What is Robo-Advisor, and How to Choose One?

Investing has never been easier, thanks to robo-advisors — intelligent, algorithm-centered systems that take the guesswork out of allocation governance. Whether you’re just starting your wealth-building journey or a seasoned investor looking for a tech-savvy companion to traditional advisors, these digital financial wizards provide data-powered, automated solutions tailored to your needs. But with so many options available, how do you find the perfect robo-advisor to match your investment objectives?

This guide breaks down everything from the definition of a robo-advisor to the different types, fees, and benefits. It also covers their regulatory aspects and key considerations to help you choose the best one for your needs.

Key takeaways

- Robo advisors implement lower acquisition costs than regular advisors, making investing straightforward for all levels of investors.

- With features like automatic reconciling and tax-loss selling, robo-advisors simplify long-term wealth management.

- From passive investing to customisable ESG and crypto portfolios, robo-advisors cater to different investment interests.

What is a Robo-Advisor?

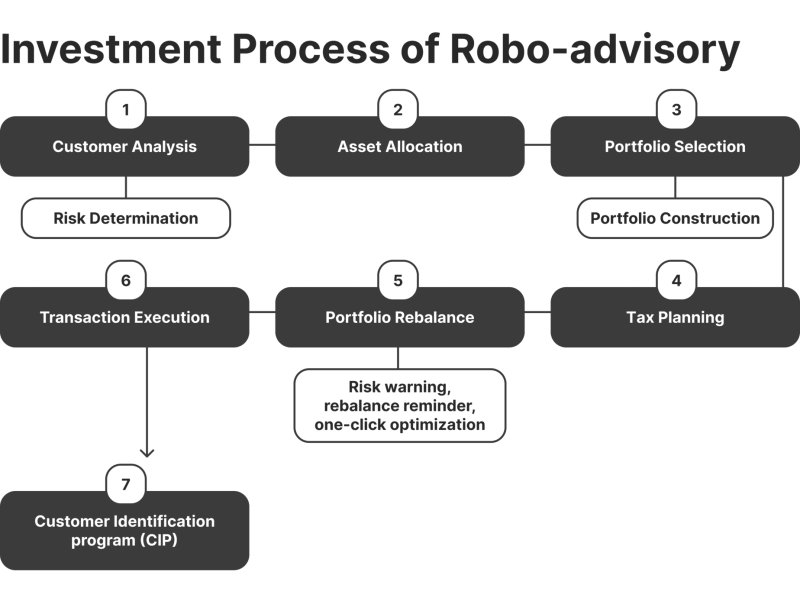

A robo-advisor is an online software that delivers machine-generated financial forecasts and investment monitoring through algorithms, requiring little human involvement. This software leverages innovative neural networks and data analysis to create and oversee investment profiles tailored to an individual’s objectives, risk appetite, and financial circumstances.

Robo-advisors typically offer a competitive substitute to established financial advisors, making advanced investment planning accessible to a broader clientele. They cater to both beginner investors looking for a discreet approach and experienced investors seeking low-cost portfolio optimisation.

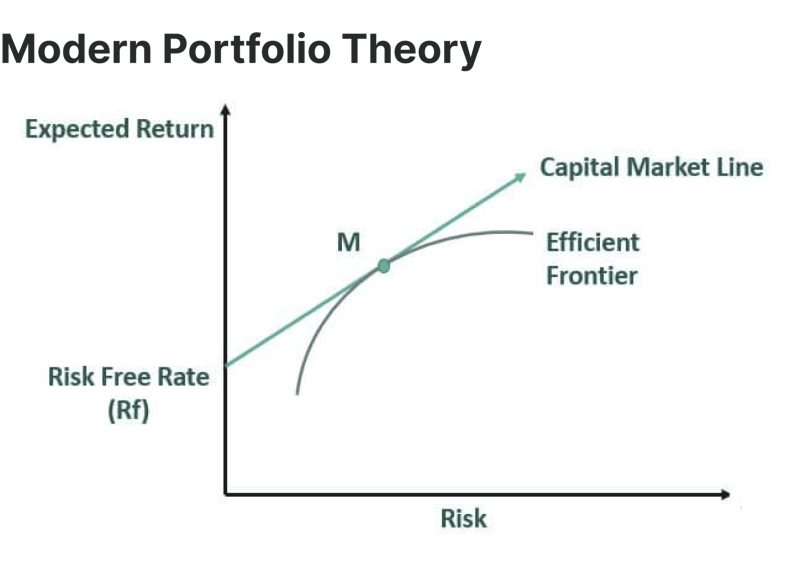

The core functionality of a robo-advisor revolves around modern portfolio theory (MPT), which emphasises inclusion and risk-adjusted returns. After gathering user information through a questionnaire, the platform allocates funds into a diversified profile of ETFs or index funds.

Most digital investment advisors also incorporate automatic replenishment, tax loss harvesting, and goal-based investing, assuring that portfolios remain aligned with an investor’s financial objectives.

The first robo-advisor, Betterment, was set up in 2008, revolutionising investing. Today, robo-advisors manage over $1 trillion globally, reshaping wealth supervision.

Main Types of Robo-Advisors

Robo-advisors have evolved significantly since their inception, offering a range of investment solutions corresponding to distinctive investor requests. While all robo-advisors share the common goal of self-service investment oversight, they can be categorised based on their features, level of automation, and services provided. Below are the primary types of robo-advisors:

Passive Robo-Advisors (Purely Algorithm-Based)

Passive robo-advisors are the most common and traditional type, offering fully programmed, algorithm-driven investment governance. They rely on modern profile theory to create low-cost, varied portfolios that are adjusted automatically.

These platforms do not involve human financial consultants, making them cost-efficient and ideal for hands-off investors. They primarily use low-cost ETFs and index funds, often including features like computer-controlled profile rebalancing and tax-loss selling for taxable accounts. Their fees are generally lower, ranging between 0.25% and 0.50% of assets under custody.

Hybrid Robo-Advisors (AI + Human Advisory Support)

Hybrid robo-advisors integrate automated investment administration with the availability of human managerial consultants. This approach attracts investors seeking the streamlined efficiency of algorithm-based investing while also requiring tailored advice for intricate financial matters such as retirement planning, estate management, or tax optimisation.

These platforms provide straightforward profile administration and direct access to CFP-certified financial advisors. The fees tend to be higher than purely algorithm-based digital investment advisors, usually ranging from 0.30% to 0.90% of assets under control.

Goal-Based Robo-Advisors

Goal-based online investment advisors focus on helping investors achieve specific financial milestones such as saving for retirement, buying a home, or accumulating wealth for children’s education. These platforms design investment campaigns that dynamically adjust based on the investor’s timeline and risk preferences. They prioritise goal-based planning, making changes in asset allocation as the investor moves closer to their objective.

Self-executing portfolio corrections and tax-efficient techniques are typically included to enhance long-term returns. This type of robo-advisor is well-suited for those who need a structured investment approach and have lasting financial objectives.

Self-Directed Robo-Advisors (Customisable Portfolios)

Unlike classical robo-advisors that follow pre-set portfolio models, self-directed robo-advisors allow investors to customise their profiles by selecting specific ETFs, stocks, or other assets based on their investment plans.

These service providers offer greater control over portfolio selection and sometimes include thematic investing options such as ESG (Environmental, Social, and Governance), tech-focused, or dividend-oriented portfolios. Some may also incorporate active trading features.

Self-directed online investment advisors are ideal for experienced investors who want more control over their profiles and who want to customise their risk exposure and asset allocation. However, they often have slightly higher costs than passive robo-advisors.

ESG Robo-Advisors

ESG robo-advisors focus on sustainable investing, catering to investors who want to align their portfolios with ethical, environmental, and socially responsible values. These platforms exclude industries such as fossil fuels, tobacco, and other controversial sectors while prioritising companies with strong ESG ratings.

The investment schemes are designed for long-term sustainability, though they may come with slightly higher fees due to specialised ESG screening and portfolio construction. These robo-advisors are ideal for socially conscious investors, those focused on climate-conscious investing, and individuals seeking sustainable growth.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Crypto Robo-Advisors

Crypto robo-advisors specialise in cryptocurrency investments, using AI-driven strategies to automate digital asset buying, selling, and rebalancing. They typically offer diversified exposure to cryptocurrencies such as Bitcoin, Ethereum, and other digital assets while incorporating risk-adjusted rebalancing to manage market volatility.

Some platforms integrate traditional assets to provide a balanced investment approach. These robo-advisors are best for investors who believe in the long-term potential of cryptocurrencies and are comfortable with the high volatility of digital asset markets.

Micro-Investing Robo-Advisors

Micro-investing robo-advisors allow users to start investing with small amounts of money, often by rounding up purchases and automatically investing the spare change. These platforms are designed to help beginners enter the investment realm with minimal barriers. They focus on small, consistent contributions to build wealth over time and typically have low or no account minimums.

Many micro-investing robo-advisors deliver an easy-to-use mobile app, making investing accessible to those with limited capital. This robo-advisor type is ideal for beginners and individuals looking to invest passively without making large initial contributions.

Major Advantages of Using a Robo-Advisors

Robo-advisors have transformed how people invest, bringing sophisticated, algorithm-based profile management to the fingertips of everyday investors. Combining automation with cutting-edge financial strategies offers these digital platforms a seamless, efficient, and cost-effective solution to outdated financial advisors.

These key advantages make them a game-changer in modern wealth governance.

Cost-Effectiveness and Lower Fees

One of the most compelling reasons to use a robo-advisor is its affordability. Former financial advisors regularly charge custody commissions ranging from 1% to 2% of assets under management (AUM), making them costly for many investors.

In contrast, robo-advisors operate at a fraction of that cost, with fees generally ranging from 0.25% to 0.50%, and some platforms even offer fee-free investing. By automating most of the investment process, robo-advisors eliminate the overhead costs associated with human advisors, making professional investment management more accessible.

Furthermore, they predominantly invest in low-cost ETFs and index funds, reducing expense ratios and increasing long-term returns. For investors with a long-term horizon, these fee savings can accumulate into thousands of dollars over time.

Accessibility and Ease of Use

Unlike classical financial advisory firms that require in-person meetings and high account limits, robo-advisors are open to anyone with an internet connection. The onboarding process is straightforward, typically involving a simple questionnaire to ascertain risk values and financial demands, after which the system builds a personalised investment portfolio.

Many platforms have designed mobile apps and online dashboards that provide real-time updates on profile outcomes, making investing more approachable for those with little or no financial experience.

Besides, robo-advisors often have low or no account minimums, allowing individuals to start investing with as little as $1 to $500. In contrast, conventional financial advisors frequently require a minimum investment of $100,000.

Automated and Data-Centered Investment Governance

Robo-advisors leverage advanced algorithms and MPT to construct well-diversified portfolios based on an investor’s goals, risk sensitivity, and time horizon. This algorithm-driven approach removes emotional biases and ensures a disciplined, rational investment strategy.

The platforms also provide goal-based investing, where portfolios are designed to align with specific financial objectives such as retirement savings, homeownership, or general wealth accumulation.

Meanwhile, robo-advisors carry out algorithmic profile modifications, assuring that an investor’s asset allocation remains aligned with their risk profile even as market conditions fluctuate. Unlike human financial experts, who can be influenced by emotions or market sentiment, robo-advisors rely purely on data and mathematical models, optimising long-term portfolio performance.

Selection and Risk Planning

Proper diversification is essential for minimising risk and achieving stable long-term returns. Robo-advisors operate equitable profiles across various asset categories, including stocks, bonds, real estate investment trusts (REITs), commodities, and alternative investments.

Further, robo-advisors continuously appraise portfolio performance and make alterations when necessary. Suppose certain asset classes become overrepresented due to market shocks.

In that case, the system automatically rebalances the portfolio by selling overperforming assets and purchasing underperforming ones, maintaining a stable and well-diversified profile.

Tax Efficiency and Tax-Loss Harvesting

Robo-advisors employ sophisticated tax-efficient strategies to help investors minimise their tax liabilities and maximise after-tax returns. One of their most valuable tools is tax-loss recuperation, which autonomously sells underperforming assets to offset gains from other investments, ultimately reducing taxable income. This strategy can yield substantial tax savings, particularly for investors with taxable brokerage accounts.

Also, some robo-advisors propose access to tax-advantaged investment accounts, among others as IRAs, Roth IRAs, and 401(k) rollovers, countenancing investors to optimise their tax benefits while growing their wealth.

Emotional Discipline and Elimination of Human Bias

One of the biggest challenges for individual investors is managing emotions during market volatility. Many investors panic-sell during downturns or chase high returns when the market is booming, leading to suboptimal financial outcomes.

Robo-advisors remove this emotional component by adhering strictly to algorithmic investment principles. They maintain a steady, data-driven approach regardless of market conditions, assuring that portfolios are adjusted objectively rather than in response to fear or greed.

Scalability and Portfolio Customisation

Robo-advisors are designed to scale with investors as their financial interests evolve. Many platforms now offer customised investment tactics that cater to different preferences. For those interested in socially proactive investing, some robo-advisors endorse ESG profiles that prioritise ethical and sustainable investments.

Others offer thematic investing options, such as technology-focused, dividend-growth, or impact-centered portfolios. Some platforms even integrate hybrid models, combining the efficiency of robo-advisory models with linkages to human business strategists for more precise financial planning.

Security and Regulation for Investor Protection

Robo-advisors operate under strict regulatory oversight, assuring that they meet industry standards for investor coverage. In the United States, they are regulated by the SEC and the FINRA and must adhere to fiduciary standards, meaning they are legally required to act in the best interests of their clients.

Most robo-advisors also provide additional security measures such as SIPC assurance, which protects investors’ assets up to $500,000 in case of brokerage failures. Some platforms also offer FDIC-insured cash management accounts, adding another layer of financial security.

Key Factors to Consider When Choosing a Robo-Advisor

With the growing prevalence of robo-advisors, choosing the right platform can significantly impact your investment success. While all robo-advisors offer automated asset allocation oversight, they differ in fees, investment methodology, features, and level of human support. To make a wise decision, consider these key factors before selecting the best robo-advisor for your needs.

Investment Methodology and Portfolio Customisation

Each robo-advisor follows a unique investment approach. Some focus on modern portfolio theory (MPT) to assure diversification with low-cost ETFs. In contrast, others incorporate factor investing, smart beta, or thematic investing for specialised exposure to industries like ESG, technology, or real estate.

While some platforms offer fully automated investing, others allow portfolio customisation, letting users adjust allocations or invest in individual stocks. Firms such as Betterment and Wealthfront provide automated governance services for investors who prefer a hands-off approach, while self-directed options such as M1 Finance afford users a greater degree of control.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Fees and Cost Structure

Robo advisors are known for their low fees, but costs vary across platforms. Most charge an annual fee between 0.25% and 0.50% of assets under management (AUM). At the same time, some, like Charles Schwab Robo Advisor, have no management fees but require a cash allocation, potentially impacting returns.

Aside from AUM fees, consider ETF expense ratios, trading fees, and premium service costs if human advisor access is required. Platforms like Vanguard Robo Advisor offer competitive rates at 0.20% AUM, making them a more affordable choice.

Account Types Supported

Different robo-advisors cater to various investment accounts, including taxable brokerage accounts, IRAs, Roth IRAs, and 401(k) rollovers. Some, like Wealthfront and Vanguard, specialise in retirement planning, while others offer 529 college savings plans or joint investment accounts. If tax efficiency is a priority, opt for platforms that support tax-loss selling and goal-based investment tactics.

Initial Investment Criteria

Some robo-advisors allow users to start investing with as little as $1, making them accessible for beginners. Solutions like Betterment and Acorns have no minimum investment, while Vanguard Digital Advisor requires at least $3,000, and Personal Capital sets a high bar with a $100,000 minimum. If you have limited funds, micro-investing platforms like Acorns can help you start small and build your portfolio over time.

Human Advisor Support vs. Fully Automated Investing

While some robo-advisors are fully automated, others offer a hybrid model that combines AI-related investing with human business consultants. Brokerages like Wealthfront and Betterment focus on fully computerised portfolio governance.

At the same time, Charles Schwab and Vanguard Personal Advisor Services provide access to Certified Financial Planners (CFPs) for more personalised financial guidance. A hybrid robo-consultant may be a better choice if you have complex financial needs.

Tax Optimisation Features

For taxable accounts, tax efficiency is key. Many digital investment advisors feature tax-loss harvesting (TLH), which helps offset taxable gains by selling underperforming assets.

Wealthfront and Betterment provide automatic TLH, while Vanguard focuses on tax-efficient asset allocation. If minimising tax liability is a priority, choose a platform with strong tax strategies.

Compliance, Regulation, and Investor Enforcement

Since robo-advisors operate entirely online, security and regulatory compliance are crucial. Most platforms are SEC-registered Registered Investment Advisors (RIAs) and insured by SIPC, covering assets up to $500,000. Many offer FDIC-insured cash accounts, encryption, and multi-factor authentication to protect investor data.

Conclusion

Digital investment advisors have revolutionised investing, making professional profile planning affordable and hassle-free. Whether you’re after low-cost passive investing, ESG portfolios, or tax-efficient strategies, there’s a robo-advisor that caters to your needs.

By analysing their benefits, customisation options, and fee structures, you can confidently select a platform that aligns with your financial demands. The future of investing is automated, so embrace the power of AI-based wealth oversight and take full control of your financial health today.

FAQ

What does a robo-advisor stand for?

A robo-advisor is an AI-powered platform that automates investing, profile and tax optimisation, and allocation based on your financial objectives and risk sensitivity.

Which is the best robo-advisor?

It depends on your needs. Vanguard robo-advisor is great for low-cost investing. Charles Schwab’s robo-advisor offers hybrid services, while Wealthfront & Betterment excels in hands-off automation.

Are robo-advisors safe?

Yes, they are SEC-regulated and follow fiduciary standards. Most are SIPC-insured (up to $500,000) and provide bank-level encryption & fraud protection.

Can you lose money with a robo-advisor?

Yes, investments are subject to market shifts. While allocation and automation help manage risk, returns are not guaranteed.