Crypto Derivatives vs Spot: Which Way is Best for Your Clients?

Whether you are a business owner or an investor, spot and derivatives markets are two of the main trading instruments you must consider. These financial options have become mainstream across various brokerage companies and exchange platforms, which, despite operating differently, play a significant role in expanding your brokerage firm.

One of the important decisions entrepreneurs face when launching a brokerage company is determining the best business model, crypto derivatives vs spot.

Most trading software, such as cTrader and MetaTrader, offer you a solid way to execute derivatives trading, where investors buy and sell financial instruments’ CFDs as a faster way to engage in the market.

However, you can expand your offerings by providing spot trading services, allowing your clients real ownership of cryptocurrencies amidst a booming market. Let’s compare crypto spot and derivatives and how you can successfully launch a brokerage platform.

Key Takeaways

- Spot and derivatives are two different ways to trade cryptocurrencies.

- Spot exchange facilitates buying, selling and storing crypto coins and tokens.

- Derivatives in cryptos entail financial trading contracts, such as futures, options, perpetuals, and more.

- Offering crypto spot trading allows you to capitalise on the growing trends of owning real coins and digital assets.

Understanding Crypto Spot Trading

Crypto spot exchanges are platforms that facilitate direct trading between users. Thus, traders can buy and sell different coins and tokens in peer-to-peer networks with other users. Unlike traditional brokerage platforms, P2P exchanges entail the interaction between buyers and sellers, while the platform operator gets a cut from the transaction.

This is a much faster way for clients to buy and store their first virtual coins and for crypto holders to sell their digital assets. Additionally, spot exchanges are more affordable, where the only payable fees are charged upon transactions.

Using crypto spot exchanges, users can store their assets using a dedicated decentralised wallet assigned to them while creating their accounts.

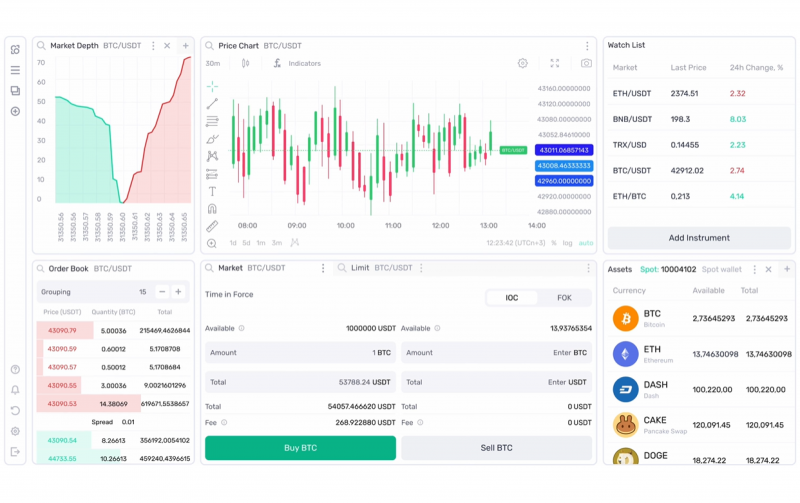

This software involves a matching engine that fulfils orders according to predetermined conditions. Spot trading system scans the order book to find the best price buying price for those who want to buy BTC, ETH and other coins. At the same time, the software matches sellers by finding the best bid for the price of the assets they are willing to sell.

Binance and Coinbase are leading crypto trading exchange platforms that support a wide range of cryptocurrencies and blockchains, ensuring safe and quick transactions between users.

Understanding Crypto Derivatives

Crypto derivatives are financial instruments that entail buying and selling an asset without actually owning it. In the crypto context, a trader can buy Bitcoin and resell it at a higher price for financial gain without actually storing any BTC in their wallet.

The notion of derivatives is to establish a contractual relationship between traders, while the contract’s value stems from the price of the underlying asset, whether it is a cryptocurrency, stock, or Forex currency pair.

This financial instrument is usually offered by crypto brokerage firms, which facilitate different trading tools and contracts. Moreover, this way is easier for beginners who want to make money from crypto capitalisation without dealing with the technicalities pertaining to decentralised wallets and exchanges.

What are Crypto Derivatives Contracts?

There are different types of crypto derivatives that expand the investor’s choice of trading options, such as futures, options and perpetual. Becoming the best derivatives broker means expanding the trader’s selection of trading tools, attracting more users to your platform and increasing your revenue streams. Here is the difference between these financial contracts.

Futures

Futures contracts are financial instruments where two parties enter a contractual agreement to buy and sell a specific asset at a predetermined price at a later point in the future.

Participants may agree to trade Bitcoin at $50,000 on a specific date, regardless of the market price, during the signing of the contract or on the execution date.

This option can be profitable if the market price increases more than the contractual value, allowing the trader to buy at a lower price and sell at a higher price.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Options

These are financial instruments that allow a trader to lock in an asset price to have the right to buy or sell it at a predetermined date. For example, two traders can enter an options contract to buy BTC at $50,000 on a particular date.

When the contract expires or the agreed-upon date approaches, the buyer has the right—not the obligation—to buy the underlying assets, and in this example, Bitcoin at $50,000.

If the asset market price is lower than the contracted price, the buyer can choose not to activate their right and decline the purchase.

Forwards

Forward contracts are similar to futures as they entail the trader of a specific asset under a predetermined price and date. However, they are conducted using over-the-counter exchange platforms and are highly customisable compared to a traditional futures contract.

Crypto futures have standardised contracts that discuss the subject amount and timeframes. However, forwards are more flexible and highly used by crypto traders who want to customise their offerings to cope with the dynamic market.

Perpetuals

Perpetuals are relatively new and are becoming more popular for crypto traders. They allow participants to enter a contract to buy/sell a specific asset at a predetermined price without a specific day.

Thus, perpetual contracts have no specific expiration date that indicates when the asset must be traded and can be held indefinitely.

Spot Broker vs Derivatives Broker: Key Differences

Whether you are looking to start a crypto broker business as a spot exchange or derivates, there are a few things that you need to consider while planning your target market.

Market Exposure

The crypto derivatives trading market is broad, and as a broker, you provide access to trading markets and allow users to execute orders to buy and sell securities.

Additionally, derivatives are flexible, including futures, options and perpetuals contracts, where you can access largely liquid pools and offer different trading services, such as managed accounts and copy trading strategies.

However, when you offer crypto spot trading, you are providing access to digital coins by connecting buyers and sellers on the same platform.

You can do that using consolidated order books and prime brokerage firms that expand the pool of available cryptocurrencies and traders.

Direct spot trading, or OTC markets, is becoming more popular because crypto investors are more interested in real ownership of Bitcoin, Ethereum and other crypto coins.

Therefore, combining both trading systems allows you to capitalise on the booming market and attract as many investors as possible to your platform.

Risk Management

Crypto derivatives and spot trading systems have different risk factors in terms of transaction safety and market exposure.

Running an exchange software entails a matching engine that links buyers and sellers to trade digital and fiat currencies with little consideration of market fluctuations and volatility.

However, exchanges have different licensing frameworks around the world. In some locations, such as the US, they are not subject to the SEC’s regulations. Therefore, traders and brokers do not receive any protection or insurance from the financial regulator.

On the other hand, crypto broker-dealers are heavily regulated worldwide, and the US regulators impose strict rules on the activity of crypto brokerage platforms. However, they offer traders a wide range of trading options, such as leverage and margin trading, which can expose the trader to market volatility and put them at a higher risk.

In January 2024, the SEC approved Bitcoin spot ETF trading on leading US investment firms, boosting investors’ confidence in trading BTC.

Liquidity Sources

Brokerage and spot trading platforms have almost similar settings when it comes to sourcing liquidity and enriching the order book.

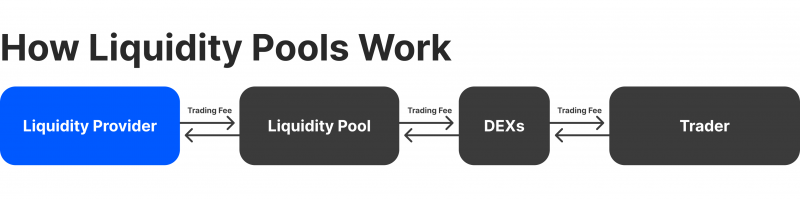

Crypto spot exchanges use multiple liquidity pools funded by institutional investors, individual crypto holders, and traders to make virtual coins and tokens highly available and affordable. Depending on the license they acquire, they can get a higher class of liquidity providers.

On the other hand, a cryptocurrency derivatives broker can connect its brokerage website to a huge number of liquidity providers, such as financial institutions, investment banks, tier-1 banks and financial corporations.

Similarly, they can supply their software through prime brokers or Prime of Prime services that consolidate liquidity from multiple pools and channel them to the broker.

Launching a Brokerage: Crypto Derivatives vs Spot

A spot crypto exchange is a lucrative business idea, especially with the wide accessibility and adoption of cryptocurrencies on online stores and e-commerce websites that facilitate Bitcoin payments.

On the other hand, offering derivatives with crypto coins and tokens enables you to accommodate seasoned investors who are looking for diversified trading instruments.

Crypto brokers are increasingly adding spot trading to their offerings, expanding their businesses and accommodating recent market trends. Here’s how you can launch your crypto company.

Crypto Derivatives Brokerage Development

CFD trading is an established market where professional traders and institutional investors trade cryptocurrencies and other assets without having to store the coins and deal with the blockchain.

This type requires more planning and considerations for liquidity and licensing, and you can start this way.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

- Create a business plan and determine your target market. Some jurisdictions require a two-year plan to issue your license.

- Hire a compliance team to ensure your legal legitimacy and keep you up with the latest regulatory changes.

- Find a trading software that you can add to your website, such as MetaTrader or cTrader.

- Connect your platform with liquidity sources. These providers range from investment banks to hedge funds, prime brokerage and prime of prime LPs.

- Add a payment gateway to facilitate money depositing and withdrawals using fiat and digital currencies.

- Hire a brokerage team to manage your investors’ portfolios and lead your trading activities.

- Plan your marketing strategy to promote your business, get traction on your platform, and launch your platform.

Crypto Spot Brokerage Development

Building your own brokerage platform can be lengthy and hectic but profitable. The crypto community is growing, and people are more appreciative of their data and personal privacy, which motivates them to use cryptocurrencies over traditional payment methods.

Building from Scratch:

- Create your business plan and determine your financial and market goals in the coming years, which can be helpful in bringing investments to your company.

- Add API hosting on your website and integrate those necessary to improve the user experience and payment execution. These include FIX API and other trading applications that communicate live market news and price changes.

- Hire a blockchain-qualified developer team to support a selected range of cryptocurrencies, tokens, stablecoins and blockchains to facilitate cross-chain and fiat-crypto exchange.

- Add a payment gateway to facilitate crypto transactions using the sender’s wallet or mobile applications and ensure a high level of security of these gateways.

Use a Turnkey Solution:

Developing your platform from the ground up takes a lot of time, and you need several stages of planning, programming, testing and launching. This process can be repeated multiple times until you find the right setting for your brokerage.

Add to that the money and resources spent on hiring and training developers and ensuring you have a suitable technical support and testing team to improve your customer experience.

You can make this journey much easier by using a ready-to-use brokerage platform, where you can make it to the market within one week.

With BBP, you can expand your service package to 3,000 financial instruments in crypto and standard financial markets with the slightest fraction of a delay in execution time.

Using a white-label crypto derivatives platform is the right way to serve your geographically dispersed investors better, utilising a multi-lingual technical support team that works 24/7 to aid your customers on time.

There is more to discover when using a pre-built brokerage solution, saving time, effort and resources and making it faster among the best crypto brokers in the market.

Conclusion

Derivatives and spot crypto trading are two popular ways to benefit from the growth in decentralised markets. Investors are highly motivated to own and trade Bitcoin, especially with the latest SEC approval to trade BTC spot ETFs.

Crypto derivatives vs spot trading have different business settings and motivations. Derivatives trading brokerages are well-known markets to investors and professional traders who want to trade futures, options and perpetual contracts on cryptocurrencies.

However, adding a crypto spot trading tool to your brokerage platform allows you to expand your services and capitalise on the recent market growth. You can facilitate direct transactions between traders and coin holders, which can ultimately grow your revenues and scale your business.

FAQ

Is crypto spot trading better than derivatives?

Spot and derivatives have different approaches. A spot, or OTC exchange platform, facilitates direct trading of cryptos between users, while derivatives are trading contracts that allow investors to gain from cryptocurrencies without storing them in wallets.

What are the disadvantages of crypto spot trading?

Spot trading in crypto has a few limitations in trading options, where you can only buy, sell and store the cryptos supported by the platform. They also have limited access to trading markets.

What are the disadvantages of crypto derivative contracts?

Trading with leverage and counterparty risks are two main challenges of derivatives crypto trading, where investors can use the broker’s leverage to amplify their potential gains. However, it amplifies their risks as well.

Is derivatives trading risky?

Derivatives trading risk management strategy is similar to risks associated with any brokerage platform, such as liquidity issues, market volatility, leverage trading and the ability to lose more than what you can afford.