Guide For MT4 Risk Management: All You Need to Know

Articles

Risk is always a never-ending companion when trading any asset class in any type of equities market using any trading platform, jeopardising the capital invested by market participants in order to make a profit.

In particular, the most popular trading system in the world, MetaTrader 4, has an advanced and effective system for dealing with risks of various types that negatively impact the trading process and traders’ capital, enabling them to handle the elements of the chosen trading strategy effectively.

This article will explain the MT4 risk management framework and the main risk management practices and tools it includes.

Key Takeaways

- Risk management calculator MT4 is a tool that allows you to determine the degree of risk in trading, primarily based on current market trends and other variables.

- Diversification is the most popular tool for hedging risk situations on the MT4 platform.

What is the MT4 Risk Management System?

Risk is an inherent element in the process of trading on any financial markets, accompanying the need to apply several tools and tactics to reduce the likelihood of negative consequences entailing the loss of initially invested capital. At the same time, most such strategies aim to preserve capital by analysing the market behaviour and assessing its moods at a particular moment.

Thus, trading within the MT4 trading platform, the most famous trading environment for interacting with capital markets, offers a system combining qualitative and quantitative metrics, tools and analytical indicators designed to provide dynamic risk management in real-time trading.

Moreover, the MT4 risk manager is equipped with an advanced learning system related to issues and techniques to reduce the likelihood of negative consequences of unsuccessfully planned trading.

It is also worth noting that MT4 risk management software offers tools that provide an integrated approach to the process of working with risks, which includes several stages, including identifying potential risks, their classification by type, preventing risk situations using high-precision analytical and statistical indicators, and also systems involved in the process of avoiding risk situations in the market by analysing similar situations in retrospect, which makes it possible to secure further the process of trading financial assets.

The MT4 risk management system is based on the conceptual foundations embedded in every trading strategy used to generate profits in the capital markets.

Key Components of the MT4 Risk Management System

As mentioned above, the MT4 risk management system is a multifunctional environment with a wide range of effective patterns and mechanisms, the application of which, to a greater or lesser extent, provides protection against risky manifestations of the unstable nature of financial markets and trading on them. Thus, this list includes the following tactics and methods within the framework of risk stewardship activities:

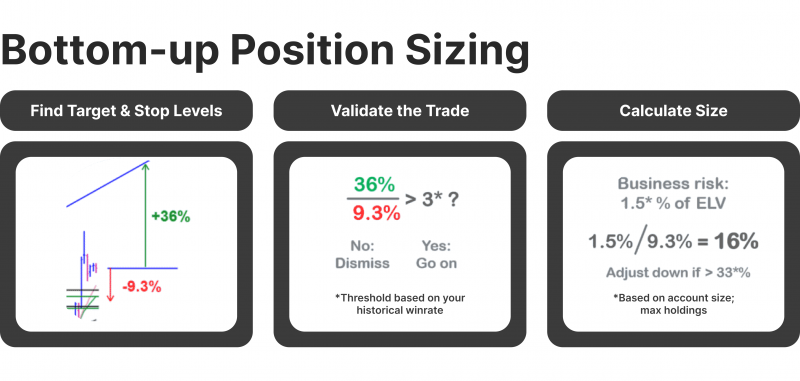

Position Sizing

Position sizing is a highly essential element of risk mitigation in trading. It involves carefully calculating the number of units or lots to trade in a single position. Position sizing primarily aims to ensure traders do not risk too much of their trading capital on a single trade, protecting their overall profile from significant losses.

Factors such as risk tolerance and account balance must be considered when performing position sizing. A position size calculator can be incredibly helpful in determining the appropriate position size based on these factors.

By inputting the specific risk tolerance level and account balance into the calculator, traders can ensure that each trade is proportionate to their overall capital and risk tolerance, promoting a balanced and well-managed approach to trading.

Risk-to-Reward Ratio

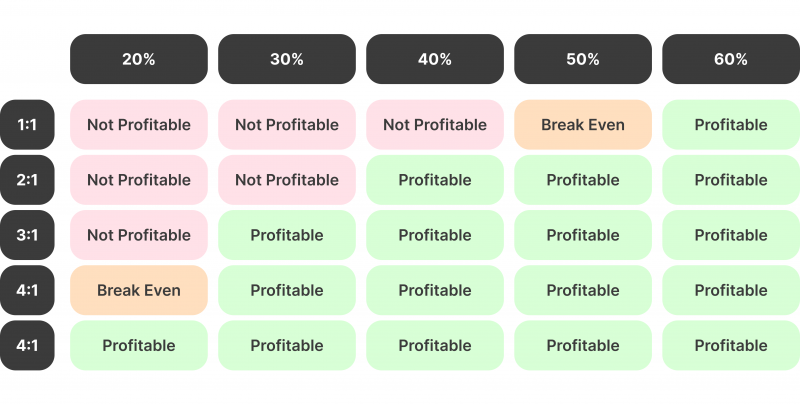

The risk-reward ratio is a crucial concept in trading. It represents the correlation between the potential profit and loss on a trade. It is used to assess the attractiveness of a trade and guide decision-making in trading schemes. The general recommendation is to aim for a risk-reward ratio of at least 1:2, meaning the reward should be at least twice the risk.

To implement this concept, traders calculate the potential risk and reward before entering a trade. This involves evaluating the potential downside and upside of the trade and ensuring that the risk-reward ratio meets their predetermined criteria.

Hedging

Hedging is a risk mitigation tactic that involves opening positions to offset losses in other trades. The purpose of hedging is to protect your portfolio from adverse market movements, reducing the impact of market unpredictability.

Diversification

It uses correlated instruments to hedge positions when necessary, minimising overall risk exposure. Hedging supports the ability of investors to supervise and mitigate risk while maintaining their investment positions.

Diversification is the process of spreading out investments that cover a range of distinct products or markets. This can include stocks, bonds, real estate, commodities, and other investment options.

The primary goal of diversification is to reduce the impact of any one investment on an overall portfolio. Holding various investments lowers the risk associated with any single asset, leading to a more stable and consistent return over time.

Diversification can be implemented by allocating investments across different asset classes, industries, geographic regions, and types of securities. For example, an investor may hold domestic and international stocks, bonds, and real estate investments to spread risk across different market areas. This can be achieved through mutual funds, ETFs, and other investment vehicles that provide exposure to diversified holdings.

Trailing Stops

A trailing stop loss is a risk reduction tool that allows traders to set a dynamic stop value that fluctuates with the market price over time. A trailing stop loss aims to lock in profits while minimising losses by adjusting the stop level as the market price fluctuates.

The main advantage of a trailing stop loss is that it enables traders to achieve more profit as the market swings in their favour while still protecting against downside risk.

Take Profit Orders

A take-profit order is a predefined instruction to close a trading position automatically at a specific price level to secure gains. This order guarantees that you will capitalise on favourable market movements by locking in profits. Implementing a take-profit order is akin to setting a stop-loss, but instead of minimising losses, it specifies the price at which you aim to realise your profit.

Stop Loss Orders

A stop-loss order is an advanced trade management tool that can autonomously close a trade at a particular price level determined by the trader.

The purpose of carrying out a stop-loss order is to limit anticipated losses and protect the trader’s account from excessive drawdowns if the market turns unfavourably. By imposing a stop-loss order, traders can define their acceptable risk level for each trade and take measures to minimise losses.

Leverage Management

Leverage management controls the use of borrowed funds to avoid magnifying prospective losses. This involves carefully monitoring and balancing the use of leverage to minimise risk and protect against significant market downturns. By effectively managing leverage, individuals and organisations aim to maintain stability and prevent excessive exposure to investment risk.

Conclusion

The MT4 risk mitigation software is an integral link in trading activities, providing access to the best practices used to prevent and avoid risky situations in the market.With a wide range of risk optimisation techniques, MT4 provides an optimal environment for testing and validating trading practices across all sorts of securities and stock markets.

Seeking answers or advice?

Share your queries in the form for personalized assistance