What is Spot Trading?

Starting their way in the world of investments, many traders, and investors ask many questions, the answers predetermining their way in this niche. Electronic trading in any market involves buying and selling financial assets, which can be done through several modes, depending on the objectives: margin trading and spot trading. The first type is more risky but also more profitable. The second is more suitable for beginners, as it does not carry significant risks. However, what is spot trading, and how does it work?

This article aims to explain what spot trading is and how it works. You will also learn about the advantages and disadvantages of this type of trading, on which financial markets it is available. In the end, you will learn about the differences between spot trading and other types of trading.

What is Spot Trading and How Does It Work?

Spot trading is a set of economic relations arising between a seller and a buyer on any type of financial market, be it a stock exchange, cryptocurrency market, or even Forex, and assuming the purchase or sale of trading instruments at the so-called “spot” or market price at the present moment of time, i.e., instantly. Spot trading is carried out on any type of market regardless of the type and specificity of the traded financial instruments and, as a consequence, is a universal way of learning the basics of the trading process without implying a high level of risk, which makes this method of trading an ideal solution for new traders and investors.

Spot trading involves standard technical or fundamental analysis within the framework of the investor’s chosen investment strategy and determining the best time to enter or exit a trade. Adhering to different ways of analyzing and processing trading information, which is mostly candlestick analysis of price movement patterns, as well as data from the order book, the investor makes a conclusion about the expediency of a spot transaction, which, as mentioned above, is instantaneous (with some exceptions), that is, the financial instrument is bought at the best current market price and right at this moment in time.

Spot trading, as well as any other type of trading mode, has similar specifics to work in terms of the general mechanics of the market, particularly in order execution. Since the stable and smooth functioning of any market is, first of all, a high level of liquidity, which directly affects the quality and speed of order execution, the spot trading mode used both for buying and selling financial assets has problems of slippage and too widespread in case the market of any particular asset is experiencing problems of insufficient liquidity, which should be taken into account when choosing this method of trading.

Key Takeaways

- Spot trading is a mode of trading various trading assets on the basis of market orders, the execution of which occurs instantly at the request of the investor.

- Spot trading carries fewer risks and has more versatility as compared to margin trading where risks are higher, but profits are higher too.

- Spot trading is available in all types of financial markets, the most popular being forex, crypto, as well as stock markets.

Advantages and Disadvantages of Spot Trading

Spot trading is undoubtedly the basis for any form of investment activity, as it allows you to start practicing your theoretical knowledge of electronic trading in the capital markets with minimal risks. Like other trading modes, spot trading has its strengths and weaknesses, which we will discuss in detail below.

Advantages of Spot Trading

Let’s start by looking at the advantages that spot trading offers to financial market traders.

1. No Deals Expiration Time

According to most market participants, one of the most significant advantages of spot trading is the ability to purchase a financial asset without restrictions on its retention time in the account. Once purchased, the asset, regardless of its type and place of purchase, can be held indefinitely in the investor’s wallet with the possibility of selling it at any time at his discretion. This feature allows the investor to use a trading strategy without time adjustments, ultimately allowing him to use all market opportunities to find the best-selling points and maximize profits.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

2. Universality

Spot trading is a universal mode because it allows buying and selling trading assets on any financial market with any investment strategy and at any level of knowledge of market mechanics. Spot trading provides the same opportunities for both novice traders and investors and professional, institutional players, and regardless of the specifics of the trading strategy they choose and the urgency of the investment objectives they pursue, spot trading works on the same principles, allowing you to get a stable income.

3. Low Risks

Unlike the margin trading mode, where there are high risks of capital loss as a result of both careless actions on the part of the investor and unforeseen circumstances, spot trading has a low level of risk, which is based only on the volatility of the markets and is directly proportional to the amount of funds invested in the purchase of a particular asset. Having specific knowledge in forecasting the price movement of financial instruments supported by some knowledge of technical or fundamental analysis, this risk can be excluded almost completely.

4. Transparency and Simplicity

Spot trading is a transparent and easy-to-learn trading mode suitable for everyone. With other numerous advantages, many, even professional investors, prefer the classic instruments of buying and selling assets even at the expense of the highly risky and, at the same time, highly profitable margin trading mode. Moreover, the simplicity and convenience of spot trading provide a quick and effective way to learn the basics of trading, which helps to eventually move on to trading with more complex financial instruments, especially leveraged ones.

Disadvantages of Spot Trading

Now let’s move on to the disadvantages that spot trading has.

1. No Leverage

The main disadvantage of spot trading is the absence of leverage, which excludes the possibility of using the broker’s (stock exchange’s) borrowed funds to multiply the capital. In this case, the size of profitability is directly proportional to the amount of investments in a financial instrument and is conditioned by the difference between the purchase and sale price.

2. Low Profit

This disadvantage follows from the previous one and implies limiting the return on investments in spot markets within the limits of the invested money. There is a simple regularity here: the higher the investment level, the higher the potentially predictable profit. At the same time, the level of such profit can be quite insignificant, primarily determined by the dynamics of asset price movements based on market sentiment.

3. Earnings in a Growing Market

Due to the peculiar nature of the spot market, trading on it is possible only in one plane when markets are growing, and assets are rising in price. All spot trades, without exception, are carried out solely to gain profit from the difference between the buy and sell price when the asset grows. Unlike the margin mode, where it is possible to make money on falling asset prices, spot trading is a very simple trading mode in terms of functionality and profitability.

Spot trading got its name due to the fact that transactions in this mode are made instantly, i.e. on the “spot” and right now.

Markets That Support Spot Trading

As mentioned above, spot trading is a universal trading mode that is very popular and has its own peculiarities of functioning. Meanwhile, this trading mode has a long history and is used with equal efficiency both in foreign exchange market, crypto, or even in trading of stock market assets.

Stock Market

Today, the stock market is where investors and traders of all levels and types who want to earn a high income and build a successful career in investment collide. The stock market offers a spot trading mode and an impressively wide range of trading instruments, the variety of which is just incredible. Here you can find different types of stocks, bonds, exchange-traded investment funds, mutual funds (depending on the geography of the market), precious metals, commodities, as well as such complex investment instruments as options and futures contracts, and the process of trading on the spot is simple and is carried out within the framework of cooperation with a specific broker to enter the stock exchange.

Cryptocurrency Market

The emergence of blockchain technology has been a powerful catalyst for the development of cryptocurrency trading, and due to its undeniable advantages, it is rapidly gaining momentum and becoming more popular than other types of trading instruments, making it a potential choice for thousands of both novice and professional investment players.

Cryptocurrency spot trading offers a wide variety of cryptocurrencies, tokens, and stablecoins that can be used to trade and convert within a particular crypto exchange using a classic set of orders of different types: a market order that is executed instantly at the best market price, a limit order that is executed at a predetermined price and a limit stop order that is placed at one price and executed when the level of a second predetermined price is reached.

Forex Market

Forex market is considered to be the largest in terms of market capitalization and the most liquid market in the world for many years. Every year, this market attracts even more new traders due to the opportunity to earn a lot of money using leverage.

Like other types of financial markets, today’s forex market provides access to spot trading in a wide variety of instruments, with an emphasis on foreign currency pairs. Other trading instruments available for trading include spot forex contracts, currency options, currency futures, currency ETF funds, retail platforms, CFDs and more. Such a wide list of instruments available for trading provides ample opportunities for capital growth even in times of crisis. Moreover, spot forex trading also involves the use of two-sided transactions, which means that assets can be traded both long and short.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

How is Spot Trading Different from Other Types of Trading?

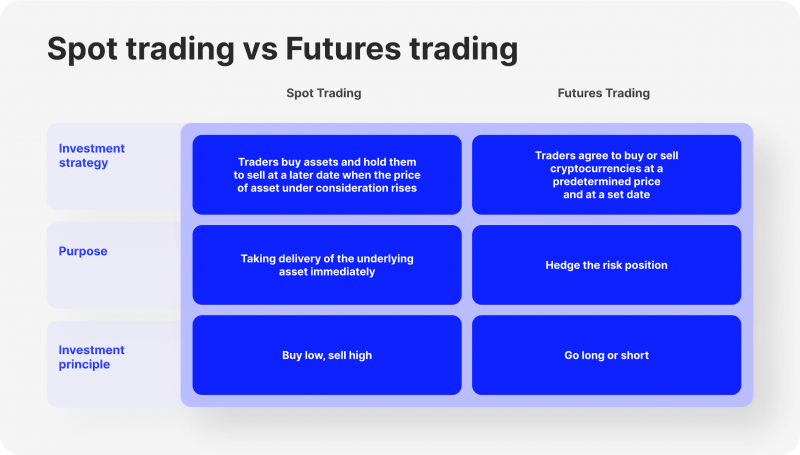

Let’s make a comparative analysis between spot trading and other trading modes since it makes sense to choose the margin type as the main object of comparison, which has similar characteristics to spot trading, but differs radically from it in terms of profitability and principles of operation.

First of all, spot trading is characterized by the instant execution of orders to buy or sell, which makes it possible to make a decision quickly based on the expediency of buying or selling an asset. This allows to carry out financial operations with assets at the desired moment and at the desired price, provided there is sufficient liquidity for this. Such a feature is essential at high volatility at the moment when the investor analyzes the chart and is ready to react at the right moment to buy or sell a trading instrument.

On the other hand, a clear difference between spot trading and margin trading is the presence of leverage. This difference has a very expressive character and is based on the fact that in the mode of spot trading, there is no possibility to use borrowed funds of the broker (exchange), and to buy the desired volume of any trading instrument, it is necessary to have the appropriate amount of funds. In the case of margin trading, regardless of the type of financial market, the investor has the opportunity to use the leverage of different levels to multiply his initial deposit, which ultimately allows him to have more profit in case of a successful forecast.

Another essential difference between the objects of comparison is the mechanism of operation of each trading mode. Spot trading implies the possibility of earning money only at the moment when the price of a trading instrument rises, i.e., when the difference between the initial price of its purchase and the final price of its sale is extracted. This condition is applicable to any type of market and has no exceptions. On the other hand, margin trading has an advantage and offers investors the opportunity to make money both in a rising market and in a falling market while using leverage, if we are talking about the digital assets market. It should also be remembered that despite the high profitability potential, the margin mode directly increases the risk of losing the deposit in case of unforeseen market events.

Conclusion

Spot trading is an excellent mode that is a universal approach to earning money in any financial market. Even beginners without knowledge, skills, or experience in trading on financial markets can safely use it in practice. Unlike the margin trading mode, the spot is a simpler and less profitable way to make money, but it is still the main mode to start a career in investing.

Recommended articles

Recent news