What is an Order Book and How Does it Work?

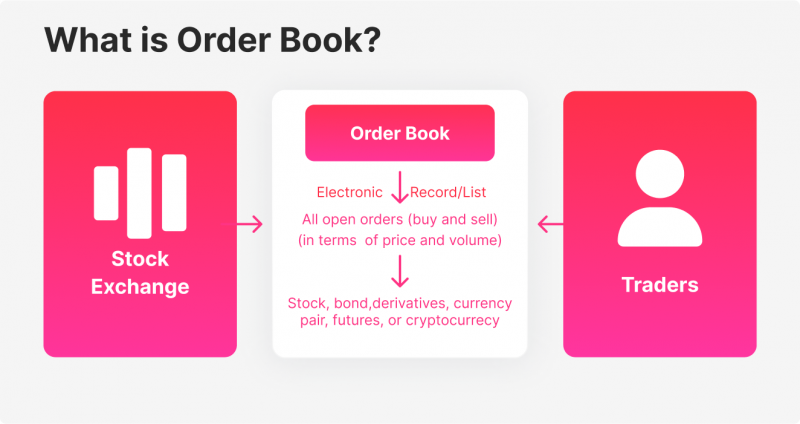

Every participant in financial markets, from novice traders to seasoned experts, deals with an array of complex tools and methodologies. One indispensable tool is the order book, an electronic tally of buy and sell orders for specific securities arranged according to price level. By illustrating market depth in detail, the order book equips traders with valuable insights, guiding their trading activities and decision-making process. In this article, we will take a deeper look at what it means and how it works.

Understanding the Order Book

In the complex world of financial markets, the order book stands as a comprehensive catalog of buying and selling interests for particular securities, playing a key role in the market’s transparency and efficiency. But what makes an order book truly remarkable is its ability to portray, in real-time, the ever-fluctuating tug-of-war between buyers and sellers, thereby painting a vivid picture of the market’s demand and supply.

An order book is like a mirror that reflects the heart of the market. Each entry within it showcases the bid price (the highest amount a buyer is willing to pay) and the ask price (the lowest price a seller is ready to accept) for a specific quantity of a financial instrument. This system is continually updated as market participants submit, modify, or cancel their orders, resulting in a dynamic data set that displays the ongoing financial narrative.

What stands out in the order book is the order matching process, which is the backbone of any marketplace. This process is driven by price-time priority, meaning that orders are filled based on the highest bid and the lowest ask, and when these prices overlap, the order that was placed first gets priority.

However, the order book doesn’t just represent numbers. It presents a story of market sentiment. The levels at which buyers and sellers are willing to transact can provide valuable insights into their expectations and their perception of the security’s fair value. For instance, a large number of buy orders at a particular price level could indicate strong support for the security, suggesting that many market participants believe it is undervalued at that price.

Moreover, by assessing the volume of orders across various price points in the order book, traders can gauge the market’s liquidity and potential volatility. For instance, a deep order book, one with a high number of buy and sell orders spread across various price levels, usually suggests a liquid market, which can accommodate large trades without significantly impacting the price. Conversely, a shallow order book could indicate lower liquidity, which may lead to more price volatility as even small trades could shift the price.

In the grand scheme of things, an order book is an important tool for price discovery. It shows where buyers and sellers converge on price, contributing to the formation of the security’s market price. The price at the top of the order book, where the highest bid and the lowest ask meet, serves as the current market price.

Types of Orders

There are several types of orders that traders can place into an order book, each serving specific needs and strategies.

1. Market Orders: This is a directive given by traders to buy or sell a security at the best available current market price. Market orders get priority and are generally filled promptly, but the final executed price is not guaranteed and may vary, especially in rapidly changing markets. The emphasis here is on speed over price.

2. Limit Orders: A limit order is a directive to buy or sell a security at a specific price or better. For example, a buy limit order could be set at the current market price or lower, and a sell limit order could be placed at the current market price or higher. Unlike market orders, limit orders are not guaranteed to be filled but give the trader control over the execution price.

3. Stop Orders: Also known as a ‘stop-loss’ order, this is an order to buy or sell a stock once the price reaches a specific trigger point, intending to limit an investor’s potential loss. This order becomes a market order once the stop price is met or exceeded.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

4. Other Order Types: Several more complex order types serve experienced traders, such as All-or-None (AON), Fill-or-Kill (FOK), and Immediate-or-Cancel (IOC). These order types come with particular conditions and are often employed to manage the risks and rewards of trading.

How Order Books Work

At their core, order books function as the operational backbone of any financial marketplace, facilitating transactions and fostering market transparency. Here is an in-depth exploration of how these order books work, keeping the marketplace alive, and facilitating the ceaseless exchange of securities.

The Essence of Matching Orders

The order book’s primary function revolves around order matching, a process guided by a set of sophisticated algorithms. As the name suggests, order matching involves pairing a buy order with a corresponding sell order. If you visualize the order book as a seesaw, it attempts to maintain equilibrium between buyers and sellers. A market sell order is matched with the highest available buy order or the “best bid,” and a market buy order is met with the lowest available sell order or the “best ask.”

To elaborate, let’s assume a trader places a market order to sell 100 shares of Company A. The order book algorithm scans the book for the highest buy order that can fulfill this request. Suppose the best bid at that moment is for 50 shares at $50 each. The algorithm will execute this part of the sell order at $50 per share. If the next best bid is for 75 shares at $49, the algorithm will sell the remaining 50 shares at $49 per share. This dynamic process ensures that market orders are filled at the best possible price at any given time.

Depth and Spread – Two Sides of the Same Coin

Two key indicators of a security’s status in an order book are its depth—the volume of open buy and sell orders—and the spread between the highest bid and the lowest ask price. These two elements work in tandem to offer a snapshot of a security’s liquidity and market sentiment.

For instance, a narrow spread (a small difference between the bid and ask prices) coupled with significant depth at these levels usually suggests a highly liquid market with healthy competition among traders, thereby minimizing the cost of trading. On the other hand, a wide spread coupled with low depth could indicate lower liquidity and higher volatility, leading to potentially higher trading costs.

Price-Time Priority Rule

A cardinal rule guiding the operation of order books is the Price-Time Priority rule. This rule means that the order with the highest bid (for buyers) or the lowest ask (for sellers) gets filled first. If two orders have the same price, the one placed earlier gets priority.

This rule is crucial to maintaining fair play in the marketplace, ensuring that every market participant, regardless of their size or trading power, abides by the same set of rules. It keeps the marketplace democratic, prevents potential manipulative practices, and aids in maintaining market integrity.

The Real-Time Nature of Order Books

Order books function in real-time, continually updating to reflect the current state of the market. This dynamic nature is fundamental to their role in the marketplace, ensuring that traders have access to the most current information. The data flowing from the order book enables participants to stay attuned to market trends and sentiment.

Understanding the intricacies of how order books work enables traders to utilize them more effectively. It offers insights into the ever-changing market dynamics and provides a framework for predicting potential price movements and strategizing accordingly.

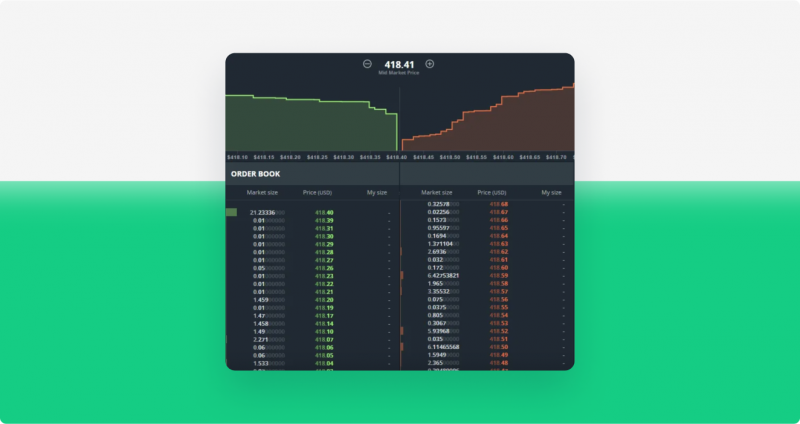

Reading and Analyzing an Order Book

To effectively decode the wealth of information contained within an order book, one needs a comprehensive understanding of market dynamics, the anatomy of the order book, and a keen eye for detail.

Understanding Bid and Ask Volumes

Beyond the best bid and ask prices, it’s important to examine the volume of orders at these price points. High volumes at the best bid or ask prices can act as temporary support and resistance levels, indicating a potential pivot or continuation of the current price trend.

Identifying Order Clusters

Looking for clusters of orders at certain price levels can be insightful. These clusters often act as psychological levels of support or resistance. For instance, a large cluster of limit buy orders could suggest that a significant number of traders believe that the asset is a good buy at that price, providing a potential level of support.

Observing Price Movements

Traders should closely observe how prices move through different levels in the order book. For instance, if the price levels are quickly eaten through on the sell-side, it could indicate strong buying pressure, signaling a possible uptrend.

Analyzing Price Gaps

Gaps or large price jumps in the order book can also provide crucial information. A gap on the sell-side may mean there’s less resistance to upward price movement, which could be a bullish signal. Conversely, a gap on the buy-side could mean lower support, suggesting potential downward momentum.

Examining Order Size

The size of individual orders can also be telling. Large orders often come from institutional traders and can significantly impact the price. If a big order is filled, it could trigger a surge in trading volume and lead to substantial price shifts.

Recognizing Spoofing Patterns

Spoofing, where a trader places a large order without intending to execute it, can mislead market participants. Noticing such patterns can help traders avoid making decisions based on artificial market movements. This requires close observation of the order flow, such as a large order consistently appearing and disappearing, which could signal potential spoofing.

While this may seem like a daunting amount of information to process, traders often utilize software tools and automated systems to help monitor and analyze order book data in real-time. Such technologies can filter and highlight important information, making it easier to spot trends, gauge market sentiment, and make informed trading decisions.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

However, it’s worth noting that relying solely on order book analysis may not provide a complete picture of the market. It’s often used in conjunction with other tools and methodologies, such as technical analysis and fundamental analysis, to build a more comprehensive trading strategy.

The Role of Order Books in Various Markets

Order books serve a vital function across several financial markets:

Stock Market: In this arena, the order book provides a real-time snapshot of trading activities for individual securities, aiding in identifying strategic entry and exit points. This visual representation of supply and demand can help traders make strategic decisions about when and at what price to trade.

Forex Market: In Forex trading, the order book represents market depth for various currency pairs. It provides real-time data about the supply and demand for different currencies, which is critical information for traders dealing in the highly liquid forex market.

Cryptocurrency Market: For cryptocurrency exchanges, order books display the interest of buyers and sellers in various digital assets. Given the volatile nature of cryptocurrencies, understanding the order book can be crucial for traders.

Conclusion

The order book is a cornerstone of modern trading and investing, providing essential real-time information on market depth and the array of buy and sell orders at various price levels. Understanding how to interpret and use order book data can give traders a significant advantage in navigating the market. Yet, as with any tool, users must be aware of the potential challenges that can arise, particularly from high-frequency and algorithmic trading. As technology continues to evolve and reshape the financial markets, the dynamics of the order book will undoubtedly evolve in step, underscoring the need for continuous learning and adaptation.

FAQ

How to read order book data to find buying opportunities?

Understanding how to read order book entries helps spot price levels with strong buyer interest, guiding you toward potential entry points.

How can the order book help anticipate short-term price movements?

By examining the order book, you can identify key levels of supply and demand, giving you better insight into where prices might rise or fall next.

Why is it essential to review the order book before placing a large order?

Checking the order book reveals market depth, helping you avoid unexpected price slippage and ensuring more controlled order execution.