What is Staking and How Does it Work?

Articles

Cryptocurrency investors now frequently use staking to increase their holdings without having to sell their digital assets. Staking can be thought of as the cryptocurrency equivalent of keeping money in a bank savings account.

The difference is that the bank gives out your money to others, splitting the interest with you. When you stake your cryptocurrency, you encrypt your digital assets to take part in preserving a blockchain network’s security and receive incentives for your contribution.

It can also be compared to mining but requires fewer resources. Supporting a blockchain network’s security and functionality entails keeping money in a cryptocurrency wallet in this way. However, even if all you’re after is earning some staking benefits, you still need to know how and why the system functions the way it does.

KEY TAKEAWAYS

- Like earning interest on money saved in the bank, staking is blockchain-based for saving and earning passive income on your crypto.

- Understanding staking requires understanding proof of work (PoW) for bitcoin mining, proof of stake (PoS) for validators, and then delegated proof of stake (DPoS), which is a more advanced PoS.

- Staking gives passive income, uses low computational power, and is carried out at crypto exchanges with options for cold staking.

- Staking comes with risks like crypto volatility, exchanges can be hacked, and your cryptos are not fully within your control.

- Staking can be carried out on centralised and decentralised exchanges, including Binance, Bybit, OKX, Kraken, and Kucoin.

How Does Staking Work?

You can “stake” some of your cryptocurrency holdings to earn a percentage-rate reward over time, provided that the cryptocurrency you possess permits it (current options include Ethereum, Tezos, Cosmos, Solana, and Cardano). During staking, your cryptocurrency is put to work by the blockchain for a specified period of time, for which you earn rewards.

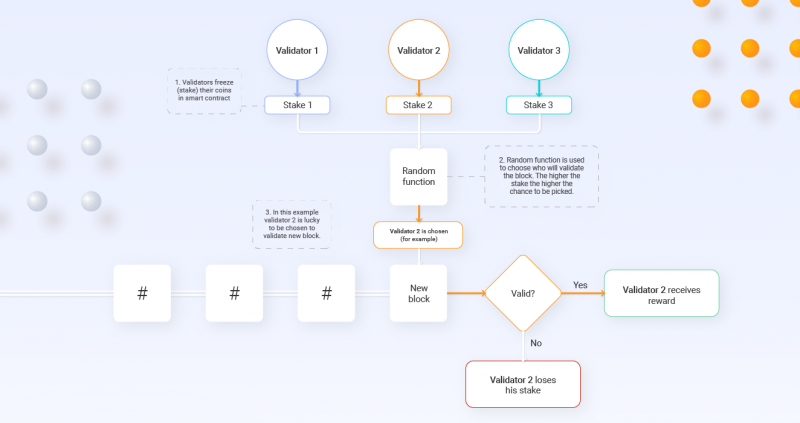

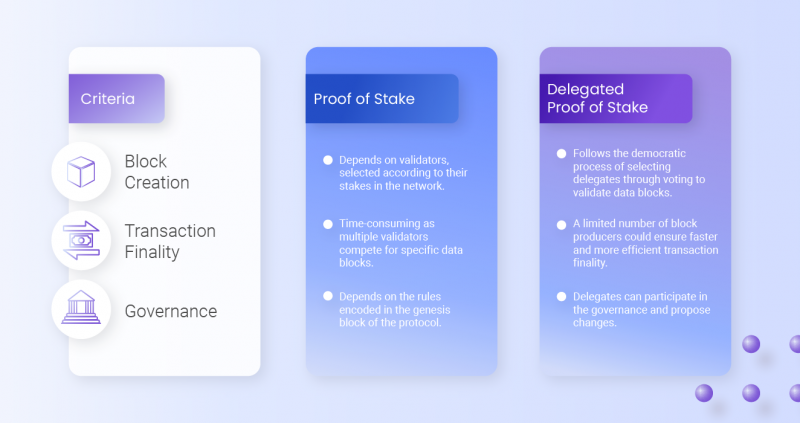

Proof of Stake is a “consensus mechanism” used by cryptocurrencies that support staking to guarantee that all transactions are secure and confirmed without the involvement of a third-party or payment processor. You can participate in that process by choosing to stake your cryptocurrency.

What Benefits Does Staking Offer?

1. To create extra Income and great rewards

Staking enables asset diversification and lowers transaction costs on the blockchain. It is the most effective way to earn additional money if you consider your options. Many people have increased their net worth by investing in and cashing out on cryptocurrency. They also reinvest their funds by purchasing additional cryptocurrencies to increase their profits.

2. Carried out at exchanges

Cryptocurrency staking is simple to do through an exchange. The three most reliable exchanges that provide cryptocurrency staking are KuCoin, Binance, and Coinbase. In contrast to them, other exchanges let you stake too.

3. Less Energy is consumed

Staking uses less energy than mining since it only requires less processing power. Undoubtedly, the cryptocurrency space gained ground when the proof-of-stake mechanism was introduced. Reducing the substantial energy consumption associated with mining has prevented environmental disruption.

4. Cold staking is straightforward and safe

The act of staking on a wallet that is not connected to the Internet is called “cold staking.” A hardware wallet may be used for this; however, an air-gapped software wallet may also be used.

Users can stake on networks that enable cold staking while keeping their money safely offline. It’s important to note that the shareholder will stop earning rewards if they remove their money from cold storage.

Large stakeholders wanting to secure the greatest possible safety of their funds while assisting the network will find cold staking especially valuable.

How To Stake Your Crypto

Staking your cryptocurrency may look difficult initially, but it’s a straightforward procedure once you get the hang of it. Follow these steps to stake cryptocurrency:

1. Purchase a PoS Cryptocurrency

For you to stake, a cryptocurrency that uses proof-of-stake to validate transactions is necessary. Polkadot (DOT), ethereum (ETH), solana (SOL), and cardano (ADA) are some of the popular PoS coins you can purchase for this purpose.

2. Transfer Your Cryptocurrency to a Wallet On the Blockchain

Your cryptocurrency will be accessible in the exchange where you bought it. Most exchanges have different staking packages, and you can choose the most convenient one.

You can also store your crypto in the most convenient blockchain wallet; you can get a software wallet by downloading it or going for a hardware wallet.

Choose the option to deposit cryptocurrency after your wallet opens, and choose the type of cryptocurrency you want. A wallet address will result from this. Go to your exchange account and select the “Withdraw Crypto” option. To move your cryptocurrency from your exchange account to your wallet, copy and paste that address and authenticate the withdrawal process.

3. Join a Staking Pool

A staking pool is another staking mechanism on most exchanges, although it works based on the kind of cryptocurrency you’re adding to the pool.

A staking pool comprises combined crypto capital added by different investors with the hope of getting rewards.

Meanwhile, when it comes to deciding on the right staking pool, it is important to always look out for the following:

Minimal fees

Most staking pools charge a modest percentage of staking rewards ranging from 2% to 5%; however, these fees vary depending on the crypto.

Reliability

Always use staking pools with good servers to avoid downtime, challenges, and investment loss.

Size

Smaller pools are less likely to be selected to validate blocks, but when they are, they can pay higher rewards because they don’t have to split rewards as widely.

You want a pool that is manageable and might break down. The biggest pools may oversaturate because some cryptocurrencies have a cap on the rewards that a pool can receive. Mid-size pools are ideal for the majority of investors.

How Are Staking Rewards Calculated?

There is no universal template when calculating staking rewards because it varies with each blockchain.

Some are updated on a block-by-block basis while taking into consideration various factors like:

- Inflation rate

- The number of coins the validator is staking

- The duration of time in which the validator has staked

- The amount of crypto’s staked on the network

- Other factors

Staking payouts on several other networks are calculated as a predetermined percentage. These incentives are given to validators as a form of inflationary compensation. Coin usage as a form of currency may grow due to inflation, encouraging consumers to spend their coins rather than hold them.

However, with this methodology, validators may determine the precise staking incentive they will receive.

For some, a regular payout schedule may be preferable to a stochastic probability of obtaining a block reward. Furthermore, the fact that this information is public could encourage more people to participate in staking.

Risks Involved in Crypto Staking

Cryptocurrency staking has several advantages for passive income generation, but it also carries several risks that you should be aware of. The following are the important ones:

- Cryptocurrency values are quite erratic. They lose value quickly as a result. When your assets decline significantly, you can receive very little interest, which could result in huge losses.

- You should know that some of the best staking coins will only be locked briefly when you consider using them. You won’t be able to use these assets in any way during this interim.

- Although you can unstake your cryptocurrency, some services require at least seven days. If you need the money right away, you can’t get it. Therefore, it is recommended to pick a platform that allows for rapid withdrawals and adjustable staking

What is Proof-of-Stake (PoS) Proper?

You are likely familiar with proof-of-work (PoW) if you understand how Bitcoin functions. In this system, miners keep track of transactions in blocks and compete to solve challenging mathematical puzzles, increasing computing power and the likelihood that the next block will be added to the chain.

Proof of work has, over time, shown itself as a very reliable tool for fostering decentralised consensus. Its extensive use of arbitrary computing is an issue. The only objective of the problems miners are trying to solve is safeguarding the network, which justifies the excess computation.

Proof-of-stake (PoS) was eventually birthed on the needs and possibility of sustaining a decentralised consensus without incurring a high computational cost.

Proof-of-stake (PoS) is a consensus algorithm in which users can lock coins (their “stake”), and the protocol randomly chooses one of them at predetermined intervals to validate the following block. The likelihood of getting chosen is typically inversely correlated with the number of coins; the more coins locked up, the better the chances.

In contrast to proof of work, where participants are chosen based on their capacity to solve mathematical puzzles, proof of stake does not depend on this. Instead, it is based on the number of coins they are staking.

However, some would counter that the production of blocks via staking allows blockchains to scale more easily (Scalability). This is one of the factors behind the Ethereum network’s switch from PoW to PoS in a series of technical updates known as ETH 2.0.

What is Delegated Proof-of-Stake (DPoS)?

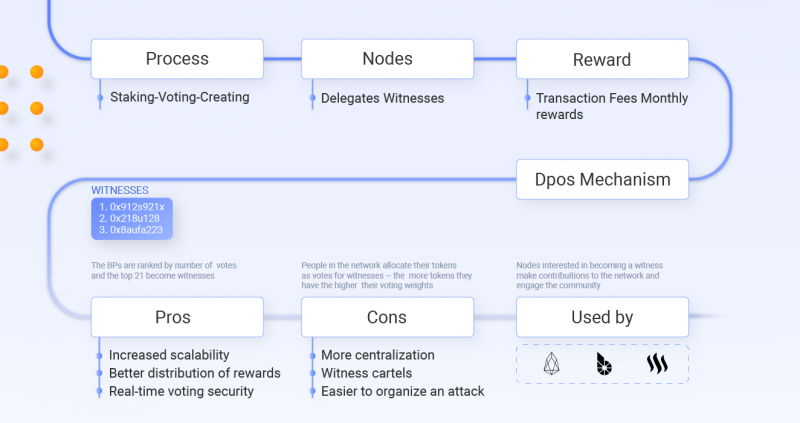

Daniel Larimer created Delegated Proof-of-Stake (DPoS), an alternative version of this mechanism, in 2014. Initially used as a component of the BitShares blockchain, other networks quickly adopted it. These include the Larimer-made Steem and EOS, among others.

With DPoS, users can commit their coin balances as votes, and the number of coins held will determine the strength of each vote.

The delegates that operate the blockchain on behalf of their electorate will always ensure security and consensus are chosen using these votes.

The staking rewards are typically given to these elected delegates, which subsequently divide a share of the rewards in proportion to their constituents’ efforts.

Consensus can be reached using the DPoS model with fewer validating nodes. As a result, it frequently improves network performance. Since the network depends on a small, chosen number of validating nodes, it can lead to a lesser level of decentralisation.

These validating nodes handle the operations and overall management of the blockchain. They take part in defining important governance characteristics and reaching consensus.

Differences Between PoS, PoW, and DPoS

The major difference between the proof-of-work and proof-of-stake is that the proof-of-work relies on the crypto mining process while the proof-of-stake relies on crypto staking.

The consensus mechanisms used by different blockchain systems include proof-of-stake and delegated proof-of-stake. They both vary in the following ways.

DPoS is often considered a more democratic and effective PoS since delegates and witnesses are voted in to create blocks. A Proof-of-Stake (PoS) user creates blocks depending on their precise currency stake and participation in the blockchain network.

Blockchains That Use PoW/PoS

Over a hundred blockchain projects use proof of work (PoW), although Bitcoin is the most well-known. Other PoW blockchain platforms include Bitcoin Cash, Dogecoin, Monero, Litecoin, Ethereum Classic, Dash, etc.

On the other hand, proof-of-stake blockchain projects have more acceptance because of their many technical and economic benefits. Some of the major proof-of-stake blockchain projects are ETH 2.0, BNB, Flow Token, Akash Network (AKT token), Tezos, Now and Decentral Games.

Blockchains That Use Delegated Proof-Of-Stake (DPoS)

Many well-known blockchain networks use DPoS consensus, but the three main ones are EOS, TRON, and Cosmos.

1. EOS

All delegates are referred to as block producers on the EOS network. After two minutes and six seconds, an election is held. After staking some EOS tokens, a user can vote for up to 30 candidates. The election then chooses exactly 21 candidates. Each block maker must have hardware that meets the minimal standards of at least 8gig ram.

2. TRON

Super Representatives are the name given to delegates on this network. One can vote for five SR candidates in each election by staking TRON tokens. Every 24 hours, elections are held. Witnesses are picked from among the top 27 applicants.

3. COSMOS

Delegates on the Cosmos network are known as Validators. A hundred of these validators can confirm the transactions that take place. Eventually, Cosmos seeks to decentralise its blockchain even more by raising the number of Validators to 300.

Top 5 Best Staking Platforms

Haven covered the essential staking details; I’ll discuss some of the finest staking platforms and explain why you should pick them. Finally, you will have the option to choose the crypto-staking platform of your choice.

1. Binance

The largest cryptocurrency exchange in terms of daily exchange volume is Binance. It’s also among the top platforms for staking cryptocurrency, supporting over 100 staking coins at zero fees.

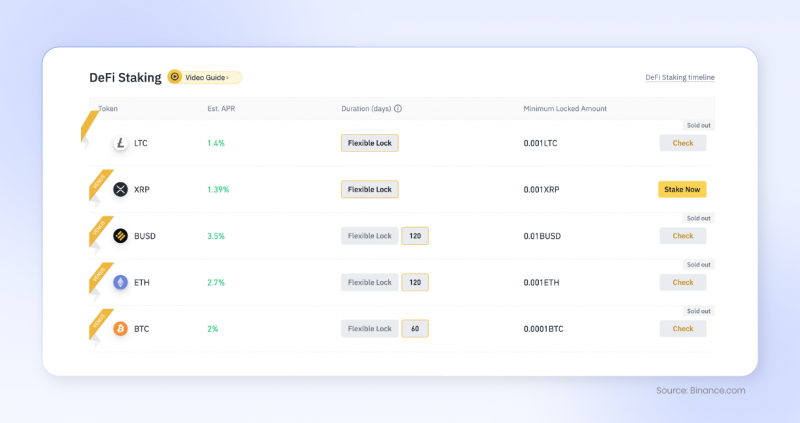

Staking on Binance can be either locked or flexible. As the name implies, locked staking is focused on a predetermined bond period, whereas flexible staking offers greater freedom at the expense of lower staking benefits. With locked staking, flexible withdrawals are possible, but you will forfeit your earnings.

Although most coins allow for a ten or 15-day staking period, Binance’s locked staking often retains our assets for a minimum of 30 days. As well as being safer, they frequently demand greater annualised percentage yields (APY).

The flexible locking period also comes with Binance Defi staking; the key benefit of Defi staking is that you don’t need to keep an on-chain wallet up to date for each project you stake in. Then there are bonds with incredibly short maturities—the majority are 24 hours.

Binance, though, could be clearer to some people. In such a scenario, you can stake using their Trust Wallet, which is officially supported.

2. OKX

With more than 20 million customers worldwide and more than 340 coins available, OKX is a major cryptocurrency exchange. The exchange is an excellent place to purchase many of the most popular cryptocurrencies for staking because it has some of the lowest trading fees with zero minimum withdrawals.

Crypto staking is available through OKX at rates as high as 70% APY. Popular coins, including Ripple, Shiba Inu, Litecoin, Dogecoin, Polygon, Avalanche, Polkadot, and others, are available for users to stake.

The possible staking period for most cryptocurrencies ranges from 15 to 120 days. Even more flexible staking features on some coins allow users to stake their tokens without locking them away. Staking Ethereum 2.0 is offered at a rate of 4.09% APY.

3. Kraken

CoinMarketCap currently lists Kraken as the fourth-largest cryptocurrency exchange. With unstaking support for most crypto coins, Kraken allows staking 12 crypto assets. Unstaking refers to taking your staked money out to trade with or withdraw.

Furthermore, you immediately receive staking incentives from Kraken, which pay out depending on the coin once every week or more. To increase your earnings, you can stake your rewards even more.

On-chain staking is Kraken’s name for this conventional method. However, they also offer off-chain staking, which is only available in a few nations. Last but not least, Kraken doesn’t charge any extra fees for staking or un-staking.

4. Defi Swap

Defi swap is a new decentralised platform for crypto exchange and farming. It was mainly created to make using Defi Coin easier for staking (DEFC). The platform offers four stake periods: 30, 90, 180, or 365 days. Earnings range from 30% to 75% APY, depending on how long you’re willing to lock your money.

Using the exchange Defi Swap is the simplest way to obtain Defi Coin. Most significant cryptocurrencies, such as Bitcoin, Ethereum, BNB, and others, are swappable. Defi Swap makes it simple to earn a greater yield on tokens like USDC and USDT by allowing you to buy Defi Coin with stablecoins.

5. KuCoin

Kucoin offers a flexible or soft kind of staking which usually comes without any hard locking period. However, if you want to earn more money, you can also enrol in their fixed-length staking programs.

The redemption period for KuCoin’s soft staking programs is the time between stopping to stake and getting back access to the staked money or incentives.

For example, the Polkadot (DOT) has a 28-day redemption period. Take heart. With most other values lying around a week or even less, that is one of the longest redemption periods.

Although there are minimum requirements for staking, KuCoin is a reputable exchange suitable for those looking for a user-friendly crypto-staking platform.

6. Bybit

ByBit offers additional flexible staking to ease your worries if you’re worried about fixed-term staking. Additionally, it is the ideal location for staking due to the wide selection of premium currencies.

Savings with ByBit allow for staking cryptocurrencies like BTC, ETH, USDT, Bit, SOL, DOT, etc. Additionally, there were several time-bond staking offers, such as those for BUSD, ATOM, USDC, ADA, DAI, etc.

Daily yields on flexible terms are automatically deposited into the customer account. Compound staking is absent; therefore, you’ll have to reinvest manually if you want to gain money continuously.

Regardless, ByBit staking is one of the most flexible options available in the cryptoverse, giving market-leading APYs.

Conclusion

Staking cryptocurrency expands the options available to everyone who wants to take part in the upkeep and administration of blockchains. Furthermore, storing digital assets is a simple way to make money. The barriers to entry into the blockchain ecosystem are lowering as staking becomes more accessible.

But it’s important to remember that some risks are associated with staking. Always DYOR and use top-notch wallets, like Trust Wallet, as smart contracts that lock up funds can be prone to bugs.