Top 10 Tips for Building an Investment Portfolio

Capitalizing on investment opportunities is a great strategy to build wealth and secure your future. Whether you’re exploring options in cryptocurrency, stocks, real estate, or mutual funds – the same fundamentals of portfolio construction apply to every market. Nevertheless, building an optimal investment portfolio takes careful consideration and a well-thought-out plan.

To help you get started, we prepared 10 tips for building investment portfolio that will assist you in achieving your financial objectives.

Key Takeaways

- An investment portfolio is a great way to diversify your assets, but it is vital to maintain balance to lower risks.

- Maintain an organized plan and manage emotions while making decisions regarding your portfolio.

- Make sure your investments are liquid enough to access funds whenever necessary, add capital to the portfolio steadily over time to increase potential growth and returns, and manage your risks.

- Keep up with market trends, learn about external factors influencing your investments, and stay informed of global events.

Tips for Building a Strong Investment Portfolio

Set Your Investment Goals

The first step is to identify and highlight your personal finance goals. Ask yourself questions such as “How much money do I need for my retirement?” or “What kind of returns do I expect from my investments?”

Do you plan to invest for a purpose, such as buying a house in 10 years? Or do you just want to have a consistent passive income? Knowing your goals will help you decide what investments to make and how much risk is acceptable.

Also, consider an investment horizon.

An investment horizon is the period of time you expect to hold a specific asset or a group of assets. Your investment portfolio should be composed of different assets with varying maturities to match up with your financial goals:

- short-term investments;

- mid-term investments;

- long-term investments.

This way, you can benefit from different market conditions and adjust your portfolio according to your financial goals.

Know Your Risk Tolerance Level And Choose Investment Strategies Accordingly

Another crucial thing to know is your risk tolerance level.

Risk tolerance measures your willingness to take on the risk associated with an investment. Different markets have varying levels of risk, and you should know what level is comfortable for you.

The stock and crypto markets generally carry higher risks than bonds or investment properties. This is because they have the potential to generate more significant returns (and, therefore, larger losses) in a short amount of time.

Each individual’s risk tolerance may vary and can change as time passes. For example, when your salary increases, you may be more inclined to take risks; conversely, when you have additional family members or expenses that need managing, the risk you are willing to endure will likely decrease. Similarly, individuals nearing retirement age often display lower comfort levels with high-risk investments.

Different Risk Tolerance Levels

Depending on the amount of risk you are willing to take, investment strategies can be divided into three categories:

Aggressive Approach

Investors with a high appetite for risk are usually well-acquainted with the nuances that move the commodity or stock market and affect different asset classes. Their intent when investing is to generate maximum return on investment, even if it means taking extreme risks – such as allocating resources to volatile assets which have an inherent chance of becoming worthless.

Moderate Approach

Investors with a moderate risk tolerance generally seek a balance between security and potential gains. They usually have an investment horizon of 5-10 years, so they pay more attention to preserving some of their profits as the investment horizon draws closer.

This is different from aggressive investors that tend to take higher risks for potentially greater returns over shorter periods of time.

Conservative Approach

Investors with a conservative approach tend to be newbies in the investing world who lack adequate knowledge and are, above all else, more concerned about safeguarding their money than achieving higher returns. “A bird in hand is worth two in the bush” serves as their motto for investing.

If you’re seeking to evaluate your risk tolerance level, a great way to do so is by visiting various investment websites that feature questionnaires specifically designed for this purpose.

As risk tolerance is based on how one handles uncertainty: you may not realize your own propensity for taking risks until confronting the real losses in the real market.

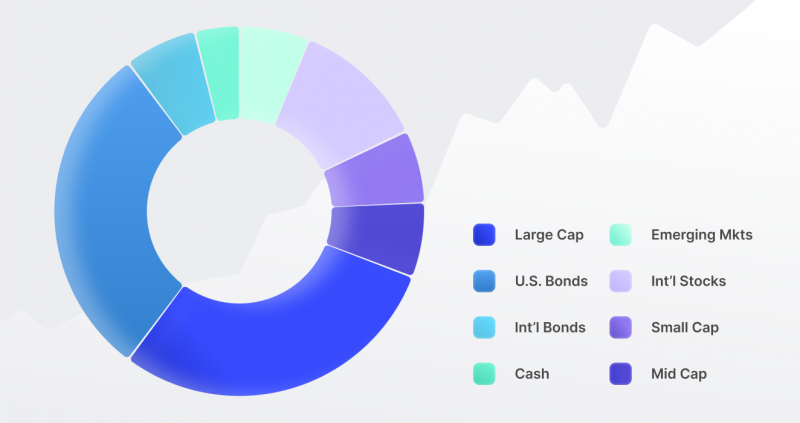

Do Not Forget About Diversification and Different Asset Classes

Crafting a prosperous investment portfolio is built on the central foundation of diversification.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

This entails owning multiple asset classes, such as stocks, currencies, bonds, or crypto, along with different types of investments within each asset class, like small-cap stocks, large-cap coins, domestic and foreign stocks of companies in various industries, and so on.

Let’s consider this situation: When stock prices heighten, bond yields typically decrease. Professionals regard stocks and bonds to have an inverse relationship. However, when these assets occasionally move in the same direction, stocks often demonstrate more volatility, which means that their ups or downs are greater than those of bonds.

Thus, investing in a well-diversified portfolio means buying assets that do not move in lockstep with one another. This helps to provide an investor with a cushion against losses during difficult times in the markets by offsetting the potential negative impacts of one asset on the overall portfolio.

Also, if you are considering taking your investing strategy to the next level, why not build a property portfolio with multiple rental properties?

Asset allocation safeguards investors from market fluctuations and helps to secure ongoing growth in the long run.

Consider Costs and Commissions

All too often, investment costs are overlooked in the process of building a portfolio. However, these can be major contributors to your long-term success or failure.

Commissions and annual fees paid to stockbrokers or counselors; expense ratios for mutual funds/ETFs; surrender charges on annuities – all these should be taken into account when constructing an optimal portfolio as they could have a considerable effect on your returns over time.

It’s important to remember that expenses reduce your investment returns, so it pays off to make sure they remain low. Mutual fund investors can take advantage of the vast array of no-load funds available, while stock buyers should compare commissions between different brokers. And if you trade crypto assets such as Bitcoin and Ethereum, there are exchanges offering fees as small as 0.25%.

Use Different Risk Management Strategies

It is impossible to eliminate risk entirely when it comes to investing. Even the most reliable assets may suddenly experience a dip in value, so investors must be aware of many risks, for example:

Sovereign risk

When a government or country is unable to, or chooses not to, fulfill its financial obligations and debts, it can pose significant risks for investors investing in certain assets such as government bonds. This type of risk is known as sovereign risk.

Loss of principal

Investing carries the risk of losing some or all of the original investment, known as a loss of principal. Many conservative investors choose to invest in assets with a lower risk of losing value in order to minimize this potential loss. However, it is essential to remember that all investments carry some degree of risk, and no one can predict the future performance of an asset with certainty.

Inflation

The risk of inflation is a significant concern for investors, as it can reduce the actual returns they receive from their investments. This is particularly true when investing in fixed income investments and bonds, which are vulnerable to changes in inflation rates.

What strategies can I use to mitigate these risks?

You can minimize sovereign risk by balancing your portfolio and not relying solely on government securities. Diversification in different markets will also help reduce the risk of inflation, whereas bonds and mutual funds are an excellent way to protect against loss of principal.

However, there are a lot more risk management strategies that investors can use to protect themselves, such as hedging or stop-loss orders.

A stop-loss order offers you a means of preserving your profits by setting a predetermined price at which an asset’s position will be closed. The stop price is placed below the current cost, helping ensure that no more than planned is lost with each trade.

Hedging is usually performed with derivatives and may also help protect against potential losses. It involves taking a position opposite the one you take in the underlying asset in order to reduce exposure to market volatility.

The key is to find the right balance of strategies that best matches your personal risk profile and investment goals.

Maintain the Right Balance and Perform an Appropriate Asset Allocation

Investing in the right assets and setting them aside isn’t enough – portfolios can become disproportionate without proactive attention paid to the balance of investments. Rebalancing ensures that each asset has an opportunity to flourish while providing security for future gains.

How does rebalancing work?

Rebalancing your portfolio allows you to readjust your asset classes by selling out of investments that have become too dominant and re-investing in underrepresented ones. Doing this helps ensure a more diversified and balanced approach for better returns over time.

What should a perfectly balanced portfolio look like?

An ideally balanced portfolio should consist of a mix of stocks, bonds, cash, and other asset classes. The exact proportions of assets will depend on your individual risk tolerance and investment goals. For instance, let’s pretend that your balanced portfolio consists of the following:

- 50% of its assets are in stocks, as they offer higher returns with more risk;

- 40% of its assets are in bonds, which provide income and lower volatility;

- 10% of its assets are in cash, commodities, and crypto.

As time goes on, some investments may appreciate in value, whereas others could depreciate. Suppose you notice that the percentage of your stock holdings has climbed to 70% while cash and cryptocurrencies have declined in value. To keep a balance between them, adjust your portfolio by investing more heavily in crypto assets and reducing the number of stocks held to maintain stability and lower your risks.

Be Sure Your Portfolio is Liquid

Having liquidity when it comes to your investments is crucial as it allows you to access your money whenever necessary. Though a good investment may be profitable, if there is difficulty or delay in being able to withdraw the funds, it can negatively impact the overall strength of your portfolio.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Therefore, it is important to select securities that offer easy liquidity rather than those with restrictions such as annual withdrawals or surrender periods. By ensuring that your funds are liquid, you can have the financial flexibility to address any unexpected circumstances in the future.

Grow It Consistently

For long-term financial success, a steady investment of funds into your portfolio is essential. By continuously adding capital to the pool, you’ll have an increased chance of meeting your financial objectives and will benefit from the exponential growth potential over time.

For example, if you invest $10,000 into your portfolio with a projected 6% annual return, at the end of 10 years, your capital would become about $16,000. However, by adding an additional $2,000 per year to the same portfolio over a decade, the final value of your investment could reach nearly double that amount at more than $30,000.

Ultimately, your investment objectives will determine the best course of action.

Keep Up With Market Trends

When shopping for companies and assets, always conduct thorough market research for the latest updates. Investing in a well-performing stock could become risky if the company’s outlook changes due to new external factors such as regulation or market fluctuations.

Don’t forget to monitor shifts in economic and political trends that can affect your investments, like changes in government policy. Additionally, it’s a good idea to stay informed of global events that have the potential to influence your portfolio, such as natural disasters, changes in technology, and currency fluctuations.

Also, staying up to date with the influential players in markets is an intelligent approach. Decisions and moves of key executives, major shareholders, and newsmakers can affect the performance of the businesses they are affiliated with.

Be Organized and Manage Your Emotions

Finally, be organized and disciplined when maintaining your perfectly balanced portfolio. To make the process easier, you should create a plan that outlines how often to review your investments and when to rebalance them.

Additionally, don’t let emotions dictate your decisions, as they can lead to irrational choices that could harm your portfolio in the long run. Whenever necessary, take a step back and approach the situation objectively, as this will help you make better decisions and apply a better investment strategy.

FAQ

How to build an investment portfolio?

To build an investment portfolio, you should consider your risk tolerance and financial goals, identify the types of investments that will best achieve those objectives, do research to find suitable products, choose a comfortable platform to trade assets, and diversify across asset classes to minimize risk. You should also be sure to use risk management strategies and rebalance it often.

Why is an investment portfolio important?

It gives you the ability to achieve your financial goals and grow your wealth in the long run. Moreover, a well-constructed portfolio can provide income and help you achieve financial security. Also, having a diversified investment portfolio can provide stability when the markets are going through turbulence.

What is a good investment portfolio?

A good investment portfolio is one that is diversified, balanced, and tailored to your individual risk tolerance. It should include a mix of asset classes such as stocks, bonds, and other instruments. Additionally, it should be regularly monitored and rebalanced in accordance with your objectives and the changing markets.

What should be included in an investment portfolio?

An investment portfolio typically includes stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate investments, commodities, and other alternative investments. Also, property investors may include physical real estate in their property portfolios. The exact mix of asset classes you choose should be tailored to your risk tolerance level.

Recommended articles

Recent news