Best Fixed Income Funds to Invest in

Having a steady revenue stream is a vital component of career planning. The fixed income market plays a crucial role in achieving this stability by supporting diversified portfolios. With their consistent returns, fixed income investments can help balance the volatility of other asset classes, providing a reliable financial foundation.

In this article, we will observe the opportunities for best performing fixed income funds and discuss their benefits and drawbacks, which will hopefully help you in decision-making.

Key Takeaways

- Fixed-income funds offer steady returns by making investments in bonds and other comparable assets.

- They spread assets over a variety of bonds, providing diversification and lowering risk.

- High-yield and emerging market bonds are among the diverse concentration areas of top-performing funds.

- For investment to be successful, it is essential to comprehend risk, return, and market circumstances.

What Are Fixed Income Funds?

Fixed income funds combine resources to buy instruments, primarily bonds and comparable assets, to produce a consistent income. Investors receive interest payments from them according to the income made by the bonds they own.

Government and corporate bonds and occasionally preferred stocks or treasury bills are common assets in these funds. Following the strategy, fund managers monitor these portfolios to balance risk exposure and income potential.

Let’s say you’re accumulating funds for a down payment on a home. You want to make a consistent income with your $10,000 investment while keeping it safe. Instead, you invest in a fixed income fund rather than a single bond.

Money from numerous investors, including you, is pooled in this fund. After that, the fund manager uses the combined funds to purchase various bonds from various companies and governments. While some of these bonds may be long-term, others may be short-term. While some may be somewhat riskier but have more potential returns, others may be extremely safe.

Investing effectively spreads your risk over many investments. This means that your entire investment won’t be lost if one bond defaults. Additionally, the fund will give you interest monthly, which you can use to help save for your down payment.

Types of Fixed Income Funds

Various bond kinds, each with distinct risk and return characteristics, are frequently included. Generally, government bonds are considered a lesser risk. Corporate bonds, issued by businesses to obtain capital, range from investment-grade bonds to high-yield bonds, sometimes called junk bonds.

Although they have a more significant default risk, high-yield bonds provide a higher potential yield. Conservative investors are drawn to investment-grade bonds issued by firms with strong financial standing because they often carry a lesser default risk. State and local governments issue municipal bonds, frequently found in municipal bond funds and occasionally offer tax advantages.

How Fixed Income Funds Function in Various Market Situations

Fixed income funds respond to market and economic events, particularly shifts in central bank-driven interest rates. Bond prices frequently fall when interest rates rise, which may affect a bond fund’s net asset value.

On the other hand, bond prices typically rise as interest rates decline. Interest rate risk, inflation, and economic growth trends affect bond yields and are factors fund managers consider when deciding on their investment strategy.

While certain funds, such as the money market, concentrate on stable, low-risk investments appropriate for fixed-rate and conservative portfolios, strategic bonds adapt their allocations in reaction to these shifts.

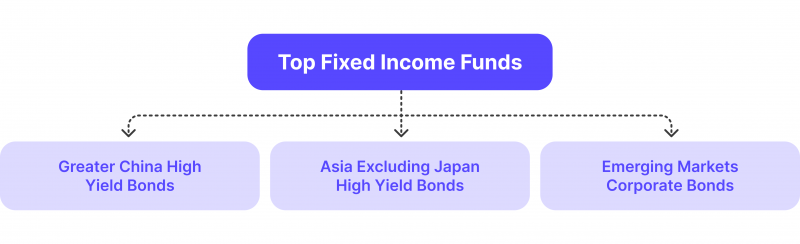

Top-Performing Fixed Income Funds

The top rated fixed income funds for the second quarter of 2024 represent a variety of bond market segments, each of which reacts differently to changes in interest rates and the state of the world economy. Below, we discuss a few of them:

Greater China High Yield Bonds

Fund Name: Fidelity China High Yield A-HMDIST(G) AUD (hedged)

2Q24 Performance: +7.0%, with a Year-to-Date (YTD) return of +10.4%

Due to favourable trends in China’s real estate market, bolstered by government initiatives to stabilise the market, this fund leads the Greater China high yield segment. Its expansion was aided by investments in high-yield corporate bonds, especially from significant real estate firms like Vanke and Longfor. It was a great performer in its category due to lower borrowing costs and a decreasing differential for Asian high-yield bonds.

Asia Excluding Japan High Yield Bonds

Fund Name: BlackRock Asian High Yield Bond A8 AUD-H

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

2Q24 Performance: +6.2%, with a YTD return of +10.1%

To capitalise on regional growth and the advantages of higher interest rates than traditional government bonds, BlackRock fixed income funds focus on high-yield bonds throughout Asian markets outside of Japan.

This currency advantage further supported returns in 2Q24, as the AUD increased by about +2.8%. The fund’s exposure to various industries, such as real estate and energy, produced balanced growth, underscoring its allure for investors looking for income with controllable risk.

Fund Name: Manulife Global Fund – Asian High Yield AA G MDIST USD

2Q24 Performance: +5.5%, with a YTD return of +13.6%

This fund generated strong returns by avoiding Japan and investing in various high-yield Asian bonds. Favourable bond yields and growing demand in emerging Asian economies drove its performance. Together with its USD hedging strategy, the fund’s exposure to both government and high-yield corporate bonds provided stability and steady growth.

This fund was a high performer because of the economic expansion in emerging Asian markets, which increased returns.

Emerging Markets Corporate Bonds

Fund Name: Goldman Sachs Emerging Markets Corporate Bond Portfolio Stable MDist AUD-H

2Q24 Performance: +4.2%, with a YTD return of +3.5%

This Goldman Sachs fund, which targets high-growth nations and focuses on corporate bonds from emerging countries, strikes a balance between risk exposure and chances to generate income.

Thanks to favourable regional economic trends and a more stable global interest rate environment, currency hedging to the AUD improved the fund’s performance. The fund’s good quarterly performance is partly a result of its preference for industries important to emerging markets, such as infrastructure and energy.

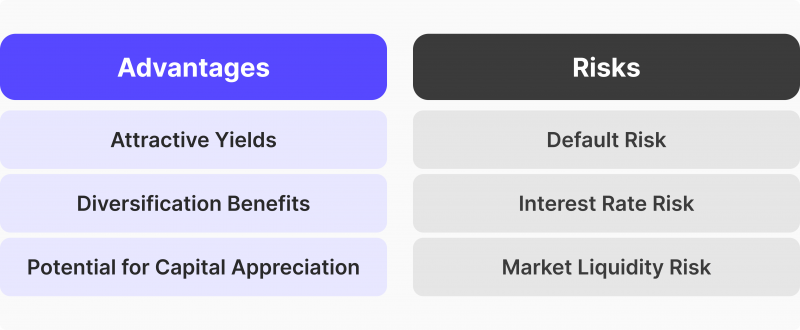

Pros and Cons of Fixed Income Investing

Any decision or investment is not straightforward and has two sides. So, let’s start with discussing the benefits and drawbacks:

Predictable Income – Pro

Consistent interest payments give bondholders steady cash flow. Those who depend on their portfolio for consistent income, such as retirees or people wishing to augment other sources of income, benefit from this predictability. Dividends from municipal, corporate, and government bond funds support this consistent source of income.

Lower Returns Compared to Equities – Con

Fixed-income assets’ growth potential is constrained since they typically produce smaller returns than stock markets. Despite offering consistent numbers, they cannot match equities’ potential for large profits. In this case, lower risk usually translates into more moderate returns, which might not satisfy investors looking for stronger long-term growth.

Principal Preservation – Pro

Generally speaking, instruments issued by dependable organisations—such as governmental bodies or highly rated businesses—carry less risk than stock market investments. This stability offers a decreased risk of principal loss for investors that value capital preservation rather than taking on higher market risks. Treasury bonds, savings bonds, and investment-grade corporate bonds are frequently included in fixed income portfolios in order to preserve capital.

Interest Rate Risk – Con

Changes in interest rates directly impact bond prices. Existing bonds with lower yields lose appeal as interest rates rise, which causes price drops. In a rising rate environment, bond investors who sell before maturity may lose money because potential buyers choose newer bonds with higher yields. Duration management becomes essential to reduce this interest rate sensitivity, particularly for long-duration fixed income assets.

Tax Advantages – Pro

There are tax benefits to several investments. For example, state and municipal taxes do not apply to interest income earned from U.S. Treasury securities. Income from municipal bond funds may also be free from federal taxes and, in certain situations, state taxes. Bond investors looking for tax-efficient income find this investing a compelling alternative due to these tax advantages.

Insufficient Liquidity – Con

Compared to liquid investments or savings accounts, fixed income investments like individual bonds or CDs could be more challenging to access. Market losses may result from selling bonds before they mature, particularly if interest rates have increased. Early withdrawal penalties may apply to investors that lock up assets. Those who require immediate access to assets may find this lack of liquidity problematic, so it’s essential to consider the investment’s timeline before committing.

The Process of Diversification – Pro

By adding diversification to a portfolio, fixed income investments aid in risk management across asset types. The performance of a portfolio can be stabilised by diversifying with bond ETFs, mutual funds, and other bond funds. Bond funds are especially useful for reducing stock market volatility and acting as a cushion when the market declines. Access to a variety of bonds across industries, credit ratings, and maturities is made possible by ETFs and bond mutual funds, which provide diversified exposure.

Global equity market value increased 13.4% to $115 trillion in 2023, while global fixed income markets gained 5.9% to $140.7 trillion.

Key Considerations for Choosing Fixed Income Funds

Duration gauges how sensitive a bond fund is to fluctuations in interest rates. Higher-duration funds typically see more significant price swings in response to changes in interest rates. Understanding duration is crucial for fixed income investors since rising interest rates tend to cause bond values to fall, which affects returns.

Shorter-duration bonds are less impacted by rising interest rates than longer-duration investments. For portfolio managers, duration management is crucial, especially in strategic bond funds where managing rate exposure can gradually stabilise returns.

Currency Hedging and Exposure to Geography

When the value of fixed income instruments issued in foreign currencies varies due to changes in the currency market, currency risk occurs. By neutralising currency fluctuations, currency-hedged bond funds seek to lower this risk, which is particularly advantageous when making foreign fixed income investments.

Currency-hedged classes are frequently chosen by investors who favour international investment platforms in order to reduce their exposure to currency volatility. Geographic exposure also influences fund performance since different regions have different central bank policies and economic situations, which have an effect on both government and corporate bond funds.

Balancing Risk and Return Across Fund Types

Risk and return must be balanced while investing in fixed income, especially when choosing between investment-grade and high-yield bond funds. While investment-grade bonds are less risky and provide more consistent returns, high-yield bonds often produce bigger returns and carry a higher credit risk.

In addition to providing a variety of income streams, diversifying across securities—such as corporate bonds, municipal bond funds, and treasury bonds—can lower portfolio risk.

Mutual funds and ETFs offer diversification, with a range of bond portfolios for a balanced risk-return ratio. In addition to consulting their own qualified advisors for individualised guidance, potential investors should review a fund’s prospectus to comprehend its risk and income possibilities.

Planning Fixed Income Investment

In this guide, we will explain how to set up fixed income portfolios for both present stability and potential future development.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

1. Examining Portfolios for Interest Rate Changes

Fluctuating interest rates significantly impact investments in fixed income. Think about reallocating investments to prepare for any rate reduction by central banks as indicated by economic indicators. In a rate-cutting environment, longer-duration bonds might become more appealing since increasing bond prices could boost their fixed yields. Stabilising returns and getting ready for economic changes can be achieved by balancing short-term and long-term bond holdings.

2. Keeping an Eye on Global Trends Sectors

There is room for expansion in specific international locations and business domains. Promising possibilities can be found by identifying growing industries, including sustainable development, green energy, and technology infrastructure.

There are two choices to consider: government bond funds funding green energy projects and municipal bond funds supporting local infrastructure projects. It is possible to give investors focused exposure to these opportunities by performing sector-based analysis and choosing funds focusing on high-growth businesses.

3. Evaluating Alternative Options

Alternatives to conventional bonds include diversified mutual funds and bond ETFs, which provide exposure to various markets and revenue streams. Bond ETFs facilitate diversification among corporate, government, and high-yield bonds while offering liquidity.

For investors prioritising income, mutual funds may provide stability through managed portfolios and exposure to various industries, as well as possible tax benefits. For long-term profits, investors can choose and manage diversified portfolios with the assistance of a reputable international investment platform.

4. Finding a Balance Between Income Stability and Risk

It is crucial to balance the necessity to control risk and the demand for income stability as markets change. Income can be generated while reducing volatility by combining a variety of corporate, government, and money market funds.

For conservative investors looking for steady income, savings bonds and other lower-risk products can be appropriate. To preserve portfolio resilience when market conditions change, it is important to regularly evaluate the fund prospectus of any bond investments to ensure alignment with income targets and risk tolerance.

5. Aligning Portfolios with Professional Advisors

When economic conditions change, working with expert advisors helps improve decision-making. Expert knowledge of market timing, allocation, and risk management benefits institutional and potential investors.

In addition to offering advice on interest rate developments, advisors might suggest appropriate fixed income securities launched in reaction to market conditions. By working with a reliable advisor, investors can make proactive portfolio adjustments that balance market stability and income potential.

Conclusion

Investing in fixed income requires careful planning and frequent modifications. To maintain the balance and flexibility of your portfolio, consider variables such as duration, interest rate sensitivity, and new opportunities. Regularly check performance to ensure your plan aligns with your financial objectives and the latest changes.

FAQ

Is it wise to invest in fixed income funds?

If you have a defined budget and want steady growth, it may be the best option. Compared to equities, they provide greater certainty, which can lessen the stress associated with the market.

To what extent are fixed income funds risky?

Interest rate risk exists. Bond prices frequently decline when market interest rates rise, which may have an impact on the value of these investments.

What is the riskiest fund type?

The most volatile investments are equity-based ones, such as mutual funds, index funds, and ETFs, whose values fluctuate daily in response to market activity.