Dealing Desk vs No Dealing Desk Brokers: Which Model Is Best for Your Startup?

In 2024, the U.S. dollar hit a seven-year high, shaking up global markets and creating new opportunities for traders and brokers alike. With forex volumes surpassing $7.5 trillion per day, the industry is more competitive than ever, attracting entrepreneurs eager to launch their own brokerages.

But before you start, one critical decision will shape your success: how your brokerage executes trades. Will you act as a market maker, managing trades in-house, or will you connect clients directly to liquidity providers? This fundamental choice comes down to two key models: Dealing Desk vs No Dealing Desk brokers.

What Is a Dealing Desk Broker?

Dealing Desk (DD) brokers, commonly known as market makers, create their own market for clients. In this setup, the broker often takes the opposite side of a client’s trade. For instance, if a trader wishes to buy a currency pair, the broker may sell it to them from their own inventory.

Here’s how that works:

- Order Placement: You place an order—say, buying or selling a currency pair—and your broker receives it through their trading platform.

- Internal Execution: Rather than sending your order straight to the market, the broker’s dealing desk can choose to match your order with another client’s order or execute it internally.

- Profit from Spreads: The broker earns money from the difference between the buy (bid) and sell (ask) prices. Sometimes, they might also add a little extra charge known as a markup.

- Risk Management: To manage the risks that come from having many trades under their roof, the broker may hedge large exposures with external liquidity providers. However, most smaller trades are handled internally.

The term “market maker” originated from stock and commodity exchanges. Firms acting as market makers are responsible for maintaining a fair and orderly market by consistently quoting buy and sell prices. In the online trading world, dealing desk brokers often play a similar role but with more control over the prices displayed to clients.

Key Features of a DD Broker

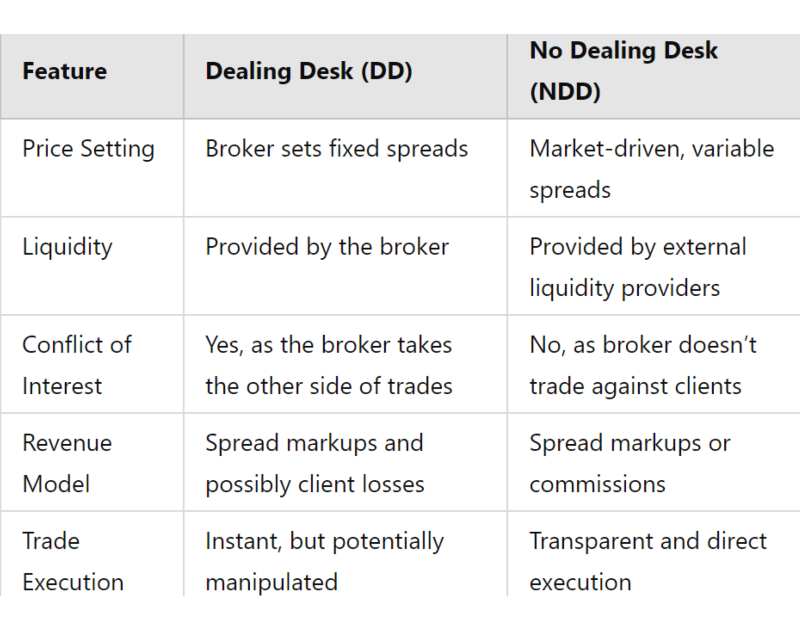

Price Setting

Since DD brokers manage their own order flow, they can offer fixed spreads. This means traders always know their transaction costs, even during volatile market conditions.

Liquidity Provision

Market makers ensure that trades can be executed instantly. Even during market turbulence, clients won’t struggle to find liquidity because the broker itself is providing it.

Revenue Generation

DD brokers earn money from the spread, which is the difference between the buying and selling price. In some cases, they might also profit from clients’ losing trades, as they take the opposite side.

What is a No Dealing Desk Broker?

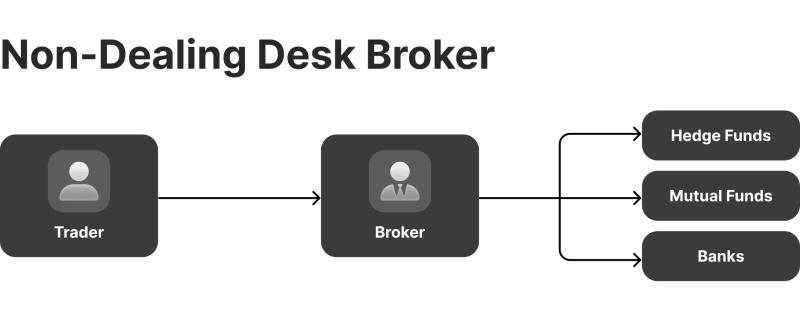

NDD brokers don’t take the other side of their clients’ trades. Instead, they connect traders directly to external liquidity providers, such as banks and financial institutions. This allows for a more transparent and market-driven trading environment.

These brokers can be of several types:

- Straight Through Processing (STP): STPs send client orders directly to liquidity providers without manual intervention. This setup eliminates dealing desk influence, making trade execution smoother and more efficient.

- Electronic Communication Network (ECN): ECNs create a marketplace where traders, banks, and other financial institutions can compete by placing their own bids and offers. This results in tighter spreads and improved price transparency.

The concept of connecting traders directly with liquidity providers gained prominence in the Forex market during the early 2000s. With advancements in internet technology and algorithmic trading, many online platforms introduced STP or ECN models, shifting towards more transparent, market-driven pricing.

Key Features of an NDD Broker

No Conflict of Interest

NDD brokers don’t manipulate pricing. Traders get real-time quotes directly from the market, but this means spreads are variable, changing based on supply and demand.

Connection to Liquidity

When traders place their trades, whether in forex, stocks, commodities, or cryptocurrencies, they rely on a network of market participants to provide liquidity. Liquidity providers facilitate transactions by offering buy and sell quotes in different markets.

Revenue Generation

Instead of making money from client losses, NDD brokers earn through commissions or small markups on the spread. This aligns their profits with traders’ success, encouraging a fairer trading environment.

Many professional traders prefer ECN brokers because they get direct access to market prices and better execution speeds.

Advantages of a Dealing Desk Broker

Let's discuss some key advantages to start a brokerage using a Dealing Desk (DD) model.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

1. Fixed Spreads for Predictability

One of the biggest advantages of a Dealing Desk broker is the ability to offer fixed spreads. Unlike No Dealing Desk brokers, where spreads fluctuate with market conditions, DD brokers set their own bid and ask prices. This means traders always know their transaction costs upfront.

Many beginner traders prefer fixed spreads because they simplify cost calculations and remove uncertainty during volatile market conditions.

2. Guaranteed Liquidity and Order Execution

Since a DD broker acts as the market maker, trades are filled instantly in most cases. There’s no need to rely on external liquidity providers, which means traders experience fewer order rejections or delays.

Retail traders, especially those trading small lot sizes, benefit from instant execution because they don’t have to wait for a counterparty to take the other side of their trade.

3. A Beginner-Friendly Trading Environment

Fixed spreads and fast execution make trading more accessible for new traders. Without unpredictable market fluctuations in spreads or order rejections, beginners can focus on learning without unnecessary stress.

Many trading platforms designed for beginners partner with DD brokers because of the stability and simplicity they offer.

Advantages of a No Dealing Desk Broker

The NDD model also has some major benefits.

1. Greater Transparency in Pricing

The biggest advantage of NDD brokers is that traders see real-time market prices directly from liquidity providers, such as banks and financial institutions. This means the broker isn’t adjusting prices behind the scenes.

Many experienced traders prefer NDD brokers because they trust that prices reflect actual market conditions, reducing concerns about unfair execution.

2. No Conflict of Interest with Traders

Because an NDD broker doesn’t take the opposite side of a client’s trade, there’s no financial incentive for the broker to see traders lose money. Instead, the broker earns from small commissions or markups on spreads.

This model offers a fairer trading environment, as brokers don’t manipulate orders or create artificial market conditions.

3. Potential for Tighter Spreads

NDD brokers connect traders to multiple liquidity providers who compete for order flow. This competition often results in tighter spreads, especially in highly liquid markets. Lower spreads allow traders to enter and exit positions at minimal cost.

ECN brokers, a type of NDD broker, often have some of the lowest spreads in the market but charge commissions on trades instead.

Which Model is Right for Your Brokerage?

Both DD and NDD models have their advantages. Here’s a quick comparison to help you decide:

When starting your brokerage, consider your target market. If you want to cater to beginner traders who prefer fixed spreads and instant execution, a DD model might be a better fit. If you aim to attract experienced traders who value market transparency and tight spreads, an NDD setup could be the way to go.

How to Choose the Right Model for Your Startup

If you aim to start your own brokerage, deciding whether to become a DD or NDD broker is one of the first pivotal steps. While both have their appeals, here are factors to consider:

Understanding Your Target Audience

The traders you aim to serve will largely dictate which brokerage model suits your business best:

A Dealing Desk model might be a better fit if your primary clientele consists of new or casual traders. Retail traders prefer fixed spreads, straightforward pricing structures, and user-friendly interfaces that simplify their trading experience. Many market makers (DD brokers) design their platforms to be intuitive and accessible, making it easier for beginners to navigate.

More experienced traders, especially those involved in high-frequency trading, scalping, or handling large volumes, typically gravitate toward No Dealing Desk brokers. These traders seek real-time pricing, minimal latency, and transparency in trade execution. The NDD model aligns with their needs by providing direct market access, reducing conflicts of interest, and offering competitive spreads.

Navigating the Regulatory Landscape

Regulatory requirements vary significantly across different jurisdictions, and compliance should be a major consideration when choosing your brokerage model.

Some regions impose stricter oversight on brokers, including requirements for separate client fund accounts, leverage restrictions, and capital adequacy standards.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

- Market makers generally require higher capital reserves to cover potential client wins and to maintain the ability to offer liquidity at all times. Some regulators may impose additional reporting and risk management obligations on DD brokers.

- Since NDD brokers don’t take the other side of client trades, regulatory scrutiny often focuses on ensuring the best execution policies and the integrity of the liquidity network. While they may not need as much capital as a DD brokerage, they must maintain strong technological infrastructure and relationships with reputable liquidity providers.

Some of the most stringent regulatory bodies in the world include the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC).

Breaking Down the Cost Structure and Revenue Model

Understanding how each brokerage model generates revenue and manages costs is crucial when planning your financial strategy.

Revenue Streams

DD Brokers primarily earn through spread markups. Since they act as the counterparty to their clients’ trades, they may also profit from client losses in certain scenarios. Additional revenue can come from swap fees, inactivity fees, and other service charges.

NDD Brokers rely on commissions or smaller spread markups but aim for higher trading volumes to sustain profitability. Since they don’t profit from client losses, their revenue model depends on executing as many trades as possible.

Operational Costs

DD Brokers require a sophisticated risk management system to ensure they balance their exposure. Hiring a skilled dealing desk team is also necessary, adding to operational expenses.

NDD Brokers must invest in robust technology that connects their platform to multiple liquidity providers in real time. The reliability of execution speeds and pricing accuracy is critical to maintaining client trust.

Investing in the Right Technology Infrastructure

Regardless of the model you choose, having the right technological framework is vital for running a competitive brokerage. Your platform must be fast, stable, and capable of handling a high volume of transactions without delays or failures.

- A Dealing Desk brokerage requires an in-house trading system that allows for price adjustments, order matching, and effective risk management. Customisable trading platforms with built-in analytics and monitoring tools can enhance efficiency.

- A No Dealing Desk broker relies on aggregation software that connects to multiple liquidity providers. To ensure seamless STP or ECN execution, investing in a high-speed, low-latency bridging solution is critical.

Many new brokerages choose white-label solutions instead of building their own infrastructure from scratch. This allows them to launch faster while reducing development costs.

Building a Strong Brand and Reputation

How you position your brokerage in the market can greatly impact client acquisition and retention. Traders today have plenty of choices, so standing out requires a strong value proposition.

- DD Brokers often attract a broad retail client base with easy-to-use platforms, simplified fee structures, and promotional offers. However, they must constantly work to establish credibility, as some traders may question the fairness of trade execution.

- NDD Brokers are generally perceived as more transparent because they do not trade against their clients. They tend to appeal to professional traders who prioritise direct market access and best execution policies.

Final Thoughts: Choosing the Right Model for Your Brokerage

There is no one-size-fits-all solution when it comes to choosing between a Dealing Desk and a No Dealing Desk model. Your decision should be based on a combination of your target audience, regulatory obligations, cost considerations, technological capabilities, and branding goals.

If you aim to attract beginners and retail traders with a predictable cost structure and straightforward trading experience, a Dealing Desk brokerage may be a better fit. However, if your goal is to cater to professional traders who value transparency and market-driven pricing, the No Dealing Desk model could be the right choice.

Whatever path you choose, ensure your brokerage is built on a foundation of transparency, regulatory compliance, and strong technology. These elements will help you attract traders and foster long-term loyalty and growth in an increasingly competitive forex market.

FAQ

What is a dealing desk?

A dealing desk is a department within a brokerage that internalises trade orders instead of passing them to external market liquidity providers. It can act as a market maker, setting its own bid and ask prices and taking the opposite side of clients’ trades when appropriate.

What is NDD in finance?

NDD, or No Dealing Desk, refers to a brokerage model where orders are directly routed to external liquidity providers without internal intervention. This setup aims to reduce conflicts of interest and provides traders with direct market access.

What are liquidity providers?

Liquidity providers are financial institutions, such as banks and prime brokers, that supply buy and sell quotes in financial markets.

What are market makers?

Liquidity providers offer bid and ask prices to brokers and large traders, facilitating market transactions. Market makers, on the other hand, actively quote prices and may take the opposite side of client trades.