend diversification in excess of the US dollar, although they may occur with heightened volatility and deeper spreads.

Deciding on the right currency pair requires careful consideration of market liquidity, volatility, economic metrics, trading techniques and objectives. By analysing these aspects and utilising relevant tools and resources, it’s possible to identify pairs that are compatible with trading methods and risk sensitivity.

FAQ

What are FX major pairs?

FX major pairs are the most traded currency pairs in the foreign exchange market, which include the US dollar and other major currencies. Examples include EUR/USD, GBP/USD, and USD/JPY. These pairs are known for their high liquidity and tight spreads.

What are FX minor pairs?

FX minor or cross-currency pairs do not revolve around the US dollar but consist of other major currencies like the Euro, British Pound, and Japanese Yen. Examples are EUR/GBP, EUR/AUD, and GBP/JPY. They often have less liquidity than major pairs but can still offer profitable trading opportunities.

What are FX exotic pairs?

FX exotic pairs include one major currency and one currency from an emerging or smaller economy. Examples are USD/TRY (US Dollar/Turkish Lira) and EUR/SGD (Euro/Singapore Dollar). These pairs tend to have wider spreads and can be more volatile, which might present both risks and opportunities.

What factors must be taken into account when deciding upon a FX pair?

When picking a FX pair, consider factors such as liquidity, volatility, economic indicators, market factors, and trading costs. Major pairs almost always carry larger liquidity and lower spreads, while exotic pairs may have greater volatility and more extensive spreads.

How can I determine which FX pair is right for me?

To determine the best Forex pair for your trading strategy, assess your trading goals, risk tolerance, and market knowledge. Testing different pairs through demo accounts can help you understand their behaviour and suitability. It’s also essential to stay informed about economic news and events that impact currency pairs.

Are there any tools or resources that can help you select FX pairs?

Yes, various tools and resources are available, such as FX trading platforms with built-in analysis tools, economic calendars, and market news feeds. Furthermore, using technical indicators and following FX market analysis can assist in making deliberate decisions.