What is Crypto Spot Liquidity: Definition & Explanation

Articles

Prior to deciding whether to invest in the cryptocurrency markets, those interested must master the principles of cryptocurrencies and liquidity. In the case of a liquid market at lower execution costs, it would be simpler for them to estimate future market action and handle their trading strategies.

In this article, we will take a closer look at the concept of liquidity, examine what crypto spot liquidity is and review several ways how to improve crypto spot liquidity. After that, we will share some of the advantages of enhanced liquidity.

First, let’s look at what liquidity is in general.

Understanding Liquidity

When a particular financial asset may be quickly and easily converted into cash without depreciating in value, it is referred to as having sufficient liquidity. As of now, cash is the most liquid of all the assets available on financial markets.

While cash is the most liquid asset, cryptocurrencies are gaining ground steadily, sometimes reaching astronomical liquidity. In contrast, real estate, art, and other “exotic” assets are examples of actual goods that are all highly illiquid.

Cash is the fastest and most accepted means of exchange worldwide. Currently, cash, for instance, is the primary tool of exchange that can be utilized to buy a painting from a rare collection or, in a more modern case, an NFT, also known as non-fungible tokens. The likelihood of finding someone willing to exchange the item for some other item is pretty slim. The truth is, very few people are willing to exchange their stuff for anything except cash.

Now, let’s take a brief look at accounting liquidity and market liquidity, which are the two primary liquidity metrics.

Accounting Liquidity

Accounting liquidity evaluates a person’s or a business’s ability to determine how quickly they can satisfy their financial responsibilities with the liquid assets at their disposal. This refers to their ability to repay debts on time.

Measuring accounting liquidity in terms of investments entails contrasting liquid assets with current liabilities or debts due within a year.

Accounting liquidity is measured by several ratios, each of which has a different definition of “liquid assets.”

Market Liquidity

Market liquidity is the degree to which a market, say a real estate market, permits the purchase and sale of assets at a predictable, accessible value.

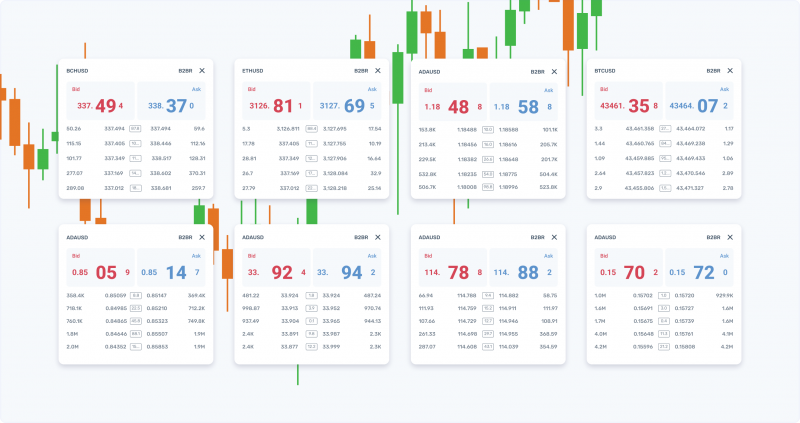

On the other hand, the stock or Forex market has a different understanding of liquidity. The bid price and the asking price will be very close to one another if an exchange has a significant volume of transactions that are not driven by selling.

Importance Of Liquidity

A strong market relies on liquidity for effective operation. Market activity is highly vulnerable to breakdowns when there is insufficient liquidity. For that reason, to better understand why this is the case, let’s explore the essential market factors that liquidity provides.

Stability In The Market

A large volume of market activity with liquidity helps balance the prices of the traded assets. On the contrary, markets with little to no trading activity are more susceptible to sudden or severe spikes in volatility. A liquidity crisis that arises from a single massive purchase or sell transaction could potentially cause abrupt price movements leading to expensive impacts on other participants.

An occurrence that most traders definitely do not like to see while trading is slippage. Slippage occurs when the bid-ask spread for an asset changes between the moment when a market order is placed and when that order is processed. Although some transactions using a market order are likely to have a modest level of slippage, this problem is more severe when clients execute a market order for an asset with little trading activity or when market volatility is at its highest. Furthermore, larger market orders frequently have higher slippage since they need more liquidity in order to be fulfilled. Also, increased liquidity improves quicker interactions by reducing slippage.

More friendly prices

Since there are an equal number of existing buyers and sellers in liquid markets, there is a high level of trading volumes on both ends. Of course, the goal of every buyer and seller is to get an asset at the best possible price. Due to competition between buyers and sellers to complete identical orders, more sellers will set competitive pricing, and more buyers will bid at some of these increased prices. Thus, high liquidity encourages market stability and, as a natural consequence, produces prices that are more equitable for all market participants.

Competent conditions in markets

Because liquid assets see large trading volumes, increased liquidity makes it simpler for market players to spot possible market trends. This information is especially beneficial to traders who rely on technical indicators to guide their trades.

Now, let’s take a deeper look at cryptocurrency spot liquidity.

Crypto Spot Liquidity

As we already mentioned, liquidity is the process of converting an asset into cash or any other kind of widely accepted medium of exchange. Since money can be transferred more quickly than other assets and is always accessible, liquidity is essential for all assets. In addition to all that, having access to competitive cryptocurrency exchange markets with solid liquidity encourages investors and businesses to sell their reserves with minimal or no value loss.

Vital to note is that all cryptos share the same attribute: they can all be traded on a free and open market. As a consequence, such investment tools are bought and sold on numerous exchanges around the world in considerable quantities having a long-term significance. Moreover, transactions sometimes tend to be exceedingly delayed due to the uncertainty of the values of liquid assets. Same as in all financial markets, the difficulty of turning a crypto asset into cash can be used to determine how liquid it actually is.

But why is crypto spot liquidity important for the market and for traders?

Cryptos Offer Unique Opportunities

Each year it is becoming increasingly more accessible and more attractive to purchase or sell a specific asset in a crypto market than in other traditional markets, mainly because of sufficient crypto spot liquidity and the popularity they gained. Additionally, there are now more market participants, and orders are executed more quickly. Such flexibility is essential given how volatile and liquid the crypto markets are and how easily transactions can be initiated or canceled.

Crypto Exchanges Created a New “Meeting Point”

Crypto exchange is a modern digital exchange where any market participant may freely exchange their cryptos, among other features. Due to individuals’ growing access to cryptocurrencies, there are an increasing number of cryptocurrency exchanges, which provide enormous trading activity globally. Thanks to the growing amount and volume of operations, the market has become more liquid, which is essential to stay efficient and persistent. Currently, hundreds of both centralized and decentralized exchanges offer peer-to-peer (P2P) methods. All of that is increasing crypto spot liquidity, thanks to which a “new meeting point” of traders occurred, leading to growing importance for crypto exchanges and cryptocurrencies overall.

A Global Embracing Of Crypto

Every asset or a currency needs to be broadly recognized and have a considerable customer base in order to survive and remain relevant. It is widely accepted that cryptos are becoming more important, especially for businesses and even giant corporations that are already looking into accepting cryptocurrencies as a form of payment in order to increase their popularity. Note that crypto liquidity and its attractiveness are essential for motivating online merchants to take steps to accept cryptos as payment, including tech giants that are already doing so.

Regulations

The crucial moment everybody is waiting for is whether countries forbid, seriously regulate, or, less likely, let cryptos be “free” and usable in financial activities. Global regulations will definitely impact cryptocurrency liquidity and its usage. Once crypto becomes a truly global means of payment, a particular country itself could see a decrease in its economy if cryptocurrencies were outlawed. It would be so because fewer crypto exchanges would exist there, making it a less attractive jurisdiction for progressive companies.

You already know that cryptocurrency liquidity is the backbone of the market. But how can business owners make sure exchanges maintain competent liquidity?

Tips For Increasing The Liquidity Of A Crypto Exchange

Every entrepreneur’s actions are driven by a desire to grow their capital and maximize the value of their money. As a consequence, cryptocurrencies have grown in popularity as a way to generate passive income via investing. Therefore, many business owners decided to invest in cryptocurrencies, as well as other attractive digital assets and saw increased production of additional income.

Crypto exchanges are businesses that deal with cryptocurrencies on a daily basis. It is worth mentioning the term “market maker,” which is frequently linked with liquidity providers thanks to their interaction with all market participants.

So how can a business improve crypto spot liquidity?

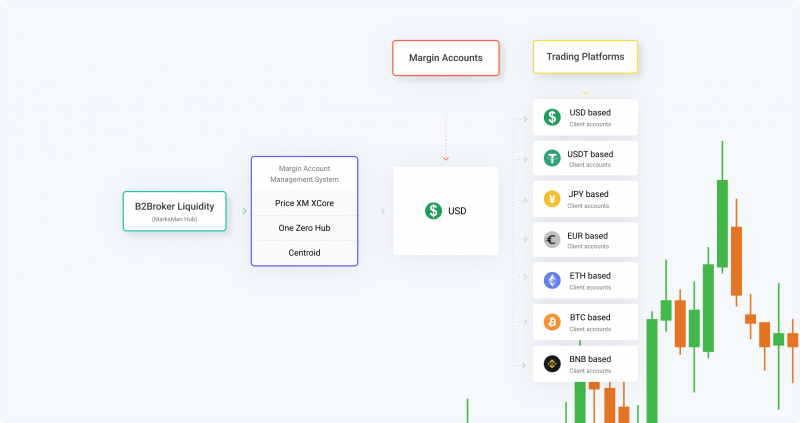

Ensure the liquidity provider you select is able to offer exceptional services. It would be great for you to do everything possible to create a long-lasting partnership. Don’t hesitate and ask questions such as the following:

Firstly, what kinds of liquidity is the market maker able to access, and what amount of resources are required by the LP to maintain a suitable level of trade activity? These are essential factors because the ability of your business to bring on new customers could consequently suffer without having sufficient liquidity.

Secondly, is there an option to observe every single transaction on the exchange and the history of all transactions? Such data will help you create more accurate projections of your possible earnings as well as the market maker’s status.

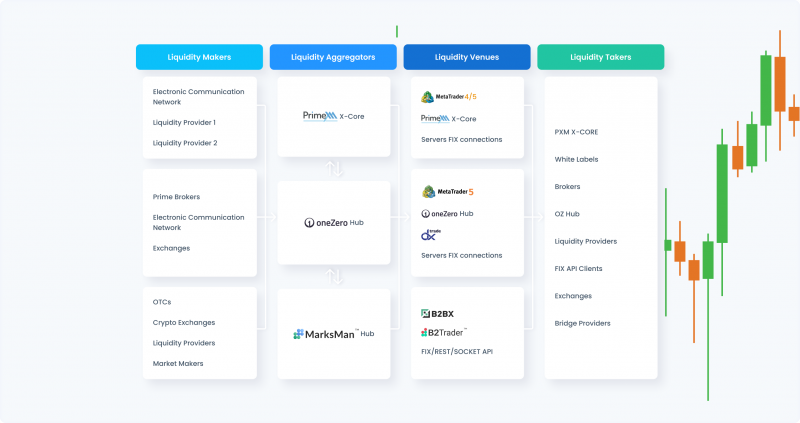

One of the most effective ways to increase liquidity is to find a crypto liquidity aggregator, which might be a challenging task. You need to compare a broad range of companies and undertake in-depth research, including important factors like pricing and trading policies, trading software, and potential costs.

On the other side, an increasing prevalence of cryptocurrency exchanges has been started by people who don’t want to work with liquidity aggregators who take a certain fee for their services. Interestingly, only a few businesses are able to expand their customer base while providing excellent liquidity. Besides that, market makers are helpful for a number of reasons, in addition to enhancing the liquidity of cryptocurrency exchanges.

Although there are numerous methods for increasing the crypto liquidity on your exchange, only a small number of them are actually put to action. For example, you might use an alternative digital currency system. It is also possible that exchange enterprises may buy cryptocurrency from some other source and deliver it to customers’ accounts in place of your cryptocurrency holdings if they are insufficient. This method speeds up the processing of transactions, enabling individuals to make more serious investments.

The good news is that the crypto industry is expected to see a lot of exciting new developments in the near future. These businesses are working to develop a centralized hotspot that will manage all transactions and payments “under one roof.”

Now, let’s proceed and take a look at the final part of the article.

Benefits of higher liquidity

High Processing Performance

The buying and selling of cryptocurrencies are accelerated and made easier by deep liquidity in the market. Because there are so many people trading on the market, all orders are filled more efficiently than ever before. However, bear in mind that the extremely high speed of transactions on the cryptocurrency market can sometimes make it challenging for traders to initiate or quit a trade immediately.

Instantly Handled Orders

Modern, sophisticated algorithms use techniques that ensure that a buyer and seller both find the best possible matches. The market maker looks for a seller who trades in a particular currency and pairs the orders when a buying order has been placed for that currency. The main objective here is to reduce order processing delays and provide efficient crypto liquidity.

Spreads With Outstanding Consistency

In accordance with their responsibility to supply efficient crypto liquidity, market makers should always ensure that the spreads are stabilized. They determine price movements and maintain them at a fair level to give traders a smooth entry point.

Traders, therefore, benefit from more accessible, more comfortable, and more effective cryptocurrency trading systems thanks to them. These factors will increase investors’ confidence, leading to their further participation in the financial markets.

Better Clarity in Technical Analysis

Technical analysis examines crypto movements that happened in the past and focuses on the projection of future prices using numerous technical indicators and charting patterns. Though many people question the validity of the technical analysis, it is a frequently used approach to understand the overall market and trading in general. Increased precision results from the more precise and developed price, and reliable chart development is possible thanks to liquid markets.

Bottom line

The popularity of cryptocurrency markets is growing, bringing an increased number of serious traders and speculators along with it. Expansion across the world will encourage a more stable environment free from slippage caused by large traders, or “whales.” Smaller, less liquid markets will nevertheless always remain, and new cryptocurrencies will continue to emerge.

When you think about the financial markets, liquidity is one of the main “drivers” of the whole organism. High liquidity markets are often preferred for trading since they make it easier to enter and exit positions.

Thus, liquidity is crucial for trading cryptocurrencies. Exchanges and market players both benefit from greater liquidity.