Crypto.com Sues SEC in a Critical Counterattack on The US Regulator

The US financial regulator body continues its streaks against crypto exchanges and decentralised brokerage platforms. In a dramatic turn of events, crypto.com sues SEC, recording a step in the court door before the Securities and Exchange Commission.

The lawsuit came after the SEC issued a Wells notice to investigate the crypto exchange. Crypto.com stated that the unfair practices of the agency motivated this decision and that it is suing the SEC in favour of the entire US crypto brokerage system.

Let’s examine the implications of this decision. Will we see a new victim on Gary Gensler’s list, or will the crypto.com lawsuit make a historical achievement?

Crypto.com Sues SEC after a Wells Notice

On 8 October, crypto.com filed a lawsuit at a Texas district court against the United States Securities and Exchange Commission for its unjustified investigation into the company’s crypto coin sales. The decision comes after a Wells notice was issued to the exchange on 22 August.

The crypto exchange platform stated that its motion aims to protect the future of the crypto industry in the United States, given the continuous crackdown of the federal agency against digital asset brokerage firms.

The SEC has been aggressively targeting centralised exchange platforms, such as Binance, Kraken, and Coinbase. Many of these ended with a hefty financial penalty as a settlement, while other cases remain in court.

Wells Notice Meaning

The Wells notice is a preliminary notification issued by the financial regulator stating its intention to take disciplinary action after completing an investigation of personnel, products/services, or business activities within the organisation.

The SEC Wells notice was sent to crypto.com on 22 August, which the exchange described as “unauthorised and unjust regulation.”

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Usually, the targeted company has a few days to issue a Wells Submission, where it selects its defendant board to answer questions regarding the notice and explain its position.

However, instead of defending against the notice, crypto.com sued the SEC for its legal threat and is looking to stop the agency’s attitude towards crypto exchanges.

SEC vs. Crypto.com: Allegations on Both Sides

The crypto exchange filed the motion to end the aggressive practices of the US regulator, especially in the absence of clear identification of what constitutes a regulated security and how the SEC classifies cryptocurrencies. Let’s review the arguments from both sides as stated.

Crypto.com Lawsuit Grounds

Crypto.com stated that the SEC’s claims regarding the sale of unregistered securities are unreasonable because cryptos are merely digital currencies.

The lack of transparency regarding the distinction between securities and non-securities drives the crypto lawsuit. The SEC regulations state that all cryptocurrencies are securities, except for Bitcoin and Ethereum.

However, the platform indicates that other cryptos are similar to BTC and ETH, as they must not be named securities and do not require registration. Moreover, the exchange has initiated a petition with the SEC, CFTC, and other crypto platforms to agree on a clear-cut categorisation of blockchain assets.

SEC and Crypto Securities

On the other hand, the regulatory body insists that selling unregistered securities breaches the financial regulations and harms the economy.

Chairman Gary Gensler states that only Bitcoin and Ethereum are not securities and can be traded and offered openly. Other coins are treated as investment instruments and must be regulated by the SEC because they impose significant risks.

In its Wells notice, the SEC points out that crypto.com selling network tokens is unlawful, mentioning BNB, SOL, ADA, NEAR, DASH, FIL, ATOM, ICP, ALGO, and FLOW. Accordingly, the agency seeks to enforce disciplinary action against the exchange, with hefty penalties for raising capital through unregulated token transactions.

The War on Crypto Exchanges: Opinions and Speculations

The lawsuit announcement was followed by a thread on X social media by the platform’s founder and CEO. Kris Marszalek said that the agency’s overreach is an abuse of power and does not comply with the nature of digital assets.

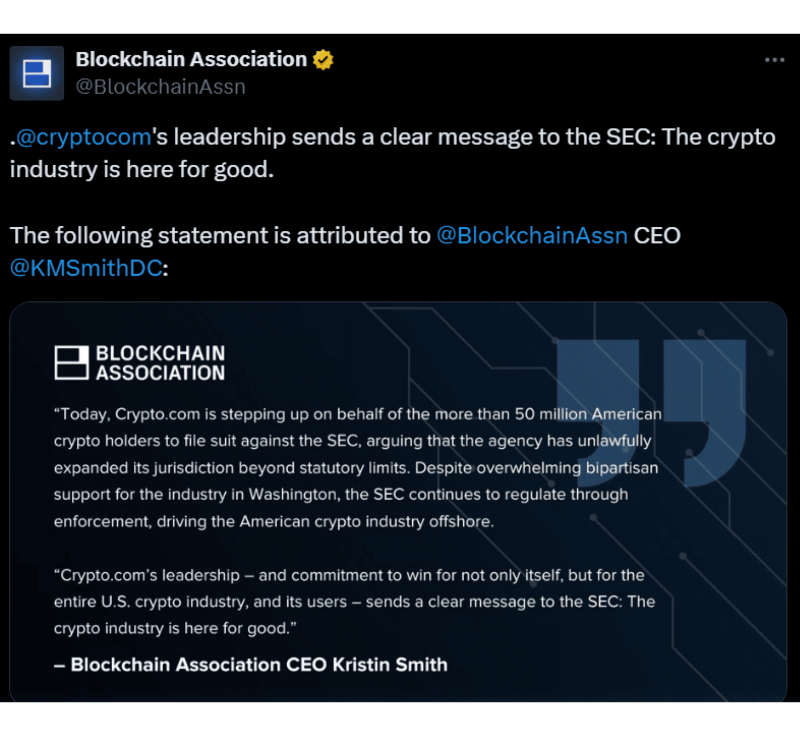

This filing amassed significant attention as other exchanges and platforms supported crypto.com. Blockchain Association, in a social media post, expressed its solidarity with crypto.com’s lawsuit and the importance of this incident for the entire industry. Other sources like The Digital Chamber also showed support for the case, highlighting the unlawful interference of the SEC.

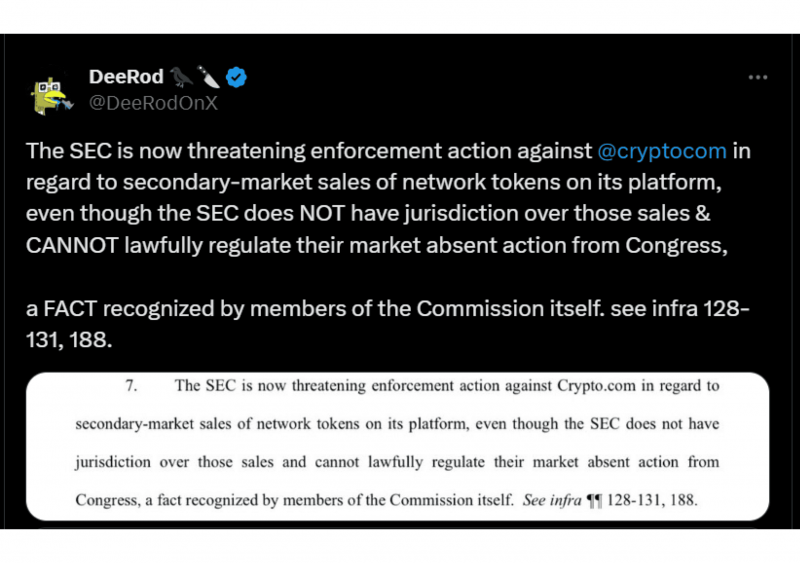

Additionally, one critique on X emphasised the lack of Congressional support as the SEC does not have a ruling over this category of sales.

At the same time, many speculated on the exit of the SEC chairman, especially after the restoration of relations between US presidential candidates and the crypto industry. Many crypto businesses may request Gensler’s absence before proceeding with the blockchain industry, which can only push the US crypto market forward.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Conclusion

Crypto.com sues the SEC in an unprecedented move against the financial regulatory body. This initiation came after the agency threatened the platform with legal action for selling unregistered securities.

The exchange platform is trying to stop the “unlawful” intervention of the agency, especially with the lack of clear differentiation between crypto assets. The case is receiving broad market support, which makes the outcomes unpredictable.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.