Why Low Latency Matters in High-Frequency Trading

Low latency sets the operating boundaries of high-frequency trading (HFT). When strategies react to market events in microseconds, execution quality depends less on signal logic and more on how efficiently infrastructure processes and delivers orders to the market.

This guide explores how architectural decisions directly influence market outcomes. We identify specific friction points where delays degrade performance and analyze the engineering choices that secure a lasting competitive edge.

Key Takeaways

- Low latency directly determines execution quality, spreads, and fill rates in HFT environments.

- Microsecond delays compound into material cost and risk at scale.

- Latency must be managed across hardware, networks, software, and risk controls together.

- Faster execution improves predictability but increases the need for real-time risk safeguards.

- Sustainable low-latency performance depends on infrastructure design, not one-time upgrades.

What Is Low Latency Trading? (and Why It Matters)

Low-latency trading is the ability to ingest market data and execute orders within microseconds. Automated strategies rely on this speed to secure a favorable position in the matching engine queue.

Latency influences execution behavior in harsh, practical ways. A delay of just 50 microseconds can push an order behind competitors. This positional disadvantage forces execution at worse prices and, over thousands of trades, erodes profit margins through slippage.

Institutional trading firms measure latency using "wire-to-wire" metrics, tracking the exact time from when a data packet hits the network card to when the system transmits a response.

True high-speed architecture must optimize three distinct phases:

- Ingestion: Reading market feeds via direct exchange connections.

- Calculation: Processing strategy logic on dedicated hardware.

- Execution: Transmitting orders through optimized network routes.

Theoretical hardware minimums cited in marketing materials often vanish in production once real-world network jitter interferes. B2BROKER focuses on deterministic performance to counter this volatility. A system consistently executing at 200 microseconds delivers better returns than one capable of 100 microseconds but suffering from high variance.

A Matching Engine Built for Volatility

Process thousands of orders per second with the B2TRADER trading platform, designed for institutional-grade stability.

How Low Latency Influences Execution Quality and Spreads

Latency directly dictates the "risk premium" embedded in the spread — liquidity providers widen the gap between bid and ask prices when they cannot update quotes fast enough to match a volatile market. This safety margin protects them against adverse selection, effectively charging traders for technical slowness.

If a pricing engine lags behind the primary exchange feed by even 10 milliseconds, the provider risks selling an asset that has already dropped in value. Eliminating the delay removes the need for artificial price padding. Tighter spreads emerge naturally when the infrastructure processes market data in real time.

Execution quality depends on minimizing "tick-to-trade" time, or the interval between a trader seeing a quote and the matching engine receiving the order. Slow connections cause high-frequency traders to target prices that no longer exist. The exchange rejects these orders or fills them at a worse rate, destroying strategy performance.

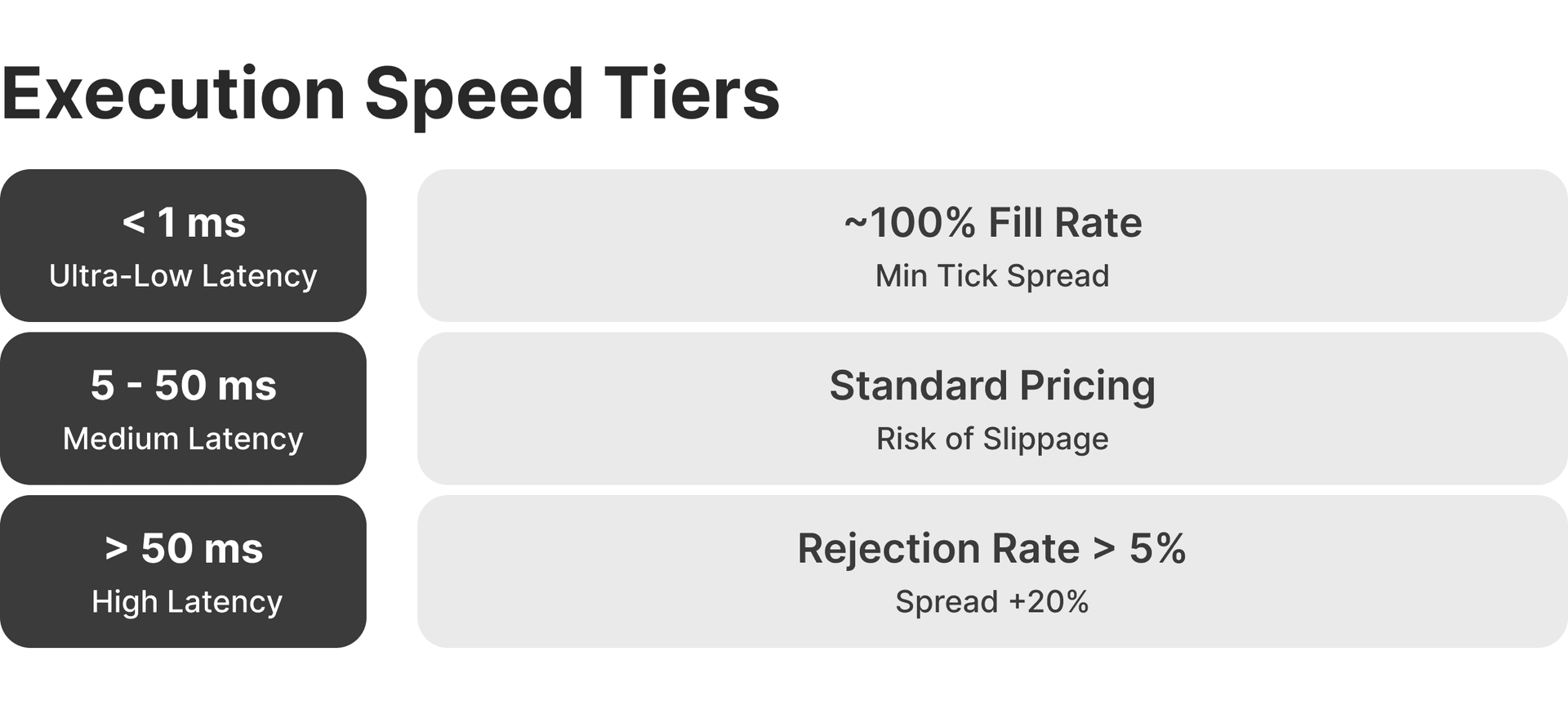

Operational environments demonstrate distinct performance characteristics based on speed:

- High Latency (>50ms): Spreads expand by 10-20% to offset uncertainty. Rejection rates frequently exceed 5% during fast markets.

- Medium Latency (5-50ms): Standard pricing applies to most pairs. Slippage remains common during news releases or liquidity sweeps.

- Ultra-Low Latency (<1ms): Pricing often tightens to the minimum tick size. Fill rates stabilize near 100% as orders arrive before the order book price changes.

Reaching the lowest latency tiers improves execution predictability but makes the system more sensitive to network queue behavior. B2BROKER balances raw speed with operational stability to prevent synchronization errors in production. Robust architecture protects against "micro-bursts" of data that often crash less resilient systems during periods of extreme volatility.

Core Components of Low Latency Trading Infrastructure

Low latency is an end-to-end property of the entire trading stack. Optimizing a single layer in isolation fails to deliver sustained performance gains because the system always operates at the speed of its slowest component.

Specialized Hardware and Co-location Services

Physics dictates execution speed. Placing servers in the same data center as the exchange's matching engine minimizes the physical distance data travels. Сolocation slashes round-trip times by eliminating the miles of fiber optic cable found in standard internet connections.

Cutting-edge setups utilize Field-Programmable Gate Arrays (FPGAs). These are chips customized to process market data directly on the hardware. Using them bypasses the general-purpose central processor entirely. The primary engineering goal here is to ensure that order execution takes exactly the same amount of time, every single time, rather than chasing erratic peak speeds.

Network Connectivity and Routing Optimization

Network design governs how efficiently data reaches the venue. Direct market access connects trading systems straight to exchanges, bypassing intermediaries that add hops. Cross-connects use short, private cables inside data centers to minimize delay and reduce jitter caused by shared infrastructure.

Some firms deploy microwave or millimeter-wave links for long-distance routes, since signals travel faster through air than fiber. These links require careful planning and weather awareness. Production environments still prioritize reliability, with redundant paths and controlled failover to avoid sudden latency spikes when traffic reroutes.

Software Stack Optimization

Standard OS networking adds context switches and locks that inflate processing time. Kernel-bypass "Kernel bypass" techniques remove this oversight, creating a fast lane where market data travels from the cable directly to the trading logic. Teams adopt these techniques when they need microsecond-level consistency.

Lock-free architectures and efficient memory management prevent the software from pausing to organize data. For example, developers often focus on memory locality (keeping data physically close to the processor). This practice stops the CPU from wasting time fetching information from distant memory modules, keeping the execution pipeline full.

Enterprise Infrastructure Without The Hardware Headache

Access cross-connected servers and deep multi-asset liquidity immediately, bypassing years of expensive development and network engineering.

Steps to Building a Low Latency Trading Environment

Building a competitive infrastructure requires a strategic framework rather than a simple shopping list. Every decision involves a trade-off between speed, cost, and complexity.

Choose the Right Hosting and Deployment Model

Your deployment model dictates performance. Market making requires co-location directly within the exchange's data center to capture microsecond advantages. Trading strategies with longer holding periods often perform well with proximity hosting in nearby facilities, significantly reducing overhead. While hybrid cloud models suit some crypto or forex operations, they introduce too much variance for traditional HFT firms.

Implement Direct Market Access and Redundant Connectivity

Establishing DMA removes broker intermediaries, reducing execution time. However, relying on a single fast line creates vulnerability. You need secondary fiber paths to handle traffic if the primary link drops.

Monitor, Measure, and Tune Latency Continuously

Infrastructure performance degrades without active management. Your team must track wire-to-wire speed and tail latency (the slow outliers that occur during market stress). Monitoring variance during peak loads reveals bottlenecks that average metrics miss, guiding necessary hardware tuning to maintain consistent execution.

Risk Management in Ultra-Low Latency Trading

Ultra-low latency amplifies operational danger just as much as it boosts profitability. An algorithm firing 10,000 orders per second can wipe out capital instantly if a logic error goes unchecked. Relying on traditional software checks creates a processing bottleneck that high-frequency strategies cannot afford.

Effective defense requires automated constraints operating at wire speed:

- Fat Finger Protection: Automated limits on order size and price

- Position Limits: Real-time tracking across multiple venues

- Kill Switches: Emergency stop mechanisms for runaway algorithms

Modern architecture solves the conflict between speed and safety using Field-Programmable Gate Arrays. These specialized chips validate compliance in parallel with the data flow. Checking the rules happens simultaneously with order transmission, removing the network latency penalty usually associated with risk management.

B2BROKER embeds these controls directly into the execution path. We design risk protocols to operate deterministically rather than relying on slow downstream monitoring. Your protection runs at the same microsecond speed as your trades, securing capital without sacrificing queue position.

Strategic Considerations When Selecting Low Latency Infrastructure Partners

Infrastructure partners determine your long-term execution capabilities. Your choice defines the ceiling of your operational performance long after the initial setup concludes. The right provider adapts to market changes alongside your business.

Liquidity Access and Venue Coverage

Low latency delivers value only when it connects to deep and consistent liquidity. Your liquidity partner should provide access to major exchanges and trading venues where price formation actually occurs. According to the industry data, a small group of venues concentrates most global volume, so coverage gaps translate directly into weaker fills. Accessing diverse venues creates a robust price stream that withstands volatility better than a single source.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

Technology Stack, Security, and Scalability

Providers must balance raw velocity with data protection. Efficient APIs must handle thousands of requests per second. Encryption protocols need to secure this traffic without adding microsecond delays. Low-latency systems must scale to support massive volume spikes without degrading execution speed.

Integration, Support, and Operational Reliability

Integration quality affects time to market and ongoing stability. Clear documentation and predictable interfaces reduce configuration errors that introduce hidden delays.

Effective partners offer:

- 24/7 monitoring with defined response times

- Clear escalation paths during incidents

- Proven procedures for market stress events

Responsiveness during outages or volatility often determines whether losses stay contained or escalate rapidly.

Power your Brokerage with Next-Gen Multi-Asset & Multi-Market Trading

Advanced Engine Processing 3,000 Requests Per Second

Supports FX, Crypto Spot, CFDs, Perpetual Futures, and More in One Platform

Scalable Architecture Built for High-Volume Trading

Transform Your Trading Performance with Advanced Infrastructure

B2BROKER has spent over a decade refining the infrastructure that powers more than 500 institutional clients. Our ecosystem combines deep, multi-asset liquidity with an ultra-fast matching engine built specifically for multiple financial markets. Integrating these components removes the technical friction between market data feeds and trade execution.

We deploy servers in top-tier data centers to minimize the physical distance to major exchanges. Integrated risk controls protect your capital at wire speed without slowing down order flow. Partnering with us grants immediate access to this battle-tested architecture, ready for high-volume trading.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Frequently Asked Questions about Latency in HFT

- Is the lowest possible latency always the best outcome?

No. Predictable, stable latency often matters more than absolute minimum latency, especially when risk controls and failover mechanisms are involved.

- How does latency affect risk management in HFT?

Lower latency shortens reaction windows, so risk controls must operate in real time and be embedded directly into execution paths. Delayed controls can amplify losses instead of preventing them.

- Can low-latency benefits apply outside of pure HFT strategies?

Yes. Algorithmic trading, market making, and institutional execution all benefit from reduced latency through tighter spreads, lower slippage, and improved fill rates.

- How often should latency performance be reviewed?

Latency should be monitored continuously and reviewed formally whenever trading volumes increase, new venues are added, or execution quality changes.