What is RSI in Crypto? – Indicator Explained

Cryptocurrency is, without a doubt, a breakthrough economic innovation. In recent years, traders’ interest in cryptocurrency has been growing due to high volatility and mostly deflationary dynamics, and traders have begun to think about what fundamental and technical analysis tools can be applied to the young cryptocurrency market.

Regardless of the strategy chosen by the trader, trading on the exchange generally follows the same algorithm: before opening a trade, it is necessary to assess the probability of reversal or continuation of the trend and determine the moment of entry. Only then an order can be placed. The final result depends on the accuracy of market research before entering the trade. It is necessary to clearly understand how the rate of any particular cryptocurrency will change.

In addition to fundamental analysis, which includes the study of political and economic news, the crypto trader performs a technical analysis. It is based on the study of cryptocurrency quotation history. The rate dynamics are believed to be cyclical, and the growth and decline in demand are regularly repeated.

There are special mathematical indicators for technical analysis, which help a trader predict the price dynamics. All the basic indicators are calculated automatically in the trading platform. For traders’ convenience, they are located directly on or next to the rate chart. Among the wide variety of indicators available for analysis, one of the most popular is the RSI indicator.

This article will explain what the RSI indicator is and how it works. We will also look at the formula for calculating this indicator, analyze its chart, and learn what signals it can give when trading crypto. You will also learn the advantages and disadvantages of this indicator and how to use it correctly in crypto trading.

What is RSI and How Does It Work?

RSI (Relative Strength Index) is a technical analysis indicator that shows the ratio of positive and negative changes in the price of a financial instrument. It is one of the most common technical indicators. Investors like to use it because it is relatively easy to calculate, and it is free from many significant drawbacks of other oscillators, such as the influence of old data (like Momentum) or the complexity of interpretation (like MACD).

The Relative Strength Index was developed by J. Welles Wilder, Jr. and presented in his book “New Concepts in Technical Trading Systems” in June 1978. The tool has gained popularity largely due to its simplicity of interpretation and the quality of its signals. The entry points produced by this indicator alone and together with other indicators show a very good risk-profit ratio in volatile and trending markets.

What is this relative strength in itself? Wilder used this term to call the ratio of the average price increase to the average price decrease over a period of time. This value allows you to estimate whether the buyers or sellers had a stronger influence on the price in the selected period and suggest future developments. To calculate the relative strength, we select all the candlesticks in the selected time frame, which showed a higher close than the previous candlestick, and determine the average value of the growth using the exponential moving average formula. A similar operation is performed for the candlesticks that closed lower than the preceding one. The ratio of these two values will give the value of relative strength (RS).

Oscillator RSI, as noted earlier, fluctuates in a certain corridor between the maximum (100) and minimum (0) values. It works on the speed of price changes, displaying the results in the above range. The greatest effect of the oscillator is observed when it is near its extremums.

The range from 70 to 100 is an overbought zone, while 0 to 30 is an oversold zone. When the RSI indicator reaches the first range, a price decline is expected. The option of staying in the corridor from 0 to 30 signals further price growth.

It should be noted that the 30 and 70 boundaries should not be taken as standard. Some experienced traders who use the RSI indicator in their trading strategies advise changing these values to 20 and 80, especially when the market is dominated by a pronounced bullish or bearish trend. Then, thanks to these limits, entry into the market is carried out more correctly.

RSI Chart, Calculation Formula and Trading Signals

In this chapter, we will talk about the subtleties of the technical part of the RSI indicator. Let’s start with the chart.

RSI Chart

Graphically, the RSI inductor is displayed as an oscillator with a scale of values from 0 to 100. Thanks to the exponential method of averaging and the formula for calculating the indicator, price movements are projected onto the chart with a scale of 0 to 100, clearly showing the true value of each price change.

The direction of the indicator’s changes always coincides with the direction of the asset’s price changes. This gives traders the opportunity to look at trend lines, support, and resistance levels not only on the price chart but also on the RSI chart. Such redundancy helps traders sift out false trend-following signals and not miss accurate ones.

Suppose the RSI chart, for example, clearly identifies the support line at 70. In that case, we are dealing with a steady upward trend because even with the price decline, the ratio of upward movement to downward movement does not fall below the ratio of 70:30.

RSI Formula

When calculating RSI, average upward price movements are correlated with average downward price movements. When averaging positive and negative price movements, exponential smoothing is used. Exponential smoothing is a method for calculating a weighted average for the period n, in which the last value is given a weight equal to 1/n, and the remaining weight (n-1)/n is given to the previous moving average value.

When using exponential smoothing, only the final direction of the last change is taken into account. That is, if crypto-asset quotations grew today, this growth would be taken into account when calculating the average value of growth, and when calculating the average value of decrease, the change is considered equal to zero. By means of simple recalculation, the ratio of average movements in the result value of the indicator falls into the range from 0 to 100.

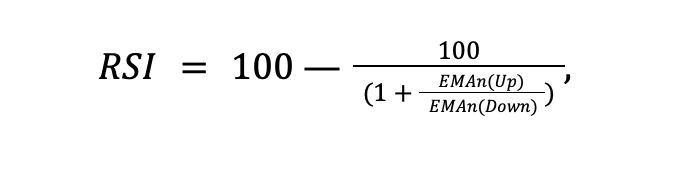

The formula for calculating the RSI indicator is depicted below:

Where:

EMAn(Up) – the average price growth for the period n, smoothed exponentially,

EMAn(Down) – the average price decrease for the period n, smoothed exponentially.

In addition, the oscillator’s universal value scale from 0 to 100 makes it possible to assess the overall strength of the trend, as well as the current oversold or overbought level of the instrument. Thus, if RSI equals 50, the average value of price growth has equaled the average value of price decrease. If RSI fluctuations range from 30-70 to 15-65, it indicates a downtrend.

RSI Trading Signals

Thanks to the RSI indicator you can get a signal to buy or sell in several ways, which can be grouped as follows:

1) Divergence

The main signal to trade is the so-called divergence between the price of an asset and the RSI chart. Divergence is observed when the instrument price reaches new highs or lows while the RSI value is lower or higher relative to previous records, respectively. For example, when the price breaks records and the oscillator’s value is lower than the previous high, this is an example of bearish divergence. A bearish divergence indicates a possible upward price reversal to a downward price reversal.

A bullish divergence can occur when the price reaches a new low, and the RSI exceeds its previous low. This can be a signal that prices are turning from downward to upward. It is important to remember, however, that a divergence break only strengthens the trend.

To understand how divergence works, imagine you are climbing a hill. If you are walking up the hill and the slope becomes more gentle, it could mean that you will soon reach the top and then begin to descend. But while you keep going uphill with each step (the price keeps going up), your elevation gain will be smaller with each step (the indicator value decreases).

2) Overbought and oversold

It is believed that the indicator above 70 means that the instrument is overbought, and below 30 is considered oversold. In other words, those who hold this view believe that if RSI is above 70, the instrument is too expensive, and it should start selling soon. Also, if RSI is below 30, the asset is too cheap, and buying should begin soon.

However, according to the RSI formula, the too-high or too-low value of the indicator indicates that the up or down movement prevailed over a certain period. It can only indicate the strength of a trend but does not necessarily indicate that a price change is imminent. In addition, the 30 and 70 levels are completely arbitrary. The real stable variation of the indicator values is better to determine statistically. In practice, it usually differs from the 30-70 range.

Nevertheless, the return from the overbought or oversold zone can serve as a trading signal. If the indicator value exceeds the upper oscillation range but returns to the range, it can serve as a sell signal. For example, the statistically averaged RSI fluctuation range was between 30 and 50. After that, the RSI fell below 30 — it entered the oversold zone. When the indicator rises above 30 again, RSI will return from the oversold zone, which could serve as a buy signal. The opposite is the return signal from the overbought zone.

3) RSI 50 Crossing

As follows from the logic and calculation formula, if the indicator crosses the 50 levels, an average movement, either up or down, becomes predominant. Such crossing may indicate the beginning of a trend. If the indicator crosses the level of 50 from below and shows a steady exceeding of this level, it is possible to talk about an uptrend. On the contrary, if the indicator crosses level 50 downwards and stably remains below this level, there is a possibility of a downtrend.

RSI indicator’s Advantages and Disadvantages

Now that you know what an RSI indicator is and how it works, it is important to consider what advantages and disadvantages it has.

Advantages

This indicator boasts a large set of advantages. We will consider the main ones.

– Versatility

One of the first advantages worth mentioning is that the RSI indicator helps the trader to use it to determine both strengths and weaknesses in any market in which the indicator is placed within any timeframe. This means that one can immediately see if a particular market is getting stronger or weaker at any given time in the current charts.

This is important because market strength is usually the main indicator of how far the market trend can go or whether a market reversal occurs.

– Accessibility

There is a wide variety of trading platforms. Each platform has its own features; however, as a rule, it offers the same indicators available for analysis. RSI indicator is one of the most popular and widely used not only in crypto trading but also in trading with other financial instruments and assets. Because of this, no matter what platform a trader is trading on, he can be sure that he will be able to find this indicator among many others.

– Easy setup

It is not easy for beginners to understand the abundance of information and tools which are necessary for both technical and fundamental analysis, as well as for the trading process itself. The RSI indicator is easy to use and does not require any outstanding knowledge in trading to be set up. As mentioned earlier, without exception, all trading platforms allow you to use it to analyze the price movements of financial assets. It is enough to find the indicator in the list of all available indicators and apply it to the chart.

– Flexibility

This indicator is rightfully considered one of the essential elements of any trading strategy, the use of which is recommended to all traders, without exception. As a rule, most traders use several tools and indicators to analyze asset price movement, its trends, and other parameters. RSI indicator can be used in conjunction with other indicators, allowing for deeper analysis of price movement, and separately, thereby allowing you to focus on specific indicators of the asset.

Disadvantages

Like any other tool (indicator) that allows a complete analysis of the price movement of a financial asset in the course of trading, the RSI indicator has its disadvantages.

– Signals Inaccuracy

The most significant disadvantage of this indicator is the lag of signals. Based on the formula of RSI, it is a lagging indicator. It was originally developed for the daily timeframe, so it usually shows many false signals on lower timeframes. With strong price jumps and high volatility, the chart line can stay in the overbought or oversold zone for a long time. The information will prove inaccurate, leading to losses for the trader. Experts advise using RSI on a calm market.

You should compare the values of different timeframes for a more reliable point of entry into the market on the RSI indicator. While a bearish signal may be formed on the hourly time frame chart, the 4-hour chart may be oversold. Therefore, it is advisable to choose the entry point when the indicator on the two-time frames gives a signal in the same direction.

RSI Setup and Recommendations for Use

Like any technical indicator, RSI can be adjusted for a specific instrument. According to the formula, the only parameter for adjusting the indicator can be the duration of the averaging period. Most often, RSI is used with an adjustment for 14 trading days. Increasing the averaging period reduces the number of false signals. However, due to some signal lag, the efficiency of profitable transactions can decrease.

In addition, the signal of level 50 crossing is better used for opening trading positions, i.e., buying securities. In this case, the indicator can be adjusted to a longer range, for example, for 21 days. Divergence and the return of the indicator from the oversold or overbought zone are recommended for partial closing of positions, i.e., selling the assets. You can adjust the indicator more sensitively by reducing the averaging period, for example, to eight or nine days.

The book “New Concepts in Technical Trading Systems” initially offers several options for using this market tool. And below, we will consider the most basic and widespread of them.

- The first way is to visually identify graphical shapes on the scale — triangles, pennants, flags, rectangles, etc. They signal the continuation or reversal of a trend. Many professional traders are skeptical of this methodology, but it has its followers.

- The next is to analyze the peaks and troughs that form above the 70 levels and below the 30 levels, respectively.

- Using RSI to determine support and resistance levels. In the classic version, these are overbought and oversold lines of 70 and 30. But you can also draw trend lines by connecting peaks and troughs using charting tools.

Conclusion

RSI is one of the leading technical analysis indicators, and almost all crypto experts agree that it is still valuable and relevant as a provider of trading signals. When used competently and interpreted correctly, it becomes an effective tool for any trader. It is a universal means of determining the trend’s strength, allowing you to trade steadily and confidently. The success of trading on RSI is directly dependent on the tools that work together with it. Together with the right indicators, RSI forms an effective system, which can be improved by changing the parameters of the instruments.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer