What is Multi-Asset Liquidity?

Articles

Multi-asset liquidity is extremely important in the modern financial landscape. It refers to the ability of an investor or market participant to easily access and trade many asset classes in a single, unified environment. The advantages of having multi-asset liquidity are numerous and can help investors eliminate certain operational risks associated with individual asset classes.

Key Takeaways

- Multi-asset liquidity is a term used to describe the ability of a broker to offer multiple asset classes and trading options within one platform.

- Multi-asset liquidity provides investors numerous trading opportunities by allowing them to capitalize on rises and falls across multiple markets.

- It also enables investors to keep a diversified portfolio that reduces risk and allows them to hedge their investments effectively.

- To ensure reliable multi-asset liquidity, brokerages turn to liquidity providers and utilize dedicated technologies that simplify the process.

What is Multi-Asset Liquidity?

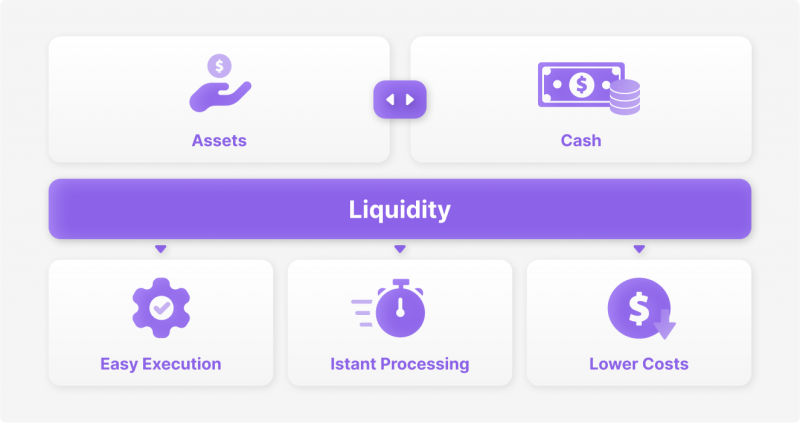

First, what is liquidity?

In finance liquidity is the degree to which an asset can be quickly bought or sold in a market without affecting its price. As a rule, liquidity indicates how many orders there are in the order book of the broker.

When an asset has high liquidity, there will always be someone on the opposing side of your trade to buy or sell from you. Conversely, with low liquidity comes a lack of orders in the order book – meaning it may take longer for trades to complete, and the final price of the asset may be affected.

Multi-asset liquidity

Multi-asset liquidity is a term used to describe the liquidity of assets across a broad range of asset classes. This means that assets from different markets can be traded simultaneously on one platform, allowing for more efficient price discovery and easier portfolio management.

By leveraging high multi-asset liquidity, investors can expand their portfolios to a wider range of markets and seize more possibilities. This minimizes potential losses from only one sector or asset type, thus mitigating risk for better returns on investment.

Multi-Asset Liquidity and Multi-Asset Funds

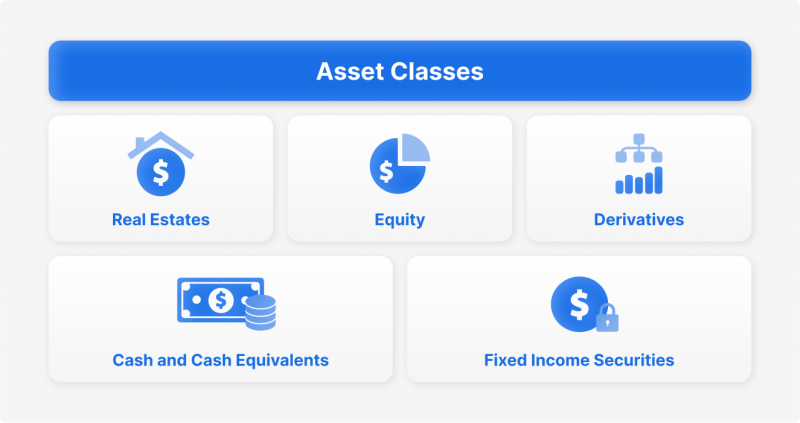

Multi-asset liquidity is an indispensable element when discussing multi-asset classes. But what are these?

A multi-asset class investment is a combination of asset classes, such as cash, stocks, or commodities, in one investment vehicle. Usually, these investment vehicles are funds (ETFs) that are diversified across different classes and sectors, allowing multi-asset investors to minimize risks.

What types of funds are there on the market?

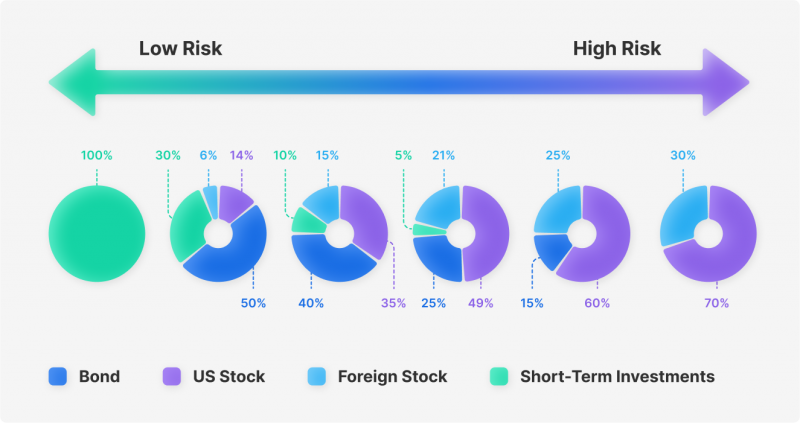

Risk Tolerance Funds

For investors looking to manage their risk-to-reward ratio, mutual fund companies offer asset allocation funds that range from conservative investments to aggressive ones. For example, an aggressive option would have a higher percentage of stocks in the portfolio.

For example, in the Guggenheim Investments company’ ETF – the Zacks Multi-Asset Income Index – 90% of the holdings are stocks:

Target Date Funds

Target date funds are multi-asset class investments that modify the balance of assets to match an investor’s desired retirement time horizon. For example, if you’re not planning on retiring for at least 30 years, a 2045 or later target fund is best suited for your needs. The longer the timeline, the more aggressive an investment fund usually is – to make the most of the longer time horizon.

Multi-Asset Brokers

Multi-asset liquidity does not necessarily have to only entail fund trading – many brokers today are choosing to offer multi-asset trading platforms, allowing investors and traders to access multiple markets (crypto, Forex, etc.) within one single account.

These new-age brokers also offer a wide range of products, such as CFDs and futures, which allow investors to speculate on the prices of underlying assets without actually owning them.

Obviously, multi-asset brokers require more diverse liquidity to be able to offer all of these products, which is why access to high-level multi-asset liquidity is necessary for these actors. Usually, brokerages turn to PoP liquidity providers, financial institutions that execute orders for a broker, to ensure a consistent and reliable liquidity pool for every investment type.

Why Multi-Asset Liquidity is Important for Investors

Numerous Trading Opportunities

With its large selection of options, multiple asset liquidity gives traders the chance to benefit from both rises and falls across multiple financial markets. By diversifying their investments into different asset classes, investors can take advantage of a wide range of trading opportunities, even in times of flat or low market activity.

Multi-Asset Strategies

By working with a multi-asset broker, traders can make the most of both short-term and long-term tactics. They are able to maintain a prolonged stock holding while capitalizing on rapidly changing markets like futures through day trading or investment strategies.

Those uncertain about managing a multi-asset portfolio should consider getting in touch with professional portfolio managers.

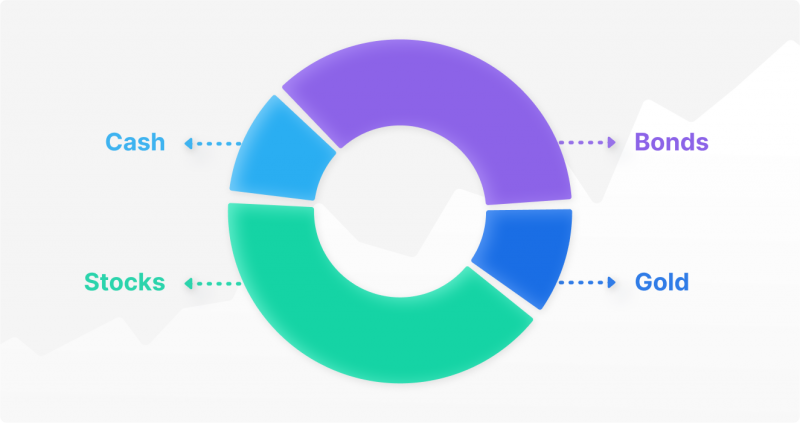

Diversification and Tactical Asset Allocation

A diversified portfolio is essential for any successful investor, as it significantly reduces overall risks and helps investors handle volatility swings with greater ease. To construct a well-rounded multi-asset investing strategy, investors consider positions in various asset classes such as Forex, equities and commodities. Doing this allows them to capture steady returns while minimizing their exposure to potential losses in the long run.

Better Hedging

Multi-asset liquidity also allows traders to effectively hedge their portfolios against potential losses. By holding investments in different asset classes, traders can offset any negative returns by making gains in areas that are rising.

For example, when the stock market takes an unpredicted plunge, multi-asset traders can turn to commodities and digital currencies to offset losses.

What Brokers Should Consider When Offering Multi-Asset Liquidity

Brokerage firms can gain immense advantages from offering a large selection of investment options. Still, this approach comes with its own set of operational and technological issues due to the need for integration across multiple trading venues and liquidity providers.

Furthermore, having a multi-asset trading platform requires taking into consideration the different regulatory frameworks for each asset class. This increases the complexity of risk management because it must be tailored to meet these rules and regulations.

However, today, many companies offer technologies, such as liquidity aggregators, that make it easier and more efficient for brokers to access multiple asset liquidity from a single source.

FAQ

What is liquidity in the financial market?

Liquidity in the financial market is a measure of how quickly and easily an asset can be bought or sold with little to no impact on its price. Liquidity is important because it allows participants to enter and exit positions quickly, reduces transaction costs, and allows for efficient price discovery.

What assets are considered liquid?

The most liquid assets are generally cash, equities, commodities, and currencies. Assets such as derivatives and fixed-income products can also be considered liquid depending on the market conditions.

What is a multi-asset fund?

A multi-asset fund is a type of investment fund that allocates its portfolio across multiple asset classes, such as stocks, bonds, commodities and cash. These funds are designed to provide investors with diversification and exposure to multiple asset types in one single fund.

What are derivatives?

Derivatives are financial instruments whose value is derived from an underlying asset. Examples of derivatives include futures contracts, options, and swaps. These instruments are used to hedge risks or speculate on future market movements and can be traded on exchanges or over the counter.