Essential Social Trading Tools Every Forex Broker Should Support

Articles

In the 21st century, even a child can’t imagine everyday life without social networks. The functioning of modern businesses is absolutely unthinkable without online communications and influencers. That’s why no one is surprised that success in FX trading depends not only on skills but also on the tools at one’s disposal.

Social trading has revolutionised the industry, allowing traders to mimic the strategies of seasoned professionals and collaborate within vibrant trading communities. However, to truly taste the power of social trading, traders must use a comprehensive suite of tools tailored to their needs.

This article will explore the essential social trading tools that every FX broker should support, empowering traders to achieve their financial goals.

Key Takeaways

- Social trading has transformed FX trading by enabling individuals to copy the strategies of successful investors and participate in vibrant trading communities.

- Multiple benefits are guaranteed with the integration of social trading tools.

- Essential social trading tools include trade copiers, signal providers, charting software, FX calculators, economic calendars, and trade journals.

Pros of Integrating Social Trading Tools into Your Brokerage Business

Social trading enables traders to imitate the trades of successful investors.

By following established advanced trading techniques and mimicking the actions of experienced traders, individuals can potentially augment their probabilities of success.

Copy trading platforms facilitate this process by providing access to various automated trading strategies, insights, and performance metrics.

Integrating social trading tools into a brokerage business can offer several advantages:

Enhanced User Engagement

Social trading tools allow traders to interact with each other, share insights, and discuss trading strategies. This fosters a sense of community among traders and keeps them engaged with your platform for more extended periods.

Increased Trading Activity

By providing access to social trading features, you can encourage more trading activity on your platform. Traders may be motivated to execute more trades as they observe others’ successful strategies or receive feedback on their own trades.

Access to Collective Intelligence

Social trading platforms enable traders to follow and replicate the trades of successful investors. This access to collective intelligence can be particularly beneficial for novice traders who can learn from experienced peers and improve their trading performance.

Brokerage Differentiation

Integrating social trading tools can help differentiate your brokerage from competitors. Offering unique features that facilitate social interaction and knowledge sharing can attract traders who value community-driven platforms.

Improved Customer Retention

Social trading tools create a more friendly user experience as traders develop relationships with other users and become more integrated into the platform’s community. This can lead to higher customer retention rates as traders are less likely to switch to competing platforms.

Expanded Revenue Streams

Social trading platforms can introduce additional revenue streams for your brokerage business. This could include premium features, subscription-based services, or partnerships with third-party service providers.

Data Insights

By analysing the activity and interactions on your social trading platform, you can gain valuable insights into trader behaviour, preferences, and market trends. This data can inform decision-making processes and help tailor your services to meet the needs of your user base better.

Compliance and Risk Management

Social trading platforms can incorporate risk management features and compliance controls to help ensure that traders make informed decisions and adhere to regulatory requirements. This can mitigate the risk of inappropriate trading behaviour or regulatory violations.

Overall, integrating social trading tools into your brokerage business can enhance user engagement, increase trading activity, differentiate your services, and provide valuable insights while also improving risk management and compliance processes.

One of the first social trading platforms was Collective2, which began offering a copy trading functionality to retail traders as early as 2003.

Essential Social Trading Tools

When it comes to social trading tools for FX brokers, there are several key features and platforms that traders highly value. Here’s a list of some essential social trading tools that every FX broker should consider supporting:

Trade Copiers

Trade copiers are indispensable tools for social traders, enabling the replication of trades from one account to multiple others. Whether you’re a novice trader seeking guidance or an experienced investor managing various accounts, trade copiers streamline the process, ensuring consistent execution across all platforms. With features like the MT5 trade copier, traders can efficiently manage their portfolios and capitalise on diverse copy trading opportunities.

Signal Provider

Signal providers play a crucial role in social trading, offering subscribers valuable insights and trade signals. By subscribing to reputable signal providers, traders gain access to expert analysis and actionable copy trading recommendations, enhancing their decision-making process. From chart patterns to market trends, signal providers provide invaluable guidance, empowering traders to operate confidently in volatile markets.

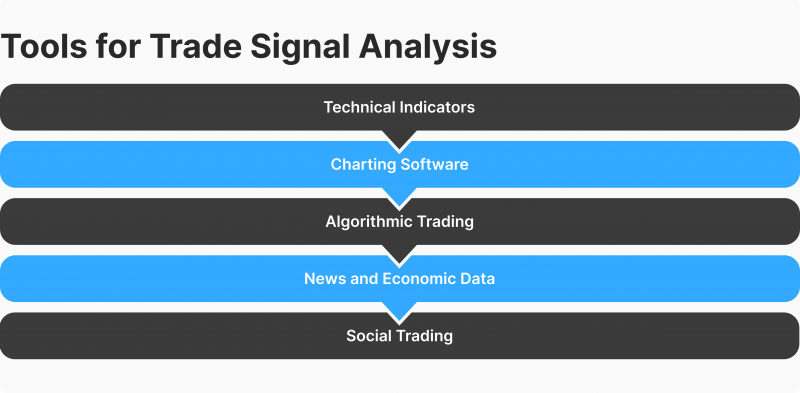

Charting Software

Charting software is essential for conducting technical analysis and identifying potential mirror trading opportunities. With tools like Tickeron and TradingView, traders can analyse price movements, identify patterns, and make informed decisions based on market trends.

Charting software enhances traders’ ability to spot entry and exit points, optimise copy trading strategy, and capitalise on market fluctuations effectively.

Forex Calculators

FX calculators are indispensable tools for managing risk and optimising trade parameters. From volatility calculators to margin calculators, these tools provide traders with essential insights into trade profitability and risk management.

By accurately calculating pips, margins, and profits, traders can make informed decisions and mitigate potential losses, ensuring long-term success in the financial markets.

Economic Calendars

Economic calendars are essential for staying informed about critical economic events and market-moving announcements. By tracking important events such as interest rate decisions and employment reports, traders can anticipate market volatility and adjust their trading strategies accordingly. Economic calendars enable traders to seize opportunities and minimise risks in rapidly changing market conditions.

Trade Journals

Trade journals are invaluable tools for tracking trading accounts, analysing past trades, and identifying areas for improvement. By documenting trades, recording observations, and evaluating outcomes, traders can refine their strategies and enhance their decision-making process over time. Trade journals promote accountability, discipline, and continuous learning, fostering long-term success in trading.

Final Remarks

When it comes to the foreign exchange market, social trading tools are crucial for achieving maximum success. For optimal strategy optimisation, risk management, and capitalising on market opportunities, successful traders use trade copiers, signal sources, charting tools, FX calculators, economic calendars, and trading journals.

By providing access to these crucial resources and encouraging a cooperative trading atmosphere, FX brokers assist inexperienced traders. By nominating traders with the right tools and resources, brokers can facilitate success and drive growth within their trading communities.

FAQs

Is social trading the same as copy trading?

Social trading centres around the social dimension of trading, enabling traders to engage, educate themselves, and independently make trading choices. In contrast, copy trading entails the automated duplication of trades from accomplished traders without any necessity for social interaction or decision-making.

What is an example of a social trade?

An example of a social trade could be when a commodities trader utilises a copy trading platform to familiarise themselves with foreign exchange markets.

What is a social trading platform?

It is an online platform that facilitates social interaction and collaboration among traders and investors.