Why Social Trading Platform is Important for Brokers?

Articles

Along with the emergence of innovative crypto technology, numerous tools have appeared with which it became possible to make a fortune on the crypto market. Today, the most popular methods of investing money in cryptocurrencies are margin trading, options and futures, crypto-stacking, banding and farming. However, one of the youngest and most interesting areas of crypto earning is social trading, which involves copying trading ideas from more experienced market participants.

In this article, we will look at such a great crypto investment style as social trading and why it is so popular today. We will also look at the main types of social trading, as well as learn what benefits the social trading platform has within the brokerage business. Ultimately, we will learn about the markets that use social trading software.

Key Takeaways

- Social trading is a separate class of trading strategies that involves copying trades and includes mirror trading, copy trading and social trading.

- Copy trade software is a set of indispensable tools that make up the ecosystem in which traders, investors, brokers and partners interact.

- Social trading has found its application mainly in the Forex, crypto and CFD markets.

What is Social Trading and Why is it So Popular Today?

Social trading refers to a trading method using which market participants can copy each other’s trades. This tool enables traders to obtain information from other traders and compare their experience and knowledge. Beginners can copy deals of more professional traders, having an opportunity to learn and benefit from others’ success. All that is needed is to choose a trader they like for copying. This solution is a relatively new concept in Forex trading and is also gaining tremendous popularity in the cryptocurrency market, which has grown manifold over the past few years.

Social trading can be very profitable when trading the financial markets. Thanks to modern technological capabilities, brokers can implement automatic copying mechanisms that repeat trades not only of the donor account but also of any other accounts connected to it. In this case, transactions are made in proportional volumes so that the burden of capital management also falls on the shoulders of a more experienced trader. These traders earn extra income from commissions by having subscribers.

Strategies presented in the social trading network can be developed both by users of the service and by employees of the company that created it. It should be noted that there are many gurus among private social trade copiers, whose strategies are not only as good as but even better than the systems offered by traders of large companies. There is a steady demand for these strategies, as the audience of private investors worldwide has grown significantly over the past decade.

Social trading platforms also reveal traders’ performance stats, open and past positions, and financial market sentiment, giving members complete information to assess the credibility of the contributors they follow on the platform.

Advantages of Using the Social Trading Platform in the Brokerage Business

The use of social trading platforms is a process of interaction between novice traders and one professional trader, which is carried out through social trading chat rooms. Without a doubt, expert traders form the basis of this method of investing by offering trading techniques to newcomers to help them gain useful experience.

Social trading platforms are designed to provide an unparalleled trading experience for both beginners and more professional players, offering a range of benefits that all types of brokerage companies will appreciate.

Accessibility & Inclusion

Social trading is an affordable way to grow investors’ capital from anywhere in the world where the Internet is available. Often, all you need to do to start social trading is create an account on the trading platform of your choice and fund your account. Traders can immediately start looking for a suitable professional to copy their strategies. Moreover, as mentioned above, today there is a wide choice among trading platforms for trading, each of which has its own features and advantages.

In addition, social trading makes it easier to get expert advice. Terms are explained in layman’s language and each trade is a digestible piece of valuable information, helping more traders understand the idea and become financially literate.

Greater Information & Transparency

Every social trading platform offers a set of tools to track transactions and check all open, closed and pending trades. This allows a comprehensive analysis of the actual trading activity of each trader registered on the platform in real time. In an era of unstable investor confidence in the financial sector, transparency, honesty and openness of information is paramount when it comes to trading financial assets, especially when it comes to trading based on the strategies of other, more experienced market participants.

Word-of-Mouth Credibility

As mentioned above, trust in social trading is one of the most important factors for success when copying trades. However, despite this, it is not an exhaustive criterion by which one should be guided. Checking a trader, his trading history, reviews, etc. is also a necessary step in order to make the final decision to copy his trading strategy. Connected traders can make informed decisions through collective trust in certain assets and/or experts. For those who do their own research (which is highly recommended), the number of followers and reviews of the respective strategies are important indicators of a trader’s creditworthiness.

Automation & Security

With social trading, beginners can immediately start trading cryptocurrency without a prior understanding of the field. In some ways, social trading can bring people together and boost their self-confidence, positively impacting them financially and socially. After all, staying connected is the most essential human nature.

In general, social trading platforms dominate exchanges with several high-quality products, high daily volume, and a dedicated user base. Take advantage of social trading on such platforms, and you will gain access to a sophisticated and tight-knit community of traders. In addition, practical measures are being introduced to maintain the quality of trading advice subscribers can receive, from live discussions and training workshops to a rigorous review process to protect less skillful traders. After all, when novice investors find the best, most suitable expert to follow, they can and should definitely use the exchange features: autofilled orders (like stop loss/take profit), leverage, margin, and more. If you have any questions, someone is always available to help you, especially in crypto, where the market is awake 24 hours a day, 7 days a week.

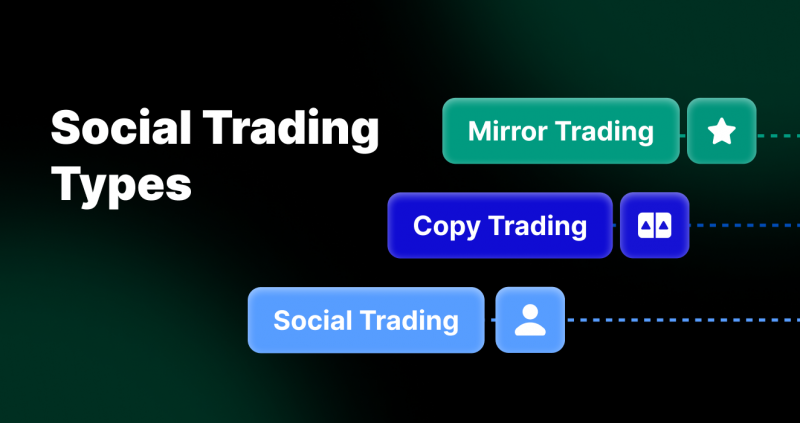

Social trading is a concept that describes a number of trading tactics that involve copying trades. One of these strategies has the same name as the concept that includes it.

Types of Social Trading and Their Peculiarities

Mirror Trading

Mirror trading means mirroring the trading ideas (strategies) of other traders. Instead of following a specific trader, players using mirror trading imitate a strategy that can be created and used by any number of traders. Mirror trading can be done by executing trades manually according to the chosen strategy, or it can be automated with the help of robots and advisors. Mirror trading usually takes less time and effort than social trading, especially if automated. Another advantage of this method is that strategies based on technical analysis can be used for any number of assets. This type of trading provides less flexibility than social trading because you are expected to blindly follow the strategy. All you have to decide is which strategy to use and when to stop using it if you don’t like it.

Copy Trading

Copy trading is the process of copying another trader’s actions. Instead of copying a strategy, you copy every action of the trader you follow. Copying can be done manually by making the same trades as the selected trader. But modern copy trading service providers allow you to completely automate this process. In this case, you only need to choose which trader (or traders) to follow and what percentage of the capital in your account is allocated to that trader. After that, copy-trading becomes entirely passive. The obvious advantage is that copy trading frees up your time for other activities and allows you to benefit from the experience of more successful traders. But the learning potential is limited. In addition, you also give up your freedom to make trading decisions, although some platforms allow you to set risk parameters or even choose which trades to make.

Social Trading

Social trading is a concept that involves traders sharing their ideas and plans through social networks, forums, and so on. It does not provide for any automation of trading. Each trader must decide which strategy to use or develop his own strategy based on the ideas shared by other traders. This is the most time-consuming and laborious type of trading on this list. It also often requires a certain level of knowledge, so it is more suitable for more experienced traders. However, novice traders can also learn from their more accomplished peers.

Although social trading requires more time and effort than other types of trading, it has the advantage of learning how to trade and helping you understand the markets. In addition, traders are free to choose different strategies and styles, and do not have to blindly follow other traders and their strategies.

Markets Where Social Trading Concept Applies

Today, social trading allows traders and investors who have little or no knowledge to gain the necessary skills to trade in the financial markets by performing the simple act of copying trading strategies from other, more professional participants. This aspect is crucial for brokerage companies willing to add social trading software to their arsenal, because it is an innovative way to make money and attracts many people to the market.

Today, social trading is predominantly applied within two markets — Forex and crypto. Let’s consider each in more detail.

Forex Market

Forex market, being the most liquid market as of today, combines high speed of deals execution, large leverage and a wide range of trading tools allowing to extract sometimes unbelievable profit.

Speaking about social trading, it appeared at the Forex market relatively recently, allowing to expand considerably money earning possibilities both for beginners and professional participants. The concept boils down to the fact that some new traders try to find more experienced ones to copy their deals at any particular instrument based on a number of criteria for selection, such as history of successful deals, amount of gained profit, etc.

Today, for example, traders can choose from a large number of brokers that offer copy trading as part of investing through a real account, as well as through a demo account on such well-known platforms such as MetaTrader 4/5 (MT4/MT5) using copy trading software.

Crypto Market

The cryptocurrency market has become a haven for many skillful traders and investors who came from other markets. Today, the crypto niche offers an unimaginably wide range of professional tools for making money through crypto trading. Spot, margin trading, futures, stacking, and lending are just a small part of the large list of ways to multiply your capital on this market.

Social trading on the crypto market is embodied by the presence of the tremendous amount of organizations and services that offer a platform for copying deals of other participants with numerous different useful copying settings. It is worth noting that this type of earning is one of the most popular in the crypto market due to the fact that many traders hope to gain high profits through the volatility of the crypto market.

CFD

A Contract for Difference (CFD) is a derivative financial instrument whose value is based on the movement of an underlying asset, such as gold, a stock index, a currency index or government bonds. It is a contract to pay or receive the difference between the current price of the underlying asset and the price at the time the contract is liquidated. It allows traders to take advantage of price movements. CFD is used either to speculate and profit from price changes, or to hedge the risk of specific instruments by reducing the risk associated with price changes. Within the frames of social trading, individuals copy transactions of other traders by purchasing contracts for the price difference of various financial assets.

Conclusion

In order to sum up all above, it should be said that social trading platforms, as one of the youngest and most promising areas for earning money in various capital markets, today play an important role in creating a reliable and, most importantly, easy-to-use solution for increasing capital, mainly among new traders. This type of earnings has become especially popular due to its simplicity and convenience, which has allowed it to become an incredibly popular tool among traders of all types and markets. In turn, this is an excellent opportunity for brokers to include social trading in their arsenal.