Benefits of WL Forex Software for Brokers in 2023

Articles

In the ever-evolving and unpredictable foreign exchange (Forex) market, both beginner and experienced brokers require dependable software to manage their businesses effectively. Forex white label solutions provide a suite of advanced solutions that can assist brokers in 2023 to stay at the vanguard of competition and deliver their customers with premier services.

KEY TAKEAWAYS

- White label Forex software is a pre-made product that brokers can use to launch their brokerage quickly.

- The advantages of white label software include reduced risk, improved customer experience, increased consumer trust, customization, and constant support.

- Potential risks include a lack of control, high dependency on third-party suppliers, and potential compatibility issues.

- Evaluating the reliability and reputation of the vendor and understanding all details in terms of service should be done thoroughly before engaging with them.

What is a White Label Software for Brokers?

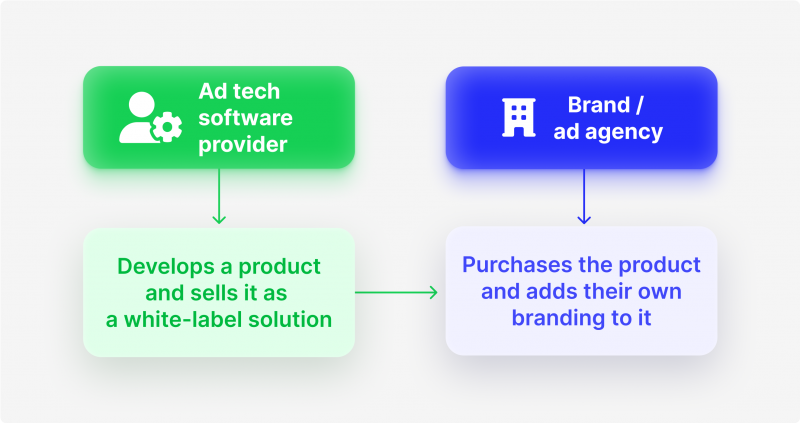

White label software is a pre-built, off-the-shelf solution that can be customized with the client’s own branding. White label products and software are designed by third-party providers with the purpose of being used or resold by other companies.

White label software is a powerful tool used widely in the Forex brokerage world. It includes various solutions, such as trading platforms, customer relationship management (CRM) systems, back-office tools, risk management systems, and so on, which enable brokers to construct and operate their full-service Forex brokerage firm.

With white label software, broker clients ensure all the necessary tools and resources to manage their operations are in place, allowing them to focus on growing their business while the vendor handles all the tedious tasks.

The use of white label solutions in the Forex market has become a popular and efficient way for brokers to establish themselves as legitimate competitors in this dynamic market.

Why Do Brokers Choose White Label Solutions?

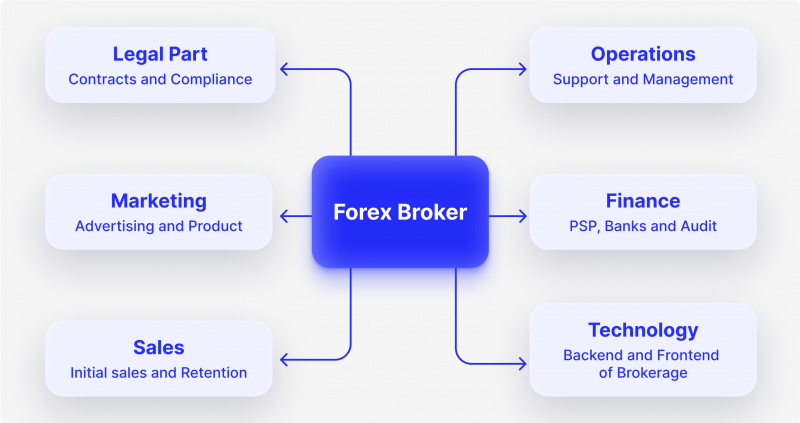

Imagine you want to create your own brokerage house. You have some initial capital and a small team of developers. Now you need to consider and build the essential components of a brokerage, such as the trading platform, CRM, etc. Not only that – you will need to think about liquidity on your platform, regulations in your jurisdiction, and marketing.

To ensure optimal liquidity for their traders, Forex brokers rely upon the services of liquidity providers. These companies provide quick and efficient order execution in the FX marketplaces.

Every single broker component is an intricate system that requires substantial resources and expertise to develop. In addition, it isn’t enough to just create “functional software” – you must deliver consumers first-class products, so they choose your business over the vast array of competitors.

That’s where solutions for brokers come in. Pre-built software is usually the perfect way for brokers looking to conserve time and money. By acquiring a ready-made piece of software, such as a copy trading platform, brokers can implement it right away in their operations without having to go through the arduous and costly software development process.

White label software has advantages for both the developer and the reseller. For the developer, it effectively increases their customer base by allowing them to offer their product to resellers. The client also benefits from this arrangement since they can begin marketing a proven tool quickly without spending on further development costs.

Benefits of White Label Forex Software for Brokers

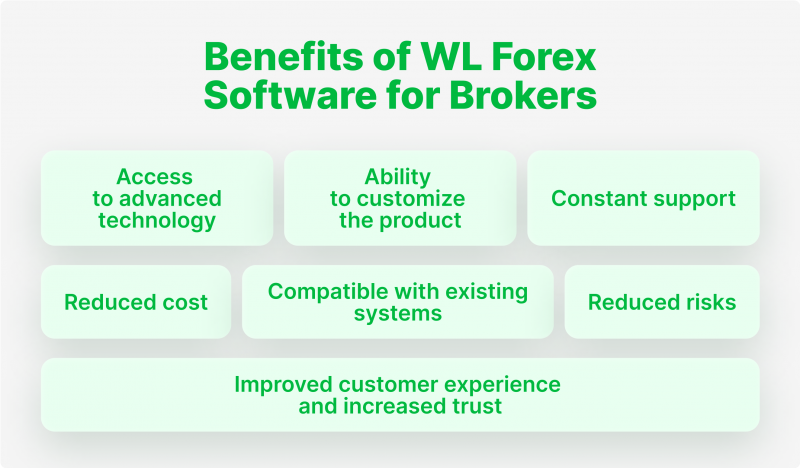

Here are some of the main advantages that can be gained from using white label service:

Reduced cost

White label solution software allows brokers to forego expensive development and maintenance costs associated with building a specific software from scratch. This can provide significant savings over time. You can check the example of prices for some software here.

Compatible with existing systems

Today’s most prominent providers offer module-like integration, which greatly enhances the whole process. This allows brokers to integrate new elements into their business without redesigning or rebuilding any existing infrastructure.

Access to advanced technology

Forex software providers strive to remain at the forefront of technology, thus allowing trading firms access to the latest tools. In doing so, brokers are able to gain a competitive advantage and stay ahead of other industry players.

Reduced risks

By opting for a pre-made product, you are capitalizing on the assurance that it has been put through its paces and tested regarding potential bugs, security issues, and compatibility dilemmas – ensuring your new software is as safe from problems during deployment as possible.

Improved customer experience and increased consumer trust

The pre-constructed white label trading platform offers brokers a cutting-edge way to elevate their customer experience. Clients enjoy the advantages of modern UI/UX designs, dependable support services, and many features available.

Moreover, customers tend to have greater confidence in a broker who uses white label software, as the software has typically been through rigorous testing and verification.

Ability to customize the product

With white label software, you don’t need to settle for a “one size fits all” solution. Brokers can modify the product’s features and functions to appeal to their client base and cater better to their needs. White Label Solution is your chance to enhance broker branding efforts.

Constant support

When you create your software from scratch, you are responsible for its maintenance and upkeep. However, with Forex WL software, you will receive ongoing support and maintenance from the provider.

Drawbacks of Using WL Software

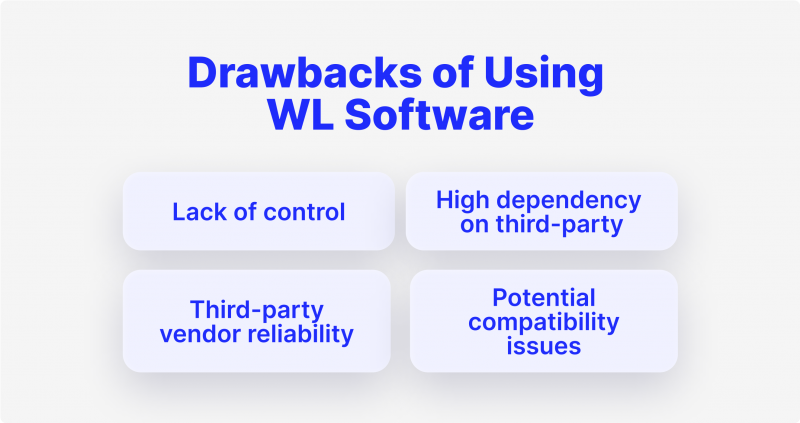

Despite the numerous benefits, certain potential risks come with opting for white label Forex software.

Lack of control

Compared to software developed from scratch, when using WL software, you are restricted to the features and tools provided by the provider. That’s why it can be difficult to manage updates or adjust how your product works – so much of this is out of your control. Furthermore, customizing a white label solution in line with your personal requirements may not always be possible.

High dependency on third-party

Additionally, brokers heavily depend on their suppliers for both assistance and updates. Therefore, if the vendor has a setback or there will be server maintenance, it can have an immediate effect on your business as well as your customers.

Potential compatibility issues

With complex technology, such as financial trading platforms, incompatibility with existing systems is always possible. This could cause major problems for a Forex broker who has already put significant time and resources into building its operations.

However, these risks can be minimized if you choose a reliable provider that offers flexible API options.

Third-party vendor reliability

When it comes to white label software, there’s no such thing as blindly trusting a vendor. Evaluating a provider’s reviews and industry reputation is paramount before making any decisions. Additionally, understanding all details in terms of service and licensing agreement should come first – costing, setup fees, and other relevant information must also be considered before signing off on contracts.

What Kind of Software Can Brokers Implement?

Brokers can find specialized software providers offering a wide range of products and services. Some of the most popular solutions include:

Trading Platform

A trading platform is a software program that provides traders with the interface to buy and sell financial assets. As an intermediary between the trader and financial markets, this platform offers a variety of features to facilitate trading. These include order-placement abilities, real-time quote viewing options, price analysis instruments, and portfolio management possibilities.

Many modern providers today offer advanced charting tools, technical indicators for risk assessment, and automated trading capabilities that enable quick decision-making in volatile market conditions. Furthermore, the optimal platform should also allow customers to trade on their phones through iOS or Android applications.

The most popular WL trading platform solutions today include MetaTrader 4 and 5, cTrader and Match-Trader.

CRM System and Back-Office Solutions

CRM is an essential platform for any broker, as it allows them to securely store crucial customer information like contact details and account history. This makes it simple to both manage accounts accurately and provide customers with personalized service in a timely manner.

CRM systems also help brokers monitor activities such as customer onboarding, payment processing, client retention, and customer feedback.

Some of the more popular CRM and Back-Office solutions are B2Core, Leverate, and CurrentDesk.

Copy Trading/MAM/PAMM Platform

Copy trading and MAM/PAMM technology enable brokers to equip their customers with the opportunity of automating their trades, either by cloning other traders’ techniques or investing in professionally managed portfolios.

These kinds of platforms are favored by novice traders who lack the confidence and knowledge to trade on their own. Additionally, copy trading and MAM/PAMM platforms can also be used as a tool to increase profits for professional traders.

Crypto Processing Software

As cryptocurrency has become one of the most sought-after asset classes, numerous brokers, even in Forex, are now getting more involved in giving their clients a chance to invest in digital assets.

Crypto processing solutions can equip brokers with the capacity to process cryptocurrency transactions by providing features and services like wallet management technology, KYC/AML compliance protocols, safe storage resources for cryptocurrencies, and liquidity solutions.

Some of the most popular crypto processing software include B2BinPay, BitPay, and CoinsPaid.

Conclusion

White label solutions are perfect for Forex brokers and other financial institutions that want to become more efficient, reduce expenses, and offer superior services. By depending on third-party technology providers, brokers can swiftly construct a secure and solid groundwork for their operations with the added bonus of customizing these products to provide even better customer service.

FAQ

What is a white label solution?

White label solution refers to a product or service developed by a third party and branded under the name of the vendor’s client. By using white label technology, brokers can quickly set up their operations while saving time and money in the development process.

What are some popular white label trading platforms?

The most popular WL trading platform solutions today include MT 4/5 and cTrader.

What should I consider before selecting a Forex software provider?

Before signing up for white label software, it is essential to examine reviews and guarantee the provider has a long-standing reputation in the industry. Be sure to understand all aspects of the service agreement, such as cost, setup fees, and other relevant information.