What is Infinite Banking, and How Can You Make It Work?

Investing in your future using savings accounts and trading instruments is one way to ensure financial security and secure your future. However, the infinite banking strategy is an increasingly popular tactic that enables users to benefit from their life insurance package.

It is a highly complex technique that some describe as a scam, while it is not. Benefiting from this strategy requires advanced knowledge of how insurance works and how the compound rate of return operates. Mixing those two concepts with the elements of whole life insurance allows you to acquire loans without affecting your savings or paying interest rates.

So, what is infinite banking? How can you implement it? Let’s explain.

Key Takeaways

- Infinite banking is an advanced concept that involves acquiring life insurance and getting loans from the policy itself.

- Infinite banking whole life insurance is designed to support people during their lifetime and after they pass away.

- Getting loans from lifetime insurance is faster, tax-free, and can be repaid at your own pace.

- Insurance companies offer fixed interest rates and dividends accumulating in the beneficiary’s account.

What is Infinite Banking?

Infinite banking is an advanced financial technique that involves getting a whole life insurance package and utilising its cash value and death benefits to acquire loans and finance your expenditure.

Nelson Nash first explained this concept in his book “Becoming Your Own Banker”. He discussed how whole life insurance policies work, highlighting that distributed dividends and cash accumulations from this policy can be used to get loans rather than relying on banks or financial institutions.

Classically, if you want to acquire credit to buy a car or a house mortgage, you need to address your bank, which will check your credit score and issue a loan if deemed feasible. However, this hack entails getting financing from your own whole life insurance policy and paying back using dividends or other vehicles involved in this mechanism.

In essence, when you get permanent life insurance, you pay a fixed amount monthly, and the insurer fixes a particular rate of return that pays out in your cash value. Using the infinite banking method, you finance your purchases from your cash value.

One significant benefit of this strategy is that you can sustain other investment instruments you might have, such as stocks, high-yield dividends, savings accounts and 401k retirement funds.

When having a savings account at a given interest rate with the bank, you usually face the challenge of taking out your money now to finance your project or postponing your plans to earn the extra interest in coming years. Also, you can access your 401k fund only after retirement.

Therefore, these loans allow you to get liquid money without breaking your savings or other long-term investments so that you can have another substantial reserve and enjoy a comfortable retirement.

Infinite Banking vs Traditional Financial Instruments

Stocks, bonds and commodities are classic investments to save for the future or grow someone’s wealth. For example, stocks enable traders to grow their money through price volatility and dividends, which are not guaranteed and rely heavily on market conditions.

Bonds offer fixed interest payments through a predetermined period, while commodities and currencies provide valuation through price fluctuations. However, these tools are diverse in liquidity and depend on market cycles and financial performance.

Conversely, infinite banking allows users to access funds quickly without relying on third-party institutions to issue credit, combined with life insurance’s fixed interest rate, which secures the cash value in the policy.

Infinite Banking vs Loans/Saving Accounts

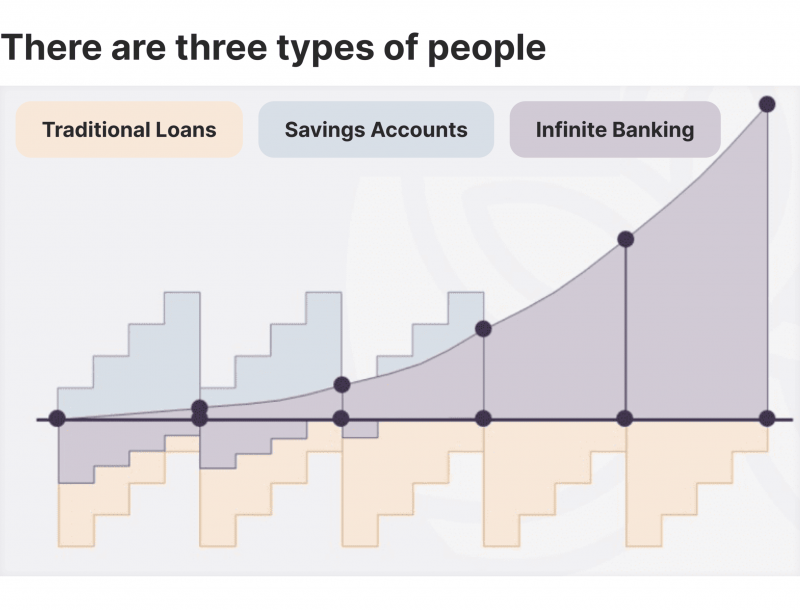

Opposite to classic financing options, such as loans, mortgages and long-term credits, infinite borrowing is done much faster.

Banks and financial institutions rigorously check your account and feasibility before issuing loans. Moreover, they charge a significant interest that must be paid on time to avoid hefty penalties.

Additionally, when you take money out of your savings account, your compound value stops growing because you withdrew your money from the savings. You need to start over to invest in a new savings account.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

On the other hand, taking loans from your insurance does not hinder your interest growth as your cash value life insurance keeps compounding value.

Users can get loans against their policy’s cash value and repay without a strict schedule. Additionally, users can cover the loan through other instruments like dividends and interest payments.

Components of The Infinite Banking Concept

Let’s dive deeper into the infinite banking system and how it works from a financial perspective. We will do so by introducing the basic parts of this strategy, which requires sound financial planning and grasp.

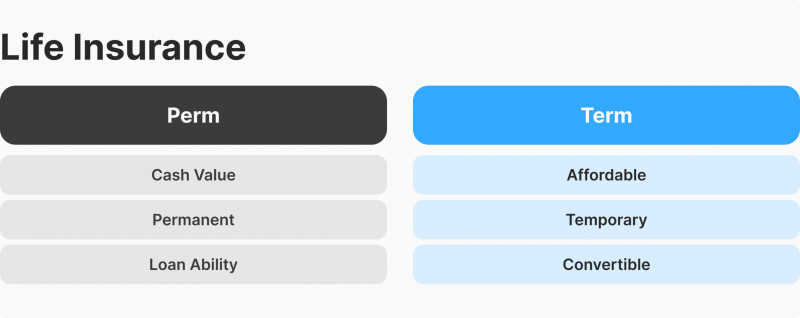

Whole Life Insurance

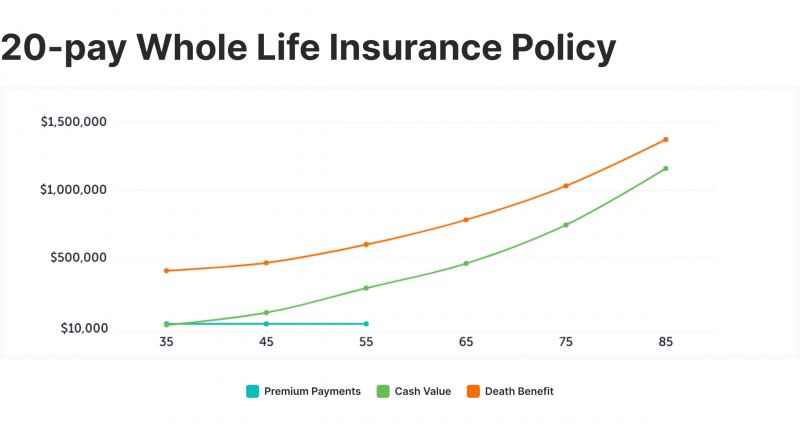

The most crucial element of this concept is permanent life insurance, as opposed to limited or term life insurance. Typically, the life policy is designed to last for years, where the beneficiary gets cash values during retirement and supports the family members when the policyholder passes away.

Insurance companies offer various packages at different premium payments extending for 10 to 40 years. Issuers conduct detailed checks and analyses before giving this life insurance, so make sure you qualify before requesting one.

You must be 18 at least to get lifetime coverage insurance with a maximum that varies between companies, extending to 100 years old. Life insurance policies are more affordable when you are younger.

Premium Payments

This is the monthly insurance amount paid by the holder. Premiums are usually fixed and agreed upon when signing the insurance contracts.

Users pay these amounts to keep the insurance package valid, which is converted towards the cash value and death benefit with a fixed interest.

Dividends

Insurance companies pay dividends to whole life insurance holders depending on the company’s stock performance, revenue performance and other economic factors.

Users can choose to receive these dividends or convert them into cash value to cover the acquired loans.

Cash Value

The cash value component is the most crucial because it is the amount accessible to the policy owner during their life. This value accumulates based on the interest rate and dividends converted into this cash account.

When users get life insurance loans, they borrow from their cash value reserve. Note that this amount is designed to support the owner during their living years and is not given to the beneficiaries when the holder passes away.

Death Benefit

The death benefit is a fixed amount determined at the beginning of the life insurance policy, which covers the death-related cost and reimburses the deceased family members (beneficiaries).

This amount can be fixed or accumulative based on the policy type and package. It remains untouched when getting IB loans and financing.

How Does Infinite Banking Work?

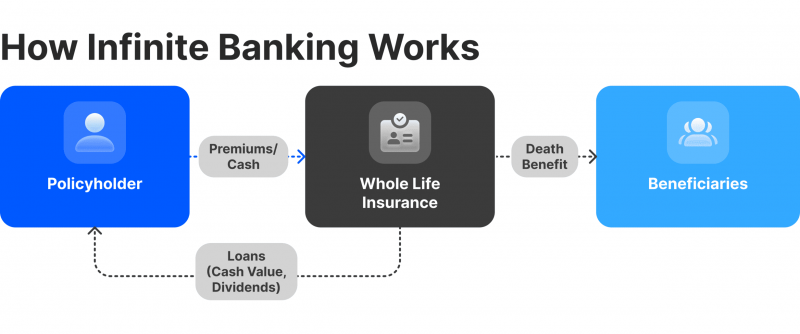

After understanding the elements of lifetime insurance and finance, let’s explain how the process works. When you get an insurance package, you make monthly premium payments to top-up your policy.

These amounts accumulate and increase through a fixed interest rate towards your cash value. When the cash value reaches a sufficient level, you can borrow from your cash reserve.

Getting financing from your policy is faster because the money is already there, and you do not need confirmation from your banker. Moreover, there are no background checks like financial institutions and mortgage issuers do.

These loans are not intertwined with taxes or a hefty interest rate; you can repay your policy at your own pace. You can also cover your loan through dividends receivables to minimise your expenses.

Infinite Banking Example

Let’s simplify this concept with an example. Assume John gets a participating whole life insurance package. The death benefit is $1,000,000, and the annual premium is $10,000.

John overpays his policy to increase liquidity and make cash value more sufficient. So, he pays $15,000 premium annually. The insurance company offers a fixed 4% plus additional dividends.

After 10 years, John quit his job and decided to start his own business, so he took out $50,000 from his cash value, which is now around $150,000 after compounding interests and dividends.

When John pays back the debt, the money goes back to his policy, and his cash reserve keeps compounding and growing.

Infinite Banking Pros and Cons

For some, this sounds like a loop to get unlimited funds, which is inaccurate. There are various challenges associated with this advanced tactic.

Advantages

- Tax-free: lifetime insurance loans have tax benefits compared to traditional loans or mortgages.

- Fixed interest rates: your policy’s cash value keeps growing at a fixed rate without being affected by market conditions.

- Easier process: taking loans from your cash value does not go through bureaucratic checks and documentation processes.

- Higher liquidity: insurance loans are faster and more guaranteed than through savings or banks, which are subject to liquidity.

- Flexibility: you can repay your loans at your own pace and without a strict schedule or delay penalties that banks apply.

Disadvantages

- Costs: whole life insurance is typically expensive, and not everyone can afford the high annual premiums.

- Growth time: cash value growth takes several years before you can get loans sufficiently unless you get higher packages.

- Complicated: this concept can be challenging for the average employee, and it is easy to make mistakes.

- Qualification: the insurance company will check if the person is medically and financially qualified for whole life insurance.

Is Infinite Banking Legit or Scam?

Infinite banking is legitimate, and insurance companies know this approach benefits policyholders. However, you must be aware of fake issuers who claim to offer life insurance to get quick and endless loans.

Accordingly, this strategy is not a short-term investment and shall not be treated as a source for immediate loans. Instead, it is a long-term plan to get financing when needed in the future.

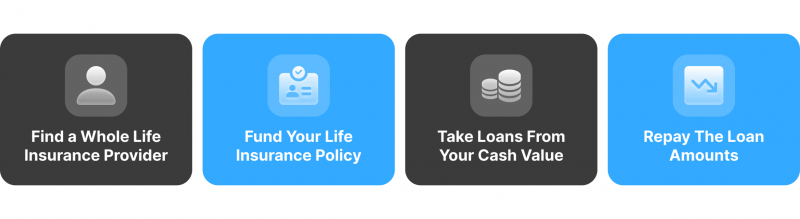

How to Execute The Infinite Banking Strategy?

This insurance-hack used to be exclusive to entrepreneurs and financial experts. However, with the spread of information and coverage over the internet, more users have gained access to this concept. Here’s how you can implement this strategy.

Find a Whole Life Insurance Company

First, you need to assess your financial status, long-term goals, and whether you can afford a permanent life policy. Also, discuss with your financial advisor and use an infinite banking calculator to determine your risk tolerance and feasibility.

Search for an insurance company offering whole life insurance and ensure their legitimacy. Inspect their background, experience, and reputation. You can also check their financial performance to evaluate their dividend payability.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Thoroughly review their permanent life insurance offering, terms and conditions and the minimum interest rate they tie with your cash value.

Fund Your Life Insurance Policy

Plan your monthly premium payments and determine your budget based on your goal. If you want to get insurance for the sole purpose of quick funding, your premium payments are more important because they affect how quickly you can use your cash value for financing.

Start paying and overpaying your policy and make a detailed schedule to track your cash value, including interest returns and dividends.

Take Loans From Your Cash Value

Once your cash value has accumulated enough money, you can start taking loans against your insurance policy. These are tax-free loans that you can spend as you want.

Getting financing from your account is like becoming your own banker, where you borrow money from yourself and repay yourself with fast procedures and no approval required from the issuer.

Repay The Loan Amounts

Start repaying your debt at your convenience. Infinite bank loans are not subject to strict payment schedules like traditional banks. However, to keep the policy running, you would want to pay back your loans to finance other projects in the coming years.

Note that repaying your loans is subject to an interest rate, which typically goes back into your cash value to keep your money growing.

Conclusion

Infinite banking is a complex financial strategy that entails getting permanent life insurance, overfunding your account, and getting loans from your insurance funds. However, it requires experts who know what this strategy is and the details behind life insurance.

Getting money from your account is possible because lifetime insurance includes death benefits and cash value. The latter accumulates with premiums, interest rates and dividend payments and is designed to finance you during your lifetime.

Life insurance loans are better than traditional financing or mortgages because they are tax-free, can be repaid at any time and do not hinder the compounding of your money.

FAQ

Is infinite banking a good idea?

Infinite banking is suitable if you want to get tax-free loans after many years of getting permanent life insurance and funding your policy.

Is infinite banking legal?

Yes. Insurance companies are aware of this strategy, although some describe it as a scam because of its complexity and detailed requirements to get sufficient financing.

Are there any risks to infinite banking?

This strategy can be costly because of the monthly premium payments the beneficiary must make before benefiting from the policy loans. However, it is immune to market conditions and economic factors.

How much money must I have to do infinite banking?

There is no fixed amount of money to get infinite banking life insurance. You need to plan your finances accurately, set your budget and determine your goals.

Who Uses The Infinite Banking System?

Since this concept requires a solid financial understanding of how insurance companies and interest-binding loans work, the infinite banking strategy is suited for entrepreneurs, real estate investors, and retirees with financial backgrounds.