What is Wallet As a Service (WaaS)?

Most companies today want to participate in the digital economy. They need to handle digital payments, manage assets, and run customer programs. However, in reality, building a wallet from scratch is a drain on capital and developer resources, and a single error can lead to a data breach with devastating consequences.

Wallet as a Service (WaaS) is the pragmatic, architectural answer to this problem. It essentially functions as pre-built financial infrastructure. It allows a business to manage digital assets without the operational burden of building and maintaining the underlying system.

Key Takeaways

- WaaS allows businesses to integrate advanced wallet functionalities without the significant cost and effort associated with in-house infrastructure development.

- This technology’s application is much broader than cryptocurrency. It is changing the operational model for how various industries, like gaming and e-commerce, manage their digital payments and loyalty systems.

- The evolution of WaaS is shaped by two major trends. The first is its integration into non-financial platforms, a concept known as “embedded finance.” The second is a move towards greater specialisation, enabled by technologies like blockchain and AI.

What is Wallet as a Service (WaaS)?

Wallet as a Service is a pre-built financial infrastructure for the digital economy. The logic is analogous to cloud computing. A company chooses to use Amazon Web Services instead of building its own data centre. Similarly, it can use WaaS instead of building its own wallet infrastructure by connecting to a wallet as a service API.

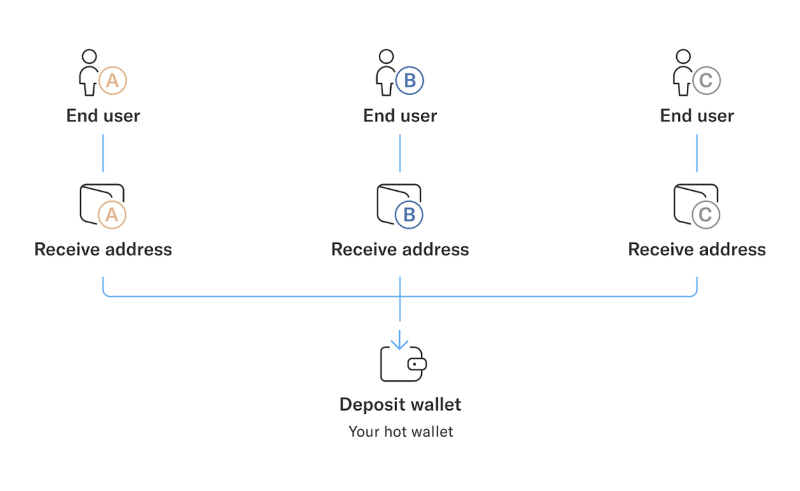

Providers such as B2BINPAY offer a toolkit of cloud-based APIs and SDKs that allow developers to rapidly integrate digital wallets into their own platforms. The capabilities of these wallets extend beyond simple payments. They can be configured to manage various cryptocurrencies, store NFTs, operate complex loyalty programs, or securely hold digital credentials.

The primary advantage here is flexibility. A fintech startup can launch a global peer-to-peer payment application supporting multiple currencies. A gaming platform can process millions of microtransactions for virtual goods. So, what’s the practical benefit? Businesses can launch new services quickly. They can scale operations effectively. And they can do this without encountering fundamental technical roadblocks.

It also permits the straightforward integration of complex functionalities—for instance, biometric authentication, tokenised payments, or cross-border transfers. The system is adaptable. Thus, a fintech startup can apply it for peer-to-peer payments, while a gaming company can utilise it for its virtual currencies. Different requirements, same core technology.

Market projections indicate the global digital wallet sector will reach $15 trillion by 2031.

The Core Features: A Comprehensive Financial Toolkit

So, what capabilities does a WaaS solution offer? Setting aside the marketing terminology, a provider offers a set of specialised tools. Each is designed to address distinct and resource-intensive challenges that businesses face.

Digital Asset Management

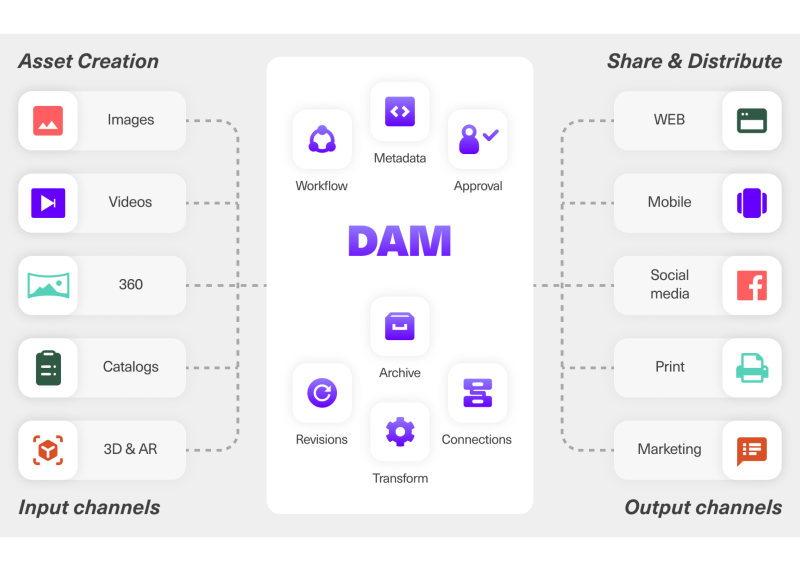

A key concept: ‘wallet’ now signifies more than just currency. That’s outdated thinking. With WaaS, a company manages all its digital assets within a single system. This includes fiat currencies, cryptocurrencies like Bitcoin, NFTs for collectables or proof of ownership, and even proprietary assets such as corporate loyalty points.

The primary benefit is the consolidation of disparate functions. A business gains a unified interface to manage storage, transactions, and asset tokenisation. This eliminates the complexity of using multiple systems.

Secure Storage

Regarding wallets, security is paramount. A failure here can be catastrophic. This is an area where WaaS providers offer distinct value. They are responsible for implementing advanced technologies, such as encryption protocols and multi-party computation, to protect private keys and user data.

And the security is comprehensive. You get a complete package. This includes offline “cold” storage and online “hot” storage solutions. Biometric authentication? That’s included. Multi-factor authentication for transactions? Also standard. The entire system is designed as a strong defence against unauthorised access.

API-Driven Integration

These WaaS platforms are designed for developers. They provide APIs and SDKs—essentially toolkits of pre-built components—that enable the direct integration of wallet functionalities into existing applications.

This modular approach enables a developer to add features like payment gateways or peer-to-peer transfers without building them from scratch. The result is efficiency. It significantly reduces development time and costs while still allowing for extensive customisation.

Regulatory Compliance

This is a critical value proposition: delegating regulatory adherence. WaaS providers manage the significant complexities of KYC, AML, and other global compliance frameworks.

For a business, it is the outsourcing of a significant operational liability and expense. It allows them to avoid costly compliance challenges and instead focus on their core growth objectives.

Multi-Currency and Cross-Border Support

These wallets manage diverse assets: fiat currencies and cryptocurrencies are handled concurrently. For businesses with international operations, this capability is not simply an advantage; it is an operational necessity.

They include the necessary integrated features: real-time currency conversion, support for stablecoins to mitigate volatility, and multi-language interfaces. This makes WaaS a powerful solution for e-commerce, financial, and travel companies that serve a global user base.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Customisability and Branding

These platforms allow businesses to “white-label” the wallet’s user interface. The objective is to ensure a seamless integration with their own brand identity, making it feel native to their application. Full customisation is possible: logos, colour palettes, and the overall UI/UX design can be tailored. Even user-specific functionalities and settings can be implemented to meet unique requirements.

Scalability and High Availability

A WaaS platform is engineered for demanding loads. It is designed to process high transaction volumes and accommodate significant user growth without any degradation in performance. It is typically built on cloud-based architecture for elastic scaling and load balancing, ensuring consistent performance. Providers usually offer high uptime guarantees, often exceeding 99.9%.

Transaction Analytics and Reporting

WaaS platforms typically include robust analytics tools that provide insights into user behaviour and transaction patterns. Thus, businesses gain access to key data: they can monitor transaction volumes and analyse user demographics. Critically, the system can also automate the generation of required regulatory compliance reports. These insights are then used to optimise services and improve user engagement.

Fraud Detection and Risk Management

WaaS incorporates advanced fraud detection and risk management systems that use AI and machine learning to identify and prevent suspicious activities.

Examples include real-time transaction monitoring for anomalies, geolocation tracking to detect unauthorised access, and alerts for potentially high-risk activities.

Seamless User Experience

Here is a fundamental principle: if the user interface is difficult to navigate, the underlying technology, no matter how advanced, provides little value. User adoption will suffer. WaaS providers, therefore, focus on creating a simple and intuitive interface for the end-user. This includes features like one-click payments for efficiency, push notifications for transaction alerts, and straightforward account recovery mechanisms.

Use Cases of Wallet as a Service (WaaS)

So, where is this technology practically applied, and for what purpose? A crypto wallet as a service offers a flexible set of functionalities that various industries are adapting to solve specific challenges. Let’s explore some of these real-world use cases.

Financial Services and Neobanking

For neobanks and fintech companies, WaaS serves as the core infrastructure. So, what is the benefit for fintechs? They gain the tools to develop secure applications with a strong focus on user experience. The result is that individuals can execute peer-to-peer payments efficiently, both domestically and internationally. It also supports virtual account systems, which allow for better financial organisation within a single platform.

E-commerce and Retail

In e-commerce, WaaS primarily addresses transaction friction. A more efficient checkout process directly results in fewer abandoned shopping carts. The bottom line: higher sales conversion. That is the commercial benefit. But this technology offers more — it also allows companies to integrate loyalty programs seamlessly, making the accrual and redemption of points an effortless aspect of the customer experience. Additionally, the system manages digital gift cards and vouchers.

Cryptocurrency and Blockchain Applications

Cryptocurrency applications are where this WaaS technology first gained significant traction. Regarding cryptocurrency and blockchain applications, WaaS is not just useful—it is practically essential. It provides a secure digital repository for assets such as Bitcoin and Ethereum. It also facilitates the management and display of NFTs. Furthermore, it serves as a secure gateway for users to interact with DeFi platforms for activities like lending and staking.

Gaming and Entertainment

In the gaming industry, WaaS serves as the financial engine. It manages the game’s virtual currencies. It enables players to truly own and trade their digital collectables, including NFTs. And it streamlines the microtransaction process for in-game items—a critical component of many contemporary gaming revenue models.

Travel and Hospitality

For the travel sector, WaaS enhances convenience. It provides a secure digital repository for airline tickets, boarding passes, and travel itineraries. It also simplifies the management of loyalty points and facilitates cross-border payments and currency conversion for international travellers.

Healthcare and Insurance

WaaS has applications in healthcare, including patient wallets for the secure storage of digital health records, insurance information, and prescription data. This can simplify complex administrative workflows. Consider more rapid processing for insurance claims. Consider straightforward, secure payment methods for telemedicine consultations.

Logistics and Supply Chain

Within logistics, WaaS simplifies B2B and B2C payment processes. It also allows companies to manage tokenised representations of physical goods. This can introduce much-needed transparency into supply chain tracking processes. Operational expenses, such as fleet management, can also be streamlined through wallet-based solutions.

Education and Learning Platforms

Educational institutions are adopting WaaS to provide students with a consolidated digital wallet for various functions: making tuition payments, receiving stipend disbursements, and accessing digital resources. These wallets can also store verified digital certificates, offering a secure method for students to present their academic credentials. Additionally, the technology simplifies fundraising for educational initiatives.

Charity and Nonprofit Organisations

Charitable organisations are utilising these platforms to accept digital donations. A key advantage? It can improve transparency concerning the application of funds. Nonprofits can also issue token-based rewards to encourage deeper engagement with specific campaigns.

Transportation and Mobility Services

For transportation services, WaaS simplifies payment processes. Digital fare collection for public transit, ride-sharing services, and tolls? WaaS enables these functions efficiently. Wallet functionalities are also used to efficiently manage subscription-based models for various mobility services.

Real Estate and Property Management

The real estate industry is also finding applications for WaaS. It is used for practical functions like digital rent collection. A more advanced application involves integrating wallets with smart contracts to automate processes like lease agreements and property sales, which reduces significant administrative overhead. These solutions can also facilitate direct utility payments, simplifying property management.

Event Management

Event organisers utilise WaaS for digital ticket management, ensuring secure storage and validation for concerts, conferences, and other events. These wallets also simplify on-site merchandise payments and can be used to provide exclusive access, such as VIP passes, through NFT-based solutions.

Government and Public Services

Even governmental bodies are beginning to adopt WaaS. They are exploring its use for direct benefit distribution to citizens via secure digital wallets. The technology can also manage digital identity credentials. This can streamline access to public services. Additionally, it allows individuals and businesses to make tax payments securely and with greater efficiency.

Personal Finance Management

WaaS also underpins personal finance applications. These are the tools that help users track and categorise their expenditures. Such wallets can be configured to support automated savings plans or budgeting targets. A key feature? They can also integrate investment portfolios. This allows users to manage diverse assets from a unified platform.

The Future of Wallet as a Service API

Will WaaS “transform digital financial ecosystems”? That is perhaps overstated. Here is the practical outlook: technology continues to evolve. Consumer demand for seamless, secure, and personalised financial services is increasing. WaaS is a significant component enabling companies to meet these expectations. It is becoming foundational infrastructure for innovation, rather than being the innovation itself.

Expansion of Use Cases Across Industries

So, what is the future trajectory of this technology? Setting aside abstract concepts of ‘transforming ecosystems,’ the evolution of WaaS is being driven by practical market demand for more seamless and secure financial services.

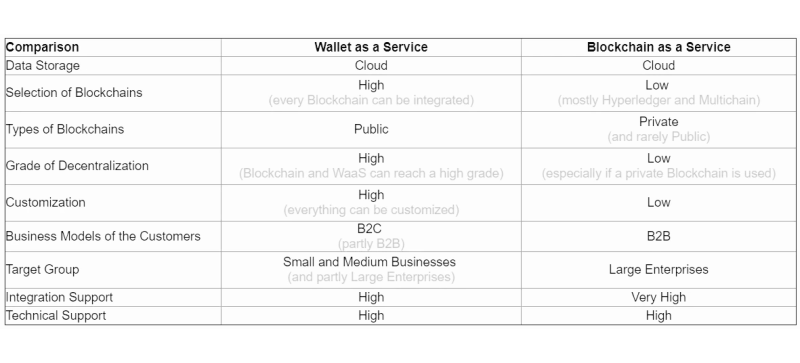

Growth in Cryptocurrency and Blockchain Integration

With blockchain technology gaining traction, WaaS will increasingly support cryptocurrency wallets, DeFi platforms, and NFTs. Future advancements may include greater wallet interoperability for seamless transfers across blockchains, enhanced security mechanisms like multi-party computation (MPC) and self-custody options, and wider adoption of stablecoins for reducing volatility in international payments.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Increased Focus on Personalisation

WaaS platforms will employ AI and machine learning to deliver highly personalised wallet experiences. This could involve automated budgeting and savings recommendations based on user behaviour, real-time fraud detection with personalised alerts, and tailored loyalty rewards or promotions based on spending patterns.

Embedded Finance and Seamless Integration

Embedded finance, which integrates financial services into non-financial platforms, will accelerate the adoption of WaaS. Examples include e-commerce platforms with instant checkouts and Buy Now, Pay Later (BNPL) options, ride-hailing apps that manage digital fare payments and subscriptions, and gaming platforms that enable in-game purchases and NFT-based asset management.

Emphasis on Security and Privacy

As wallets manage increasingly sensitive data, WaaS providers will emphasise advanced security measures. Future developments could include enhanced biometric authentication systems like voice or retina recognition, decentralised identity (DID) solutions for improved privacy, and quantum-resistant encryption to counter emerging threats from quantum computing.

Regulatory Alignment and Global Compliance

WaaS providers will focus on maintaining compliance across jurisdictions to address growing regulatory scrutiny in digital finance. This may involve real-time updates to adapt to changing laws, built-in anti-money laundering (AML) and counter-terrorism financing (CTF) frameworks, and support for regional data sovereignty requirements to ensure local data protection standards.

Cross-Border and Multi-Currency Capabilities

As businesses operate globally, WaaS will focus on enabling frictionless cross-border transactions. Future improvements include instant currency conversion at competitive rates, adoption of regional and global payment standards like Central Bank Digital Currencies (CBDCs), and advanced remittance services with lower fees and faster settlements.

Adoption of Decentralised Wallets

Decentralised wallets, giving users more control over their private keys, will gain prominence. Wallet as a Service providers may offer hybrid solutions that combine custodial and non-custodial features, enable decentralised identity management for secure user verification, and integrate wallets with decentralised ecosystems to support Web3 applications.

IoT and Connected Wallets

The Internet of Things (IoT) will drive the adoption of connected wallets, enabling secure transactions between smart devices. For instance, wallets embedded in autonomous vehicles will handle toll payments and refuelling. Smart appliances will make automated consumable purchases, and wearable devices will be secure wallets for contactless payments.

Sustainability and Green Finance

To align with global sustainability goals, WaaS providers will adopt eco-friendly practices. These may include wallets for managing carbon credits and offsetting personal or corporate carbon footprints, support for green cryptocurrencies that use energy-efficient mechanisms, and tools for tracking and reporting the environmental impact of wallet transactions.

Conclusion

Ultimately, Wallet as a Service is not a revolution in itself, but rather a powerful catalyst. It is a utility—much like cloud computing—that enables other companies to build innovative products faster, more affordably, and more securely.

WaaS manages the complex, resource-intensive, and high-risk aspects of digital finance, allowing businesses to focus on their core products and customer needs. It is the unseen but essential infrastructure that will power the next generation of digital interaction. The future is digital, and WaaS is a key technology providing access to it.

FAQ

What is Wallet as a Service (WaaS)?

WaaS is a cloud-based solution that empowers businesses to integrate digital wallet features using APIs, SDKs, and tools without building complex infrastructures.

How does WaaS benefit businesses?

WaaS saves development time and costs, boosts security, ensures compliance, and supports multi-currency and customisable wallet features.

What industries can use WaaS?

WaaS suits industries like finance, e-commerce, healthcare, gaming, transportation, real estate, education, and government.

Is WaaS secure?

Yes, WaaS ensures security with encryption, biometric authentication, multi-factor authentication, and fraud screening systems.