Best Mutual Funds in 2026 – The Comprehensive Investor Guide

Achieving success in the financial markets demands careful planning and the strategic use of various instruments to build a profitable trading account.

Mutual funds are fundamental to a strong investment portfolio, pooling capital across diverse markets and asset classes to capitalise on opportunities that align with investors’ needs and market trends.

With the evolution of the financial services industry and reduced entry barriers, a wider range of types and sub-categories have emerged. Let’s explore how they work and how you can invest in them.

Key Takeaways

- Mutual funds are managed capital pools that seek investments in a combination of asset classes and markets.

- Investors buy units to contribute to the money collective, which is used by a professional fund manager to find the best growth opportunities.

- Funds focus on different objectives, such as growth potential, income stability, low-risk returns, or low-cost investments.

- Classic mutual fund types are equity, debt, hybrid, index, and money markets, while tens of variations exist to suit customised financial goals and emerging needs.

What Are Mutual Funds?

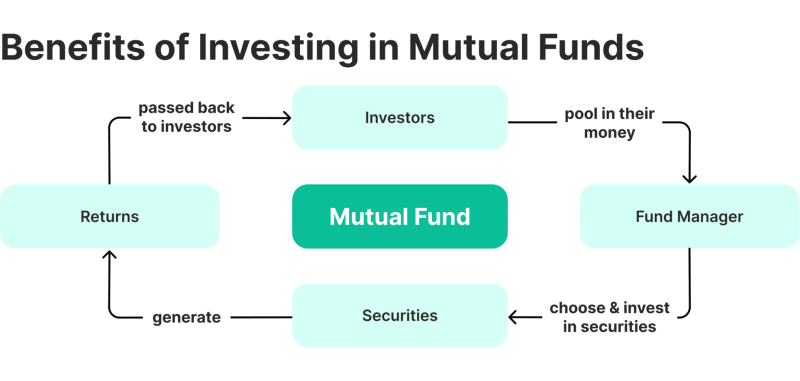

Mutual funds are money pools allocated by investors and managed by professional experts who find the best investing opportunities to grow the fund. Money managers utilise their expertise and knowledge to generate income according to selected markets, asset classes, investment types, trading parameters and other factors.

Investors contribute by buying units, with the net asset value (NAV) representing the per-unit value of the entire fund.

These money pools are managed by an entity called Asset Management Company (AMC), which is legally responsible for managing the capital and investing it in various securities through a selected manager.

Fund managers decide where to invest and how much to allocate based on the fund’s objective, such as capital appreciation, risk minimisation, or fixed-income generation.

Mutual funds focus on earning from low-risk assets and minimising the risk associated with volatile securities, like stocks, currencies or bonds.

You select investments based on risk tolerance, financial goals, and time horizon. Whether aiming for long-term wealth creation or a stable income, these investments play a major role in balancing an investment portfolio.

How Do They Work?

When investors buy units in a fund, they contribute to the allocated money, and they earn (or lose) proportionally as the overall account’s value changes.

The NAV determines the value of their holdings, which tells how much one unit of the mutual fund is worth at a given time. The NAV fluctuates based on the fund’s performance.

If the stocks or bonds in the portfolio perform well, the NAV increases. If the investments perform poorly, the NAV decreases.

Mutual funds are invested in various asset classes, including stocks, bonds, and money market instruments. The best mutual funds ensure optimal returns by balancing risk and reward and generating predictable income.

Investors earn returns through capital appreciation, dividends, or interest income, making it easier for them to align their investment strategy with their financial goals and risk preferences.

Industry Overview

The mutual fund industry dates back to the middle of the 20th century and has grown significantly. It offers a variety of investment options to suit different financial goals.

Today, you can find over 20 different categories and money pool indices that serve similar purposes but with different objectives and factors.

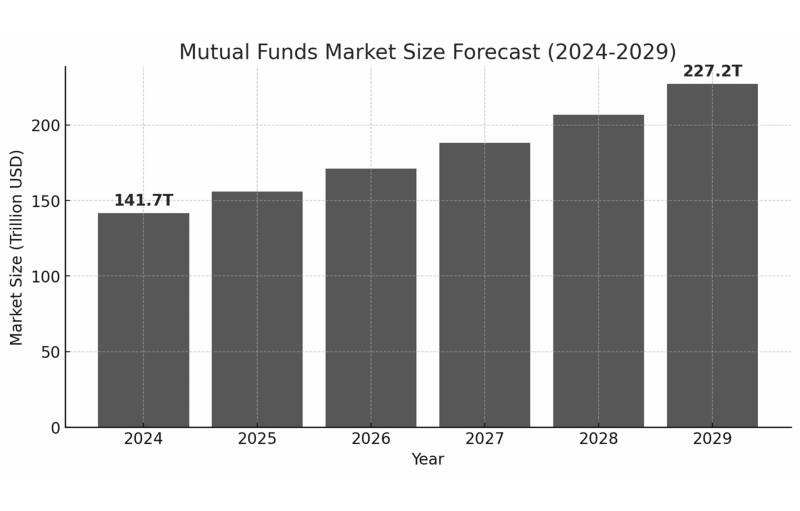

The global mutual fund market size was estimated in 2024 at $140 trillion, which is expected to grow by $85 trillion at a CAGR of 9.9% until 2029.

Equities and stock indices are some of the best-performing mutual funds, triggered by the increasing adoption of passive earning through indices and low-risk ETFs.

Stock funds offer higher long-term growth potential compared to other mutual fund types, providing investors with opportunities to generate significant returns over time, especially in a bullish market.

This industry is governed by regulatory authorities and frameworks. For example, the Securities and Exchange Commission (SEC) oversees the mutual fund market in the United States, ensuring transparency and investor protection.

Over the years, the SEC introduced several reforms that shaped the market dynamics to become what it is today, starting with the Investment Company Act of 1940. This law established the modern mutual fund industry by creating a legal framework for fund operations requiring them to register with the SEC and introducing limits on leverage.

Following the 2008 economic crisis, the Dodd-Frank Act (2010) was passed to restore confidence in financial markets. It introduced stricter oversight of money markets, reducing systemic risk.

It required stress testing, liquidity buffers, and transparency to help prevent panic withdrawals and ensure market stability.

Massachusetts Investors Trust was the first mutual fund, launched in 1924. It focused on blue-chip stocks across industrials, finance, and consumer goods.

Core Types of Mutual Funds

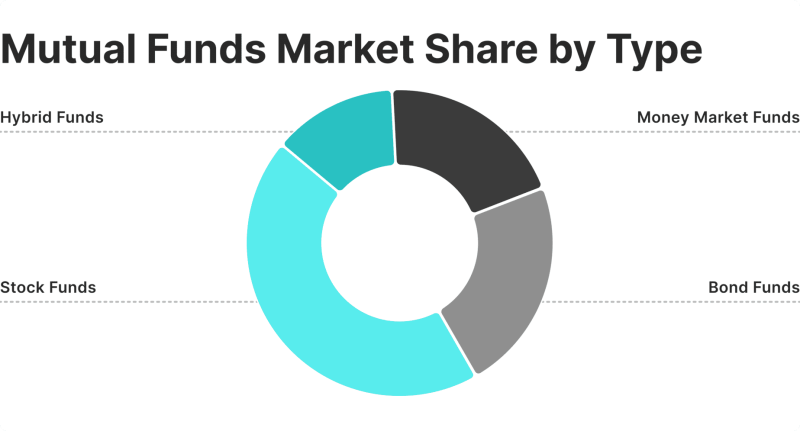

With the growing opportunities to execute different investing strategies, there are five basic types of mutual funds that most market participants look after.

Equities, debt notes, hybrid instruments, indices, and money markets are popular destinations for fund investors and managers. Let’s explore how they work and what differentiates them.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Equity Funds

Equity funds invest mainly in stocks, offering high growth potential at a high risk. They are popular due to the diversification of stocks across tech firms, healthcare, AI manufacturers, power and energy companies, and real estate stocks.

Stock funds include large-cap, mid-cap, and small-cap firms:

- Large-cap: Invests in the top 100 firms by market cap that carry low to moderate risk, including Apple, Microsoft, and Amazon.

- Mid-cap: Invests in the best 101-250 companies that offer higher returns at moderate risks, including Roku, Etsy, and DoorDash.

- Small-cap: Invests in +250 ranked firms that can be highly volatile but with generous returns, including Crocs and Spirit Airlines.

Equity funds suit investors looking for long-term stability and generating predictable returns over a long investment horizon.

Debt Funds

Debt funds invest in fixed-income securities, including government and corporate bonds, treasury bills, and money market instruments. They provide stability and predictability, making them ideal for risk-averse investors.

They balance the safety and return potential of short-term and long-term money pools. As such, they focus on low-volatility assets that carry low risks, making them suitable for portfolio diversification.

Hybrid Funds

Hybrid funds combine equity and debt investments to balance risk and return, offering reliable diversification options through a single fund.

They adjust asset allocation based on market conditions, adding flexibility to an investor’s account and attracting more participants who want to capitalise on growing market opportunities.

Index Funds

Index funds track stock market indices based on market categories or capitalisation, like the S&P 500 or Russell 1000, which covers the largest 1,000 large and mid-cap stocks in US companies.

They offer low-cost access to broad market exposure, making them ideal for conservative investors who prefer to focus on a selected market segment.

Since index funds replicate the performance of a market benchmark, they provide a reliable long-term investment strategy. They maintain low expense ratios and minimal tracking errors, which suits investors seeking steady returns with low fees.

Money Market Funds

Money market funds invest in short-term, high-liquidity instruments like treasury bills and commercial paper. MMFs are highly reliable because they are backed by the full faith and credit of the government or reputable corporations.

They offer capital preservation and quick access to money, making them suitable for investors who prefer flexibility and having access to their capital at any time.

Money market funds are commonly used for emergency capital and short-term savings. Vanguard Federal Money Market Fund and Fidelity Government Money Market Fund are top categories that invest in government-backed assets and offer high liquidity and low risk.

Alternative Mutual Fund Types

In addition to core equity and debt funds, alternative types cater to specific investment strategies. These variations emerged due to the rising popularity and accessibility of such assets.

These include equity-based funds targeting high-growth sectors, debt-based funds that offer unique fixed-income opportunities, and hybrid or specialised investments balancing risk and return.

Equity-Based Variants

These types focus on returns from stock investments, such as earnings on dividends, share valuation, and thriving sectors. Let’s review these types.

Growth Funds

These funds focus on stocks with strong potential for capital appreciation, such as tech firms and developing markets. These funds reinvest profits instead of paying dividends, making them ideal for long-term investors seeking wealth accumulation.

Dividend Yield Funds

Dividend funds invest in stocks that provide regular dividend payouts, seeking those with high annual yields or stable rates that carry little valuation risk.

They are suitable for investors looking for passive income along with capital appreciation, which can be found in financially stable companies with consistent dividend histories, ensuring both income and potential growth.

Aggressive Growth Funds

Aggressive growth refers to investing in high-risk, high-reward stocks, focusing on companies with significant growth potential to achieve returns in a shorter time.

They provide significant price fluctuations and suit risk-tolerant investors, aiming to outperform market indices while carrying higher volatility. Such opportunities can be found in trending investments and emerging industries.

Sector Funds

Sector funds concentrate investments in selected industries such as technology, healthcare, or energy, aligning with investors’ preferences.

They capitalise on sectoral growth trends and breakthroughs, offering high returns when industries perform well. However, investors must analyse sector trends carefully, as they can carry some risks if the stocks underperform or the industry faces difficulties.

International Funds

International portfolios invest in foreign markets, providing global diversification and access to more markets.

This approach reduces dependency on national factors and domestic market performance, offering exposure to emerging and developed economies.

Emerging Market Funds

Emerging funds invest in developing economies with high growth potential, offering solid returns in a short period of time at a higher volatility risk.

They may include markets experiencing rapid industrialisation and economic expansion, making them attractive for long-term and foreign investments.

Debt-Based Variants

These types focus on stable investments backed by governments or high-class corporations. They offer high security and little to no default risk.

Fixed Income Funds

Fixed incomes invest in government and corporate bonds, providing steady returns with low risk. They suit conservative investors who prefer income stability over capital appreciation.

They rely on returns from interest payments, coupon rates, and debt repayments as risk-free earning strategies.

Income Funds

Income-focused types rely on generating regular payouts through interest-bearing securities, which can be similar to fixed incomes.

Unlike growth funds, they prioritise stability and periodic income over capital valuation and volatility. They invest in a mix of bonds and dividend-paying stocks, ensuring reliable cash flow for income-focused investors.

Credit Risk Funds

Credit risk pools invest in lower-rated corporate notes and junk bonds to generate higher returns at high risk.

They include lower-grade and non-institutional bonds and ETFs to provide better yields than government securities, making them suitable for risk-taking investors who prefer short-term returns.

Hybrid & Specialised Fund Variations

This category blends multiple asset classes from selected sectors. Diversified funds spread risk across various investments while actively adjusting allocations based on market conditions.

They aim for balanced growth, income predictability, or targeted exposure with professional management.

Balanced Funds

Balanced portfolios maintain a mix of equities and debt, offering stability with growth potential for moderate-risk investors seeking diversification.

They combine the possible volatility of stocks with stable bonds with frequent allocation adjustments to ensure optimal risk-return balance.

Asset Allocation Funds

Asset allocation securities dedicate money pools between different asset classes based on market trends and growth developments.

They provide flexibility by adjusting equity, debt, and cash holdings dynamically to capture the best earning opportunities while minimising the associated risks.

Funds of Funds

Funds of funds (FoFs) invest in other mutual funds instead of individual securities to provide more diversification across multiple fund strategies.

This approach combines active and passive management, ensuring broad exposure to different asset classes with professional oversight.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Low-Risk & Short-Term Alternatives

This category prioritises liquidity and capital protection by investing in stable assets like government bonds, money market instruments, or fixed deposits. They offer steady but modest returns, making them ideal for those seeking short-term financial stability with minimal risk.

Liquid Funds

Liquidity-focused pools invest in short-term money market funds and other instruments that provide high liquidity and low risk. They act as emergency liquidity access, offering quick redemption and minimal volatility.

They can be used to park surplus capital while earning better returns than regular savings accounts.

Capital Protection Funds

Capital protection funds allocate a significant portion to debt instruments, while a smaller portion goes to equity funds. This approach balances principal safety and capital valuation potential.

Thematic & Alternative Mutual Fund Variations

This category focuses on specific trends, sectors, or strategies, such as technology, commodities, or ESG (Environmental, Social, and Governance stocks).

They invest in non-traditional assets like hedge strategies or private equity for more diversification. Therefore, they offer high growth potential but carry higher risk.

Commodity Funds

Commodity funds invest in physical materials like gold, silver, and oil, offering investments in scarce and historically vital resources.

They track commodity prices in real markets, exposing investors to global economic trends, hedging against inflation, and providing solid portfolio diversification.

Target Date Funds

Target date investments adjust asset allocation for investors nearing retirement. They start with higher equity exposure and gradually shift to conservative assets to ensure stable and predictable returns.

This automated risk reduction minimises investor’s effort, making them ideal for long-term retirement planning.

Equity-Linked Savings Schemes

Equity-Linked Savings Schemes (ELSS) offer tax benefits while earning from equity returns and dividends.

They have a three-year lock-in period that invests money pools in high-growth potential stocks. This approach combines tax savings with wealth creation, making them a popular choice for investors seeking tax-efficient growth.

How to Start Investing?

Investing in mutual funds begins with understanding your financial goals, risk tolerance, budget limits, and investment horizon. Selecting the best portfolio requires thorough research, focusing on fund performance, expense ratios, and fund manager expertise. Here’s how you can start.

- Identify the mutual fund types that best fit your objectives: Equity funds suit aggressive investors, while debt notes cater to conservative investors. Hybrid funds offer balanced risk, and index-based funds provide low-cost diversification.

- Determine your money allocation and investment approach: Choose between a lump sum to allocate all your money for your selected mutual fund or a Systematic Investment Plan, which allows periodic investments to reduce market timing risks.

- Review investment platforms and historical performances: Use online platforms to find your preferred mutual fund and review available fund managers. Analyse historical returns and compare expense ratios to select the best fund investment.

- Monitor and rebalance your investments regularly: Track your investments, market performance, and mutual fund returns. Adjust your portfolio to align with changing financial goals and market conditions, and take a disciplined approach to maximising your wealth over time.

Advantages and Disadvantages

While such portfolios offer great diversification and growth stability compared to traditional financial instruments, they can be challenging to comprehend and track, making them less popular than traditional assets.

Pros

- Diversification: Reduced risk by investing in a mix of assets and spreading the risk and return across different markets.

- Professional Management: Invested money pools are managed by experts with solid trading history to make reliable decisions.

- Liquidity: High liquidity and accessibility allow investors to buy or sell units anytime.

- Accessibility: Investors can start with low capital through Systematic Investment Plans or by finding low-cost platforms.

- Transparency: Mandatory regular disclosures help investors track fund performance more accurately.

Cons

- Market Risk: Equity funds fluctuate with market conditions, carrying significant risks.

- Expense Ratios: Fund managers charge higher fees, especially highly experienced ones.

- Lock-In Periods: Some investments, like Equity-Linked Savings Schemes, have restricted withdrawals.

Conclusion

Mutual funds offer a diverse range of investments, aligning with various financial goals and investor preferences. Fund managers lead money pools and allocate capital to markets and investments that generate income according to given parameters or fund objectives.

Whether seeking high-growth potentials, stable and predictable returns, or diversified allocations to spread your risks, these portfolios provide opportunities for wealth creation.

FAQ

Is investing in mutual funds a good idea?

Yes. They can be highly profitable if you select the right market and make the right investment. Equity funds offer high returns but carry some risks, while debt funds provide stable returns. However, the fund outcome depends on market conditions and management performance.

Are mutual funds tax-free?

They are not entirely tax-free. For example, in the US, long-term capital fund gains are taxed at 0%, 15%, or 20%, depending on income. In the UK, gains above the capital gains tax allowance are taxable, while EU countries have different tax treatments depending on investment duration.

Is mutual fund investment good for beginners?

Yes. Beginners can utilise professional fund managers and portfolio diversification to invest successfully in mutual funds. You can find low-cost or low-risk funds or use Systematic Investment Plans to allow gradual allocation without a hefty one-time payment.

Can you invest in mutual funds with $1,000?

Investing with $1,000 is simple. Choose a reputable platform, find a suitable fund manager, and select the best portfolio based on goals. Invest via a lump sum or SIP. Diversify across equity, debt, and hybrid funds for balanced growth. Monitor fund performance and adjust if required to minimise risk.