What are Metals in Trading and How it Works?

Today, electronic trading has become not just a way to increase personal capital, but has also opened up new opportunities and solutions in the investment activities of both private and institutional investors. Indices, commodities, cryptocurrencies and securities are just a short list of the most popular trading instruments, which also includes a special asset class that is only getting more expensive every year despite economic crises and turmoil. These are precious metals.

This article will explain trading in precious metals and how it works. In addition, you will learn about the list of the most popular precious metals in demand among investors. Finally, we will list the major commodity exchanges where you can buy gold, silver, and other traded precious metals.

Key Takeaways

- Trading precious metals is a process of buying or selling financial derivatives on these metals, as well as physical objects in the form of coins and bars.

- Gold, silver, palladium, and platinum are the main precious metals which serve today as an excellent investment and risk hedging instrument.

- The precious metals are traded on the commodity exchanges, the most famous being the London Metal Exchange.

What is Metals Trading?

The precious metals market is a sphere of economic relations that regulates transactions with precious metals and securities quoted in gold (gold certificates, bonds, futures, etc.). In turn, trading in precious metals is a process of making a profit by buying/selling physical gold, silver, or other valuable metal, which are presented in the form of futures contracts with a fixed expiration date or CFDs.

Basically, online trading of precious metals such as silver, gold, copper, palladium, and platinum is carried out to diversify risks and create a more balanced trading portfolio. Like other commodities, the value of precious and other non-ferrous metals is determined on exchanges, such as the London Metal Exchange, the Shanghai Futures Exchange, the Brazilian Commodity Futures Exchange, etc.

The international market of precious metals is a set of individual trading floors that specialize in the conclusion of purchase and sale transactions for precious metals, both based on spot and futures contracts. Unlike futures contracts for gold and silver, spot contracts are more convenient for long-term investors because they have no expiration date. This allows you to buy the precious metal on the exchange and keep it in your account for as long as you like. These contracts are not attached to the international benchmark. They reflect demand and supply in a country’s local precious metal market.

At the same time, prices correlate closely with world prices for precious metals because London is the center of price formation for precious metals, where spot prices for precious metals are formed through the London Bullion Market Association (LBMA). All the trading floors are oriented to the prices of this organization, and in case of sharp price difference, there is an arbitrage, which again brings the markets to balance.

Various trading strategies can be implemented with a combination of trading spot and precious metal futures contracts, such as hedging spot deliveries, etc. Besides, precious metals trading via spot contracts have no traditional characteristics of futures contracts, such as maturity, the necessity of guarantee, forward curve interest rate, and so on. There is also a difference in fees and charges between the exchange and the broker.

The price of precious metals is primarily determined by market conditions and factors that form the supply and demand balance. That is the volume of metal production on the one hand and demand among investors, manufacturers, jewelers, and other people who use this metal in their production. Discovery of new deposits, depletion of old deposits, implementation of new mining technology, or improvement of processing technology. All of these factors affect gold, silver, and other precious metals.

Also, it’s essential to remember fluctuations in the dollar because the world precious metal prices are mostly set in dollars. Some investment analysts even have a rule: if the dollar is getting cheaper, precious metals are getting more expensive. The general situation in the stock market also influences the price of precious metals. Separately, it’s possible to distinguish specific decisions made by different precious metals producers. For example, large producers can make a strategic decision and agree to suspend the production of metal to increase the market value of their production. A similar strategy is used by oil producers in the oil market.

Buying gold and other precious metals has always been considered a conservative investment. The prices of these assets grow steadily over the long term. However, the horizon is counted for years – from 10 years and more to get a good profit. That’s why investors use precious metals as a defensive asset in times of crisis. The main purpose of buying such assets is to reduce the portfolio’s overall volatility. However, unlike bonds and dividend stocks, one must understand that these instruments cannot generate cash flow. Their yields are purely speculative. As a result, if the value declines amid an economic crisis, the investor may face a long-term loss-making position.

Trade in precious metals has become especially popular because of gold, the value and unique qualities of which have made a great contribution to the development of this area.

How Does Metals Trading Work?

The precious metals market is a special precious metals trading center where continuous buying and selling occurs at market prices for commercial and industrial consumption, investment, risk insurance, speculation, and others. Markets for precious metals are strictly regulated. Precious metals are bought and sold in troy ounces. The precious metals market was always used mainly by conservative investors, but in recent years, interest in precious metals as an investment instrument has grown sharply.

Trading metals, unlike trading securities and commodities, can take place in many ways, depending on the preferences of market participants. Each of them has its own characteristics, advantages and disadvantages, but at the same time, all have a certain level of popularity. Let’s consider each of them in more detail.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

ETFs

An ETF (Exchange Traded Fund) is an investment fund with shares traded on a stock exchange. Its quotes replicate the portfolio dynamics, including stocks, commodity futures, currencies, bonds, and other assets. The ETF can even copy the structure of leading stock exchange indices, for example, the American S&P500.

Today there are ETFs for various precious metals, the purchase of which can be equated with a mechanism for hedging risks because it has long been known that, for example, gold has always been the most popular protective asset that helps to survive various economic crises. Among other metals, platinum, palladium, copper, etc. are available.

Precious Metals Futures and Options

Investing in most precious metals is available through the purchase of futures contracts and options offered by many modern stock and commodity exchanges. One of the essential advantages of this method of trading precious metals is that futures contracts allow multiplying profits due to the use of leverage, which, however, may become a severe disadvantage if the leverage is used carelessly without realizing the potential risks of losses.

Crypto Platforms

The rapidly growing cryptocurrency sector has given investors the opportunity to buy precious metals at special platforms, one good example of which is OneGold, allowing them to invest in precious metals using cryptocurrency assets, which greatly increases the efficiency of trading due to low commissions and a wide range of metals.

Physical Assets

Buying physical metal is one of the oldest and, at the same time, the easiest way of investing. The purchase of bullion is done by special financiers. The precious metal is suitable for storage at home, for example, in a safe deposit box or in any other place with good protection. One of the main advantages of this way of investing is keeping assets offline. The absence of online access to precious metals excludes the possibility of remote theft, which is why this method of precious metal investing is so popular today.

Main Types of Precious Metals Traded on the Exchange

The modern system of trade in precious metals is an association of a number of commodity exchanges, each of which offers access to the possession of a large list of metals whose value is the standard of profitability. The most popular options among precious metals for investment are the following.

Gold

Any experienced investor knows that investing in precious metals, namely gold, is the best way to save money because it always goes against the market. For example, if stocks and bonds are going down, the value of gold will go up because, in a crisis, investors actively buy it to save their savings.

Historically, gold is a safe investment instrument with a low yield. Even though speculation with gold is not possible, and considerable profits in the short term are just as impossible, it can protect finances from economic crises, inflation, currency devaluation, etc. Gold is kept in the reserves of all world banks and is a universal payment instrument: it can be sold for the local currency anywhere in the world. That is why in a crisis, investors try to save money by selling securities and buying gold.

One of the most profitable ways to invest in gold is to buy shares of gold mining companies. Their value is determined by the exchange price of the precious metal. Virtually all gold mining companies pay an annual dividend, which is an additional return on the value of the stock in a long-term investment.

Silver

The popularity of silver as an investment instrument requires little debate. Silver has the highest electrical conductivity among metals and is easy to work with. Because of these qualities, it is widely used in various industries.

Silver quotes are influenced not only by investment demand but also by industrial demand. It makes it possible to predict future price dynamics by analyzing fundamental factors in advance. Investors’ demand is influenced by the situation in the world economy, while industrial demand is influenced by the situation in the mining and manufacturing sectors.

One can invest in silver in a physical form – bullion bars and coins; in an impersonal form – opening an ICO, purchasing silver at the exchange; or in the form of securities of silver-mining enterprises – stocks, ETFs, mutual funds, etc. Each investor can choose the investment object according to the parameters he or she needs.

Platinum

Investing in platinum has long been considered not the most profitable investment option. Still, in the past few years, this asset is gaining popularity and becoming more relevant. Today, platinum is a great opportunity to invest money to save in the future. According to statistics and dynamics, which show the rate of platinum, money invested in its purchase will be saved and multiplied.

The main reasons for the high demand for platinum are its characteristics, which in certain aspects are unique in the production of various parts and in the jewelry industry, making platinum one of the rarest and most highly effective metals used for many years.

The structure of platinum demand is fairly diversified, with autocatalysts accounting for only about 40%, jewelry accounting for 30%, and the remaining 30% split between chemical, glass, electrical, fuel, and medical applications.

Palladium

Palladium is one of the metals of the platinum group, very close in physical and chemical properties to platinum and gold. Because of its rarity and good resistance to various corrosive influences, it belongs to the noble (precious) metals. However, it is rarely used as a jewelry material. Its main use is in industry. The main raw material for its production is copper-nickel ores, during the processing of which palladium is a by-product. Palladium is now available on all commodity exchanges through ETFs, futures contracts, bullion bars, coins, etc.

Best Commodity Exchanges to Trade Metals

The current state of the global economy allows easy access to metals markets and takes the first step towards investing in precious metals. The abundance of commodity exchanges that offer all the necessary tools for investment activity gives precious metal traders the freedom of choice, which can be made in favor of one of the following commodity exchanges.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

1. London Metal Exchange (LME)

The London Metal Exchange is the global center of industrial metal trading. Most of all, options and futures contracts for base metals are traded on this exchange, with real delivery options. LME trading floor unites industrial players and financial markets and enables them to exchange commodities and money at any time of the day or night.

The LME offers futures and options contracts for aluminum, copper, tin, nickel, zinc, lead, aluminum alloy, North American Special Aluminum Alloy (NASAAC), cobalt, molybdenum, steel billets, polypropylene, and linear low-density polyethylene. Producers or traders of copper, tin, or anything else listed on the LME can sell the metal to one of the London Metal Exchange’s many large warehouses worldwide and obtain a warrant.

2. Chicago Mercantile Exchange (CME)

The Chicago Mercantile Exchange, one of the largest commodity exchanges in the world, is a not-for-profit corporation whose mission is to provide space for futures and options trading, collect and disseminate market information, maintain a clearing mechanism, and enforce trade rules.

Today, the CME trades futures and options contracts for crops, energy, stock indices, currency pairs, interest rates, metals, weather, and real estate values in the most developed regions of the United States, as well as appropriate options and over-the-counter market assets.

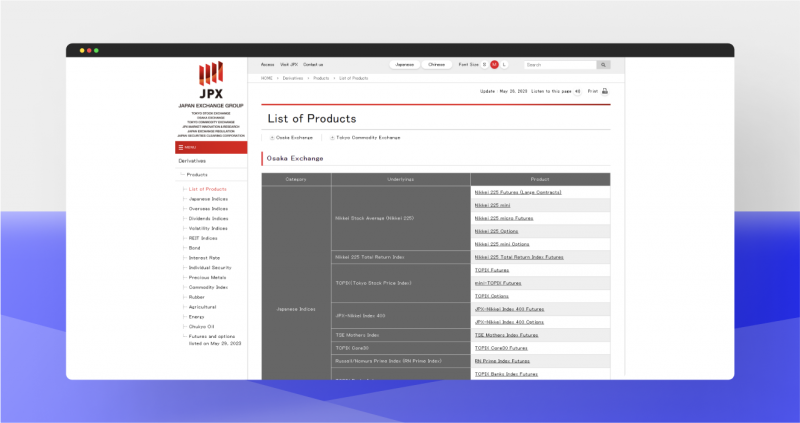

3. Tokyo Commodity Exchange (TOCOM)

This exchange represents the largest commodity market in Japan, since the Tokyo Commodity Exchange accounts for more than 88% of commodity derivatives trading in that country. TOCOM trades futures and options on such products as metals, oil and petroleum products, as well as rubber and indices. Options contracts are only available for gold. The Tokyo Commodity Exchange is considered a universal market.

4. New York Mercantile Exchange (NYMEX)

The New York Mercantile Exchange is the world’s most famous futures exchange, specializing in oil futures trading. The New York Stock Exchange was founded in 1882 to trade agricultural products. Over history, the exchange attracted more and more new commodity groups and today has taken the lead in trading energy and precious and non-ferrous metals, attracting many private and institutional investors.

Conclusion

Trading precious metals is not only a popular way to increase capital, but also a classic method of hedging risks in unforeseen situations. Gold, silver, platinum, and palladium are benchmarks of reliability and stability, investments that will always bring returns despite economic crises and market collapses.