How to Set Up an Introducing Broker Program

Retail trading activity in the financial markets is rising, with more and more traders looking to enter the game, as recent data shows. However, the world of trading can feel overwhelming for those new to the game, and certain clients may need a helping hand in starting their trading journey.

Having a network of broker partners who assist clients with onboarding and training clients and then referring them to your firm can be highly beneficial for all parties – traders and brokers. But how do you create an organised and mutually beneficial partnership?

In this article, we’ll discuss what to consider when building an IB program and what it takes to become an Introducing Broker yourself.

Key Takeaways

- IBs focus on building long-term client relationships, while affiliate marketers primarily act as one-time promoters.

- A solid technical solution with features like automatic calculations and allocations, a CRM system, and back-office software is essential for managing IB programs and partners.

- Competitive remuneration can motivate IBs and attract high-value clients.

- Selecting a reputable broker with favourable compensation models and brokerage partner conditions before joining an IB program is important.

What is an Introducing Broker?

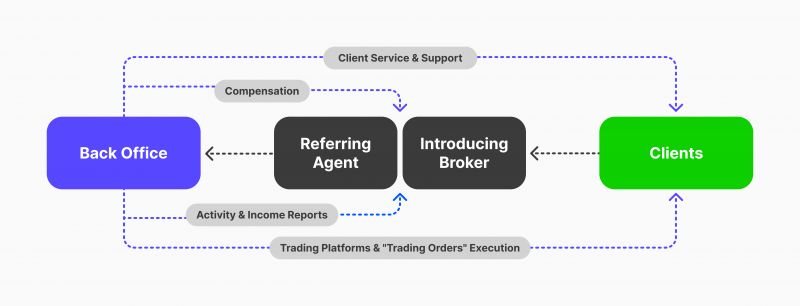

An Introducing Broker (IB) is a financial services company that acts as an intermediary between investors and a clearing brokerage. Their main goal is to attract as many clients as possible to the brokerage and earn money through referral fees, commissions, or other rewards.

Forex Introducing Brokers offer a range of services to investors, including helping them find the best investment products, offering advice on trades, managing risks, and providing customer service. They work closely with the main broker to ensure clients can access all necessary software, support, advice, and directions.

Introducing Brokers vs Affiliates

The broker affiliate program is another way for brokers to attract clients.

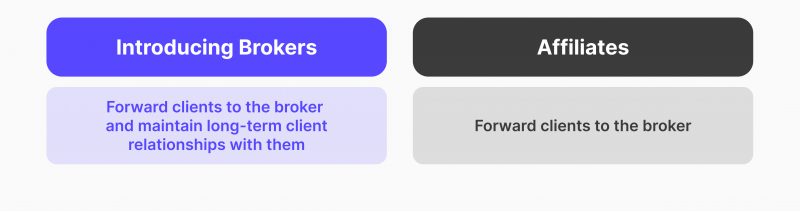

However, affiliates primarily aim to promote the broker or a specific product to drive traffic and generate transactions. Once the link is created and the client is forwarded, their involvement usually ends. Basically, their mission is to distribute the key message of the clearing brokerage.

On the other hand, IBs take on a more comprehensive role in nurturing relationships with clients and adding value to the brand. They actively support and promote the main brokerage, ensuring that their referred clients continue to receive high-quality services and benefits. IBs also focus on maintaining a long-term relationship rather than just generating one-time transactions.

In essence, an IB is more invested in providing ongoing support, while an affiliate marketer acts as a promoter.

Some programs offer an opportunity for affiliate marketers to transition into becoming IBs. At this point, they will have additional responsibilities.

How Do Introducing Brokers Make Money?

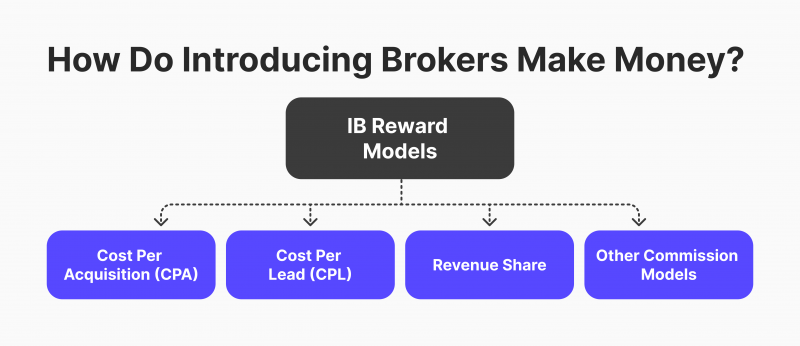

While becoming an IB may involve helping others, it is not a venture without rewards. An Introducing Broker is compensated through various reward models that offer the opportunity for additional income.

Here are some of the most common reward models in the Forex Introducing Broker partnership program:

Cost Per Acquisition (CPA)

One of the most common and profitable commission models for IBs is CPA. Under this structure, partners earn a predetermined amount every time they successfully refer a client to the brokerage. This referral can be by clicking on an ad, registering for an account, or depositing funds.

Cost Per Lead (CPL)

In this model, partners receive compensation for every lead they generate for the brokerage. A lead is a potential customer who completes a designated form or registration process.

Revenue Share

The Revenue Share model offers a more long-term and passive income stream for IBs. This model implies that partners receive a commission percentage from every successful transaction made by their referred clients. The more active the referred client is, the higher the commission an IB earns.

Other Commission Models

Apart from the three main models mentioned above, there are other commission structures brokerages implement. For example, IBs may earn a fixed reward for every lot traded by their referred clients or a percentage of the overall commission earned by the brokerage. IBs also have the opportunity to earn from additional services offered by brokerages, such as educational resources or managed accounts.

How to Run a Successful IB Program

Running a successful IB program requires a combination of effective tools, a client-oriented approach, and continuous effort. Here are some key steps that can help take your IB partnership program to new heights:

Have a Solid Technical Solution

An efficient technical solution is the backbone of any successful IB program. It should facilitate automatic calculations and allocations, making it easier for brokers to manage their partners and ensure accurate compensation.

Usually, a solid customer relationship management (CRM) system and back-office software help brokers effectively manage IB programs and partners. These tools track partners’ performance, manage client referrals, and accurately calculate commissions.

When choosing a reliable CRM, it is recommended to pay attention to several factors:

- Compatibility with existing systems and software

- Adequate tracking and reporting features

- User-friendly interface

- Customisable commission structure

- Multi-level partner management capabilities

- Automated payment processing

- Integration with popular trading platforms like MT4 and MT5

Offer Competitive Remuneration

One of the primary motivations for IBs is adequate compensation for their efforts in introducing new clients to your brokerage. Ensure you offer a competitive rate that aligns with industry standards and adequately rewards partners who bring in high-value clients who regularly trade with your firm.

Provide Support and Resources for IB Growth

IBs want to grow their business just as much as your brokerage. Offer support and resources, such as excellent marketing tools, trading guides, and other educational materials, and demonstrate your commitment to helping IBs succeed. This will help you in retaining Introducing Brokers and, as a consequence, their traders.

Promote Your IB Program Effectively

Many brokers make the mistake of not promoting their IB program. To attract top-quality partners, you need a dedicated landing page with a detailed description of the program and an easy registration process.

Moreover, expanding outreach efforts by targeting influential traders in your niche and promoting on relevant websites can help broaden your reach and attract potential partners. Additionally, establishing a presence on industry websites and affiliation directories can significantly enhance visibility and attract a larger pool of potential partners.

According to the US Commodity Futures Trading Commission, Introducing Brokers is not permitted to accept funds from individuals.

Why Partnering with IBs Is Beneficial for Your Company

A profitable IB program has many advantages for Forex, stock or any other brokerage. Here are some of them:

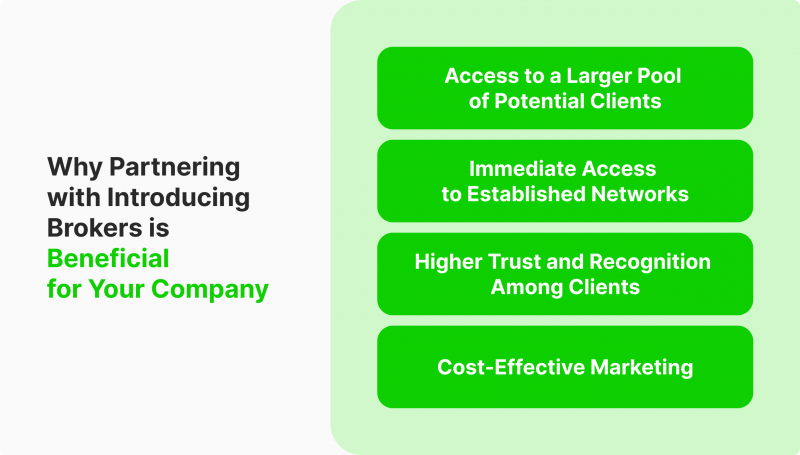

Access to a Larger Pool of Potential Clients

IB partnerships allow brokers to reach a larger pool of potential clients than traditional marketing methods. While online and offline marketing campaigns can reach a target audience, they can be expensive and time-consuming. On the other hand, IBs have an established network of active traders who trust their recommendations and are more likely to convert into active clients.

Moreover, by partnering with IBs from different countries or those who speak different languages, brokers can further expand their reach and cater to a diverse customer base. Such partnerships are especially beneficial when facing restrictions or regulations in a particular market, as IBs can help mitigate the impact of such changes by bringing in clients from other regions.

Cost-Effective Marketing

IB program is an effective and cost-efficient marketing strategy for brokers. Unlike traditional advertising methods, which require significant financial investments, IBs only receive a commission for each new active customer they bring to the organisation. Brokers only pay for successful conversions, making it a highly cost-effective approach.

Immediate Access to Established Networks

By working with IBs, brokers gain direct entry into their network of traders, which can help increase the client base quickly and efficiently. Furthermore, when partnering with an IB from another business, brokers can also gain access to their loyal clients if they leave the organisation.

Higher Trust and Recognition

In the financial industry, where trust and recognition play a significant role in client acquisition and retention, partnering with IBs can be highly beneficial. As IBs have already established relationships with their clients, their recommendations hold more weight and can help build trust and recognition for the broker’s brand.

How to Become an Introducing Broker Yourself

In case you are planning to become an Introducing Broker yourself, here are some essential steps to get started:

1. Obtain the Necessary Permits

Before starting, be sure you understand all the conditions and complexities of running a successful IB entity. It may be better to consult with a professional advisor on these matters.

Some regions, such as the US or Australia, do require licences to perform IB operations. However, even if accreditation isn’t mandatory in your region, obtaining one can enhance your credibility and build trust with potential clients. Traders want to know they are working with a reputable and knowledgeable IB who can guide them through the trading process.

2. Select the Right Brokerage to Partner

The success of your Introducing Broker entity largely depends on the reputation and reliability of the broker you select. Consider the following factors when evaluating potential brokers:

- Reputation in the market

- Regulations and compliance standards

- Range of products and services offered

- Commission structure

- Technology and trading platforms provided

- Marketing support

- High level of liquidity

3. Ensure the Reward Model is Suitable for You

Select the right compensation model that aligns with your goals and resources. Evaluate the commission rates and terms offered by your broker and choose a model that provides you with fair compensation for your efforts.

4. Reach to Your Clients

When starting an IB entity, make sure you can reach your potential clients. Consider the following strategies to increase awareness:

- Understand Your Target Audience: Identify your ideal client and tailor your marketing efforts to their needs and preferences. Consider whether they are day traders or long-term investors, what trading instruments they focus on, etc. Provide the guidance and support they require at every stage of their financial journey.

- Content Creation: Regularly create valuable content, such as blog posts, videos, or podcasts, that provide insights, tips, and industry updates.

- Promotional Materials: Utilise the marketing materials provided by your broker to create banners, buttons, and other visual assets to showcase your partnership. These materials can be displayed on your website or shared on social media platforms.

- Client Feedback: Encourage existing clients to leave feedback and testimonials, as positive reviews can significantly impact your online reputation and attract new clients.

- Networking: Attend industry events, webinars, and forums to connect with other professionals in the forex industry and expand your network. Collaborate with influencers and industry experts to amplify your reach and gain exposure to a wider audience.

5. Introduce Your Clients to the Business

Once you have partnered with a certain company and become visible to traders, it’s time to start referring your clients. There are multiple strategies you can employ to attract new customers.

If you already have a client base or a community of online followers, start by referring them to the broker you are partnered with, which can help you generate commissions right from the start.

6. Consistently Bring in New Clients

To ensure the long-term success of your Forex IB partner program, focus on consistently bringing in new clients. Here are some strategies to achieve this:

- Referral Incentives: Offer incentives to encourage your existing clients to refer their friends and colleagues to your program. The rewards can be in the form of bonuses, discounts, or exclusive access to educational resources.

- Expand Your Reach: Explore different marketing channels to reach a broader audience. Consider paid advertising, social media marketing, email marketing, and search engine optimisation (SEO).

- Continuous Client Support: Maintain a strong relationship with your clients by providing ongoing support and assistance throughout their trading journey.

7. Foster Trust and Transparency

Build trust with your clients by providing accurate and reliable information, being transparent about potential risks, and always acting in their best interests.

8. Leverage Technology and Automation

Utilise technology and automation tools to streamline your operations and make your successful Introducing Broker program more efficient. Invest in a reliable CRM system that allows you to manage client relationships, track commissions, and monitor the performance of your referrals. Automate repetitive tasks like client onboarding and commission calculations to save time and improve productivity.

9. Stay Compliant with Regulations

Ensure that you comply with all relevant regulations and legal requirements in your jurisdiction. Stay updated with regulatory framework changes to avoid legal issues and protect your clients’ interests.

10. Evaluate and Adjust

Regularly evaluate the performance of your Introducing Broker operations and make necessary adjustments to optimise results. Analyse key metrics, such as client acquisition cost, conversion rates, and client retention, to identify areas for improvement. Continuously monitor market trends, competition, and client feedback to adapt your strategies and stay ahead of the curve.

Closing Thoughts

Introducing Brokerage programs is a mutually beneficial relationship between brokerages and IBs that can significantly enhance client acquisition, retention, and overall growth for both parties. A sound IB program should be built on trust, communication, and continuous effort to provide the best experience for clients.

FAQ

How does an Introducing Broker make money?

One of the primary ways an IB earns money is through rebates – a share of the commission or spread that clearing brokers charge their clients for executing actual trades.

What is the difference between an Introducing Broker and a clearing broker?

An IB acts as an intermediary between clients and the clearing broker. The IB’s primary role is attracting clients to the services the clearing broker offers. On the other hand, a clearing broker handles all aspects of trade execution and settlement for its clients.

Can an Introducing Broker accept funds?

No, an IB is not allowed to accept funds from clients. Only a clearing broker is authorised to handle client funds and process financial transactions on their behalf.

What is the difference between a broker and a dealer?

A broker does not take ownership of securities but rather facilitates their purchase or sale. On the other hand, a dealer is a market participant who buys and sells securities for their account.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer