What Is CCI Indicator, and How to Use It?

Is it possible for a single technical indicator to more than double the returns of a traditional buy-and-hold strategy? A recent study found that the Commodity Channel Index (CCI) delivered an astonishing 1,108% returns on the S&P 500—while a basic buy-and-hold strategy only made 555%.

That’s why so many traders use the CCI indicator to spot trends, find the best time to buy and sell and predict market reversals before they happen.

In this guide, you’ll learn the CCI indicator, how to read it, the best settings and some common strategies widely used by traders.

Key Takeaways

- The CCI indicator measures the difference between the current price and its historical average, helping traders spot overbought and oversold conditions.

- The best settings for the CCI vary by strategy, but a common choice is a 14-period CCI for short-term trading and a 50-period CCI for long-term trends.

- A CCI value above +100 suggests an overbought market, while below -100 indicates an oversold market.

What Is the CCI Indicator?

The Commodity Channel Index was developed by Donald Lambert in 1980 to analyse commodity price cycles. However, due to its versatility, traders use it today across multiple asset classes, including stocks, forex, and crypto.

The CCI indicator compares the current price to the average price over a set period. If the price is significantly higher than the average, the CCI value rises, showing a strong trend. Conversely, if the price is much lower, the CCI drops, signalling potential weakness.

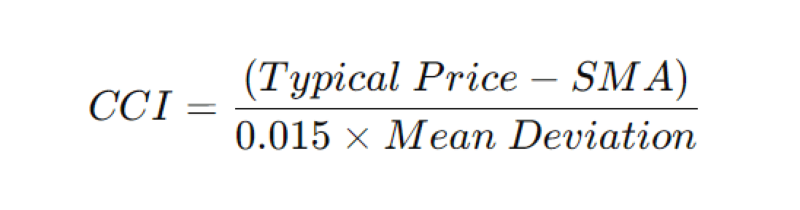

The CCI formula is as follows:

Where:

- Typical Price: This is calculated by taking the average of an asset’s high, low, and closing prices for a given period.

- Simple Moving Average (SMA): The SMA is simply the average of the typical prices over a set number of periods (for example, 20 days). It helps smooth out short-term fluctuations and gives a clearer picture of the overall trend.

- Mean Deviation: This is the average absolute difference between each typical price and the SMA. It measures the average distance between the typical prices and the SMA, giving insight into market volatility.

- Constant Factor (0.015): The constant factor scales the CCI values so that most readings fall within a range of approximately -100 to +100. This makes interpreting the indicator easier and helps identify when an asset is significantly overbought or oversold.

The CCI indicator does not have fixed upper and lower limits like the RSI (Relative Strength Index), making it more adaptable to different market conditions.

How to Read the CCI Indicator

To effectively use the CCI stock indicator, traders must understand its key levels:

Above +100: Strong Upward Momentum

When the CCI rises above +100, it’s a sign that the market is experiencing strong upward momentum. Some traders interpret this as a sign that the asset might be overbought, meaning it could be due for a pullback.

However, it’s important to note that an overbought signal doesn’t guarantee an immediate price drop—it simply suggests that prices have climbed quickly and could be ripe for a reversal or a pause.

Below -100: Strong Downward Momentum

Conversely, a CCI reading below -100 indicates strong downward momentum. This might suggest that the asset is oversold, potentially setting the stage for a price rebound.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

But just like with overbought conditions, an oversold reading isn’t a crystal ball—it doesn’t mean prices will definitely bounce back right away. Markets can linger in oversold territory for longer than expected.

Between -100 and +100: Neutral Territory

When the CCI falls between -100 and +100, it signals that the market is in a neutral zone. In this range, no strong trend is evident, which might mean that the asset is trading sideways.

Recognising these neutral conditions can be just as important as spotting potential trends because it may signal a period of consolidation before a new trend emerges.

Choosing the Best Settings for Your Trading Style

The sensitivity of the CCI depends on the number of periods you use in the calculation. Different trading styles may require different settings:

Short-Term Trading (10-20 Periods)

Shorter periods make the CCI more sensitive, generating more frequent signals. This can be useful for day traders or those who need quick, responsive indicators. However, increased sensitivity might also mean more false signals, so pairing the CCI with other indicators or confirmation tools is crucial.

Swing Trading (30-50 Periods)

For swing traders, using a moderate period setting helps smooth out the noise, allowing you to focus on more sustained trends. This balance reduces the risk of getting whipsawed by minor price fluctuations while still catching significant moves.

Long-Term Trading (50+ Periods)

When trading on a longer time frame, a higher period setting can help confirm the strength and longevity of a trend. This setting is ideal if you’re less concerned with short-term volatility and more focused on capturing large, trend-driven moves.

A 14-period CCI is a great starting point. It offers a balanced view that isn’t too jumpy.

CCI Indicator Best Settings

While no universal setting fits every market, many traders use a 14-period- or 20-period setting for a balanced approach. Shorter periods make the indicator more responsive to price changes, whereas longer periods reduce volatility and noise.

Experimenting with different settings on historical data can help you determine what works best for your specific trading style and the asset you are analysing.

Best CCI Indicator Strategies

In this section, we’ll walk through some of the most popular strategies for using the CCI.

1. Overbought and Oversold Strategy

One of the simplest ways to use the CCI is to examine overbought and oversold conditions. The basic idea is to use the indicator’s +100 and -100 levels as signals.

- Buy Signal: When the CCI falls below -100, the market is considered oversold, which might indicate a good buying opportunity. Once it moves back above -100, it suggests that the selling pressure might be easing, which is a signal to buy.

- Sell Signal: Conversely, when the CCI rises above +100, the market is seen as overbought. When the CCI then falls back below +100, it may indicate that the upward momentum is slowing down, suggesting a sell signal.

Let’s look at the example. The CCI drops below -100, indicating that the stock might be oversold. After a few days, it moves back above -100. This crossover can be taken as a signal to consider buying. Later, if the stock’s CCI rises above +100 and then falls back below that level, it might be time to sell.

Even though this method is straightforward, be cautious. In strong trends, the CCI might remain in the overbought or oversold territory for an extended period, which can lead to premature buy or sell signals.

2. Trend-Following Strategy

Another common approach is to use the CCI to confirm the strength of a trend. Instead of just looking at reversals, this CCI indicator strategy focuses on riding the trend once it’s in motion.

- Confirming an Uptrend: When the CCI stays above +100, it signals that the market is in a strong uptrend. In such cases, you might consider holding or buying more of the asset.

- Confirming a Downtrend: If the CCI remains below -100, it confirms a downtrend. This could be a cue to sell or avoid buying.

Many traders pair this approach with a moving average (MA) crossover. For example, if a short-term MA crosses above a longer-term MA while the indicator is above +100, it reinforces the uptrend signal.

Using the CCI as a trend confirmer helps you stay in the trade longer during strong trends. However, you should also use additional analysis tools to watch for signs of trend exhaustion or reversals.

3. Divergence Strategy

The divergence between the price of an asset and the CCI indicator can be a powerful tool for predicting trend reversals. Divergence occurs when the price makes a new high or low, but the CCI does not follow suit.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

- Bullish Divergence: The price makes a lower low, but the CCI forms a higher low. This discrepancy can signal that the selling pressure is decreasing, and a reversal to the upside might be coming soon.

- Bearish Divergence: The price makes a higher high, but the CCI makes a lower high. This situation suggests that the buying strength is waning, potentially leading to a downturn.

Divergence strategies require a keen eye. Because the early signals can sometimes be subtle, it is better to practice this method on historical charts before using it in live trades.

Integrating CCI with Other Tools

While the CCI indicator is powerful on its own, combining it with other technical analysis tools can enhance its effectiveness. For example:

- Adding RSI to the strategy helps validate market conditions by confirming whether an asset is truly overbought or oversold.

- MACD (Moving Average Convergence Divergence) can provide insights into trend strength and momentum, further validating signals from the CCI.

- Bollinger Bands can help assess volatility and confirm the readings of the CCI indicator, especially during periods of rapid price changes.

Integrating multiple tools can create a more comprehensive trading strategy, reducing the chances of false signals and improving overall performance.

Conclusion

The CCI indicator is a powerful tool that helps traders identify trends, reversals, and overbought/oversold conditions. While it works well on its own, combining it with other indicators increases accuracy.

To succeed with the CCI stock indicator, traders should:

- Understand how to read the CCI indicator to spot trading opportunities.

- Choose the best settings based on their trading style.

- Use it with trend-following, divergence, and multi-indicator strategies for better results.

Like any trading tool, risk management is crucial. Always backtest strategies before applying them to live trading.

FAQ

What does the CCI indicator tell you?

The CCI indicator measures the difference between the current and average prices over a specific period. It indicates whether an asset is potentially overbought or oversold, helping traders identify possible trend reversals.

What is the CCI buy signal?

A CCI buy signal typically occurs when the indicator crosses upward from below -100, suggesting that the asset is oversold and may be due for a price rebound. Traders often wait for confirmation from additional indicators before entering a trade.

How accurate is the CCI indicator?

The effectiveness of the CCI indicator varies based on market trends and the asset. While it can be a valuable tool when combined with other technical indicators, using it alone in volatile or sideways markets may result in misleading signals.

Which is better, RSI or CCI?

RSI and CCI serve slightly different purposes. RSI primarily measures the speed and change of price movements, while CCI focuses on deviation from the average price. Many traders use both to get a more balanced view of market conditions.