What are NDFs? Overview Of Non-Deliverable Forward And Its Functionality

Articles

NDFs gained massive popularity during the 1990s among businesses seeking a hedging mechanism against low-liquidity currencies. For instance, a company importing goods from a country with currency restrictions could use NDFs to lock in a favourable exchange rate, mitigating potential foreign exchange risk. Over the years, the utility and flexibility of NDFs have only grown. The article will highlight the key characteristics of a Non-Deliverable Forward (NDF) and discuss its advantages as an investment vehicle.

Key Takeaways

- NDFs are contracts that hedge currency risks, settling rate differences in cash without physical currency exchange.

- NDFs result in cash settlements based on rate variances, while DFs involve actual currency exchanges.

- Incorporating NDFs can boost a brokerage’s market stance, attracting clients and enhancing profitability.

Basics of NDFs

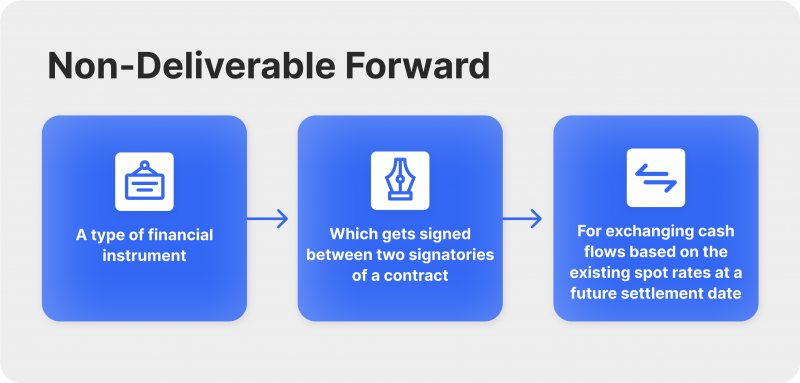

An NDF is a currency derivatives contract between two parties designed to exchange cash flows based on the difference between the NDF and prevailing spot rates.

NDFs allow counterparties to conclude currency exchanges in the short term. The settlement date, the agreed-upon date for the monetary settlement, is a crucial part of the NDF contract. The exchange’s financial outcome, whether profit or loss, is anchored to a notional amount. This fictitious sum is the agreed-upon NDF face value between the parties.

Several key components define an NDF:

- Fixing Date: This is the designated date when the current spot rate is juxtaposed with the NDF rate, leading to determining the notional amount.

- Settlement Date: On this day, the difference arising from the exchange rates is settled. One party transfers the amount to the other, who receives the rate difference in cash.

- NDF Rate: This is the rate settled upon at the transaction’s inception, representing the direct rate of the currencies involved.

- Spot Rate: This is the most recent rate for the NDF, typically sourced from the central bank.

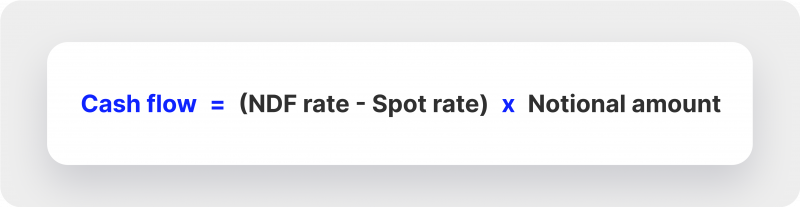

The formula determines the cash flow:

It’s crucial to note that NDFs culminate in a cash settlement. The notional amount, representing the face value, isn’t physically exchanged. Instead, the only monetary transaction involves the difference between the prevailing spot rate and the rate initially agreed upon in the NDF contract.

NDFs are mainly executed over-the-counter (OTC), with durations typically extending from one month to one year. Dollars are the most prevalent currency used to resolve these instruments.

An essential feature of NDFs is their implementation outside the native market of a currency that is not readily traded or illiquid. For example, if a particular currency cannot be transferred abroad due to restrictions, direct settlement in that currency with an external party becomes impossible. In such instances, the parties involved in the NDF will convert the gains or losses of the contract into a freely traded currency to facilitate the settlement process.

Deliverable Forward VS Non-Deliverable Forward

DF and NDF are both financial contracts that allow parties to hedge against currency fluctuations, but they differ fundamentally in their settlement processes.

In a Deliverable Forward, the underlying currencies are physically exchanged upon the contract’s maturity. This means both parties must deliver and receive the actual currencies at the agreed-upon rate and date. On the other hand, an NDF does not involve the physical exchange of currencies. Instead, the difference between the agreed NDF rate and the prevailing spot rate at maturity is settled in cash, typically in a major currency like the USD. This cash settlement feature makes NDFs particularly useful for hedging exposure to currencies that face trading restrictions or are not easily accessible in international markets. In contrast, DFs are more suitable for entities that genuinely need the physical delivery of the currency, such as businesses involved in international trade or investments.

NDFs VS NDSs: Understanding Functional Differences

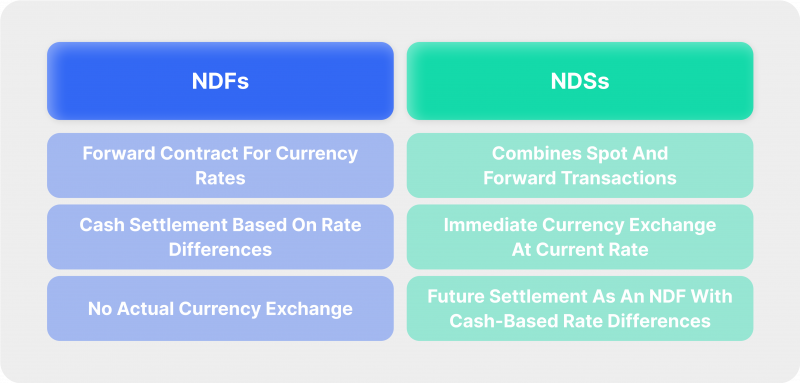

NDFs and NDSs, or Non-Deliverable Swaps, also often confuse investors, as their role is somewhat similar, but functionalities still differ.

As said, an NDF is a forward contract wherein two parties agree on a currency rate for a set future date, culminating in a cash settlement. The settlement amount differs between the agreed-upon forward rate and the prevailing spot rate on the contract’s maturity date. This mechanism allows parties to hedge against potential currency fluctuations without needing physical currency exchange, making NDFs particularly valuable in markets where certain currencies cannot be freely traded or are subject to restrictions.

On the other hand, an NDS is a more complex instrument that combines elements of spot and forward transactions. Essentially, an NDS is a foreign exchange swap consisting of two legs: a spot foreign exchange transaction and an NDF transaction. The first leg involves an immediate currency exchange at the current spot rate, while the second leg, set for a future date, is settled as an NDF, with the difference between the agreed rate and the spot rate settled in cash. This structure allows parties to manage short-term liquidity needs while simultaneously hedging against future currency risk.

In summary, while NDFs and NDSs offer mechanisms to navigate and hedge against currency risks in restricted or non-convertible currency markets, their functional differences lie in their settlement processes and overall objectives. NDFs are straightforward hedging tools, while NDSs combine immediate liquidity provision with future risk hedging, making each instrument uniquely suited to specific financial scenarios.

List Of NDF Currencies

A handful of currency pairs dominate the NDF market. Among these are:

- CNY

- INR

- KRW

- TWD

- BRL

- RUB

London is the principal centre for NDF trading, although New York, Singapore, and Hong Kong also see significant activity.

While the USD dominates the NDF trading field, other currencies play an important role as well. The euro and Japanese yen are the most active currencies in this space. The British pound and Swiss franc are also utilised on the NDF market, albeit to a lesser extent.

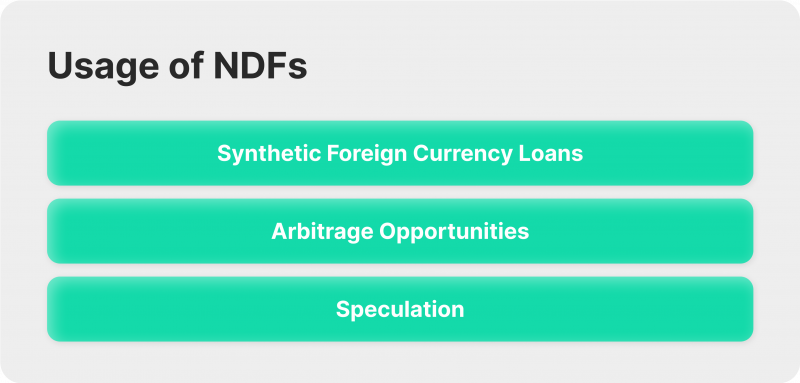

Usage of NDFs

It might still be confusing what the actual usage of NDFs is, so let’s break it down.

1. Synthetic Foreign Currency Loans

NDFs enable synthetic foreign currency loans to be formulated. Consider a scenario where a borrower seeks a loan in dollars but wishes to repay in euros. The borrower acquires the loan in dollars, and while the repayment amount is determined in dollars, the actual payment is made in euros based on the prevailing exchange rate during repayment. Concurrently, the lender, aiming to disburse and receive repayments in dollars, enters into an NDF agreement with a counterparty, such as one in the Chicago market. This agreement aligns with the cash flows from the foreign currency repayments. As a result, the borrower effectively possesses a synthetic euro loan, the lender holds a synthetic dollar loan, and the counterparty maintains an NDF contract with the lender.

2. Arbitrage Opportunities

In certain situations, the rates derived from synthetic foreign currency loans via NDFs might be more favourable than directly borrowing in foreign currency. This presents potential arbitrage opportunities. While this mechanism mirrors a secondary currency loan settled in dollars, it introduces basis risk for the borrower. This risk stems from potential discrepancies between the swap market’s exchange rate and the home market’s rate. Additionally, the lender is exposed to counterparty risk. While borrowers could theoretically engage directly in NDF contracts and borrow dollars separately, NDF counterparties often opt to transact with specific entities, typically those maintaining a particular credit rating.

3. Speculation

A significant portion of NDF trading, estimated between 60% to 80%, is driven by speculative motives. A distinguishing factor between outright forward deals and NDFs is the settlement process. In NDFs, settlements are executed in dollars, primarily because dealers or counterparties cannot finalise the transaction in the alternative currency associated with the deal.

Why Should A Broker Offer NDF Trading?

NDF trading can be a strategic move for brokerage firms aiming to diversify their product offerings. Here’s why:

Profitability Potential

NDFs, by their very nature, are the most valuable to markets where traditional currency trading is restricted or impractical. This creates a niche yet significant demand, allowing brokers to capitalise on the spread between the NDF and the prevailing spot market rate. With the right risk management strategies, brokers can optimise their profit margins in this segment.

Expanding Client Base

The global financial industry is replete with corporations, investors, and traders seeking to hedge exposure to illiquid or restricted currencies. By offering NDF trading, brokers can attract this substantial and often underserved client base. Given the specialised nature of NDFs, these clients are also likely to be more informed and committed, leading to higher trading volumes and, consequently, increased brokerage revenues.

Competitive Edge

In an industry where differentiation can be challenging, offering NDF trading can set a brokerage apart. It showcases the firm’s commitment to providing comprehensive financial solutions and its capability to navigate complex trading environments.

Enhanced Liquidity

With a growing interest in emerging markets and their associated currencies, the demand for NDFs has consistently risen. Brokers offering NDF trading can benefit from this increased liquidity, ensuring smoother operations and better price offerings for their clients.

Where To Find NDF Liquidity

For those seeking liquidity in NDFs, it’s essential to turn to specialised financial service providers and platforms that fit this niche market. These platforms and providers offer the necessary infrastructure, tools, and expertise to facilitate NDF trading, ensuring that traders and institutions can effectively manage their currency risks in emerging markets.

NDF Currencies Offered by B2Broker

B2BROKER stands out as one such NDF liquidity provider, extending its clientele to a comprehensive range of NDF currencies. Their offerings include:

- USD/BRL

- USD/CLP

- USD/COP

- USD/IDR

- USD/INR

- USD/KRW

- USD/TWD

Advantages of B2Broker’s NDF Liquidity Offering

Distinguishing itself from traditional providers, B2Broker has innovatively structured its NDFs as Contracts For Difference (CFDs). This approach grants clients unparalleled flexibility and ease of use. While standard NDFs often come with a T+30 settlement period, B2BROKER ensures clients can access settlements as CFD contracts on the subsequent business day. This streamlined approach mitigates client settlement risks and accelerates the entire process, guaranteeing efficiency and confidence in their transactions.

Bottom Line

In the intricate landscape of financial instruments, NDFs emerge as a potent tool, offering distinct advantages for investors. They safeguard against currency volatility in markets with non-convertible or restricted currencies and present a streamlined cash-settlement process. For brokerages, integrating NDFs into their asset portfolio can significantly enhance their market positioning. By offering this specialised instrument, brokerages can reach a broader and more sophisticated client base, boosting their presence in the competitive financial arena and promoting diversification.

FAQ

How are NDFs used for?

NDFs hedge against currency risks in markets with non-convertible or restricted currencies, settling rate differences in cash.

What is an NDF in trading?

An NDF is a financial contract that allows parties to lock in a currency exchange rate, with the rate difference settled in cash upon maturity rather than exchanging the currencies.

How big is the NDF market?

The NDF market is substantial, with dominant trading in emerging market currencies like the Chinese yuan, Indian rupee, and Brazilian real, primarily centred in financial hubs like London, New York, and Singapore.

What are the key currencies included in the list of NDF currencies?

The list of NDF currencies typically includes currencies like USD/BRL, USD/CLP, USD/COP, USD/IDR, USD/INR, USD/KRW, and USD/TWD. These non deliverable forward currencies are essential for hedging in markets where direct currency exchange is restricted.

How do non deliverable forwards differ from deliverable forwards?

Non deliverable forwards settle the rate differences in cash without the physical exchange of currencies, whereas deliverable forwards involve the actual exchange of currencies at maturity. This makes non deliverable forwards ideal for non deliverable forward currencies that are not easily accessible in international markets.

Why should brokers offer non deliverable forwards with a comprehensive list of NDF currencies?

Offering non deliverable forwards with an extensive list of NDF currencies allows brokers to attract clients dealing with restricted or illiquid currencies. This enhances the broker’s market stance and provides clients with effective tools to manage currency risks using a variety of non deliverable forward currencies.