The Impact of Monetary Policy on Investment Strategies

Central banks are constantly making adjustments to manage their economies. They are either trying to stimulate growth during slow periods or to contain inflation when the economy overheats. This isn’t abstract theory; it’s a constant balancing act with real-world consequences.

For anyone with money in the market, these actions are not background noise. They are a primary market driver. Watching these policy shifts is a fundamental requirement for protecting capital and identifying opportunities. Operating without this awareness is a significant and unnecessary risk.

This breakdown is about the real impact of monetary policy — and how those decisions in high-level meetings translate directly to the performance of your investments.

Key Takeaways

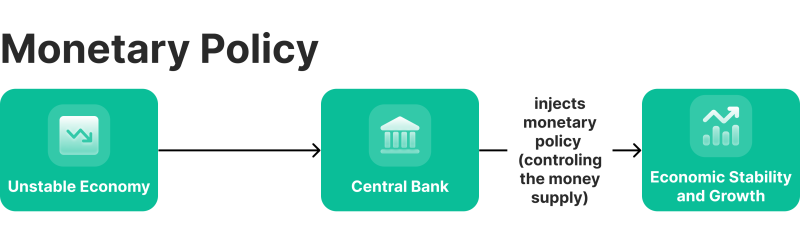

- Monetary policy is the toolkit a central bank uses to control the cost of money. Their stated goal is economic health and stable prices.

- The central bank handles monetary policies. The government handles fiscal policies through taxes and spending.

- Every move a central bank makes directly alters the logic for investing in stocks, bonds, and holding cash.

What is Monetary Policy?

Monetary policy is the playbook central banks use to control a nation’s money supply and influence credit conditions. Its core job is to keep the economy from running too hot (causing runaway inflation) or too cold (leading to a recession). This duality exists because economies are cyclical. The central bank’s job is to smooth out the roughest parts of that cycle.

To do this, they have two basic stances. An expansionary policy acts as a stimulant, aiming to boost a slow economy by making money more accessible. A contractionary policy is a restrictive measure used to fight rising inflation by slowing things down.

The major players—the Fed in the US, the ECB in Europe, the BoE in the UK—are always in the spotlight. Their decisions on which mode to use and which tools to deploy create the environment where every investor succeeds or fails.

Monetary vs Fiscal Policy

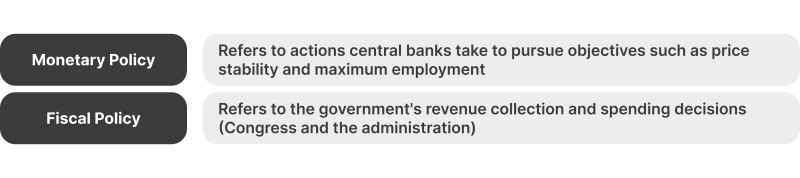

It’s critical not to confuse monetary and fiscal policy. They operate in fundamentally different ways and can sometimes work against each other.

Monetary policy is the central bank’s territory. Its tools are broad and systemic, affecting the entire economy through the financial system: consumer demand, liquidity and more. When the central bank raises interest rates, it impacts every mortgage, car loan, and business line of credit in the country.

Fiscal policy is the government’s job. This involves direct, and often targeted, action. The government can use tax credits to support a specific industry or fund a large infrastructure project to create jobs. Its tools are more specific compared to the broad-based nature of monetary policy.

How Does Monetary Policy Affect Investments?

Monetary policy forces investors to answer one core question: How much risk are you willing to take?

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The answer changes depending on interest rates. When rates are low, holding cash yields little, pushing capital towards growth opportunities in assets like stocks and real estate. But when rates are high, preserving capital becomes the priority. The safety of a government bond suddenly looks far more appealing than market volatility, and money flows out of riskier assets. This also has a significant effect on currencies.

Currency exchange rates are another important piece of the puzzle. When a country’s interest rates rise, its currency often gets stronger as foreign money seeks those higher returns. What’s the downside? This makes the country’s exports more expensive, which can hurt the bottom line of companies that sell a lot of goods abroad.

Central Bank Instruments

Central banks have a few core tools they use to achieve their objectives.

- Open Market Operations: This is the main tool used every day. The central bank buys and sells government bonds to either add money to the banking system or remove it. This action is the most direct way they control liquidity and short-term rates.

- Discount Rate Adjustments: This sets the interest rate for banks that need to borrow directly from the central bank itself. Even if banks don’t use this option often, everyone watches this rate. Its level sends a very clear message about where the central bank wants policy to go.

- Reserve Requirements Changes: This tells banks what percentage of their deposits they must keep on hand. Think of this as a powerful, but rarely used lever, as most central banks now prefer the flexibility of OMOs.

These instruments work together to stabilise economies, and their application shapes the risk-reward dynamics of various asset classes.

Impact of Monetary Policy

A central bank’s decisions create powerful ripple effects that transmit directly into the performance of equities, bonds, and currencies. An expansionary stance acts as a tailwind for growth; a contractionary one acts as a brake.

For investors, simply watching these events unfold is not enough. The goal is to understand what these policy changes might do next and to position a portfolio accordingly. This is crucial for protecting capital and acting on new opportunities as they appear.

Expansionary Policies

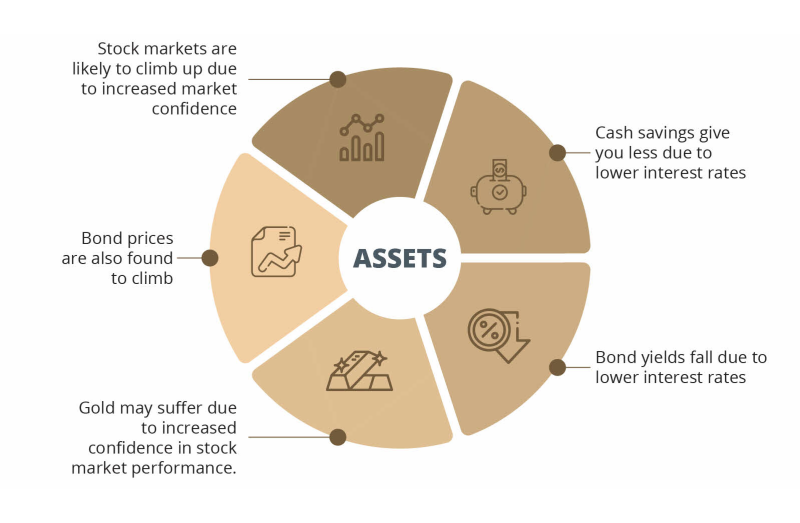

An expansionary policy has one main goal: to make capital more accessible and stimulate the economy. The central bank does this by lowering benchmark rates and ensuring the financial system has ample liquidity. The resulting reduction in borrowing costs encourages businesses to invest and consumers to spend. Consequently, equity markets often see a direct benefit. Investors, faced with poor returns on safe assets, have a clear incentive to move capital toward stocks and higher-yield bonds to pursue growth.

Stocks

Money moves toward companies that promise fast future growth, even if they aren’t making a profit today. There’s a general feeling of optimism in the market. This mood especially helps businesses that depend on consumer spending, like technology companies and retailers.

Bonds

This is a difficult environment for conservative income investors. Yields on safe government bonds fall. To get a meaningful return, investors are often pushed into riskier corporate debt. The appeal of ultra-safe government bonds diminishes.

Cash and Local Currency

The currency tends to weaken as interest rates are low. This is why holding excess cash often leads to a real loss in purchasing power during these periods, as it encourages capital to be spent or invested.

The Playbook for Contractionary Policy

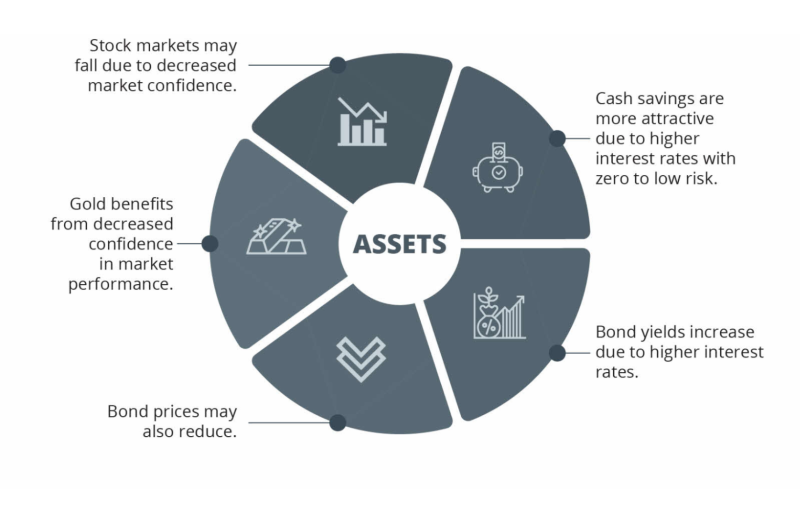

Contractionary monetary policies are implemented with the specific purpose of reducing inflation and preventing an economy from overheating. By raising interest rates, regulators deliberately increase the cost of borrowing, which in turn discourages spending and slows the overall pace of economic activity.

This phase of monetary tightening fundamentally alters the risk-reward calculation for investors. As growth prospects diminish, the appeal of safe-haven assets like government bonds and cash increases significantly. Holding cash becomes a viable strategy, and investors actively re-evaluate their portfolios, seeking a new balance appropriate for a slower-growth environment.

Stocks

The market mood shifts. Investors begin to ask, “Will this company be resilient during a downturn?” instead of “How fast can it grow?”. Solid companies with strong cash flow, in sectors like utilities and healthcare, become more attractive. High-growth companies can face significant valuation pressure.

Bonds

This is the time for patience to be rewarded. While other asset classes are volatile, an investor can purchase safe government debt that now pays a respectable interest rate. It’s a steady approach that becomes very appealing when riskier assets are falling.

Cash and Local Currency

Cash becomes a highly strategic asset. A positive return can finally be earned in simple savings vehicles. Holding cash provides stability and the flexibility to purchase other assets at potentially lower prices. The local currency often strengthens, increasing purchasing power.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Policy and the Fight Against Inflation

This is the delicate balancing act for any central banker. Stimulate too little, and risk a recession. Stimulate too much, and risk unleashing inflation that erodes savings. Their timing is rarely perfect, and the market understands this. When inflation gets out of control, the central bank is forced to act decisively, often at the risk of causing the economic slowdown they were trying to avoid.

In 2014, the European Central Bank took the radical step of introducing negative interest rates. It was an unconventional measure to force banks to lend money rather than hoard it during a period of deflationary risk.

Case Study: COVID-19 Monetary and Fiscal Policies

The 2020 pandemic triggered an “all-in” policy response. Central banks globally, led by the Fed, dropped rates to zero, launched massive quantitative easing programs and pumped trillions into the financial system via asset purchases. Governments simultaneously provided massive fiscal support.

The immediate result was an environment of intense speculative activity. People who had never invested before were actively trading a range of volatile assets. This created a widespread sense of speculative euphoria.

However, the aftermath of this period was severe. By 2022, as supply chains struggled to meet demand, the excess liquidity contributed to the highest inflation in decades. This forced central banks to reverse course and raise rates at a historic pace. The same investors who saw large gains during the stimulus period often sustained heavy losses during the correction. It was a classic lesson in how a liquidity-driven market behaves and how its withdrawal exposes underlying economic fundamentals.

Conclusion

Monetary policy isn’t academic. It sets the rules of the game for investors. It dictates the flow of capital across the globe and determines which assets are poised to perform well.

Expansionary cycles generally reward calculated risk-taking. Contractionary cycles reward caution and capital preservation. Understanding which cycle you are in is the first step. Aligning your strategy to that reality is how you manage risk and find opportunities for real monetary gains.

Recent news