Exploring The Potential of Alternative Trading System (ATS)

Articles

The trading realm has achieved unprecedented volumes in 2023. Digital innovations related to online exchanges, prime brokerages and connectivity applications have made sure to lower trade barriers worldwide. The global trading industry has never been this accessible and efficient for all parties involved.

However, in particular circumstances, utilising standardised exchanges and mainstream trading platforms is not always optimal since they can often be restrictive. This is especially true in the case of large-volume trades conducted by big corporations and financial institutions. In this case, an alternative trading system (ATS) provides a great substitution.

Key Takeaways

- Alternative trading systems are private trading environments constructed for high-volume trading needs.

- ATS platforms are only available for enterprise clients who wish to execute block deals outside the standard trading landscape.

- ATS platforms are anonymous, frequently cheaper and faster than their traditional counterparts.

- While ATSs are entirely legal, they are susceptible to price manipulation risks due to their lack of transparency.

What Is An Alternative Trading System?

An alternative trading system (ATS), as the name suggests, is an alternative to traditional exchanges. ATS foregoes the need for centralisation, supervision and the presence of intermediaries, which is virtually mandatory in conventional exchange spaces.

Before the construction of ATS platforms, NYSE and NASDAQ were clear-cut leaders of the market, which could potentially lead to a harmful oligopoly within the trading field. Thus, automated trading alternatives were created to offset this development and prevent the domination of any singular exchange platforms. Aside from their peer-to-peer nature, ATS platforms are also very flexible, provide ample liquidity sources and exponentially faster execution periods. ATSs are also less regulated and standardised, which can give investors greater freedom to create their custom contracts.

Thus, alternative trading systems are quite popular in modern settings, with companies and large-scale investors utilising them to avoid the limitations of standardised exchanges. However, the lack of normalised practices and regulatory supervision introduces its own set of challenges and drawbacks.

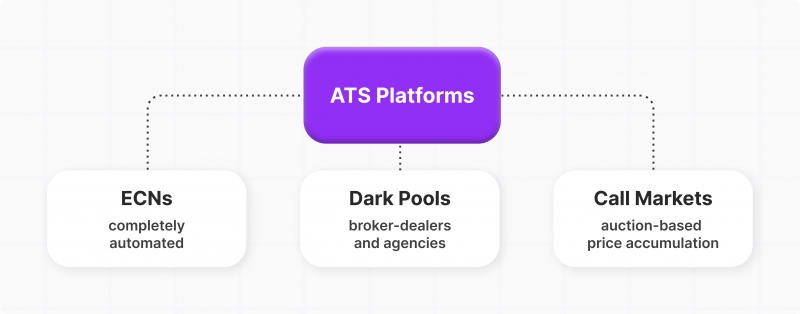

Different Types of Alternative Trading Systems

Alternative markets have been around ever since the 1970s and have branched out into several different variations, presenting various benefits, degrees of customisation and overall functionalities. While the general principle of alternative trading systems stands true for all of the below-presented variants, it is crucial to understand their distinctions.

Electronic Communication Networks (ECNs)

ECNs are the oldest and most reliable ATS platforms in the market. In the 1970s, the US government permitted the creation of automatically regulated exchanges without human intervention outside of technical support. ECNs soon became extremely popular with more prominent investors who wanted to conduct deals swiftly, efficiently and without domino effects that persist in standard exchanges.

The domino effect in trading represents a phenomenon where a large volume of shares is issued on the standard exchange platform. While the process can go smoothly in some cases, sometimes the large-volume issuance could experience substantial price swings due to the change in the trader strategies.

This is caused by the fact that different traders purchase vast volumes of issued stocks at other times. Sometimes, the domino effect could go in the company’s favour, but most corporations don’t like to take this chance with sensitive deals. ECNs are a perfect tool to prevent domino effects and allow corporations to sell big new stocks without any hitches or complications. The one considerable downside to ECNs is the per-transaction charge automatically defined by the platform, which could accumulate quite a hefty price tag.

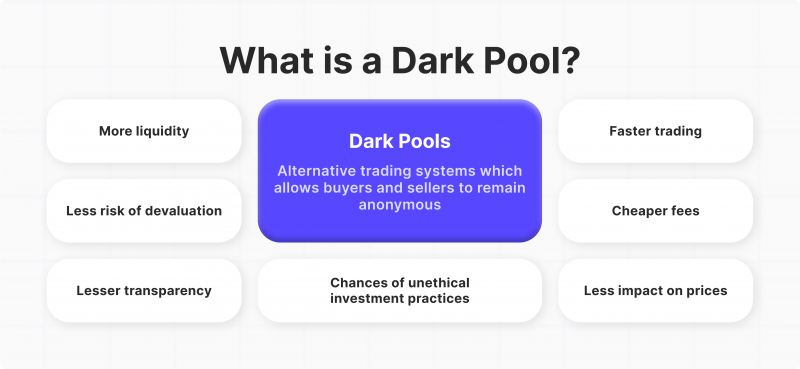

Dark Pools And Crossing Networks

Dark pools are the most secretive and anonymous versions of ATS trading. They are also considered quite controversial due to lack of transparency. Dark pools allow large-scale traders and corporations to execute peer-to-peer deals virtually outside the regular market. The abovementioned deals do not directly impact the trading market and are mostly left in the dark from the open public.

Despite the lack of information and heightened secrecy, dark pools are entirely legal and regulated by the SEC. There are several variations of dark pools, including broker-dealer and exchange-owned versions. For companies and investors who seek to determine their favourable prices, broker-dealers are a superior choice. In contrast, exchange-owned dealers simply convert the standardised market prices to execute the dark pool deals.

Dark pools are mainly accessible through crossing networks, which are often automated and allow traders to match orders without displaying the deals publicly. Crossing networks significantly contribute to dark pools’ uneven and often tarnished reputation, but they also provide a unique advantage for large-scale traders to execute orders efficiently.

The primary attraction of dark pools is their complete anonymity and swift order execution for large-scale trades. Price slippage and decline are very present risks for corporations that intend to sell millions of stocks quickly. Dark pools allow private companies to minimise this risk and execute a share issuance deal without unpleasant surprises.

Call Markets

Finally, call markets resemble an auction-like system to determine prices and create a supply-demand equilibrium for traders within the ATS trading environment. Call markets depend highly on auctioneers, who establish the bid and ask price accumulation and provide fair prices for the closed-out ATS ecosystem.

Unlike regular auctions, call markets are designed to benefit all parties involved and create an optimal price by aggregating all orders and requests. Call markets are great liquidity enhancers, providing ample support for buyers and sellers who might struggle to complete large-scale deals on regular exchange markets.

ATS was first introduced back in the 1970s with a mission to liberate the exchange market from the dominating presence of NYSE and NASDAQ.

Pros And Cons of Utilising ATS

ATS trading has become a viable alternative to mainstream exchange dealings, building a unique position within the tradable assets market. However, ATS’s financial intricacies should be understood carefully, as they benefit a specific niche of large-scale traders.

Reduced Transaction Fees And Elevated Liquidity

In most cases, alternative trading systems boast significantly lower fees than traditional exchanges since there is no need to route or process orders through a central authority. ATS platforms are primarily peer-to-peer solutions, which cuts out the necessity for a middleman and contributes to decreased trading fees. ECNs are essentially the most expensive variation of ATS platforms since they charge fees based on the number of transactions.

Dark pools and call markets are considerably cheaper, but the pricing may vary for large-volume transactions. In most cases, ATS traders juggle different variations of alternative systems to determine the best possible price for their dealings. Regardless of the pricing, all ATS platforms share the advantage of ample liquidity since they are designed to simplify the search for matching orders.

For example, corporations or whale investors with considerable share volumes might find it difficult to sell their stocks in traditional exchange environments. While the stocks will be sold eventually, reaching the finish line might take a while. In such cases, the stock prices decrease with unpredictable market swings and other significant factors.

Moreover, significant share issues are often caused by the company’s desire to acquire liquidity swiftly and without substantial delay. Since standardised exchanges represent free markets, there is no guarantee that corporations and investors will receive the above-mentioned liquidity in their preferred time frame. ATS platforms ensure that liquidity is not a problem, allowing investors to find matching orders for massive asset exchange deals.

Faster Order Execution

Order execution is another crucial factor within the trading landscape. Standard exchange platforms have certain limitations with processing and executions. Increased regulatory pressure requires additional checks and redundancies to be carried out before the order ever reaches the open trading floor. Thus, standard exchanges often fail to provide near-instant execution times.

Additionally, the trading hours are often limited with typical exchange environments like the NYSE. While after-hours trading is possible, this practice is limited, especially for large-scale companies running low on time. Conversely, ATS platforms are round-the-clock and can facilitate high-volume trades without material delays. As outlined above, most ATS platforms are highly automated, preceding the need for extensive checks and redundant procedures related to order execution. Thus, alternative trading systems are exponentially faster than their open market counterparts.

Complete Anonymity

Anonymity is another crucial factor for big-ticket investors. In frequent cases, investors or companies prefer to execute deals privately, desiring to avoid public panic or other adverse reactions. For example, company X might want to issue shares to increase their cash reserves for a specific R&D project. If Company X were to execute this deal in public, the trading landscape could take this signal as a negative sign for the company, assuming that Company X is strained for cash and might be headed for bankruptcy. Thus, by acquiring liquidity in a closed-out ATS environment, company X will maintain its share price and continue business as usual.

While anonymity is excellent for companies that trade on ATS platforms, it is obviously a double-edged sword for the rest of the market. Suppose the above-outlined example was reversed, and company X needed anonymity to mask their imminent downfall. In that case, utilising the ATS platform is harmful to the regular shareholders of the company, as they will be kept in the dark regarding the company’s short-term future.

Regulatory Concerns: The Biggest Downside of ATS

The ATS requirements in the legal context are pretty lacklustre and devoid of most safeguards in the standard exchange platforms. Thus, ATS platforms are susceptible to counterparty risks and heavy price manipulation. While ATS platforms are free of criminal or illicit activities, their lack of transparency eliminates any guarantees of a fair price deal.

Price discovery is primarily facilitated in a dark environment that prevents traders from having tangible data. Thus, company X might issue shares for $80, believing it is the best price available on the market, while the actual fair price could be $100. Investor X cannot know this and will lose 25% of their potential cash flow.

This is a considerable concern for large-volume traders within the network since a massive price manipulation could offset all possible benefits of ATS platforms, including speed, efficiency and anonymity. While specific ATS platforms issued by reputable banks are more trustworthy and reliable, there is still a realistic possibility that traders will not get a fair deal.

The SEC has disclosed many litigations and lawsuits related to the ATS platforms from 2011 to the present, showcasing their uneven nature and considerable market risks. Thus, regulations for ATS platforms present an interesting dilemma for traders. On the one hand, the lack of strict laws makes it possible to have swift, anonymous and highly effective ATS platforms. On the other hand, the pricing could be spectacularly skewed in any number of deals presented within the alternative trading systems. It is up to the traders themselves to weigh the risks and make the final decision.

Technical Challenges to Consider

Aside from the massive regulatory considerations, ATS platforms are also susceptible to technical shortcomings. It is important to remember that most ATS platforms are automated and largely anonymous. While major system breakdowns are unlikely, thanks to the digital progress in recent years, more minor errors and technical issues should be expected. Sometimes, this will only amount to one-off delays or slight inconveniences.

However, with bigger deals, technical problems could lead to incorrect price quotes or outright trade failures. Thus, selecting an ATS platform with appropriate safeguards for technical challenges is crucial and offers their clients complete compensation if anything goes wrong.

Final Thoughts

The alternative trading system is a much-needed trading venue that accommodates more prominent corporations and whale investors across the globe. ATS platforms allow companies to share and purchase high-volume shares without price slippage and delays. However, these platforms sometimes have technical issues and present considerable price manipulation risks. So, before entering an ATS platform for your large-scale trading needs, it is vital to understand both sides of the equation and make an informed final choice.

FAQ

What is the difference between an exchange and an ATS?

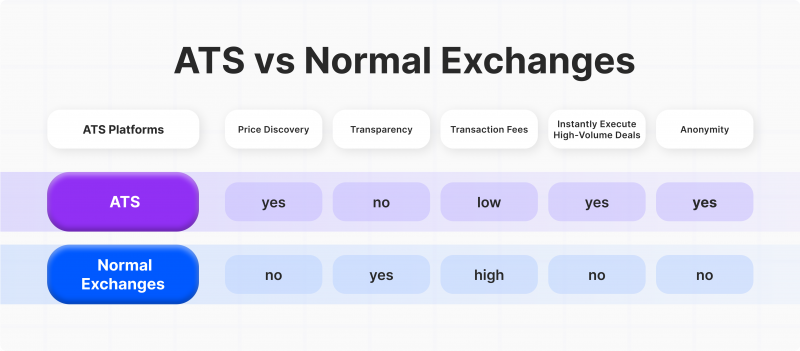

ATS platforms are more suitable for large-scale deals that are difficult to execute on standard exchanges. ATS platforms are also not accessible to most of the individual investors.

What are the advantages of ATSs?

ATS platforms are anonymous, offering lower transaction fees and faster processing of orders. ATS environments are also outstanding venues for executing high-volume stock deals.

What is the biggest downside of ATS?

The most prominent flaw of ATS platforms is the lack of appropriate regulations related to price manipulation. Since ATS platforms are mostly anonymous, it isn’t easy to ensure fair pricing, and many companies have sued ATS platforms for this very concern.