How Smart Order Routing Optimises Your Trade Execution

Articles

The investment field has progressed tremendously from the age-old days of simplified trading in closed rooms. Previously, to find the best deals available on the local market, traders had to search for them manually, identifying the best prices and matching orders on their own.

Today, the trading landscape has become global, with thousands of primary and secondary exchanges offering numerous trading venues for various assets and currencies.

In this global and thriving environment, it is practically impossible to navigate the trading market without automated support and still find the optimal prices. So, exchanges and brokerages have developed various order-matching systems to scrape market information and come up with the most competitive quotes across the international market.

This piece will analyse one of the most successful order routing applications – smart order router algorithms.

Key Takeaways

- Smart order routing is a system that automatically searches for available order matches across multiple markets.

- SOR systems are excellent for finding deals at favourable prices and within sensitive time windows.

- SOR systems are more effective in volatile markets like crypto and specific forex pairings.

- The only glaring downside of SOR systems is their technological limitation, occasionally showing signs of faulty algorithms.

Primary Ways to Execute Trade Deals

smart order routing system was invented to simplify the order execution process for traders dramatically. Previously, investors had two distinct choices on how to handle their deal execution.

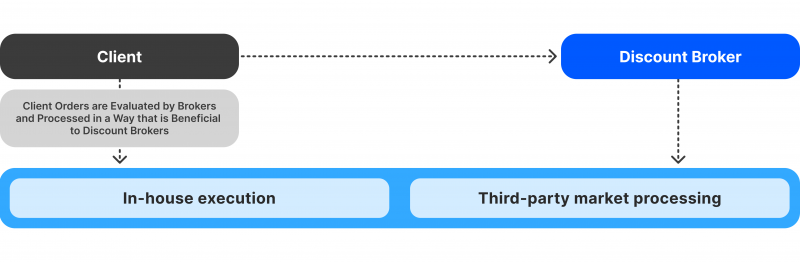

The first option was to connect with a regular or discount broker who would route the specific order to several possible destinations, either processing the deal in-house or sending it to third-party liquidity providers for execution.

With this option, traders have no control over the destination of their deals. They can’t choose a more favourable option, as the entire process is in the hands of brokerage agencies.

This indirect order routing process is relatively safe and effective for liquid and calm markets which don’t experience severe fluctuations and volatility spikes. However, using regular broker services to process deals in volatile markets could lead to unfavourable results and missed opportunities.

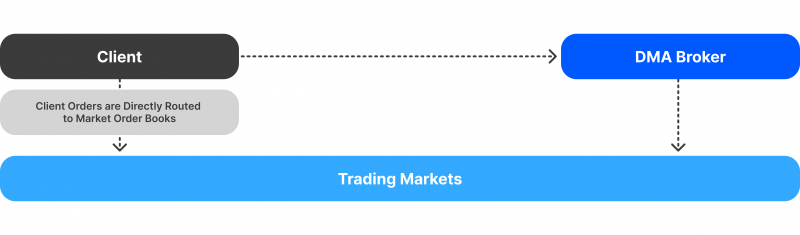

The second option is to connect with direct market access brokers and have control over your order routing process. DMA brokers automatically send your direct order to various platforms, including popular exchange platforms, alternative trading systems, ECNs, and other liquidity pools.

In this case, brokers serve as less intrusive parties, directly connecting traders to various order books and markets. In this case, investors can utilise the smart order routing (SOR) algorithm to increase the efficiency of their deal executions drastically.

What is Smart Order Routing?

Smart order routing was designed to optimise trade execution for investors, transforming the search for the best possible order matches into an automated process.

Without the SOR system, direct market order routing is very resource-intensive, as traders must search across multiple venues and liquidity pools to manually obtain the most suitable price match.

While some financial institutions have built-in processes that simplify this task, retail traders and smaller companies simply don’t have enough time and resources to scrape the market information by hand. So, the SOR system allows them to automate the price-searching procedure completely.

The smart routing process searches through all relevant markets that could include a specific order match and provides an optimal option. As a result, traders can save time, money and resources, enjoying the speedy execution of direct orders without the arduous process of analysing the market options.

How Smart Order Routing Works in Practice

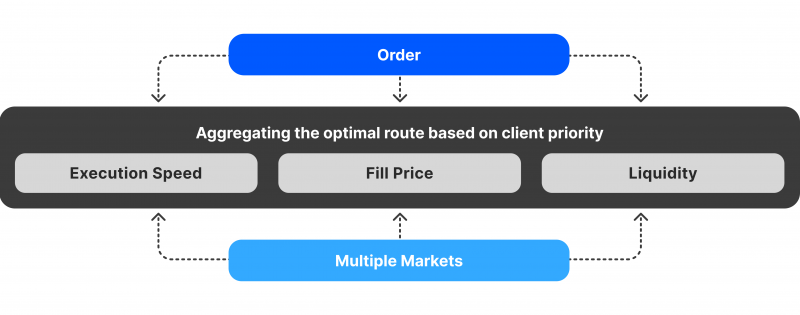

As outlined above, the goal of smart order routing systems is simple – finding the best-priced and swiftly executable deals across multiple markets. However, the technical process of SOR is increasingly complex, combining numerous routing rules that determine the quality of matching orders. In simple terms, the SOR system evaluates the market data in the context of active price quotes and corresponding liquidity zones.

Suppose the SOR system searches for matches across dark pools, ATS and significant exchanges. Each of these venues could experience market volatility and have varying levels of liquidity. So, the SOR system has to automatically decide which option is optimal, considering the price and liquidity of a specific tradable asset.

Despite their complex tasks, smart order routing systems have showcased impressive results, consistently delivering optimal deals for direct market traders.

Algorithmic trading involves SOR systems in its methodology, allowing developers to create automated strategies executed in a matter of seconds.

Why Do Trading Markets Need the Smart Order Router?

The smart order routers are invaluable tools across many tradable markets, including forex, crypto, the stock market, securities, commodities and numerous other sectors. However, the effectiveness of the SOR system is directly increased in proportion to the volatility levels.

Automated routing is much more advantageous for traders in uncertain and illiquid markets. So, let’s examine the extent of unique benefits produced by SOR systems in highly volatile markets.

Eliminating Slippage

Slippage is one of the biggest concerns for traders in the crypto or other uncertain markets with high volatility. Orders that get delayed could be executed at changed prices, causing potentially massive losses for high-volume traders.

Even if the volumes are insignificant, trading with uncertain price quotes will drastically reduce your ability to formulate successful trading strategies.

With the SOR system present, slippage is minimised or even eliminated since SOR ensures near-instant execution if the order is matched anywhere across multiple markets.

While there will be rare cases when the order is simply not matched, the SOR system has showcased remarkable consistency in finding suitable deals with unmatched speed and efficiency. As a result, traders will no longer have to experience faltering or spiking prices for their deals.

Optimising Investment Strategies

Volatile markets are known for their time-sensitive opportunity windows. For example, the crypto market could experience a bull run that lasts for as little as several weeks or days. On the contrary, stocks listed on the New York Stock Exchange could enter a bull run for months or even a better part of a year. With such small windows for profit, securing the deals fast and formulating short-term strategies is essential.

However, discount brokers could often provide deals after a considerable delay. While not significant for other markets, even several hours of delay in crypto markets could reverse a winning trade into a losing one.

With SOR systems, traders can ensure their strategies are no longer exposed to market risks. SOR algorithms are known for their swift execution, letting traders know that if there’s a deal on the market, they will get a match as fast as technically possible.

Solving the Liquidity Gaps And Minimising Market Exposure

Finally, smart order routing is profitable for individual traders and market equilibrium in general. The crypto industry, for example, has greatly benefitted from the popularisation of smart order routing, as the liquidity gaps get filled more effectively across markets. The blockchain landscape is inherently segregated into different pools, networks and platforms.

Many major exchanges are secluded systems that don’t have direct access to other liquidity pools. As a result, the industry often suffers from liquidity gaps being created due to the lack of standardised liquidity flows.

The SOR system bridges the various crypto liquidity pools, allowing the market to become more streamlined and helping traders find matching deals without artificial roadblocks.

Is the Smart Order Routing Technology Good Enough?

The smart order routing systems are still fresh, only popularised in the late 2010s and early 2020s. However, the road to developing an optimal SOR system is still far ahead.

SOR systems have been known to produce faulty results, experience algorithmic errors and showcase difficulties when integrated into digital infrastructures.

While the underlying methodology is strong and shows promise, the technical side of SOR systems has to catch up with its innovative methods.

The crypto industry players are working hard to produce new SOR systems with improved core algorithms and enhanced efficiency, hoping to develop a smart order routing solution that dominates the market in the future.

It will be interesting to see whether the SOR systems can reach the technical fluency required to be the number one solution in the crypto field.

Final Remarks – Is SOR the Future of Trading Venues?

The smart order routing systems perfectly fit volatile markets like crypto and forex, allowing traders to automate searching for profitable deals. The SOR systems dramatically decrease market exposure risks and ensure little to no slippage is involved in everyday dealings.

However, the technology is far from optimal, with the underlying algorithm being susceptible to errors, miscalculations and occasional breakdowns. So, if you are considering utilising smart order routing systems, you should carefully analyse their potential shortcomings aside from the impressive list of advantages.