What Is Zero Spread Forex Broker And How Does It Work?

Being successful in the FX market frequently requires carefully considering transaction costs alongside trading strategies. Picture a scenario where trades can be executed without the concern of the bid-ask spread — this is precisely the advantage provided by zero spread Forex brokers.

By removing spreads, these brokers deliver exceptional cost clarity and accuracy for traders. However, how do these brokers operate, and which traders are likely to gain the most from their services?

This article explains the role of the zero spread Forex brokerage model in trading, how it makes money, and who should use it to optimise their trading strategies.

Key Takeaways

- Zero spread Forex brokers eliminate the bid-ask spread, offering trades at identical buy and sell prices.

- Zero spread FX broker accounts benefit scalpers, day traders, and high-volume traders who rely on precise execution and minimal transaction costs.

- While spreads are eliminated, traders may face additional fees, such as higher commissions, swap rates, or account maintenance charges.

What is a Zero Spread Forex Broker?

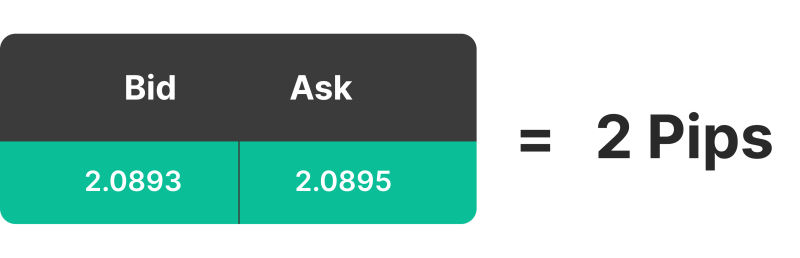

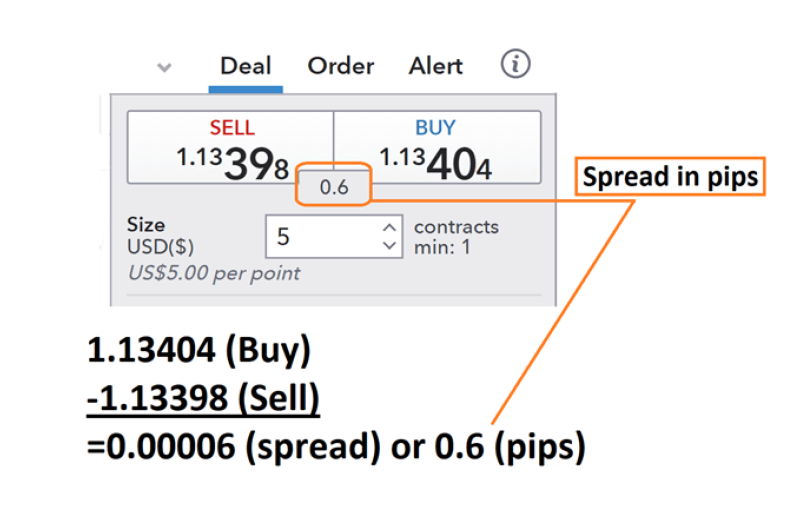

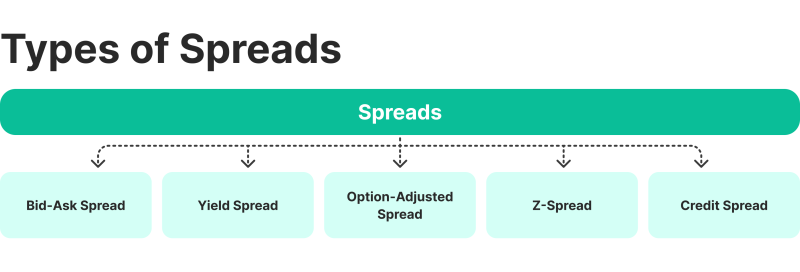

A zero spread Forex broker is a type of broker that eliminates the difference between the bid (buy) price and the ask (sell) price on trading instruments, offering spreads as low as 0.0 pips.

This means traders can enter and exit trades at the same price level, reducing transaction costs. Instead of earning from spreads, these brokers usually charge a commission per trade or implement other fees to compensate for the absence of spreads. This setup appeals to traders prioritising precise cost calculations, such as scalpers and day traders.

Zero spread accounts are particularly advantageous for trading highly liquid assets like major currency pairs, where even slight price changes can impact profitability. By removing the variable cost of spreads, traders gain better cost predictability, making it easier to calculate profits and losses.

However, while these accounts offer transparency, they often come with conditions like higher minimum deposits or fixed commissions per lot traded.

Zero spread accounts offer cost clarity, reducing the breakeven point to just the commission. This makes them ideal for high-frequency traders and scalpers.

Zero Spread Trading Mechanism

Zero spread brokers generally function by accessing liquidity from multiple liquidity providers (banks, financial institutions, and large market participants) who provide bid and ask prices. These brokers aggregate the best possible prices and offer them to traders without adding a markup to create a spread. This allows traders to execute trades at prices as close as market rates.

However, these brokers charge a fixed commission per trade in place of spreads. For example, instead of earning a profit from a 2-pip spread, the broker may charge $3–$10 per lot traded, depending on the currency pair and market conditions. This commission is a predictable cost for traders and ensures that the broker earns revenue even without a spread.

Strong Points of Zero Spread Forex Brokers

Zero spread Forex brokers provide several advantages, especially for traders prioritising cost efficiency and precise trade execution. Below is a detailed explanation of the key benefits:

Lower Transaction Costs

With zero spreads, traders eliminate the need to pay the difference between the bid (buy) and ask (sell) prices. This can lead to significant cost savings, particularly for high-frequency traders and scalpers who execute multiple trades daily. By removing the spread, the cost per trade becomes significantly lower, allowing traders to allocate more capital to their strategies rather than transaction fees.

This benefit is particularly evident when trading major currency pairs, such as EUR/USD or USD/JPY, where price fluctuations are often small. In these scenarios, traders can profit from even minor market movements without being burdened by the additional cost of spreads.

Transparent Pricing

Zero spread accounts offer a high level of transparency in pricing. The primary expense is the fixed commission charged by the broker. Traders can easily calculate their trading costs and plan their strategies more effectively without worrying about fluctuating spreads or hidden fees.

This clarity is especially valuable for beginners and experienced traders, as it simplifies profit and loss calculations and clarifies the cost structure. Predictable pricing ensures traders can focus on their market analysis and execution without being distracted by unexpected charges.

Ideal for Scalping and Day Trading

Scalping and day trading strategies rely on frequent trades and the ability to capture small price movements within short time frames. Zero spread accounts are highly beneficial for these trading styles, as they reduce the breakeven point required for trades to become profitable. When spreads are eliminated, traders can enter and exit positions more efficiently without overcoming the initial spread cost.

This enables them to take advantage of short-term market opportunities and make their strategies more effective. The cumulative savings from zero spreads can be substantial for scalpers, who may execute dozens or hundreds of trades in a single session.

Precision in Execution

Forex brokers with zero spread ensure that trades open and close at precise price levels without the additional cost of spread fluctuations. This precision is beneficial in fast-moving markets where prices change rapidly, and wide spreads may distort the expected trade outcomes.

For traders who rely on accurate execution, such as those using algorithmic or automated trading systems, zero spread accounts provide a reliable framework for consistent performance. Eliminating variable spreads ensures that trades are executed at the intended prices, improving overall trading accuracy.

Better for High-Volume Traders

Traders who execute large orders or frequently trade in significant volumes benefit greatly from zero spread accounts. The absence of spreads removes the cumulative cost of the bid-ask difference, which can otherwise add up quickly for high-volume trades. Instead, traders pay a fixed commission per trade, which becomes predictable and manageable.

Additionally, many brokers offer tiered commission structures, where the per-trade commission decreases as trading volumes increase. This makes zero spread accounts cost-effective for professional traders and institutional investors handling substantial trading volumes.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

How Do Zero Spread Forex Brokers Make Money?

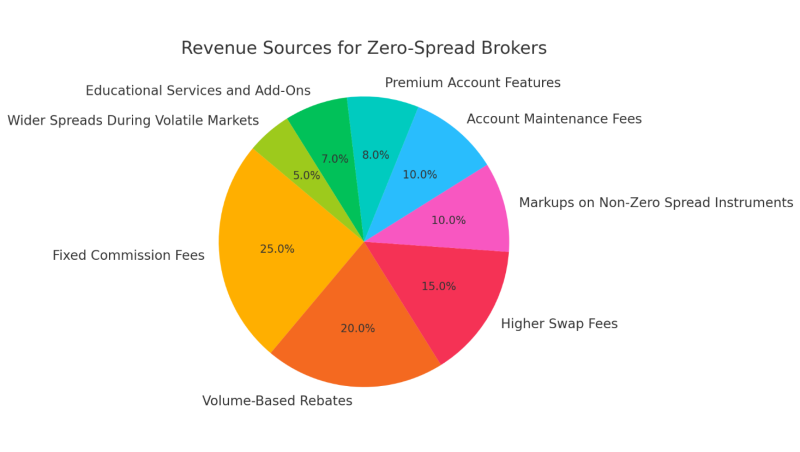

Zero spread FX brokers attract traders by offering no difference between the bid and ask prices, meaning trades can be executed without paying a spread. While this eliminates a common cost source for traders, brokers still need to generate revenue to sustain their business. They achieve this through alternative mechanisms, including commissions, fees, and partnerships with liquidity providers.

Below is a detailed explanation of how zero spread brokers make money.

Fixed Commission Fees

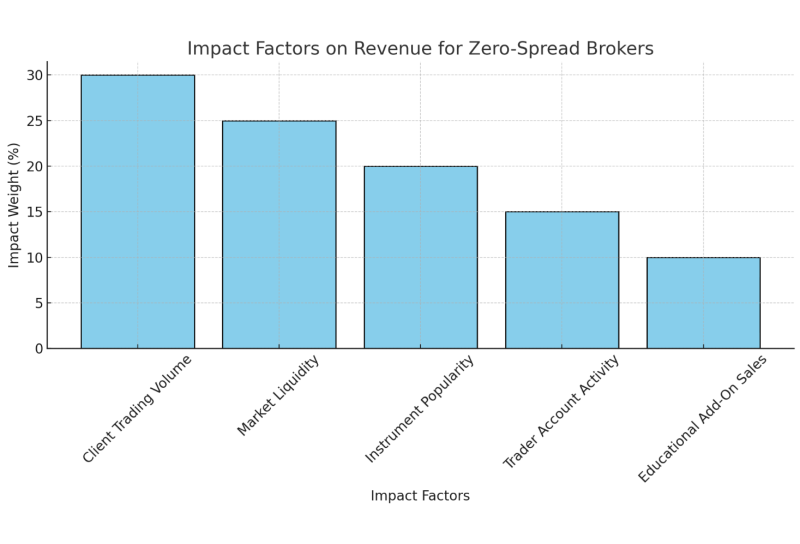

Zero spread brokers generate revenue primarily by charging a fixed commission per trade, replacing the revenue they typically earn from spreads. For instance, brokers may charge a flat fee for every lot traded instead of marking up the bid and asking prices to create a spread.

For every transaction (opening and closing a trade), the broker charges a specific commission based on the trade size. For instance, a broker might charge $7 per standard lot (100,000 units of the base currency) traded. The commission is proportional to the trade volume, so larger trades result in higher commissions.

This model ensures the broker earns a consistent and predictable revenue stream, regardless of market conditions or spread fluctuations.

Volume-Based Rebates from Liquidity Providers

Zero spread brokers often collaborate with liquidity providers, such as large financial institutions, banks, or aggregators, to access the best market prices. In this relationship, brokers aggregate and route their clients’ trades to these liquidity providers, who may offer rebates or discounts based on the trading volume generated by the broker’s clients.

The broker benefits from economies of scale. The more trades routed through the liquidity provider, the higher the rebate the broker receives. This incentivises brokers to attract high-volume traders, such as scalpers or institutional clients, to maximise their earnings.

Rebates provide an additional revenue stream without directly charging traders beyond the fixed commissions.

Higher Swap Fees (Overnight Charges)

While zero spread accounts reduce or eliminate trading costs associated with spreads, brokers often recoup lost revenue by increasing swap rates — the fees charged for holding a position overnight. Swap rates reflect the interest rate differential between the two currencies in a Forex pair, but brokers may add a markup to these rates.

Traders who leave positions open past the daily market rollover time are charged a swap fee. For example, if a standard swap rate for a currency pair is $1.50, the broker may charge $2.00, earning an additional $0.50 per lot.

Swap fees are an ongoing revenue source, particularly for traders who hold positions over multiple days.

Markups on Non-Zero Spread Instruments

Zero spreads are often limited to highly liquid instruments, such as major currency pairs. For other instruments, such as exotic currency pairs, indices, or commodities, brokers may apply traditional spreads or add markups.

For instruments not covered under the zero spread model, brokers can apply standard spreads or increase the bid-ask difference slightly to earn a profit on each trade.

By diversifying their offerings, brokers ensure they earn from instruments where spreads remain applicable, even while advertising zero spread accounts for popular assets.

Account Maintenance Fees

Some brokers charge account maintenance fees or require traders to meet certain conditions, such as maintaining a higher minimum deposit or trading a specific monthly volume, to offset the cost of offering zero spread accounts.

Brokers may charge monthly fees to access a zero spread account or inactivity fees for accounts that fail to meet trading volume thresholds.

Maintenance fees create a steady revenue stream, encouraging traders to stay active and meet volume requirements.

Premium Account Features

Some brokers limit zero spread offerings to premium accounts, which require higher initial deposits or subscriptions to additional services.

To access zero spreads, traders may need to open a premium account with a higher minimum deposit (e.g., $1,000 or more). Brokers might also bundle zero spread accounts with add-on features like VPS hosting, advanced market analysis tools, or exclusive customer support, often for an extra fee.

Premium accounts attract serious traders willing to pay more for enhanced services, creating an additional revenue stream for the broker.

Educational Services and Add-Ons

Some brokers offering zero spread accounts generate revenue by upselling their client’s educational materials, signals, or trading tools. These services are optional but often marketed as essential for successful trading.

Traders may purchase add-ons, such as automated trading systems, market analysis subscriptions, or one-on-one coaching services offered by the broker.

These upsells provide a supplementary revenue stream, often targeting novice traders seeking an edge in the market.

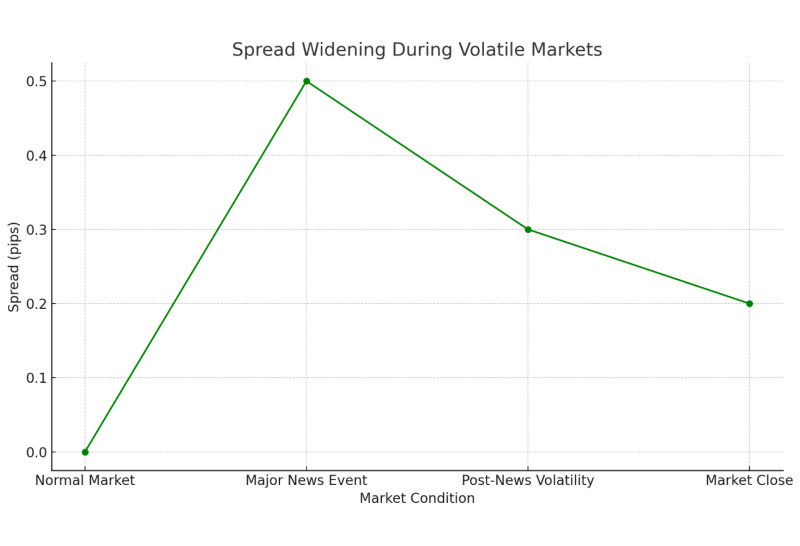

Wider Spreads During Volatile Markets

While zero spread brokers advertise 0.0 pip spreads, this condition is often only applicable during periods of high market liquidity. Spreads may widen temporarily during volatile or low-liquidity conditions, even for zero spread accounts.

Brokers might allow spreads to widen during periods of market uncertainty, such as major news events or after market hours, earning revenue from the widened spreads.

Temporary deviations from the zero spread model can help brokers capitalise on market fluctuations while maintaining their overall offering.

Who Should Use Zero Spread Forex Brokers?

Zero spread Forex brokers cater to specific types of traders who can benefit most from these accounts’ unique cost structure and features. While the elimination of spreads reduces transaction costs, the accompanying fees, trading conditions, and market dynamics make these brokers particularly suitable for specific trading strategies and profiles.

Below is a detailed explanation of who should consider using zero spread Forex brokers.

Scalpers

Scalping involves executing multiple trades within short timeframes to capture small price movements. Since scalping relies on frequent trades, even a small spread can significantly impact profitability. Zero spread accounts are ideal for scalpers because they eliminate the cost of spreads, allowing traders to focus solely on commission fees.

Scalpers benefit because zero spread accounts lower the breakeven point, making trades profitable quickly. Precise execution at the bid and ask prices gives scalpers an edge in highly competitive and fast-moving markets.

Day Traders

Day traders, like scalpers, execute multiple trades daily but usually hold positions for longer durations, such as several minutes to a few hours. Zero spread brokers provide day traders with predictable costs, helping them better manage their strategies.

Day traders benefit from zero spreads because they offer clear cost structures, making calculating potential profits and losses for each trade easier. The absence of spreads ensures that trade costs remain low, even for high-frequency trading within the day.

High-Volume Traders

Traders who execute large orders or frequently trade in significant volumes are well-suited to zero spread accounts. High-volume trading amplifies the cost savings from eliminating spreads, as traditional spreads can add up quickly for large transactions.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

High-volume traders benefit because zero spread brokers often charge lower commission rates for larger trading volumes. This makes trading more cost-effective for professionals or institutional traders. The predictable fee structure allows these traders to better manage large-scale strategies without incurring hidden costs.

Traders Using Automated or Algorithmic Strategies

Automated trading strategies, including algorithmic trading, rely on precision and consistency. These systems often execute trades based on predefined rules and require minimal cost variability to maximise efficiency.

Automated traders benefit because zero spread accounts ensure consistent pricing. This enables algorithmic strategies to perform optimally without interference from fluctuating spreads. Precise execution at zero spreads helps maintain the accuracy of programmed strategies, particularly in high-frequency trading scenarios.

Traders Focused on Major Currency Pairs

Zero spread brokers often offer their most competitive pricing on highly liquid major currency pairs, such as EUR/USD, GBP/USD, or USD/JPY. Traders who focus on these pairs benefit the most from the absence of spreads.

Major currency pair traders benefit because these pairs have high trading volumes and liquidity, making them ideal for zero spread accounts. The minimal price fluctuations in these pairs allow traders to capture profits more efficiently without the added burden of spreads.

Traders Prioritizing Cost Transparency

Zero spread accounts are well-suited for traders who prefer precise and predictable cost structures. The fixed commission model eliminates uncertainties caused by variable spreads, which can fluctuate due to market dynamics.

Cost-conscious traders benefit because knowing the exact trading cost upfront helps them confidently plan strategies. Predictable costs are significant for traders who closely monitor their risk-reward ratios.

Experienced and Professional Traders

Experienced traders who understand the nuances of commission-based trading and the conditions of zero spread accounts can maximise their benefits. Professionals often execute trades in larger volumes and appreciate the cost savings provided by zero spread brokers.

Professionals benefit from leveraging the competitive pricing of zero spread accounts to optimise their trading strategies. Their ability to handle higher account minimums and commissions ensures they can fully exploit these accounts’ benefits.

Traders with Fast Execution Requirements

Zero spread accounts often come with precise and fast trade execution, making them suitable for traders who require minimal slippage or delays.

Traders with fast execution requirements benefit from execution reliability at zero spreads in volatile markets or during news events. Precise pricing ensures that traders enter and exit positions at their intended levels, maintaining the integrity of their strategies.

Conclusion

Zero spread Forex brokers revolutionise trading by eliminating one of the most common costs — spreads—while providing traders with transparency, precision, and cost efficiency. However, they are not one-size-fits-all.

Familiarisation with their fee structures, trading conditions, and unique benefits is crucial to determining whether they align with your trading style. Zero spread brokers can be a game-changer when used strategically, whether you’re a scalper, day trader, or professional.

FAQ

What is a zero spread Forex broker?

A broker offering accounts with no spread between bid and ask prices, replacing spread costs with fixed trade royalties.

How do zero spread brokers make money?

They earn through fixed commissions, swap fees, markups on non-zero instruments, account fees, and rebates from liquidity providers.

Who benefits most from zero spread accounts?

Scalpers, day traders, high-volume traders, algorithmic traders, and those trading major currency pairs benefit from lower costs and precise execution.

Are there hidden costs in zero spread accounts?

Yes, fees like commissions, swap rates, or maintenance charges may apply. Always review the broker’s terms.

Are zero spread accounts suitable for beginners?

They can be, but higher deposits and commissions may not suit small-volume traders.

Recent news