What Do High Interest Rates Mean For Crypto Hodlers?

Cryptocurrencies transformed from being a digital means of sending and receiving the money to an integral part of the financial system, grabbing the attention of leading traders, governmental regulators, and banks.

The crypto community now speculates on the US interest rates and inflation reports to plan their crypto trading strategies, benefiting from the fluctuations after the Federal Reserve (FED) interest rate hike news.

News from the Federal Reserves drives much of the movement in the financial market. How do these markets respond to interest rate changes? And what is the impact on cryptocurrencies? We will answer these questions in detail as the following.

Key Takeaways

- The interest rate is the Fed’s monetary tool to adjust the economy and control inflation and unemployment rates.

- Higher interest rates make high-risk securities less appealing to traders.

- Cryptocurrencies are indirectly affected by interest rate hikes, and stagnations are mostly driven by macroeconomic factors.

- Stocks and indices suffered notable price drops in September in light of the Fed interest hike from 5.25% to 5.50%.

Interest Rates Overview

Fed is the entity in charge of the US economy and introduces monetary and fiscal policies to respond to economic changes. The Fed maintains the economy based on three main drivers: inflation, unemployment, and interest rates, while the latter is mostly associated with economic growth.

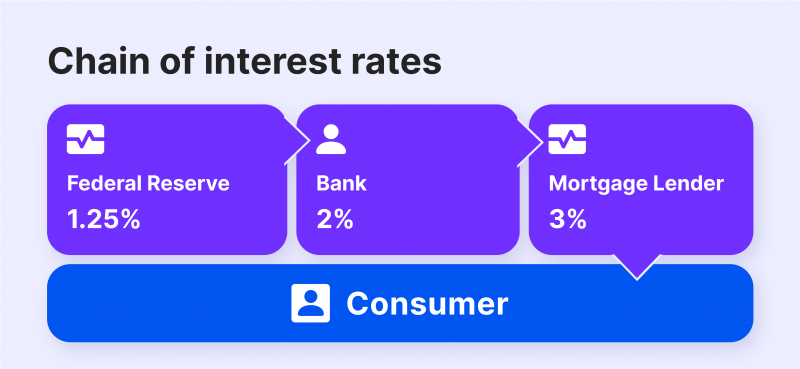

Fed Funds Rates are interest rates that commercial banks charge while borrowing from each other or the central bank. The interest rate affects how commercial banks set loan rates, like mortgages and credit lines. Eventually, interest rates affect the population’s spending habits and the value of money. The central government uses interest rates to drive other economic determinants like inflation rates and unemployment.

When the economy grows rapidly and the inflation level surges, the Fed raises interest rates to slow down the growth rate, pull down prices, and avoid the economy overheating, which happens when growth surpasses output.

When the Fed interest rate increases, it cools the economy’s growth because it makes borrowing more expensive and increases the cost of credits. Therefore, businesses tend to slow down on their investments and expansions when the interest rates increase.

The Fed Reserve cannot directly influence the unemployment rates. However, with interest rate changes, it can indirectly affect employment. When interest rates go down, businesses are more likely to borrow money and credits for investments, requiring more workforce and increasing the employment rate in the economy.

Current Fed interest rate hikes are motivated by the record inflation figures in the U.S., reaching 9.1% in June 2022 after running a zero-interest rates policy for two years between 2020-2022.

When Does The Fed Increase Interest Rate?

Interest rates are pretty much the driving force behind business activity in an economy. The Federal Government lowers interest rates to stimulate borrowing and make loans more affordable, encouraging individuals and businesses to take more loans and spend more money. Thus, companies start venturing into business expansion, investing in new product/service lines, and improving working conditions. This increasing business activity requires more service providers, increasing the country’s general product/service output.

Moreover, the population is more likely to borrow low-cost credits to fund their expenses and holidays and purchase more pricy products like automobiles and mortgages. However, when interest rates increase, it means that credits and loans cost more now, deterring consumers from additional expenditures. Also, when the economy is growing at unmatched rates, overtaking the gross domestic product (GDP), demand increases more than supply, resulting in rising prices of goods and services.

When the economic growth keeps skyrocketing, it causes “economy overheating”, with high inflation and employment rates, increasing the price so much and creating an asset bubble, which eventually can lead to severe recession. Governments try to avoid economic overheating by increasing interest rates to demotivate exaggerated productivity but gradually to avoid economic shock.

How Monetary Policies Impact Trading

Monetary policies, like interest rates, affect institutional and individual wealth and the money they are willing to invest. When Fed interest rates increase, the cost of borrowing becomes higher, and investors have less money available for trading. When interest rates increase, organisations tend to slow down on their investments and expenditures, which may reduce the business’s growth rate and stock valuation.

Moreover, when traders decrease their activity in financial markets because of increased money costs, major financial markets are affected, and prices start tumbling. Traders tend to avoid investing in “high-risk” assets and go to more “risk-averse” securities like bonds.

On the contrary, when interest rates are reduced, people have more money and can borrow more at lower expenses, encouraging them to explore more trading opportunities and portfolio diversification options.

Inflation Rate and Financial Markets

High inflation rates mean high living standards and higher prices for goods and services. Therefore, retail traders and individual investors must allocate more money for the consumer basket and buying household essentials, leaving them with less money for trading.

At the same time, financial institutions and organisations avoid taking many high-priced loans, leading to lower activity in marketplaces, especially since big financial corporations trade with massive capital and manage several portfolios of renowned investors.

These two events lead to lower demand for securities in most exchanges like stocks, cryptocurrencies, and Forex, and based on basic economic fundamentals, lower demand creates lower prices.

The Relation Between Interest Rates and Financial Markets

Interest rates affect individual and institutional capital and spending tendencies. Thus, lowering interest rates leads to more investments simply because loans and other products become more affordable, and more money is available for trading.

On the other hand, increasing interest rates lead to market stagnation, where traders slow down their investments, especially in high-risk securities. Let’s see the impact of interest rates on cryptocurrencies and stocks, two of the most affected markets from Federal rates.

On Cryptocurrencies

The impact of interest rates on cryptocurrencies is complex due to differences between micro and macro market factors. Let’s explain this.

Analysing from a macroeconomic perspective says that increasing interest rates leads to slowed trading activities because credits and money cost more. Therefore, classical traders refrain from investing in high-risk assets, prominently cryptocurrencies, since they are highly liquid and volatile, creating a bearish crypto market.

From the microeconomics perspective, interest rates are increased in times of higher inflation, meaning prices go higher, and fiat money loses value because $1 will have a lower buying power. Therefore, traders hedge this loss in the Dollar value with a higher return currency, which is Bitcoin, pushing Bitcoin and other cryptocurrencies prices higher and creating a bullish market.

On Stock Markets

Stock markets experience a more direct connection with inflation and interest rates, and they affect and get affected by Fed monetary policies. When interest rates drop, organisation tend to increase their investment window and spend more on business internal and external improvement, which mostly lead to enhanced productivity and output.

However, when interest rates are so low or for a longer time, it increases the wealth in people’s and organisations’ pockets, who are ready to spend more and increase the demand for multiple products that are not sufficiently supplied. This occurrence increases the price and creates inflationary pressures on the economy, and as a result, the Fed might push the interest rates higher to cool down the fast-paced growth.

The impact on financial markets was visible after the September reports of increasing Fed Fund rates to 5.5%, where the NASDAQ stock exchange slipped by almost 1.30%, and the S&P 500 went down by just south of 1% shortly after the announcement.

Can Increased Interest Rates be Good for Traders?

Traditionally, increased interest rates tighten business activities and stagnate financial markets. Higher interest rates mean loans become more expensive, and individuals and companies are left with a smaller investing capital.

However, some stocks appear to perform better with increased interest rates. The financial sector and corporations that deal with banks and provide necessities are the biggest winners from higher interest rates. For example, banks’ stocks like JPMorgan Chase, Goldman Sachs, and Bank of America flourish when the Fed Reserve increases the rates.

Higher interest rates mean that commercial and investment banks can charge more for giving out loans like mortgages and credits while paying depositors and saving accounts lower rates. Other sectors that profit from these increased rates are insurance and brokerage firms.

Cryptocurrencies are indirectly affected by higher interest rates because they entail higher risks. However, decisions to increase interest rates hint at a rise in inflation, motivating crypto enthusiasts to dump their inflated fiat money in exchange for higher-return cryptocurrencies.

How Did Interest Rates Affect Crypto Market Previously?

Unlike stock, cryptocurrencies enjoy an indirect connection with Fed interest rates. Corporations’ stocks are directly associated with the GDP and national output, justifying their direct link to interest rates, whereas cryptocurrencies are affected due to investors changing appetites.

Crypto enthusiasts may argue that cryptos provide a hedge for rising interest rates in light of inflation since they provide higher returns than fiat money. However, they are associated with high risks and become extremely volatile with each Federal Fund Rate announcement.

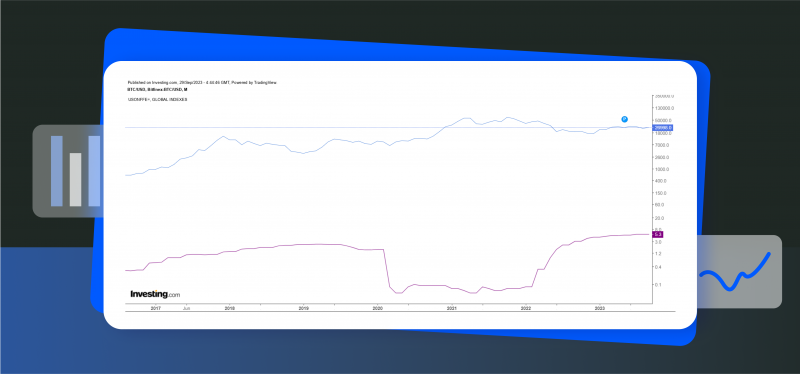

We tracked how Bitcoin’s value in USD has reacted to changes in interest rates since 2017. Data showed that Bitcoin price presents a negative relationship with Fed Rates – When interest rates increased, Bitcoin price decreased.

The figure also explains the skyrocketing crypto prices in 2020-2021 after interest rates fell to almost 0% during the COVID-19 pandemic, pushing Bitcoin prices north of $64,000 twice in 2021. However, it seems that markets got used to interest rate increases, showing fewer or less severe symptoms after rate increments.

Interest rates jumped from 1.5% to 5% in June 2022-2023. In the same period, the Bitcoin price suffered a drop from around $20,000 to $16,500 in six months before recovering to the range of $30,000 by June 2023. These changing events show that cryptocurrencies indeed suffer every time the Fed Reserve announces a new rate increase. However, lately, the market has shown some tolerance to these changes, indicating only short-term tumbles before climbing again.

The Future of Markets With High-Interest Rates

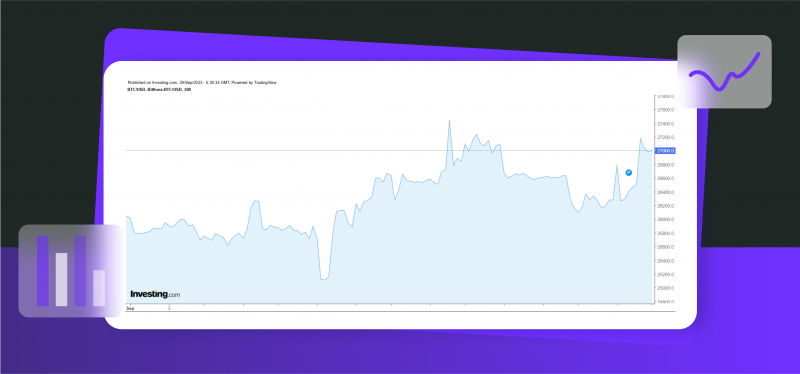

Cryptocurrencies showed resistance to the raging news of interest rate hikes. Bitcoin price went down from around $27,000 at the beginning of September to $25,100 after the first week before recovering to just north of $27,000 by the last days of September.

The same happened to the second-largest cryptocurrency, Ethereum, which started the month at $17,000 before dropping to $15,500 by the 10th and climbing again to $16,500 during the week of September.

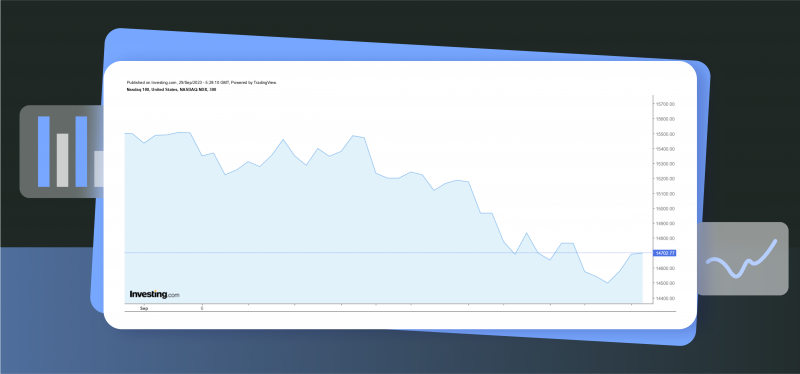

However, the impact was more severe on stocks, where NASDAQ and S&P 500 stumbled upon higher interest rates. Nasdaq composite started September at around $15,500 and kept trembling until the 20th, when it started declining, losing around 3.5% in a couple of days, and continued sinking to around $14,500 by the end of September.

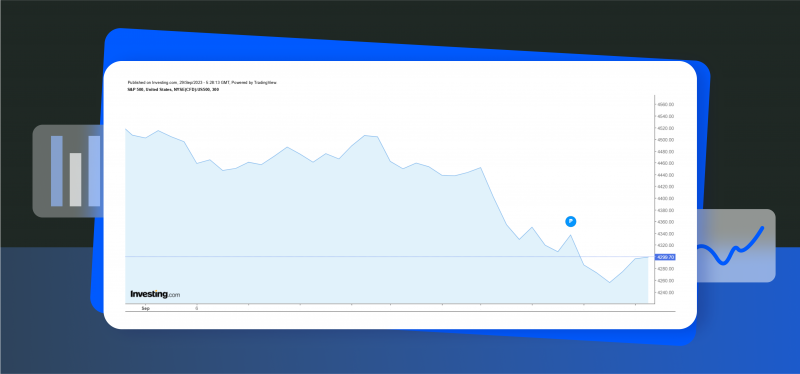

The S&P 500 index also showed similar symptoms, starting the month at $4,500 and starting its decline on the 19th and losing 2.8% of its value by the 22nd of September before losing another 1.1% a couple of days later.

However, interest rates are unlikely to keep increasing as policymakers predict this to be the last or penultimate hike this year. Yet, 2024 looks promising, with expectations for Fed rates to start dropping the next year, reaching the reigns of 4.5% as inflation figures improve.

This may carry some good news for consumers and corporations as loans will become more affordable next year, with the expectation for a series of interest declines over the next few years.

Conclusion

High interest rates negatively affect financial markets, especially the stock and crypto markets. Higher interest rates mean loans and credit become more expensive, and investors now have less money to invest, or simply they are discouraged from investing in high-risk securities. However, this seems to be the end of the interest hikes series, and the next year might bring some good news for borrowers and investors, as rates are expected to move downwards.

FAQ

How long will interest rates stay high?

The Fed interest rate hikes undertaken this year are expected to stabilise or decline in 2024, and the current 5.5% Fed Fund Rates are expected to drop to 5% the next year or 4.5% in the following years.

How does interest rate work?

Interest rates drive inflation and unemployment rates in the economy. The Fed increases interest rates during high inflation to make loans and credits more expensive, demotivating investors and traders, slowing economic growth and bringing inflation to acceptable levels.

What do higher interest rates mean for crypto?

Higher interest rates make loans more expensive to obtain, and traders and investors are less willing to invest because other expenses are rising. Additionally, when the interest rate is high, investors avoid high-risk securities like cryptos, lowering the market demand and prices.

Will the stock market go down if the Fed raises interest rates?

Yes. Federal Fund Rate increases make it more expensive for corporations to borrow money, slowing down their operations and investments. These events decrease companies’ overall output and productivity, lowering their stock value and leading to general stock market stagnation.

추천 기사

07.11.22

최신 뉴스